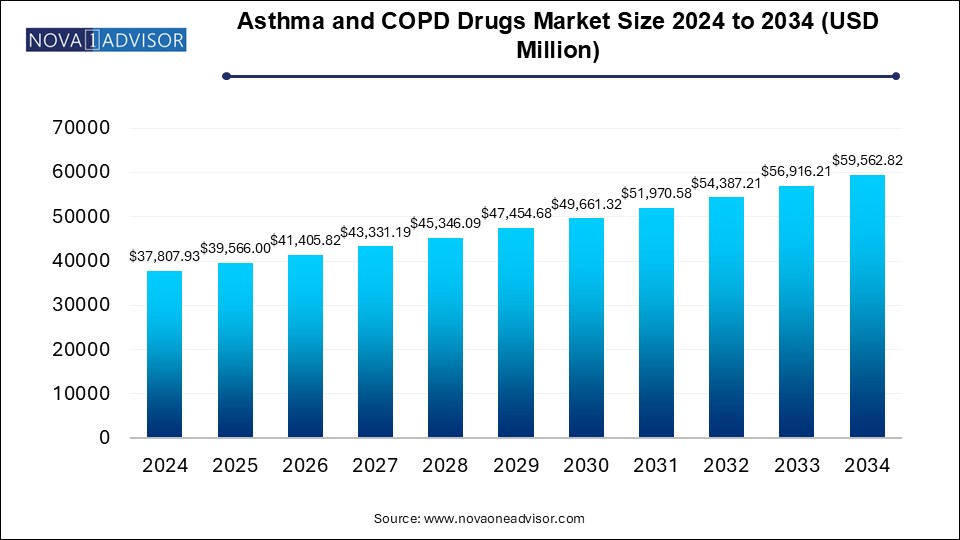

The asthma and COPD drugs market size was exhibited at USD 37807.93 million in 2024 and is projected to hit around USD 59562.82 million by 2034, growing at a CAGR of 4.65% during the forecast period 2025 to 2034.

Asthma is a chronic, non-communicable inflammatory lung condition affecting the airways. Hyper-responsiveness of the airways results in recurring episodes of wheezing, shortness of breath, chest tightness, and coughing. Unlike other obstructive lung diseases, asthma is largely reversible. The strongest risk factor for asthma is allergy. Additionally, asthma can be triggered by exposure to irritants, physical exertion, β-blockers, cold air, animals, and dust.

Chronic obstructive pulmonary disease (COPD) is characterized by persistent airflow limitation that is not entirely reversible. COPD encompasses emphysema, a complex lung condition involving alveolar damage, and chronic bronchitis, which is marked by prolonged inflammation of the lower respiratory tract. Tobacco smoking is the primary cause of COPD, while passive smoking, occupational hazards, and air pollution also contribute to its development.

Diagnosis of asthma and COPD involves physical examinations and various tests, including X-rays, sputum eosinophil counts, and nitric oxide tests. Treatment options include inhaled corticosteroids, leukotriene modifiers, and theophylline. Acute respiratory attacks, however, can be managed using short-acting beta agonists and anticholinergic medications.

The global market for asthma and COPD drugs is experiencing growth due to the increasing prevalence of these respiratory conditions. According to the World Health Organization (WHO), asthma affected an estimated 262 million individuals and was responsible for 461,000 deaths in 2019. Additionally, the rising number of COPD cases is driving market expansion. For instance, the American Lung Association reported that in 2018, 99 million adults in the U.S. had chronic bronchitis, while 2 million adults had emphysema.

Furthermore, advancements in respiratory disease treatments and the introduction of new products are expected to propel market growth. In December 2020, AstraZeneca, a leading pharmaceutical company, secured EU approval for ‘Trixeo Aerosphere’ as a maintenance therapy for COPD. However, the high cost of asthma treatment remains a key challenge, potentially limiting market growth in the coming years.

The Asthma and COPD Drugs Market is segmented based on disease type, medication class, and geographic region. By disease type, the market is primarily divided into asthma and COPD.

In terms of medication class, the market is categorized into combination drugs, inhaled corticosteroids (ICS), short-acting beta agonists (SABA), long-acting beta agonists (LABA), leukotriene antagonists (LTA), anticholinergics, and others.

Regionally, the Asthma and COPD Drugs Market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and the rest of LAMEA).

By disease type, the asthma segment held the largest market share in 2024 and is expected to maintain its dominance throughout the forecast period due to the growing number of asthma patients. However, the COPD segment is anticipated to experience substantial growth, driven by advancements in COPD treatment.

Based on medication class, combination drugs were the leading contributors in 2020 and are expected to continue leading the market due to the effectiveness and reliability of combination therapies. However, the inhaled corticosteroids segment is projected to grow significantly during the forecast period due to ongoing advancements in respiratory treatments.

From a regional perspective, North America accounted for the largest share of the Asthma and COPD Drugs Market in 2020 and is expected to retain its dominance, driven by the rising prevalence of asthma, presence of major pharmaceutical manufacturers, increasing tobacco consumption, and well-established healthcare infrastructure. However, the Asia-Pacific region is projected to exhibit the highest compound annual growth rate (CAGR) of 5.81% from 2021 to 2030, attributed to the growing number of hospitals and a large patient population.

This report provides a detailed analysis of the global Asthma and COPD Drugs Market size, highlighting current trends and future projections to identify potential investment opportunities.

It presents an in-depth market analysis from 2025 to 2034, allowing stakeholders to capitalize on emerging opportunities.

A comprehensive regional analysis helps in understanding market dynamics and aids strategic business planning by identifying key growth prospects.

The competitive landscape is thoroughly examined, including profiles and growth strategies of key industry players, offering valuable insights into market positioning and future developments.

Asthma and COPD are respiratory disorders primarily identified by breathing difficulties.

The market is driven by both conditions, with asthma currently leading due to the increasing prevalence of asthma cases and rising air pollution levels.

Key growth factors include the increasing incidence of respiratory diseases, expansion of healthcare facilities, and continuous advancements in asthma and COPD treatment. Additionally, government initiatives aimed at improving patient care and quality of life are expected to further fuel market expansion.

North America is projected to generate the highest revenue, driven by the high prevalence of respiratory conditions, the presence of leading pharmaceutical manufacturers, and the increasing number of hospitals and diagnostic centers.

However, challenges such as the high cost of asthma and COPD treatments and inadequate healthcare infrastructure in certain regions may impede market growth during the forecast period.