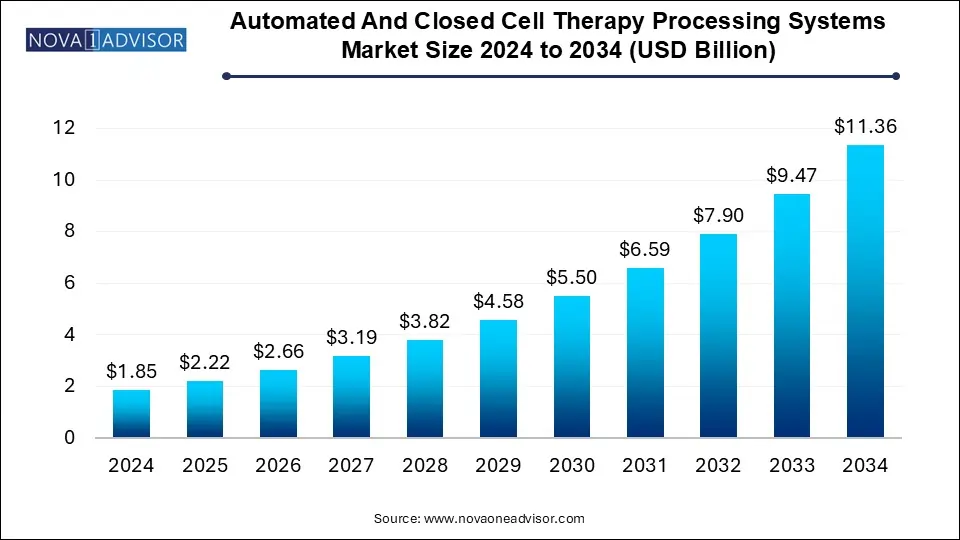

The automated and closed cell therapy processing systems market size was exhibited at USD 1.85 billion in 2024 and is projected to hit around USD 11.36 billion by 2034, growing at a CAGR of 19.9% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.22 Billion |

| Market Size by 2034 | USD 11.36 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 19.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Workflow, Type, Scale, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | MiltenyiBiotec; Lonza; Fresenius Kabi AG; Danaher Corporation; BioSpherix, LLC; Terumo Corporation; Sartorius AG; ThermoGenesis Holdings, Inc.; CELLARES; Thermo Fisher Scientific Inc. |

The growing popularity of regenerative medicine & cell therapies, coupled with a range of benefits offered by automation technologies for developing these therapies, is expected to propel market growth. In addition, the growing integration of software technologies and advanced therapy development processes is also anticipated to drive market growth. Rising investments by bio manufacturers for developing cellular therapy products through rounds of series funding are anticipated to offer lucrative growth opportunities. Moreover, the increasing demand for scalable, safe, and contamination-free cell therapy manufacturing solutions, highlighted by innovations such as animal origin-free formulations, is driving the market’s growth.

In April 2024, Thermo Fisher Scientific Inc. launched an animal origin-free (AOF) formulation for cell therapy manufacturing. This innovative formulation enhances T-cell expansion and supports scalable production while reducing risks associated with animal-derived materials. It aims to streamline cell therapy processes with improved safety and reliability, which is crucial for consistent and reproducible therapeutic manufacturing. The AOF approach aligns with industry trends focusing on reducing contamination risks and increasing efficiency in automated cell therapy processing systems.

The growing popularity of regenerative medicine & cell therapies, coupled with a range of benefits offered by automation technologies for developing these therapies, is expected to propel market growth. For instance, in October 2024, Cell X Technologies and Aspen Neuroscience entered a collaboration and licensing agreement to enhance Aspen's iPSC-derived autologous clinical manufacturing. Cell X's Celligent technology aimed to automate cell processing workflows for improved efficiency and product insight. This platform targeted automating traditionally manual GMP manufacturing processes for cell therapies.

The increasing prevalence of cancer globally has increased the demand for automated and closed-cell therapeutic processing systems. According to the National Cancer Institute, cancer remained a top cause of death globally, with nearly 20 million cases and 9.7 million deaths reported in 2022. By 2040, new cancer cases are projected to increase to 29.9 million annually, with cancer-related deaths rising to 15.3 million.

The separation segment dominated the market and accounted for a share of 31.7% in 2024 and is expected to grow at the fastest CAGR of 20.7% over the forecast period. The segment’s growth is attributed to the need for enhanced efficiency, scalability, and cost reduction in cell therapy manufacturing, achieved through the automation of critical processes such as cell expansion and separation. For instance, in February 2024, Multiply Labs and Thermo Fisher Scientific Inc. expanded their partnership to automate critical steps in cell therapy manufacturing, specifically focusing on cell expansion and separation processes. This collaboration aims to streamline workflows, improve efficiency, and accelerate production while maintaining quality control. The automation was expected to enhance scalability, reduce costs, and meet the growing demand for cell-based therapies.

The expansion segment is expected to grow significantly over the forecast period. The segment is driven by the increasing demand for scalable, efficient, and automated manufacturing solutions to improve the production and potency of cell and gene therapies, particularly for complex treatments such as solid tumors. For instance, in September 2024, Xcell Biosciences Inc. enhanced its partnership with Laboratory Corporation of America Holdings by launching the AVATAR Foundry, a platform designed for large-scale cell and gene therapy manufacturing automation. This innovation aims to boost the scalability and potency of cell therapies, especially for treating solid tumors. The collaboration addresses the increasing demand for efficient, scalable production in the rapidly growing cell therapy market.

The non stem cell therapy segment accounted for the largest market revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of advanced gene-editing technologies for precise treatment of diseases such as cancer, diabetes, and blood disorders drive the need for efficient, scalable, and safe cell therapy processing systems. For instance, CRISPR is a gene-editing tool that acts as molecular scissors, enabling precise modification of DNA sequences. It is used in gene therapy to treat diseases by correcting mutated genes or regulating defective ones. Applications include editing immune cells for cancer treatment, modifying stem-cell-derived pancreatic cells for Type 1 diabetes, and correcting blood stem cells to treat blood disorders such as sickle cell disease and β-thalassemia.

The stem cell therapy segment is expected to grow significantly over the forecast period. The segment’s growth is attributed to the growing demand for scalable and efficient automation solutions to enhance the manufacturing, accessibility, and quality of stem cell therapies. For instance, in October 2024, Cellular Origins and Fresenius Kabi AG partnered to develop scalable automation solutions for cell and gene therapy manufacturing. The collaboration focused on improving production efficiency and scalability to meet growing demand. The goal was to automate complex manufacturing steps, enhancing the accessibility and quality of these therapies.

The pre-commercial/ R&D scale segment accounted for the largest market revenue share of 75.0% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the need for automated, scalable quality control solutions to streamline manufacturing processes and overcome bottlenecks in pre-commercial and R&D stages of cell therapy development. For instance, in April 2024, CELLARES launched Cell-Q, the automated cGMP quality control (QC) workcell for cell therapies. The system aims to eliminate bottlenecks in manual QC processing, enhancing efficiency and scalability. It extends IDMO (Integrated Distributed Manufacturing Operations) capabilities, supporting seamless manufacturing from production to quality control in cell therapy development.

The commercial scale segment is expected to grow significantly over the forecast period. The need for scalable, efficient, and high-quality manufacturing solutions to support large-scale production of cell therapies for commercial applications is driving the segment’s growth. For instance, in May 2024, ADVA Biotechnology and Cellipont Bioservices partnered to optimize cell therapy manufacturing using the ADVA-X3 platform. The collaboration aims to enhance cell therapy production processes' scalability, efficiency, and quality. This platform would help streamline manufacturing, making it more suitable for large-scale commercial applications.

North America automated and closed cell therapy processing systems market held the largest share of 51.0% in 2024 owing to the increasing demand for integrated solutions that streamline the storage, transportation, and processing of cell and gene therapies, enhancing the efficiency of clinical trials and commercialization efforts. For instance, in June 2024, Cryoport Systems, LLC partnered with Minaris Regenerative Medicine to enhance the development of cell and gene therapies. The collaboration focuses on providing integrated solutions for the advanced storage, transportation, and processing of cell and gene-based products. This partnership aims to streamline the commercialization and clinical trials of regenerative therapies.

U.S. Automated And Closed Cell Therapy Processing Systems Market Trends

The U.S. automated and closed cell therapy processing systems market held a dominant position in 2024 and is expected to grow at the fastest CAGR over the forecast period due to the growing adoption of advanced robotics to streamline manufacturing processes, reduce labor costs, and enhance scalability and efficiency in cell therapy production. For instance, in September 2024, Multiply Labs announced a collaboration with Legend Biotech to automate cell therapy manufacturing using advanced robotic systems. This partnership was expected to evaluate Multiply Labs' robotic technology, which can seamlessly integrate with existing cell therapy processes, potentially reducing labor costs and improving manufacturing throughput.

Europe Automated And Closed Cell Therapy Processing Systems Market Trends

The Europe automated and closed cell therapy processing systems market was identified as a lucrative region in 2024. The region’s growth is attributed to the increasing demand for scalable, efficient, and automated solutions to enhance the production of high-quality cell therapies with minimal manual intervention. For instance, in October 2022, ScaleReady USA introduced the Cue Cell Processing System from Fresenius Kabi, designed to automate and streamline cell therapy manufacturing. The system enhances efficiency by integrating cell processing with closed, automated workflows. This innovation aims to support scalable, high-quality cell therapies with minimal manual intervention.

Asia Pacific Automated And Closed Cell Therapy Processing Systems Market Trends

The Asia Pacific automated and closed cell therapy processing systems market is anticipated to grow at the fastest CAGR over the forecast period. This growth is attributed to the growing investment in automation to enhance efficiency, scalability, and precision in manufacturing advanced cell and gene therapies, meeting the rising demand for high-quality treatments. For instance, in October 2024, Terumo Corporation automated its manufacturing processes to expand its capabilities in producing cell and gene therapies. This move enhances efficiency and scalability, allowing to produce high-quality therapies at a larger scale. The company's investment aims to support the growing demand for advanced therapies and improve manufacturing speed and precision.

The China automated and closed cell therapy processing systems market is expected to grow rapidly in the coming years due to the adoption of integrated, full-process automation technologies that enhance production efficiency, data monitoring, and support clinical trials and R&D in cell therapy development. For instance, in October 2024, Sino-Biocan (Shanghai) Biotech Ltd launched the WUKONG Automated, Closed, Integrated Cell Processing System, offering full-process automation from blood collection to cell drug production. The system enhances efficiency with continuous, closed-loop operations, real-time monitoring, and comprehensive data recording, supporting clinical trials and pharmaceutical R&D.

The Japan automated and closed cell therapy processing systems market held a substantial market share in 2024 owing to the integration of robotics and pharmaceutical technologies to streamline production, improve manufacturing quality, and facilitate cost-effective technology transfer, supporting research institutions and startups in cell therapy development. For instance, in May 2024, YASKAWA ELECTRIC CORPORATION and Astellas Pharma Inc. partnered to develop an innovative cell therapy platform that integrates robotics and pharmaceutical technologies. This collaboration aims to streamline the transition from research to commercial-scale production, enhancing manufacturing quality and stability.

Automated And Closed Cell Therapy Processing Systems Market Recent Developments

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the automated and closed cell therapy processing systems market

By Workflow

By Type

By Scale

By Regional