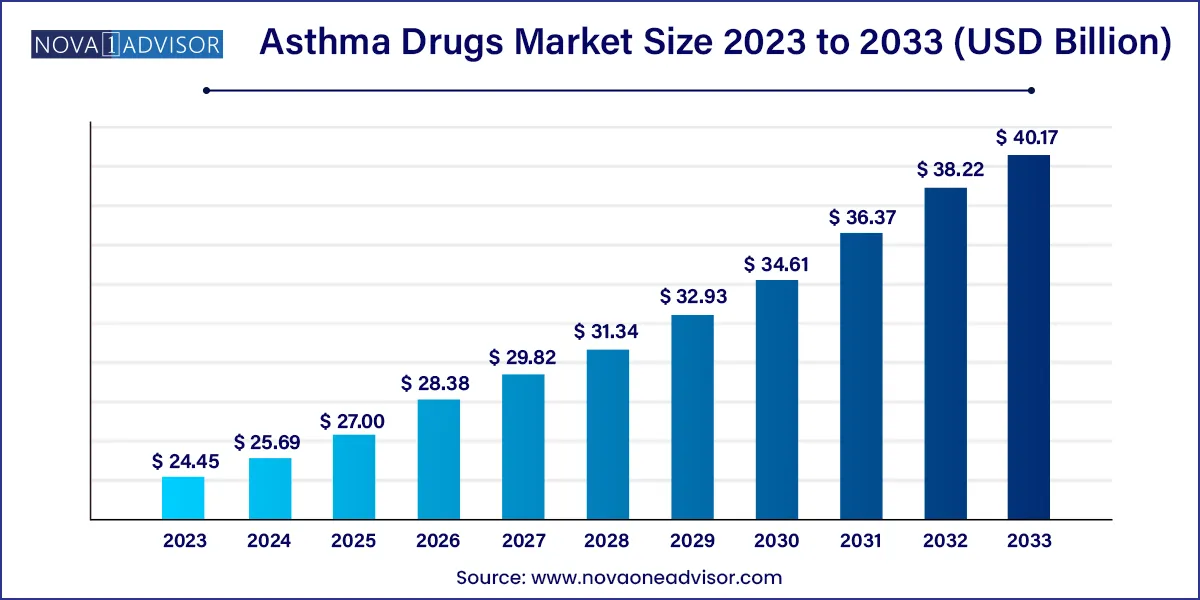

The global asthma drugs market size was valued at USD 24.45 billion in 2023 and is projected to surpass around USD 40.17 billion by 2033, registering a CAGR of 5.09% over the forecast period of 2024 to 2033.

The asthma drugs market stands as a critical segment of the global pharmaceutical landscape, dedicated to the treatment and management of a chronic respiratory condition that affects over 260 million people worldwide. Asthma is characterized by inflammation and narrowing of the airways, leading to symptoms such as wheezing, coughing, chest tightness, and shortness of breath. Although not curable, asthma can be effectively managed with a variety of pharmacological interventions that either control long-term inflammation or provide immediate symptom relief.

Over the years, the market has evolved from relying solely on bronchodilators to adopting advanced combination therapies, biologics, and personalized medication strategies. The two primary classifications of asthma drugs are quick relief medications and long-term control medications. The growing understanding of asthma phenotypes and endotypes, as well as increasing use of biomarkers, is driving the development of targeted therapies, particularly for patients with moderate to severe forms of asthma.

Global health initiatives, improved diagnostic protocols, increasing air pollution, and rising allergic conditions among populations are key contributors to the expansion of the asthma drugs market. Additionally, technological innovations in inhaler devices and increased awareness through patient advocacy organizations are supporting consistent demand. With rising prevalence in both developed and emerging economies, the market is poised for steady growth over the forecast period.

The asthma drugs market stands as a critical segment of the global pharmaceutical landscape, dedicated to the treatment and management of a chronic respiratory condition that affects over 260 million people worldwide. Asthma is characterized by inflammation and narrowing of the airways, leading to symptoms such as wheezing, coughing, chest tightness, and shortness of breath. Although not curable, asthma can be effectively managed with a variety of pharmacological interventions that either control long-term inflammation or provide immediate symptom relief.

Over the years, the market has evolved from relying solely on bronchodilators to adopting advanced combination therapies, biologics, and personalized medication strategies. The two primary classifications of asthma drugs are quick relief medications and long-term control medications. The growing understanding of asthma phenotypes and endotypes, as well as increasing use of biomarkers, is driving the development of targeted therapies, particularly for patients with moderate to severe forms of asthma.

Global health initiatives, improved diagnostic protocols, increasing air pollution, and rising allergic conditions among populations are key contributors to the expansion of the asthma drugs market. Additionally, technological innovations in inhaler devices and increased awareness through patient advocacy organizations are supporting consistent demand. With rising prevalence in both developed and emerging economies, the market is poised for steady growth over the forecast period.

Rise in biologic therapies for severe eosinophilic asthma (e.g., dupilumab, mepolizumab).

Integration of digital health tools with inhalers to monitor adherence and respiratory function.

Increasing pediatric focus with tailored formulations and delivery mechanisms.

Development of once-daily combination inhalers for better patient compliance.

Expansion of over-the-counter (OTC) options for mild asthma treatment.

Focus on environmentally friendly inhaler propellants due to climate regulations.

Investment in RNA-based therapies for novel mechanisms of action.

Growth of generic and biosimilar production, especially in Asia-Pacific.

| Report Attribute | Details |

| Market Size in 2024 | USD 25.69 Billion |

| Market Size by 2033 | USD 40.17 Billion |

| Growth Rate From | CAGR of 5.09% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Medication, Mode of Administration, Organization Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | GlaxoSmithKline, Pfizer, Vectura Group, Boehringer Ingelheim, Roche, Novartis, Merck, AstraZeneca, Teva Pharmaceutical among others. |

The rising prevalence of asthma worldwide, particularly in urban and industrialized areas, is a significant market driver. Factors such as increasing air pollution, indoor allergens, sedentary lifestyles, and dietary changes have contributed to the rise in asthma incidence. In cities like Delhi, Beijing, and Los Angeles, exposure to particulate matter and nitrogen dioxide significantly raises the risk of asthma development, especially among children.

Moreover, climate change has exacerbated allergic asthma, with longer pollen seasons and intensified air pollution episodes. This has led to a corresponding increase in hospital visits, long-term medication use, and demand for both controller and rescue therapies. As asthma becomes a persistent public health concern, governments and healthcare systems are intensifying screening and treatment efforts, further propelling drug sales.

One of the key restraints limiting market penetration, especially in low- and middle-income countries, is the high cost of biologic drugs. Treatments such as omalizumab and benralizumab can cost thousands of dollars per month, making them inaccessible to a majority of asthma patients, particularly those without comprehensive insurance coverage.

Even in developed regions, disparities exist in the availability of advanced therapies through public healthcare systems. This has created a two-tier treatment landscape, where most patients continue to rely on conventional corticosteroids and bronchodilators. Without significant reforms in reimbursement policies and pricing strategies, the uptake of biologics and targeted therapies will remain limited to high-income populations.

An exciting opportunity in the asthma drugs market lies in the evolution of inhaler technologies and integration with smart healthcare. Companies are investing in digital inhalers embedded with sensors that monitor inhalation patterns, medication usage, and symptom control in real time. These devices can sync with mobile apps to provide alerts, track adherence, and share data with healthcare providers.

Such innovations are especially valuable in managing pediatric and elderly patients, where adherence is often suboptimal. Moreover, smart inhalers provide insights into patient behavior, enabling personalized treatment adjustments. In the long run, these technologies can help reduce hospitalizations and emergency visits, making them attractive for payers and providers alike

Long-term Control Medications dominate the market due to their widespread use in chronic asthma management. These include inhaled corticosteroids (ICS), long-acting beta agonists (LABAs), leukotriene modifiers, and biologics. ICS-LABA combination therapies such as fluticasone-salmeterol have become the cornerstone of moderate to severe asthma care. Biologic agents targeting specific inflammatory pathways, like anti-IL-5 or anti-IgE drugs, are increasingly prescribed for severe eosinophilic or allergic asthma, enhancing the long-term control segment.

Quick Relief Medications are expected to grow rapidly as more patients seek immediate symptom management. Short-acting beta-agonists (SABAs) such as albuterol continue to be first-line therapies for acute asthma attacks. Although the trend is toward reducing reliance on SABAs due to concerns over overuse, these medications remain indispensable for emergency management. Innovations in combination inhalers that include both quick and long-term control components are expected to support growth in this category.

Inhalers dominate the administration segment, as they deliver medication directly to the lungs with minimal systemic exposure. Metered-dose inhalers (MDIs) and dry powder inhalers (DPIs) are the most commonly used devices. The familiarity, portability, and quick onset of action make inhalers a patient-preferred option. In recent years, combination inhalers that integrate corticosteroids with bronchodilators have shown improved compliance and symptom control.

Injections are the fastest-growing mode, primarily driven by the adoption of biologics. Injectable therapies are typically administered subcutaneously and provide targeted action over several weeks. Products like mepolizumab and dupilumab have gained favor among specialists treating refractory asthma cases. The convenience of self-administration and extended dosing intervals support their growing use in outpatient settings.

Private organizations currently lead the asthma drugs market, especially in terms of drug development, clinical trials, and innovation. Pharmaceutical giants and biotech firms dominate the landscape by investing heavily in R&D and launching advanced therapies, especially in biologics and fixed-dose combinations. Private institutions also collaborate with academic centers and CROs to expedite regulatory approvals.

Public organizations are gaining traction, particularly in emerging markets. Government-run hospitals and healthcare systems are the primary channels for asthma drug distribution in countries like India, Brazil, and South Africa. Public-sector involvement is crucial for expanding access to essential medications, especially generics, in underserved areas. National health programs focusing on respiratory diseases are further strengthening this segment.

Adults represent the dominant application segment, as adult-onset asthma is more likely to be severe and persistent. Occupational exposure, environmental triggers, and co-morbidities like obesity contribute to the higher burden among adults. As a result, this demographic requires sustained use of controller medications, including advanced therapies.

Pediatric patients are the fastest-growing segment, due to increasing diagnosis rates and rising pediatric allergy prevalence. Childhood asthma often involves different phenotypes and requires specific drug formulations and devices. Companies are focusing on child-friendly inhalers and low-dose corticosteroids. Moreover, school-based asthma education and screening programs are increasing diagnosis and early treatment, supporting segment growth.

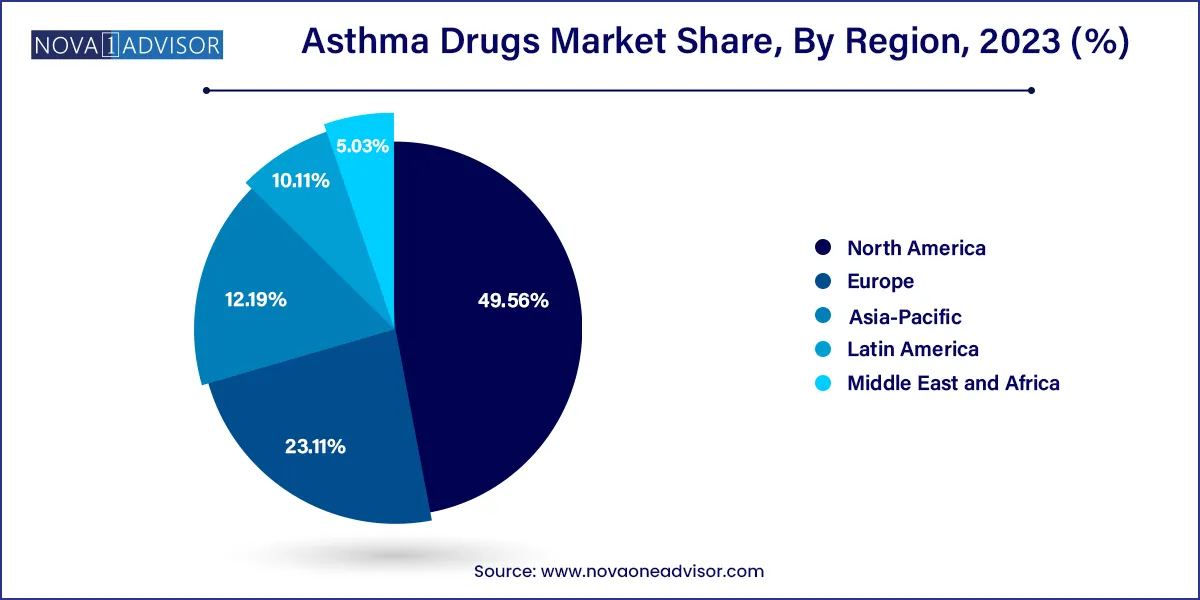

North America dominates the global asthma drugs market, owing to high disease awareness, strong reimbursement frameworks, and a robust pipeline of innovative drugs. The U.S. accounts for a major share due to high prevalence, with nearly 25 million people living with asthma. Regulatory agencies like the FDA provide accelerated pathways for breakthrough therapies, encouraging innovation. High healthcare spending and access to specialists further bolster drug uptake in this region.

Asia-Pacific is the fastest-growing region, driven by urbanization, increasing air pollution, and greater diagnostic outreach. Countries like China and India are witnessing a surge in asthma cases, particularly among children and industrial workers. Governments are investing in primary healthcare, while pharmaceutical companies are targeting these high-volume markets with affordable generics and branded generics. Japan and South Korea, with their advanced healthcare systems, are also contributing to regional growth through adoption of biologics and digital inhalers.

In February 2024, AstraZeneca received FDA approval for its once-daily triple-combination inhaler "Breztri Aerosphere" for maintenance treatment in adults with asthma.

In March 2024, Sanofi and Regeneron announced new clinical trial data showing improved outcomes with Dupixent in moderate-to-severe pediatric asthma patients.

GlaxoSmithKline (GSK) launched a new DPI version of its best-selling inhaler Seretide in January 2024, optimized for low-resource settings.

In April 2024, Teva Pharmaceuticals partnered with a digital health startup to launch a connected inhaler device integrated with real-time symptom tracking.

Novartis initiated Phase III trials in December 2023 for its anti-IL-13 biologic targeting steroid-resistant asthma.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asthma Drugs market.

By Medication

By Mode of Administration

By Organization Type

By Application

By Region