The global autologous cell therapy market size was exhibited at USD 8.35 billion in 2023 and is projected to hit around USD 49.21 billion by 2033, growing at a CAGR of 19.41% during the forecast period 2024 to 2033.

.webp)

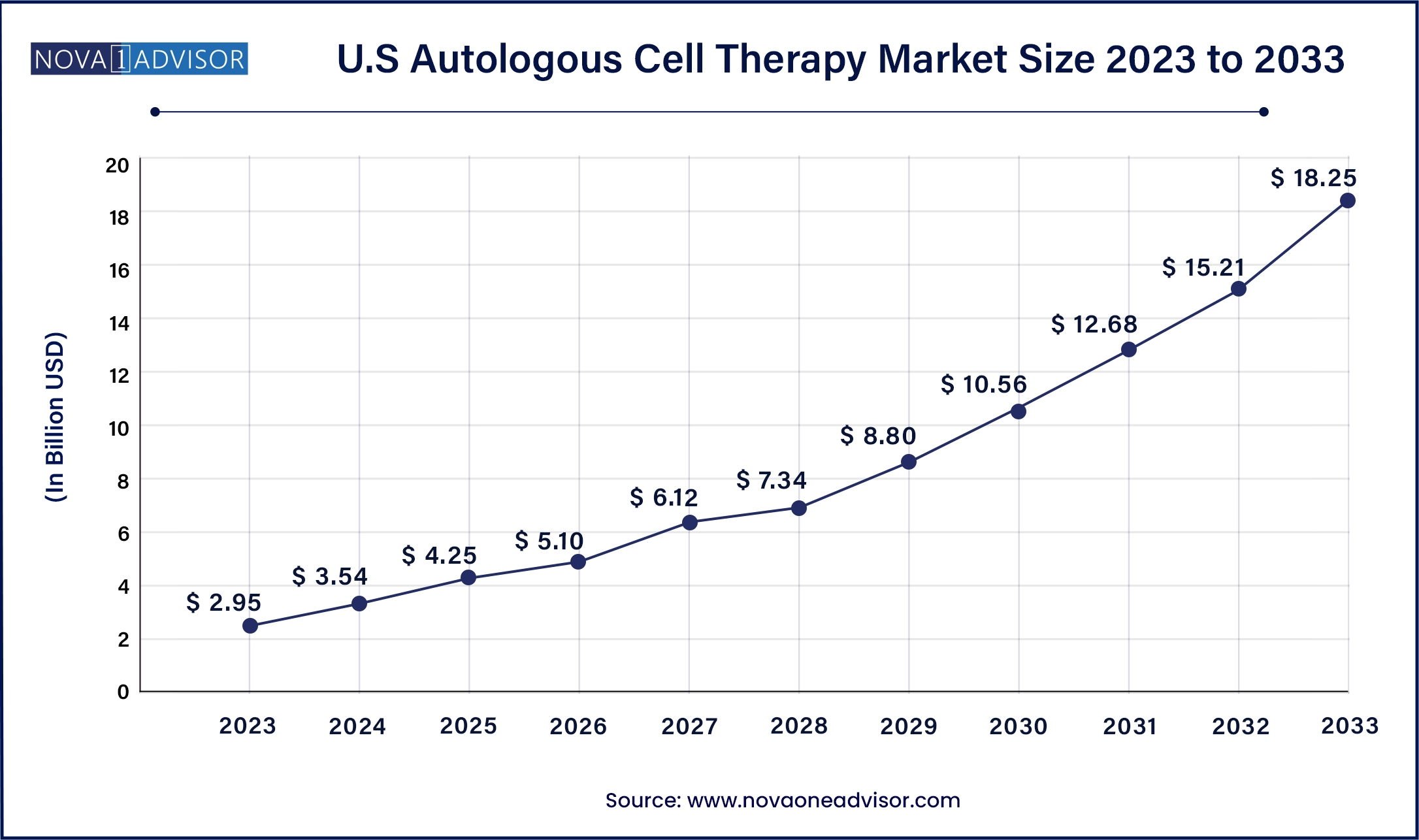

The U.S Autologous Cell Therapy market size was valued at USD 2.95 billion in 2023 and is anticipated to reach around USD 18.25 billion by 2033, growing at a CAGR of 19.99% from 2024 to 2033.

North America dominated the autologous cell therapy market with a revenue share of 45.0% in 2023. The market in this region is highly competitive since most of the major market players such as BrainStorm Cell Therapeutics, Bristol Myers Squibb is operating in this region. Furthermore, the growing burden of the geriatric population, numerous immunological advantages, and the reduced risk of autologous cell therapy rejection have created new growth opportunities for the autologous cell therapy Market.

U.S. Autologous Cell Therapy Market Trends

The autologous cell therapy market in the U.S. held the largest share in the North American region in 2023 and is expected to grow rapidly over the forecast period. In the US, the FDA’s approval of several autologous cell therapies for various indications has boosted market confidence and investment. The presence of a robust healthcare system and strong intellectual property protection laws further support market growth. In January 2024, the FDA approved a manufacturing process change for Kite's Yescarta CAR T-cell therapy, reducing the median U.S. turnaround time for leukapheresis to product release from 16 to 14 days.

Europe Autologous Cell Therapy Market Trends

The Europe autologous cell therapy market was a lucrative region in this industry. The European Medicines Agency’s (EMA) supportive regulatory environment for advanced therapies is driving market growth. The EU’s commitment to funding research through programs like Horizon 2020 supports the development of a dedicated bioreactor for the expansion of tumor-infiltrating lymphocytes (TILs) for autologous cell therapy (ACT) contributing to market expansion. In addition to these factors, the growing prevalence of chronic diseases across all these regions is creating a large patient pool for autologous cell therapies.

The autologous cell therapy market in the UK is driven by the presence of a robust healthcare system, growing research activities in stem cell therapies, and supportive regulatory frameworks. Moreover, partnerships between universities and biotech companies are contributing to advancements in this sector.

France autologous cell therapy market is expected to grow rapidly from 2024 to 2030. The market is driven by the country’s strong focus on research & development in the biotechnology and pharmaceuticals sectors, supportive regulatory environment, and growing awareness about regenerative medicine. Additionally, collaborations between academic institutions and industry players are playing a crucial role in market growth.

The growth of the autologous cell therapy sector in Germany is propelled by the country's aging demographic, enhanced government investment in research efforts, and beneficial reimbursement schemes. Additionally, partnerships between academic institutions and industry participants are fueling advancements in this area.

Asia Pacific Autologous Cell Therapy Market Trends

Asia Pacific autologous cell therapy market is anticipated to witness fastest growth over the forecast period. owing to the rising burden of diseases, strong research activities in autologous cell therapies, the presence of a well-established biotechnology sector, developing healthcare facilities, and growing awareness for cell therapies. In May 2024, Cytiva, in collaboration with Gilead Sciences' Kite Pharma, unveiled Sefia, a cutting-edge cell therapy manufacturing platform designed to overcome challenges like dependency on manual labor, limited capacity, and risk of batch failures. This innovation caters to the increasing demand for autologous cell therapies, highlighted by over 1,000 clinical trials worldwide and the presence of 10 approved CAR-T therapies across the U.S., Europe, and the Asia-Pacific region.

The autologous cell therapy market in China is witnessing the rapid economic growth and increasing healthcare expenditures which have led to a surge in investments in biotechnology research and development. The Chinese government’s focus on developing its domestic biotech industry is also fueling the growth of the autologous cell therapy market such as China National Science and Technology Development Plan.

The Japan autologous cell therapy market is expected to grow from 2024 to 2030. The Japanese market's growth can be attributed to the country’s aging population and increasing government investments in regenerative medicine. In addition, collaborations between academic institutions and industry players are fostering innovation in this field. In April 2022, Metcela Inc. strengthened its development of cardiac stem cell-based therapies by acquiring Japan Regenerative Medicine Co., Ltd. (JRM), previously under Kidswell Bio. Following a partnership established with Kidswell Bio in January, Metcela enhanced this relationship by allotting new shares to Kidswell Bio.

Latin America Autologous Cell Therapy Market Trends

The autologous cell therapy market in the Latin America is expected to grow rapidly due to factors such as the region's aging population, the increasing prevalence of chronic diseases, and supportive government initiatives. A key driver of this growth is the aging population, which is more susceptible to conditions treatable by autologous cell therapy, like cancer and neurological disorders. The rising incidences of chronic diseases, including diabetes and cardiovascular diseases fuel demand for these personalized treatments. Moreover, initiatives by governments, as seen with Brazil's National Health Surveillance Agency (ANVISA) approving autologous cell therapy products, further propel market expansion.

Brazil autologous cell therapy market is expected to grow from 2024 to 2030 due to increased awareness of regenerative medicine, significant government support for R&D, including efforts by the Brazilian Health Ministry through the National Stem Cell Bank (BNHuCel), and the contribution of academic institutions like the Universidade de São Paulo. This growth is also spurred by the rising prevalence of chronic diseases, such as diabetes and Parkinson’s disease, highlighting the demand for innovative treatments.

Middle East and Africa Autologous Cell Therapy Market Trends

The autologous cell therapy market in MEA was identified as a lucrative region in this industry. The autologous cell therapy market in the Middle East and Africa is growing due to increased adoption of cell-based therapies, advances in stem cell research, and rising awareness about the benefits of autologous cell therapies. Government efforts to boost biotechnology and partnerships between academia and industry are also supporting market expansion. For example, South Africa's Department of Health is planning a National Stem Cell Bank to encourage regenerative medicine research. Additionally, collaborations like the one between the University of Cape Town and Novartis for developing CAR T-cell therapies showcase the innovation in the region, promising new and tailored treatments for the local population.

Saudi Arabia autologous cell therapy market is driven by an increased need for advanced treatments for diseases like cancer and heart conditions. Government support, regulatory improvements by the Saudi Food and Drug Authority, and public-private partnerships are boosting the sector's development. Collaborations with international firms are spurring innovation, while growing awareness among patients and doctors about the therapy's benefits is increasing demand.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.15 Billion |

| Market Size by 2033 | USD 9.97 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 19.41% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Source, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | BrainStorm Cell Therapeutics; Holostem Terapie Avanzate S.R.L; Pharmicell Co. Inc; Opexa Therapeutics; Caladrius Biosciences Inc; U.S. Stem Cell Inc; Lonza; Bristol Myers Squibb; Novartis; Autolus therapeutics; Tego Science; Corning Incorporated; Bio Elpida; Vericel Corporation; Catalent, Inc; Sartorius AG . |

The key factors driving the market growth include numerous immunological advantages, a rise in the proportion of the geriatric population across the globe, and a reduced risk of autologous cell therapy rejection. Autologous cell therapy is widely used in a range of diseases such as cancer, neurodegenerative disorders, cardiovascular disorders, autoimmune disorders, orthopedics, wound healing, and others.

Autologous cell therapy's immunological benefits significantly drive its market growth. By using the patient's cells, the therapy minimizes the risk of immune rejection, creating a safer treatment option. This approach has shown considerable promise, particularly in cancer treatments, where immune compatibility is crucial for therapy success. Personalized treatments leveraging these advantages are becoming increasingly sought after, reflecting a broader trend toward individualized medicine.

The global population of individuals aged 65 and older is projected to more than double by 2050, reaching over 1.5 billion. This demographic shift increases the prevalence of age-related diseases such as cardiovascular disorders and neurodegenerative diseases. These conditions are key application areas for autologous cell therapy, which, in turn, stimulates market growth as demand for effective treatments rises.

The autologous approach significantly reduces the risk of therapy rejection which is a major advantage over allogeneic therapies (using donor cells). This not only improves patient outcomes but also simplifies the path to regulatory approval. The clinical and regulatory efficiency of autologous cell therapies encourages investment and innovation in this sector, responding to the critical need for compatible and effective therapeutic options. In November 2023, Novartis secured global rights to a selection of Legend Biotech’s CAR-T cell therapies, including a promising candidate for lung cancer and large cell neuroendocrine carcinoma, in a deal worth over USD 1.0 billion. This agreement allows Novartis to leverage its T-Charge platform for developing and manufacturing these therapies.

In terms of revenue, the bone marrow segment dominated the market with a share of over 42.9% in 2023. Based on sources, the autologous cell therapy market is segmented into bone marrow, epidermis, mesenchymal stem cells, haematopoietic stem cells, chondrocytes, and others. The bone marrow in autologous cell therapy is been successfully used to treat different diseases. It is one of the major sources used for cell therapy where the patient’s healthy stem cells are collected from the bone marrow or blood before treatment stored. Alternatively, autologous cell therapy with bone marrow provides certain benefits over a donor’s stem cells.

The mesenchymal stem cells segment is anticipated to witness the fastest growth over the forecast period owing to their preclinical and clinical applications in tissue regeneration to therapy for immune diseases. For instance, in March 2020, the Celltex Therapeutics Corporation announced that it has begun active discussions with the FDA regarding a study using of MSCs against COVID-19 symptoms. In addition, the company has researched the safety and efficiency of the use of MSCs for patients suffering from injuries, pain, and maladies associated with vascular, autoimmune, and other debilitating including inflammatory lung conditions, chronic obstructive pulmonary disease (COPD), and pneumonia.

In terms of revenue, the cancer segment dominated the market with a share of over 20.7% in 2023. Based on application, the market is segmented into cancer, neurodegenerative disorders, cardiovascular disorders, autoimmune disorders, orthopedics, wound healing, and others. According to WHO (World Health Organization), cancer disease accounts for nearly 10 million deaths in 2020.

As per the American Cancer Society, in 2023, 1.9 million new cancer cases were diagnosed and 608,570 cancer deaths in the U.S. Autologous cell therapy is anticipated to find its major demand in cancer application with the growing burden of cases and demand for treatment and therapy. In August 2022, Anixa Biosciences mentioned that it has administered the first dose of its follicle-stimulating hormone receptor (FSHR)- targeted autologous cell therapy to an ovarian cancer patient in a Phase I trial.

In terms of revenue, the hospitals & clinics segment dominated the market with a share of over 50.0% in 2023. Based on end use, the market is segmented into hospitals & clinics, ambulatory centers, academics & research, and others. The increasing burden of cancer, autoimmune diseases, cardiovascular diseases, and neurodegenerative disorders have led to the rising requirement for treatment and therapies.

The academics & research segment is anticipated to witness growth at a CAGR of 20.8% over the estimated timeframe. Autologous cell therapy is garnering an increasing amount of interest worldwide and is being extensively studied. It is an emerging field of science that uses the living cellular to treat and prevent disease. Academics and research mostly conduct research in bone marrow, epidermis, mesenchymal stem cells, haematopoietic stem cells, and chondrocytes. For instance, in October 2022, Allogene Therapeutics mentioned the new survey of the U.S academic institutes that specialized in the administration of CAR T, which discovered 82% of respondents agreed that CAR T therapies have assisted in the management of cancers.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global autologous cell therapy market.

Source

Application

End-use

By Region