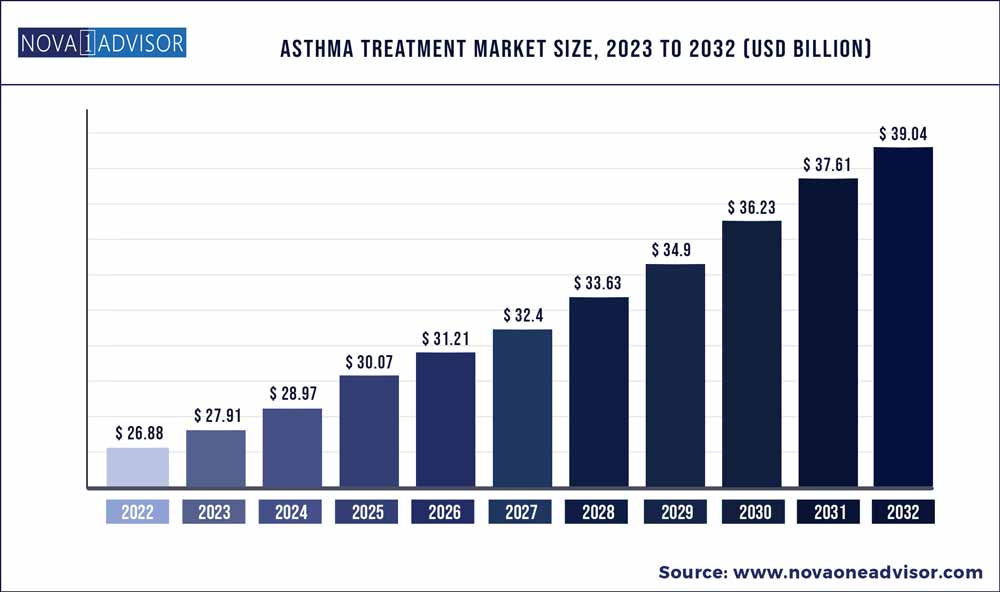

The Asthma Treatment market size was exhibited at USD 26.88 billion in 2022 and is projected to hit around USD 39.04 billion by 2032, growing at a CAGR of 3.8% during the forecast period 2023 to 2032.

Asthma is a condition, in which the airways narrow and swell, resulting in extra mucus formation. This can make breathing difficult and cause coughing, a whistling sound, and shortness of breath. Asthma is a minor annoyance for some people. For some, it can be a major issue that disrupts daily activities and could result in a life-threatening asthma attack, which is also called asthma exacerbation.

Symptoms in some people worsen in situations such as exercise-induced asthma, which could be exacerbated by cold and dry air. Irritants in the workplace such as chemical fumes, gases, or dust cause occupational asthma. Airborne allergens such as pollen, mold spores, cockroach waste, or skin and dried saliva shed by pets cause allergy-induced asthma.

Asthma medications include nebulizers and spacers. Nebulizer is preferred for asthma patients. It is a device that can deliver doses of medicines quickly and easily to asthma patients.

Report Scope of the Asthma Treatment Market

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 27.91 Billion |

|

Market Size by 2032 |

USD 39.04 Billion |

|

Growth Rate from 2023 to 2032 |

CAGR of 3.8% |

|

Base Year |

2022 |

|

Forecast Period |

2023 to 2032 |

|

Segments Covered |

By Medication, By Route of Administration, By Adjunct Therapy, By Distribution Channel, By Geography |

|

Key companies profiled |

AstraZeneca Teva Pharmaceutical Industries Ltd. GlaxoSmithKline plc Boehringer Ingelheim International GmbH Roche Holding AG / Novartis AG Merck & Co., Inc. Koninklijke Philips N.V. Sanofi-Aventis SA MundiPharma. |

In the current healthcare scenario, respiratory health is of paramount importance, especially because respiratory diseases such as asthma are one of the leading causes of death and disability worldwide. According to the World Health Organization (WHO) report on “The Global Impact of Respiratory Disease” published in 2017, an estimated 334 million individuals suffer from asthma. According to the Centers for Disease Control and Prevention (CDC), during the 2019-2020 coronavirus pandemic, individuals suffering from moderate to severe asthma were at a greater risk of falling ill with acute respiratory disease. Numerous clinical trials are being conducted by market players for the development of new therapeutics for asthma, especially in light of the 2019-2020 coronavirus pandemic.

MARKET TRENDS

One of the key market trends prevailing in this market is the strong and robust R&D being undertaken by key market players for the development of advanced therapeutics for asthma. Since asthma is a chronic disease that affects a substantial number of patients worldwide including children, a number of prominent pharmaceutical companies are involved in developing drugs for asthma. This involvement includes the presence of several strong pipeline candidates for asthma treatment in various stages of clinical trials. For instance, in September 2019, Novartis announced positive results from the phase III IRIDIUM study of inhaled combination QVM149 in patients diagnosed with uncontrolled asthma. This drug candidate for asthma treatment allows patients to better control their asthma symptoms, which enables a greater improvement in the patients’ lung function. Positive clinical developments as such is projected to further propel the asthma treatment market growth during the forecast period.

MARKET DRIVERS

One of the critical market drivers of this market is the increasing prevalence of chronic respiratory diseases such as asthma globally. Asthma is considered to be the most common chronic disease worldwide, and this has particularly driven the need for advanced therapeutics for asthma treatment. Asthma, if especially present in the individual in the severe form, is a severely debilitating disease and thus requires the administration of treatment drugs for asthma. Thus, the increasing need for a better quality of life for the patients undergoing asthma treatment is also expected to drive the market growth. According to the American Academy of Allergy, Asthma & Immunology (AAAAI), in the United States in 2016, it was estimated that approximately 8.3% of children in the U.S. had asthma. The introduction of low cost and effective therapeutics is anticipated to drive the growth of the global market during the forecast period.

The other critical driver is the increasing need for better clinical and therapeutics for asthma in light of the 2019-2020 coronavirus pandemic. Since, both the COVID-19 and asthma are respiratory illnesses, there is a greater demand for asthma treatment. This is primarily because since asthma is considered to be the most common chronic illness, with a large patient population pool, the COVID-19 is anticipated to worsen the symptoms of asthma in the individuals suffering from it, thus necessitating the need for effective asthma treatment. The Centers for Disease Control and Prevention (CDC), during the 2019-2020 coronavirus pandemic has issued special guidelines for patients undergoing treatment for asthma and also advocated greater precaution for asthma patients. This is projected to spur the demand for advanced asthma treatment drugs which, in turn, will favor growth of this market.

In light of the 2019-2020 coronavirus pandemic, there is a greater demand for various types of treatment drugs for asthma, because both the respiratory illnesses are closely linked. The increasing demand for asthma treatment has led to the U.S. FDA issuing priority regulatory approvals to a number of asthma drugs, which includes key generic equivalents. For instance, in April 2020, the U.S. FDA provided regulatory approval to Cipla’s key generic asthma treatment drug, and a similar generic equivalent from Lupin is also anticipated to gain regulatory approvals. Such developments and trends are further leading to the increasing product launches of significant capability from prominent companies. The increasing product launches are further undertaken in order to ensure that there are no significant asthma medications shortages. The above factors combined with the need for efficient therapeutics is further projected to fuel the demand for these drugs and boost the global market growth.

MARKET RESTRAINT

Despite the increasing prevalence of asthma globally including in both, emerging markets such as Asia, and developed markets such as North America, there are certain restraining factors that are limiting the adoption of these therapeutics. One of the major factors restraining the growth of the market is higher costs associated with asthma inhalers, which is often considered the primary treatment for Asthma. For instance, the prices of Advair, a critical asthma drug has risen from US$ 317 in 2013 to US$ 499 in 2018, documenting an increase of 57.0%. Apart from the high medication costs, another critical factor has further limited market growth: the underdiagnosis of asthma. Underdiagnosis of asthma leads to poorer clinical outcomes for the patient who are unable to adopt the appropriate asthma pharmaceuticals as a treatment for their medical condition. Such factors are anticipated to significantly restrain market growth.

By Treatment Analysis

Based on treatment, the global market is segmented into long-term control medications and quick-relief medications. Since asthma is considered to be a chronic disease, the primary treatment for such disorders is often long-term medications for the control and management of asthma symptoms. Hence, long-term control medications dominated the global market share in 2019. Some of the key medications of this segment include Advair, Qvar, Symbicort and have been instrumental in the dominance of this segment in the global market. Some of the key drug classes of this segment include inhaled and combination corticosteroids, leukotriene modifiers, anticholinergics, and immunomodulators.

The quick-relief medications segment is anticipated to account for the second-largest segment. The drug classes under this segment include short-acting beta-agonists (SABAs) and the medications in this segment provide prompt relief of asthma symptoms by the relaxation of airway muscles. Some of the key asthma medications of this segment include albuterol sulfate.

By Route of Administration Analysis

In terms of route of administration, the market is segmented into injectable, oral, and inhalation. The inhalation segment is anticipated to dominate the route of administration segment because a significant number of products for treatment of asthma are administered in this form. Some of the prominent products include Pulmicort, and Qvar and this segment is anticipated to hold control over its market share in the forecast period, resulting in the dominance of this segment in the global market. The injectable segment is anticipated to experience growth in the forecast period because a number of immunomodulators, a key drug class, is anticipated to grow in the forecast period and these drugs are injected subcutaneously.

The oral segment is anticipated to experience limited growth in the forecast period. The increasing influx of generic equivalents, and the increasing uptake of immunomodulators, is expected to limit the growth of the segment during the forecast period.

By Distribution Channel Analysis

In terms of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies & drug stores, and online pharmacies. One of the key reasons for the dominance of the hospital pharmacies segment is that the therapeutics used in asthma treatment can often be prescribed only in hospital settings with trained medical professionals. This enables the proper adherence to the treatment guidelines and also the appropriate and safe administration of critical therapeutics, some of which have to be administered through subcutaneous injections. Such proper and appropriate treatment often allows for the effective control of asthma symptoms.

The retail pharmacies & drug stores are anticipated to command the second largest market share, because the refilling of asthma prescriptions such as inhaled corticosteroids which can be undertaken at these locations, are some of the major factors responsible for the growth of this segment in the forecast period.

The online pharmacies are anticipated to grow at the highest CAGR, because of the ease and convenience given to the patients in terms of acquiring the critical asthma medications.

REGIONAL ANALYSIS

The market size in North America stood at USD 13.42 billion in 2022. The market in the region is characterized by a high prevalence of asthma, and also the greater awareness of advanced and efficient asthma therapeutics. These factors, along with higher awareness among patient population towards new and emerging therapeutic options, the strong market growth potential of the region due to underdiagnosis of asthmatic patients and the presence of major biopharmaceutical companies are their strong product offerings, are responsible for a dominant share of the region in the global market. Europe accounts for the second-largest market share because asthma is the most common noncommunicable disease amongst children in the region and this is anticipated to drive the adoption of advanced therapeutics in the region. The market in Asia-Pacific is projected to register a comparatively higher CAGR during the forecast period. The increasing presence of key products in the region is anticipated to drive the demand for asthma drugs during 2023-2032. For instance, the growth of Pulmicort, a key asthma drug, in the region was driven by a positive performance in China and coupled with the presence of a large and underpenetrated market in the region, together are projected to drive the market growth in Asia Pacific during the forecast period. The rest of the world market comprises of Latin America and the Middle East & Africa and is currently in the nascent stage. However, increasing prevalence of chronic respiratory diseases and growing launches of key products including efficient generic asthma therapeutics is projected to fuel the market demand during the forecast period.

Some of the prominent players in the Asthma Treatment Market include:

Segments Covered in the Report

This report forecasts the volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor has segmented the Asthma Treatment market.

By Medication

By Route of Administration

By Adjunct Therapy

By Distribution Channel

By Geography