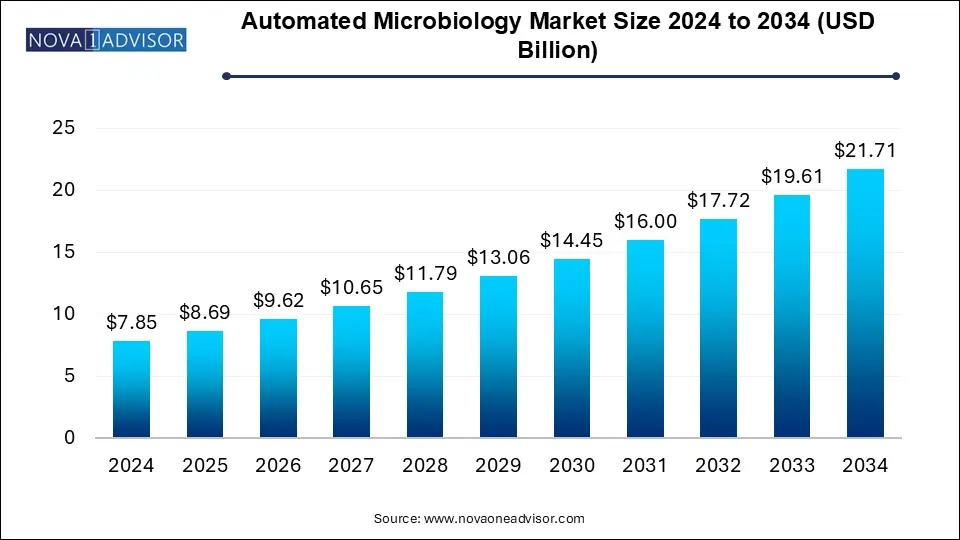

The automated microbiology market size was exhibited at USD 7.85 billion in 2024 and is projected to hit around USD 21.71 billion by 2034, growing at a CAGR of 10.71% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.69 Billion |

| Market Size by 2034 | USD 21.71 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.71% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Automation Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | BD; QIAGEN; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Danaher; Merck KGaA; bioMérieux; Abbott; DiaSorin S.p.A.; BioRad Laboratories, Inc. |

The increasing prevalence of infectious diseases globally is a significant driver for the automated microbiology market. With the rise of hospital-acquired infections (HAIs), antimicrobial resistance (AMR), and foodborne illnesses, there is a growing demand for rapid and accurate microbial identification and susceptibility testing. Automated microbiology solutions, such as mass spectrometry, PCR-based detection, and AI-driven microbial identification, help reduce turnaround times and improve diagnostic accuracy. Additionally, the COVID-19 pandemic has accelerated the adoption of automated systems in laboratories, emphasizing the need for high-throughput and real-time pathogen detection.

Key drivers of the automated microbiology industry include the increasing prevalence of healthcare-associated infections (HAIs) and the growing need for rapid and precise microbial identification. Hospitals and diagnostic laboratories are increasingly adopting automation to enhance workflow efficiency and ensure timely and accurate diagnoses. Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are further improving the accuracy and performance of automated microbiology systems.

Opportunities in the market lie in the adoption of innovative technologies such as MALDI-TOF mass spectrometry and molecular diagnostics, which enable comprehensive microbial identification and antimicrobial susceptibility testing. The rising concern over antimicrobial resistance (AMR) is fueling demand for automated systems capable of quickly detecting and analyzing resistant pathogens. Additionally, the expansion of molecular diagnostic capabilities in resource-limited settings presents an opportunity for the development of portable and cost-effective automated microbiology solutions.

Recent trends in the automated microbiology industry include the seamless integration of automation into laboratory workflows to enhance efficiency and reduce turnaround times. The adoption of cloud-based data management and connectivity solutions is enabling real-time monitoring and data sharing, improving overall laboratory operations. A heightened focus on quality control and regulatory compliance is driving advancements in both software and instrumentation. Moreover, strategic collaborations between vendors and healthcare providers are fostering innovation and enabling tailored solutions that meet the specific needs of diagnostic laboratories.

Artificial intelligence (AI) is revolutionizing microbial diagnosis by enhancing speed, accuracy, and efficiency in detecting pathogens. AI-driven machine learning algorithms analyze complex microbiological data, aiding in the rapid identification of microbial species and antimicrobial resistance patterns. These advancements enable precise and early disease detection, improving patient outcomes. AI also facilitates automation in clinical microbiology labs, reducing human errors and processing large datasets efficiently. However, challenges such as data standardization and ethical considerations must be addressed to maximize AI's potential in microbial diagnostics.

Based on products, the reagents & kits segment dominated the market with the largest revenue share of 47.86% in 2024. The market is driven by increasing demand for rapid and accurate microbial identification, rising prevalence of infectious diseases, and the growing adoption of automation in clinical diagnostics. Technological advancements in reagent formulations, including ready-to-use culture media and molecular diagnostic kits, enhance laboratory efficiency and reduce turnaround times. Additionally, stringent regulatory requirements for microbial testing in pharmaceutical, food, and healthcare industries are propelling demand for high-quality reagents. Companies are also investing in innovation, such as multiplex PCR kits and AI-driven assay development, to improve diagnostic precision and workflow automation, further fueling market expansion.

The instruments segment is expected to grow at a highest CAGR from 2025 to 2034. is driven by the increasing need for high-throughput microbial testing, technological advancements in automation, and the rising burden of infectious diseases. Laboratories are adopting automated instruments such as microbial identification systems, blood culture analyzers, and antibiotic susceptibility testing (AST) systems to enhance accuracy, reduce manual errors, and improve turnaround times. The growing demand for fully integrated diagnostic platforms, coupled with AI and machine learning innovations, is further accelerating market growth.

Based on automation type, the fully automated segment dominated the market with the largest revenue share in 2024 and expected to grow at a highest CAGR from 2025 to 2034. The growth of the fully automated microbiology industry is driven by the increasing need for high-throughput, accurate, and rapid microbial diagnostics in clinical, pharmaceutical, and food safety laboratories. Fully automated systems minimize human intervention, reducing errors and improving efficiency, which is crucial in handling the rising burden of infectious diseases and antimicrobial resistance.

Technological advancements, including AI-powered analytics, robotics, and real-time data integration, further enhance automation by streamlining workflows and ensuring faster turnaround times. Additionally, stringent regulatory requirements for standardized and reproducible microbial testing, along with the demand for cost-effective solutions, are pushing laboratories to adopt fully automated microbiology systems for improved operational efficiency and diagnostic precision.

The clinical diagnostics segment dominated the market with the largest revenue share of 50.83% in 2024. The rising prevalence of infectious diseases, antimicrobial resistance, and the growing need for rapid, accurate diagnostic solutions. Automation enhances laboratory efficiency by reducing manual workloads, minimizing human errors, and improving turnaround times for microbial identification and antibiotic susceptibility testing (AST). Technological advancements, such as AI-driven data analysis, molecular diagnostics, and integrated automation platforms, are further accelerating adoption in clinical laboratories.

The biopharmaceutical production segment is expected to grow at a highest CAGR from 2025 to 2034. The adoption of advanced technologies, such as real-time monitoring systems, AI-driven analytics, and high-throughput microbial detection platforms, streamlines workflows and reduces human intervention, minimizing errors. Additionally, the rising production of biologics, vaccines, and cell & gene therapies necessitates reliable microbial testing solutions to maintain product safety and efficacy, further propelling the demand for automated microbiology systems in the biopharmaceutical industry.

The hospitals & diagnostic laboratories segment dominated the market with the largest revenue share of 45.0% in 2024. The market is driven by the rising incidence of infectious diseases, growing concerns over antimicrobial resistance, and the need for faster, more accurate microbial diagnostics. Automation enhances efficiency by reducing manual workload, minimizing errors, and improving turnaround times for critical tests such as blood cultures, microbial identification, and antibiotic susceptibility testing (AST). Advancements in AI-powered diagnostics, integrated automation platforms, and real-time data analysis further streamline laboratory workflows, ensuring rapid and precise results.

The pharmaceutical & biotechnology companies’ segment is expected to witness the highest CAGR during the forecast period. The market is driven by the growing need for stringent microbial quality control, contamination detection, and regulatory compliance in drug development and manufacturing. Automation enhances testing accuracy, reduces human errors, and accelerates microbial identification, ensuring the safety and efficacy of pharmaceuticals, biologics, and vaccines.

North America automated microbiology market dominated the global market with the largest revenue share of 42.0% in 2024. The market is driven by advanced healthcare infrastructure, increasing prevalence of infectious diseases, and growing concerns over antimicrobial resistance. The region's strong regulatory framework, including guidelines from the FDA and CDC, mandates stringent microbial testing in clinical diagnostics, pharmaceutical production, and food safety, boosting demand for automated solutions.

U.S. Automated Microbiology Market Trends

The automated microbiology market in U.S. is driven by a well-established healthcare infrastructure, increasing prevalence of infectious diseases, and the rising burden of antimicrobial resistance. Stringent FDA regulations for microbial testing in clinical diagnostics, pharmaceuticals, and food safety further push the adoption of automated solutions. The growing integration of AI, machine learning, and robotics in microbiology labs enhances efficiency and accuracy, reducing turnaround times. Additionally, significant R&D investments and the presence of major players such as BD, Thermo Fisher Scientific, and bioMérieux continue to propel market growth.

Asia Pacific Automated Microbiology Market Trends

The Asia Pacific automated microbiology market is experiencing rapid growth due to increasing healthcare expenditures, rising infectious disease cases, and expanding pharmaceutical and biotechnology industries. Governments across the region are investing in advanced diagnostic solutions to enhance laboratory efficiency and improve patient outcomes. The growing adoption of AI-powered automation, along with increasing awareness of antimicrobial resistance, is further fueling demand. Additionally, regulatory developments and international collaborations in microbiological research are driving innovation and expansion across clinical, pharmaceutical, and food safety sectors.

Automated microbiology market in China is driven by its fast-growing healthcare sector, increasing government investments in diagnostics, and the need for stringent microbial quality control in pharmaceuticals and food safety. The rising burden of hospital-acquired infections and antimicrobial resistance is pushing hospitals and diagnostic labs toward automation for faster, more accurate microbial identification. Additionally, advancements in AI-based diagnostics, automation, and local manufacturing of microbiology instruments are making automated solutions more accessible, fueling market expansion.

Japan automated microbiology market is supported by advanced healthcare infrastructure, high adoption of robotics and AI-driven automation, and a strong pharmaceutical and biotechnology industry. The country’s stringent regulatory requirements for microbial testing in clinical and industrial applications drive the demand for high-precision automated microbiology systems. Additionally, Japan’s aging population and increasing focus on infection control contribute to the growing adoption of rapid diagnostic solutions in hospitals and research institutions.

Europe Automated Microbiology Market Trends

The automated microbiology market in Europe is driven by strict regulatory frameworks, technological advancements, and growing concerns about antimicrobial resistance. The European Medicines Agency (EMA) and other regulatory bodies mandate stringent microbial testing, increasing the demand for automated diagnostic solutions across healthcare, pharmaceutical, and food safety sectors. Additionally, the increasing adoption of AI-powered diagnostics and laboratory automation is enhancing efficiency, while strategic collaborations among key industry players are driving market expansion across the region.

The UK automated microbiology market is fueled by government initiatives to improve diagnostic capabilities, rising antimicrobial resistance concerns, and growing investments in healthcare automation. The country’s National Health Service (NHS) is actively integrating AI and automated microbiology solutions to enhance efficiency and reduce diagnostic turnaround times. Additionally, strong regulatory policies for microbial testing in pharmaceuticals and food safety are pushing companies to adopt advanced automation solutions.

The automated microbiology market in Germany is growing due to its strong healthcare infrastructure, advanced biopharmaceutical industry, and strict regulatory policies for microbial testing. The country is a hub for microbiology research and innovation, with key players investing in AI-powered automation and high-throughput diagnostic solutions. Additionally, the increasing adoption of automated microbiology systems in hospitals, diagnostic laboratories, and pharmaceutical companies is driving market expansion, supported by government-funded healthcare initiatives and research programs.

Latin America Automated Microbiology Market Trends

The Latin American automated microbiology market is expanding due to increasing healthcare investments, rising infectious disease cases, and growing pharmaceutical and food safety regulations. Countries in the region are adopting automated microbiology solutions to enhance diagnostic efficiency and ensure compliance with international microbial testing standards. Additionally, partnerships between global market leaders and local healthcare providers are facilitating the adoption of advanced diagnostic technologies, driving market growth.

Automated microbiology market in Brazil is growing due to rising government investments in healthcare infrastructure, increasing demand for rapid microbial diagnostics, and stricter pharmaceutical and food safety regulations. The prevalence of infectious diseases and hospital-acquired infections is pushing hospitals and laboratories toward automation for faster, more accurate microbial identification. Additionally, the expansion of local biopharmaceutical manufacturing and the adoption of AI-driven laboratory automation are further accelerating market growth in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the automated microbiology market

By Product

By Automation Type

By Application

By End-use

By Regional