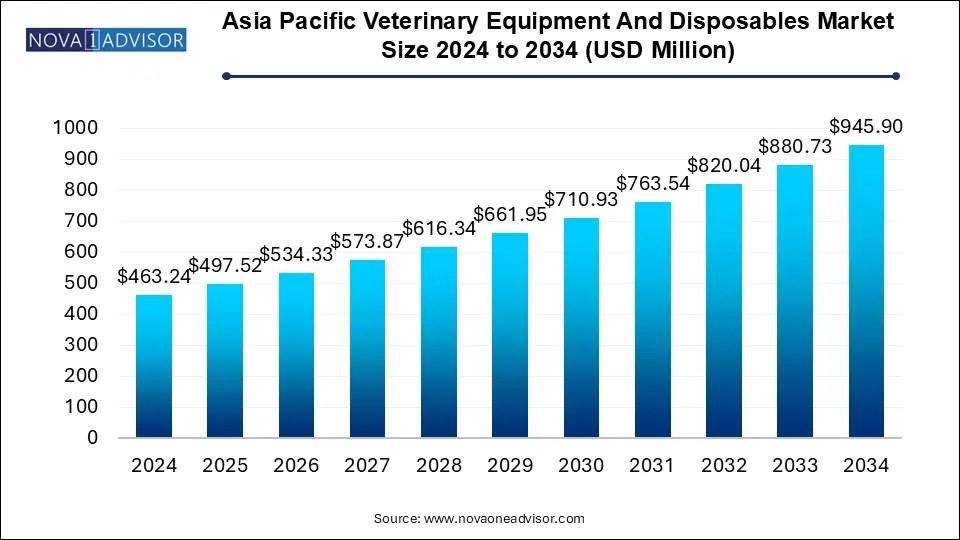

The Asia Pacific veterinary equipment and disposables market size was exhibited at USD 463.24 million in 2024 and is projected to hit around USD 945.9 million by 2034, growing at a CAGR of 7.4% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 497.52 Million |

| Market Size by 2034 | USD 945.9 Million |

| Growth Rate From 2025 to 2034 | CAGR of 7.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Animal type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | Asia Pacific |

| Key Companies Profiled | Smiths Medical; Nonin; B. Braun Melsungen AG; Kshama Equipments; Vetland Medical Sales & Services; Midmark Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Dispomed Ltd.; Zoetis |

Rising research activities, pet population, and the number of vet visits are factors expected to boost the market growth in the region. The increase in the pet population is supported by factors such as the high aging population in countries like Japan, Australia, and South Korea; increasing single-member households; and rising disposable income. The livestock population is also on a growth trend due to the rising demand for medical research and meat-& livestock-derived products, which is a result of the growing human population.

The COVID-19 outbreak restricted the growth of the market for veterinary equipment and disposables due to a reduction in patient volume in veterinary clinics as well as hospitals and the cancellation of or delayed animal-based research projects. A 2020 survey by the UN’s Food and Agriculture Organization (FAO) on the “Impact of COVID-19 on the delivery of veterinary animal disease reporting and services”, indicated a negative impact on veterinary services globally including Asia Pacific. Survey participants reported a decrease in procedure volume and activities in laboratory diagnostics, visits to livestock farms, supply chain challenges, and others, thus lowering the demand for veterinary equipment and disposables.

Several initiatives by the government and private sector are among the other factors indirectly fuelling the veterinary equipment and disposables market growth. For instance, in India, a scheme to control Foot & Mouth Disease (FMD) and brucellosis was launched in September 2019 through the use of vaccines on 100% cattle and livestock. The scheme aims to control FMD by 2025 and eradicate the same by 2030. The goal is to increase domestic production, leading to increased exports of milk products and livestock products.

In May 2019, a fundraising round led by BitRock Capital in China invested over USD 30 million in OneDegree Hong Kong-based pet insurance company. In addition, in its Budget 2021, the Indian government reduced custom duties on some raw materials and inputs used by the domestic animal husbandry industry, to promote domestic manufacturing. These initiatives by public and private players are expected to drive the market for veterinary equipment and disposables. Research is another area where the use of animals and related equipment and disposables is growing. In fact, as per Cruelty Free International, China, Japan, Australia, and South Korea are among the global top 10 animal testing countries.

According to a report published by Animal Medicines Australia (AMA) in November 2024, the pet population of Australia is estimated to be 28.7 million, whereas there are 6.9 million households, which equates to 69% of households owning a pet. The household penetration of various pet species is 47.8% for dogs, 33.3% for cats, 12.1% for fish, 10.5% for birds, 3.7% for other small mammals, 3.1% for reptiles, and 0.8% for other pets. It was observed that the total number of pet owners had increased from 61% in 2016 and 2019 to 69% in 2024, which was a result of the increase in the pet adoption rate during the COVID-19 pandemic.According to Animal Medicines Australia, household expenditure on veterinary services has been increasing in the country. Australians were estimated to have spent over USD 2.6 billion on veterinary services in 2019. The top reasons for vet visits are general checkups, vaccination, illness/injury, de-sexing, dental concerns, surgery, pathology and lab tests, X-rays and imaging, and hospitalization.

According to the World Health Organization (WHO), over 55,000 people per year, mostly in Asia and Africa, die from dog bites due to low awareness regarding the need for medical attention. Rabies is endemic in India, where 36% of global rabies deaths occur. Rabies results in 18,000 to 20,000 fatalities annually. As bites in children frequently go unnoticed and unreported, 30% to 60% of rabies cases and fatalities in India are reported to involve children under the age of 15.

Harbin Veterinary Research Institute (HVRI), in China, is among the many entities involved in the development of vaccines and other treatments for diseases including African swine fever. In March 2020, HVRI announced that it would be testing its potential vaccine candidate in a clinical trial, involving 10 to 20,000 pigs. Veterinary equipment and disposables market players can leverage such initiatives by supplying necessary products for R&D.

Based on animal type, the market is segmented into companion animal and livestock animal segments. The companion animal segment is further categorized into dogs, cats, horses, and others. Companion animals are domesticated or tamed animals that live with humans and provide them with social and emotional support.

In terms of end-use, the veterinary hospitals/ clinics held the largest revenue share of more than 80.0% in 2024. Veterinary hospitals/ clinics witness the highest footfall of patients and perform the majority of the veterinary procedures and surgeries that involve the use of equipment and disposables.

The research institutes segment is expected to witness the fastest CAGR over the forecast period owing to an increase in research activities for the development of animal products.

In terms of product, the critical care consumables segment dominated the market in 2024 with a revenue share of 40.0% owing to its high usage in almost all types of veterinary procedures. The product segment is categorized into critical care consumables, anesthesia equipment, fluid management equipment, temperature management equipment, rescue and resuscitation equipment, research equipment, and patient monitoring equipment.

The research equipment segment is expected to witness the fastest CAGR of 8.7% over the forecast period. An increase in research activities undertaken for various applications, such as veterinary research, drug development, and production of biological agents, is one of the main drivers anticipated to boost demand for research equipment.

Shenzhen Mindray Animal Medical Technology Co., LTD. is one of the leading medical devices and comprehensive solutions providers for pets and animals. Its portfolio includes the WATO EX-65 Pro Vet anesthesia machine, the ePM 12M Vet patient monitoring system, the Vetina CS7 rigid endoscopy system, and the BeneFusion eSP/eVP/eDS Vet infusion pumps.

Based on country, the market is categorized into Japan, China, Hong Kong, Taiwan, India, Thailand, Australia, South Korea, Singapore, Vietnam, New Zealand, Malaysia, Philippines, and Indonesia segments. The China, Hong Kong, and Taiwan segment held the largest revenue share of 30.10% in 2024. The Singapore segment is expected to register the fastest CAGR of 10.99% over the forecast period.

The presence of a large number of manufacturers, distributors, and traders is expected to contribute to the market growth. For instance, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. in China, offers a wide portfolio of patient monitoring systems, anesthesia machines, infusion pumps, in-vitro diagnostic analyzers, and medical imaging equipment for veterinary applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Asia Pacific veterinary equipment and disposables market

By Product

By Animal Type

By End-use

By Country