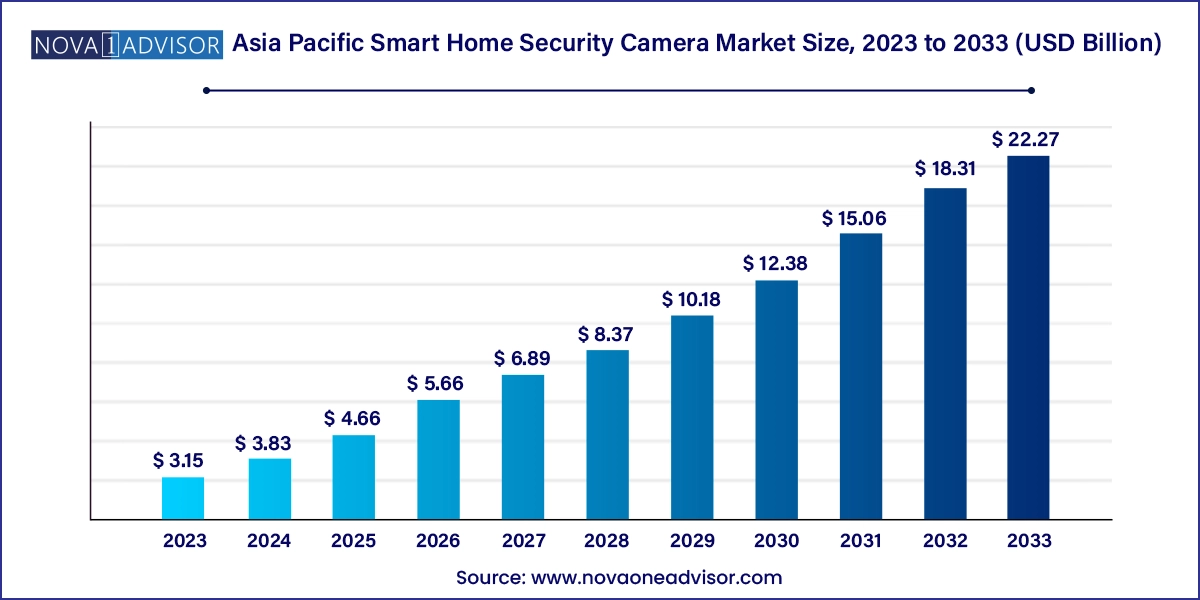

The Asia Pacific smart home security camera market size was exhibited at USD 3.15 billion in 2023 and is projected to hit around USD 22.27 billion by 2033, growing at a CAGR of 21.6% during the forecast period 2024 to 2033.

The Asia Pacific smart home security camera market is experiencing remarkable growth, driven by rapid urbanization, technological advancements, increasing adoption of Internet of Things (IoT) devices, and a rising emphasis on residential safety and surveillance. As cities expand and populations become more concentrated in metropolitan hubs, the need for efficient home security solutions has intensified. Homeowners are increasingly investing in smart surveillance technologies that offer real-time alerts, remote access, motion detection, and cloud-based storage to protect their properties from theft, vandalism, and intrusion.

Smart home security cameras, once considered a luxury or premium add-on, are now emerging as a necessity, particularly in high-density urban centers of countries like China, India, Japan, and South Korea. The integration of Artificial Intelligence (AI) and Machine Learning (ML) in these cameras is enhancing functionality through facial recognition, behavior analysis, and predictive alerts. These smart cameras also support integration with broader home automation systems, including voice-activated assistants and smart locks, delivering a comprehensive home security ecosystem.

In addition to residential applications, small commercial establishments and rental properties are also deploying smart home cameras to deter criminal activity and ensure tenant safety. Factors such as affordable pricing, enhanced image resolution, and energy efficiency further contribute to the market’s expansion. The proliferation of mobile applications and cloud platforms has further enabled real-time remote monitoring, thus appealing to a tech-savvy younger generation of homeowners across Asia Pacific.

Governments across the region are also promoting digital infrastructure development, and increased investments in smart city initiatives are creating a conducive environment for smart home solutions. However, while the prospects are promising, the market also faces challenges, including concerns related to data privacy, interoperability, and cybersecurity.

Rising Popularity of AI-Powered Cameras: Smart cameras equipped with AI capabilities such as facial recognition, human detection, and anomaly detection are gaining traction.

Cloud-Based Storage and Remote Monitoring: Demand for cloud-integrated storage for video footage and the ability to monitor homes from mobile apps is rapidly growing.

Voice Assistant Integration: Smart cameras compatible with Amazon Alexa, Google Assistant, and Apple HomeKit are preferred for their convenience and automation.

Increasing Use of Edge Computing: Edge-based processing within the camera units is helping reduce latency and enhance real-time decision-making without relying heavily on internet bandwidth.

Subscription-Based Services: Many brands are offering subscription models for premium features such as video history storage, advanced AI capabilities, and multi-device management.

DIY Installation Trend: Consumers are increasingly opting for do-it-yourself camera systems due to ease of installation and cost-effectiveness.

Growing Demand in Rental Housing: With more people renting apartments in urban cities, landlords are integrating smart security systems as value-added features.

Integration with Broader IoT Ecosystems: Cameras are becoming part of integrated smart home solutions alongside thermostats, lighting, and door locks.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.83 Billion |

| Market Size by 2033 | USD 22.27 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 21.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | China, India, Japan, South Korea, Australia & New Zealand |

| Key Companies Profiled | Vivint Smart Home; ADT Inc.; SimpliSafe; Brinks Home Security; Xiaomi Inc.; Skylinkhome; Samsung Electronics Co; Frontpoint Security Solution; Wyze Lab Inc.; Blink |

Integration of AI and IoT in Smart Surveillance Systems

One of the most significant drivers for the Asia Pacific smart home security camera market is the seamless integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into home surveillance technologies. AI-enabled features such as facial recognition, motion detection, real-time alerts, and smart playback have significantly enhanced the efficiency and reliability of these systems. The real-time decision-making capability of AI ensures immediate responses to potential threats, reducing false alarms caused by animals or weather conditions. Furthermore, IoT connectivity allows for easy pairing of cameras with smartphones, smart TVs, and voice assistants, creating a holistic user experience. For instance, a user in Tokyo can receive a real-time alert and video feed on their smartphone if an unknown person is detected near their door. This level of intelligence and automation is driving strong consumer demand, particularly among younger urban dwellers.

Concerns Regarding Data Privacy and Cybersecurity

Despite the rising adoption, data privacy and cybersecurity remain significant concerns restraining the market’s full potential. As smart home security cameras collect sensitive personal data, including video footage of private spaces, any breach can lead to severe privacy invasions and potential misuse. Cases of camera hacking, unauthorized data sharing, and weak default passwords have eroded consumer confidence in some markets. For example, in recent years, incidents of unsecured IP cameras being hijacked and streamed on unauthorized platforms have alarmed consumers. These risks are especially heightened in a region like Asia Pacific where data protection regulations vary widely between countries. The lack of a unified cybersecurity framework poses challenges to device manufacturers and service providers, urging the need for better encryption standards, frequent firmware updates, and user education on cybersecurity best practices.

Rising Smart City Developments in Emerging Economies

The ongoing development of smart cities across Asia Pacific presents a massive growth opportunity for the smart home security camera market. Governments in countries such as India and China are investing in urban infrastructure upgrades that emphasize smart grids, connected homes, and intelligent surveillance systems. In India, the Smart Cities Mission aims to develop 100 cities with modern infrastructure, encouraging the use of smart technologies in residential and commercial settings. These initiatives promote the integration of smart surveillance not just in public places but also at the residential level, paving the way for increased adoption of smart cameras. Moreover, rising disposable incomes and increasing smartphone penetration in rural and semi-urban areas will drive broader market access, making smart security systems more mainstream beyond metropolitan hubs.

Wired smart home security cameras market accounted for a revenue share of 56.0% in 2023. due to its convenience, flexibility in installation, and compatibility with modern home automation systems. Unlike wired cameras, wireless variants can be installed without the need for extensive wiring, which appeals to urban apartment dwellers and renters who seek non-invasive solutions. These cameras typically rely on Wi-Fi or Bluetooth connectivity and are favored for their portability and ease of relocation. Moreover, leading brands in the region are launching affordable wireless models that support real-time mobile alerts and cloud storage, enhancing user appeal. The trend toward minimalistic and aesthetic home designs also aligns with the wireless camera's sleek and cable-free setup, further boosting its dominance in the region.

Wired cameras, while less dominant, are experiencing stable demand in large residential buildings and high-security areas where uninterrupted power supply and stable internet connectivity are essential. These systems are typically chosen for their reliability and consistent video quality. Some consumers in South Korea and Japan continue to prefer wired solutions due to their resistance to hacking and stable network performance, especially in properties with dedicated IT support or centralized surveillance rooms.

The indoor smart home security cameras market accounted for a share of 40.1% in 2023. driven by the increasing need to monitor entrances, gardens, garages, and perimeters of residential properties. Rising incidents of package thefts and doorstep crimes in densely populated cities like Shanghai and Mumbai have prompted homeowners to invest in outdoor surveillance solutions. Modern outdoor cameras are equipped with night vision, motion sensors, and weather-resistant designs, making them suitable for diverse climates across the Asia Pacific. These devices often serve as both preventive and evidentiary tools, deterring crime while also recording events for later review or legal use.

Doorbell smart home security cameras market is anticipated to grow at a CAGR of 21.9% over the forecast period. gaining popularity among tech-savvy homeowners for their dual functionality and integration with intercom systems. These devices allow users to see, speak, and record visitors via their smartphones. Their compact size and affordability make them ideal for apartments and single-family homes alike. Countries like Australia and South Korea have seen an uptick in doorbell camera adoption, especially among residents looking to enhance convenience and safety without major installations. Furthermore, real-time visitor alerts and package delivery monitoring are particularly appealing in markets with growing e-commerce trends.

China leads the Asia Pacific smart home security camera market in terms of both production and consumption. Major domestic players such as Xiaomi, Hikvision, and Dahua Technology dominate the market by offering high-quality yet affordable camera systems. The widespread use of smartphones and robust internet infrastructure further boost camera integration in urban households. Smart city initiatives and government policies favoring digital surveillance have also accelerated adoption.

India is emerging as one of the fastest-growing markets, driven by increasing urbanization, rising middle-class income, and growing security concerns. The surge in e-commerce and frequent incidents of doorstep package theft have made doorbell and outdoor cameras especially popular. Indian startups are also entering the market, offering localized, budget-friendly options with multilingual support to cater to Tier 2 and Tier 3 cities.

Japan’s adoption of smart home security cameras is fueled by its tech-savvy population and high standards of home safety. Wired systems are still popular due to their stable connectivity and low cybersecurity risks. Integration with robotic home assistants and smart lighting systems is increasingly common in urban homes.

South Korea boasts a high penetration of smart home ecosystems, and smart security cameras are integral to this infrastructure. Residents in Seoul and other metropolitan areas prefer AI-enabled models with facial recognition and biometric alerts. Samsung SmartThings and LG ThinQ platforms support wide camera integration, fueling domestic demand.

In Australia and New Zealand, smart cameras are in demand across both urban and rural areas. Wireless doorbell and outdoor cameras are widely adopted in single-family homes. Rising incidences of burglary in suburban areas have encouraged greater investment in DIY security solutions. Cloud-based monitoring and subscription services are particularly popular due to the region's high mobile internet penetration.

February 2024: Xiaomi launched a new line of smart indoor cameras under its MIJIA brand in China, featuring AI-based motion detection and dual-band Wi-Fi support. The product is targeted at urban households and integrates seamlessly with Xiaomi’s broader smart home ecosystem.

January 2024: Hikvision announced an expansion of its AI-powered security solutions to Southeast Asia, including India, with plans to open regional distribution centers to enhance product accessibility and reduce delivery times.

November 2023: Ring (a subsidiary of Amazon) introduced its next-generation video doorbells in Australia and New Zealand, featuring improved night vision and customizable privacy zones.

September 2023: TP-Link launched its Tapo series of budget-friendly wireless smart cameras across the Asia Pacific, offering competitive pricing and easy mobile app integration.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific smart home security camera market

Technology

Application

Country