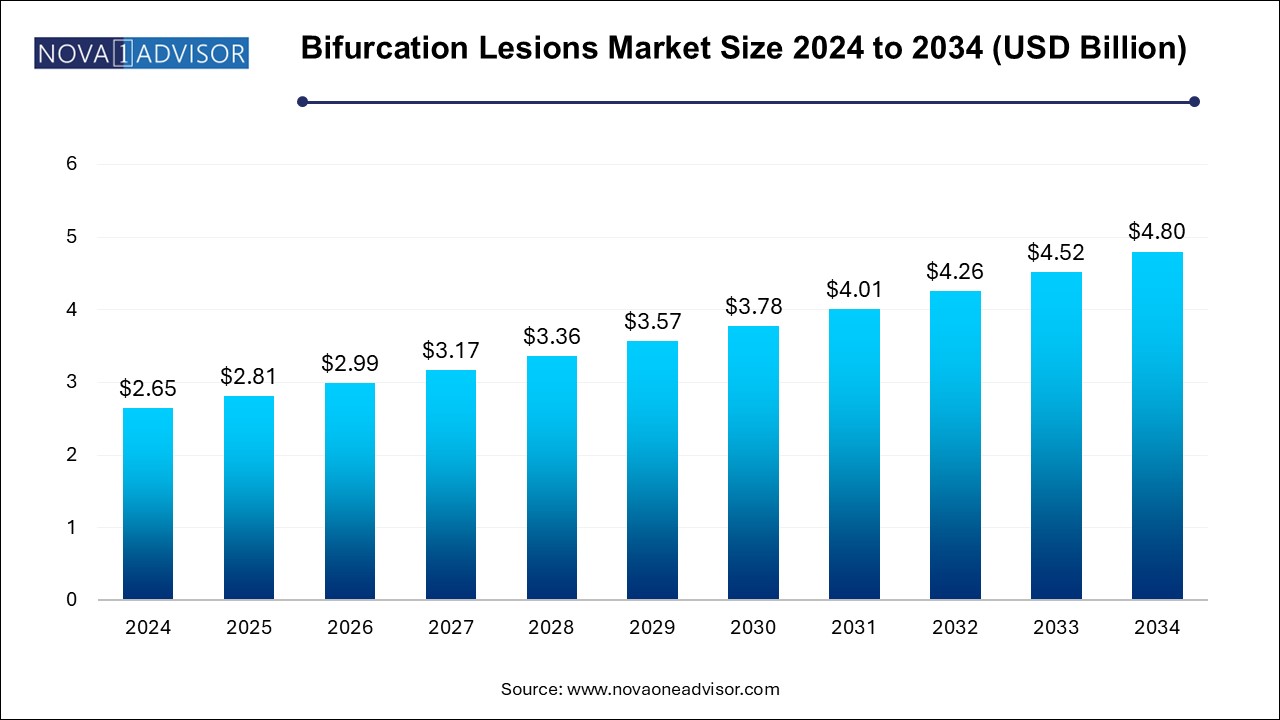

The bifurcation lesions market size was exhibited at USD 2.65 billion in 2024 and is projected to hit around USD 4.8 billion by 2034, growing at a CAGR of 6.1% during the forecast period 2025 to 2034.

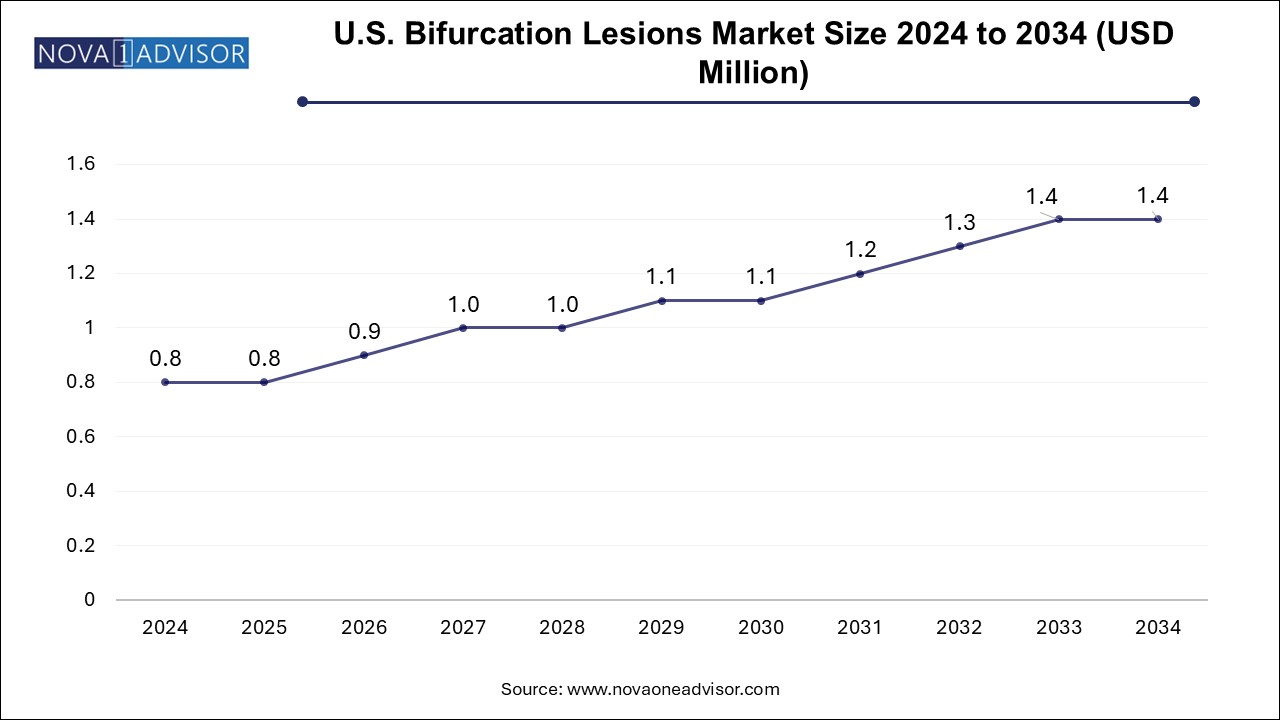

The U.S. bifurcation lesions market size is evaluated at USD 0.80 million in 2024 and is projected to be worth around USD 1.4 million by 2034, growing at a CAGR of 5.21% from 2025 to 2034.

North America bifurcation lesions market dominated with the largest revenue share of 39.3% in 2024. The increasing number of cases of cardiovascular diseases (CVD), the rising number of congenital heart diseases, and technological advancements drive the market's growth. According to an American Heart Association article published in January 2024, cardiovascular disease accounted for 931,578 deaths in the U.S., an increase of nearly 3,000 from the previous year. Furthermore, the age-adjusted death rate for cardiovascular conditions rose by 4.0%, reaching 233.3 per 100,000 individuals. This escalating burden of cardiovascular disease underscores the urgent need for innovative treatment solutions, particularly for managing complex coronary conditions like bifurcation lesions.

U.S. Bifurcation Lesions Market Trends

The bifurcation lesions market in the U.S. accounted for the largest market share in North America in 2024. Increased incidence of peripheral artery disease and the rising incidence of CVD among the aging population. According to the CDC article published in May 2024, about 6.5 million individuals aged 40 and older in the United States are affected by Peripheral Artery Disease (PAD). This condition often involves bifurcation lesions in peripheral arteries. The growing prevalence of PAD emphasizes the need for advanced treatment solutions, including those explicitly addressing bifurcation lesions in peripheral arteries. This increased incidence of PAD fuels the demand for effective interventions, thereby driving market growth.

Europe Bifurcation Lesions Market Trends

The bifurcation lesions market in Europe held the second-largest revenue market share in 2024. The high death rate of CVDs is boosting the demand for bifurcation lesions in Europe. According to a WHO article published in May 2024, CVDs are the leading cause of disability and premature death in Europe. They are responsible for over 42.5% of all deaths annually, accounting for approximately 10,000 deaths every day. The high prevalence of cardiovascular diseases (CVDs) in Europe emphasizes the growing need for advanced treatment solutions, particularly for complex conditions such as bifurcation lesions. These lesions, which often result in more complicated procedures and higher risks of complications, require innovative techniques and tools to improve patient outcomes. With the rising burden of CVDs, the demand for effective treatments for bifurcation lesions has risen, prompting the development of more advanced stenting techniques, diagnostic tools, and surgical interventions.

The Germany bifurcation lesions market is anticipated to grow at the fastest CAGR during the forecast period. The rising number of CHD and technological advancements fuel the market's growth. According to the Springer article published in March 2024, with 11,314 deaths attributed to CHD in Germany, it highlights the significant burden of cardiovascular diseases (CVDs) in the country. This stark reality underscores the urgent need for advanced treatment options, particularly for complex conditions like bifurcation lesions. The high mortality rate associated with CHD emphasizes the critical importance of improving clinical outcomes through innovative cardiovascular care approaches. As the number of patients requiring effective treatments for bifurcation lesions increases, the demand for advanced stenting techniques and other interventional solutions in Germany is set to rise, driving market growth in the region.

The bifurcation lesions market in the UK held the second-largest market share in Europe in 2024. The increasing incidence of CHD and technological advancements drives the market's growth. According to the British Heart Foundation article published in September 2024, coronary heart disease (CHD) remains a leading cause of mortality in the UK, contributing to approximately 68,000 deaths annually. This translates to an average of 190 fatalities every day or one death every eight minutes. The high prevalence of CHD highlights the urgent need for effective treatments, particularly for complex conditions such as bifurcation lesions. The growing number of patients requiring advanced care solutions highlights the importance of innovative treatment approaches, such as stenting techniques and interventional therapies, in addressing these challenging conditions.

The French bifurcation lesions market is anticipated to witness at a significant CAGR during the forecast period. The growing number of CVD cases and rising incidence of ischemic heart disease drives the growth of the market. According to the Elsevier B.V. article published in November 2024, in France, ischemic heart disease (IHD) continues to place a substantial burden on public health, with over 242,000 hospitalizations and 31,000 related deaths in 2022. This growing prevalence of cardiovascular conditions, which affects nearly 3 million adults, underscores the increasing demand for effective treatments for complex coronary conditions, such as bifurcation lesions. With an aging population and a rising number of patients requiring advanced interventional therapies, there is a heightened need for innovative solutions in cardiac repair. This includes using advanced stenting techniques and other specialized approaches to treat bifurcation lesions, thereby driving the market growth in France.

Asia Pacific Bifurcation Lesions Market Trends

The bifurcation lesions market in the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The rising number of CVD cases and increasing R&D activities. Growing geriatric population in the Asia Pacific region. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, the Asia-Pacific region has approximately 697 million people aged 60 years and older, making up about 60% of the global elderly population. This age group is more vulnerable to cardiovascular diseases, and the growing number of older individuals in the region is driving an increased demand for treatments related to bifurcation lesions.

The China bifurcation lesions market accounted for the second-largest share in the Asia Pacific in 2024. The increasing number of surgeries and rising CHD cases drive the market's growth. According to the Chinese Medical Association article published in April 2024, in China, coronary heart disease (CHD) affects around 2 million individuals, with approximately 150,000 new cases diagnosed each year. CHD is the leading cause of mortality among those with congenital disabilities, accounting for nearly 40% of deaths in individuals under 20 years of age. This high incidence emphasizes the growing need for advanced treatments, including those targeting bifurcation lesions, to address the rising cardiovascular disease burden in the country.

The bifurcation lesions market in Japan is anticipated to grow at a significant CAGR during the forecast period. The increased number of CVD procedures and rising CHD cases drive the market's growth. According to the NCBI article published in February 2024, in Japan, a significant number of cardiovascular surgeries, totaling 63,054, are performed annually to address the rising incidence of cardiovascular diseases. This growing surgical demand highlights the need for specialized treatment options, particularly for complex conditions such as bifurcation lesions. With the prevalence of cardiovascular conditions continuing to escalate, the bifurcation lesions industry in Japan is poised for expansion, driven by the demand for advanced interventions that enhance patient outcomes and improve the effectiveness of cardiovascular surgeries.

The India bifurcation lesions market is experiencing significant growth. Growing healthcare expenditures, government initiatives, and the rising CHD cases drive the market's growth. According to the Apollo Hospital article published in September 2024, in India, approximately 150,000 to 200,000 children are born each year with congenital heart disease, contributing to the growing need for advanced cardiac treatments. The prevalence of heart conditions, including complex cases such as bifurcation lesions, increases, and there is a heightened demand for effective interventions and surgical solutions. The rising incidence of congenital and acquired heart diseases in India is expected to drive market growth as healthcare providers seek innovative therapies to improve patient outcomes and address the complexities of heart disease treatment.

Latin America Bifurcation Lesions Market Trends

The bifurcation lesions market in Latin America is growing. The increasing incidence of CHD and a strategic initiative by key players and organizations drive market growth. According to the American College of Cardiology Foundation article published in September 2024, estimates indicate that congenital heart disease is significantly more prevalent in Latin America and the Caribbean, with rates 60% higher than cancer. This condition occurs in approximately eight to 13 cases per 1,000 births across the region. The high incidence of congenital heart disease highlights the increasing demand for advanced cardiovascular treatments, including those for complex conditions like bifurcation lesions. As the need for effective surgical solutions rises, the bifurcation lesions industry in Latin America is expected to experience growth, driven by the demand for innovative therapies and improved patient outcomes in heart disease treatment.

The Brazil bifurcation lesions market is expanding due to several distinct growth drivers. For instance, in September 2023, the Brazilian government and healthcare institutions are taking significant steps to improve cardiovascular care and outcomes. Initiatives like the collaboration between Mount Sinai and the Brazilian Clinical Research Institute aim to advance research and medical education in cardiovascular diseases. These efforts highlight the rising need for cutting-edge treatment options in the country. Brazil continues to tackle the increasing prevalence of cardiovascular conditions, including complex bifurcation lesions. The demand for advanced interventional solutions is expected to grow, driving the demand for the bifurcation lesions industry in Brazil.

MEA Bifurcation Lesions Market Trends

The bifurcation lesions market in MEA is expected to grow at a lucrative CAGR during the forecast period, due to the increasing incidence of CVD diseases, rising CHD incidence, and the growing use of advanced medical technologies in the region. According to the Frontiers Media S.A. article published in 2024, in the Middle East and Africa (MEA) region, congenital heart disease (CHD) impacts around 1% of live births, resulting in approximately 1.5 million new cases yearly. The region faces distinctive challenges, including high rates of consanguinity and disparities in healthcare access, which contribute to the complexity of diagnosing and treating cardiovascular conditions. The prevalence of cardiovascular diseases, including bifurcation lesions, continues to rise, and there is an increasing demand for advanced interventional solutions and treatments to address these conditions. This growing need drives the expansion of the bifurcation lesions industry across the MEA region.

The Saudi Arabia bifurcation lesions market is anticipated to grow at the fastest CAGR of 5.0% over the forecast period. The rising number of surgeries and increasing incidence of CVD cases drive the market's growth. According to the article published by BMC Cardiovascular Diseases in March 2024, in May 2024, 1.6% of individuals aged 15 and older in Saudi Arabia were affected by cardiovascular diseases (CVD), including heart conditions and related disorders. This prevalence highlights the growing need for advanced healthcare solutions, including bifurcation lesions.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.81 Billion |

| Market Size by 2034 | USD 4.8 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Boston Scientific Corp.; Abbott; Cardinal Health; Medtronic; C. R. Bard, Inc.; Johnson & Johnson Services, Inc.; Spectranetics; Terumo Medical Corp.; Tryton Medical Inc. |

Based on application, the coronary segment led the market with the largest revenue share of 70.0% in 2024, due to increased percutaneous coronary intervention procedures and technological advancements. Coronary refers to the arteries that supply blood, oxygen, and nutrients to the heart muscle, which is critical in maintaining heart function and cardiovascular health. According to the Yale Medicine article published in October 2024, In the U.S., about 900,000 percutaneous coronary interventions (PCIs) are performed annually, highlighting the significant prevalence of coronary artery disease and the growing need for effective treatment options. Bifurcation lesions, which represent a substantial portion of coronary stenoses, pose unique challenges during these procedures. The high volume of PCIs emphasizes the demand for advanced stenting techniques and specialized devices to address these complex lesions.

The peripheral segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing number of peripheral artery disease and technological advancements drives the market's growth. Peripheral refers to areas or structures located away from the central part of the body, typically involving the limbs, such as the arms and legs, and the blood vessels supplying these regions. According to the NCBI article published in June 2024, globally, it is estimated that over 235 million people are affected by peripheral artery disease (PAD), highlighting its widespread prevalence. This condition, which primarily impacts the arteries in the limbs, is closely associated with the occurrence of bifurcation lesions in peripheral vessels. The high prevalence of PAD underscores the growing need for advanced treatment options, including specialized devices and techniques tailored to address bifurcation lesions in peripheral arteries.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the bifurcation lesions market

By Application

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Application

1.2.2. Regional scope

1.2.3. Estimates and forecast timeline.

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity price analysis (Model 1)

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Application Segment

2.2.2. Regional Outlook

2.3. Competitive Insights

Chapter 3. Global Bifurcation Lesions Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising incidence of congenital heart disease

3.2.1.2. Increasing number of CVD incidence

3.2.1.3. Increasing awareness among the population

3.2.2. Market restraint analysis

3.2.2.1. High cost of treatment

3.2.2.2. Limited awareness and adoption

3.3. Bifurcation Lesions Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Bifurcation Lesions Market: Application Estimates & Trend Analysis

4.1. Bifurcation Lesions Market: Application Dashboard

4.2. Bifurcation Lesions Market: Application Movement Analysis

4.3. Bifurcation Lesions Market Size & Forecasts and Trend Analysis, by Application, 2021 to 2034 (USD Million)

4.4. Coronary

4.4.1. Market estimates and forecast 2021 to 2034 (USD Million)

4.5. Peripheral

4.5.1. Market estimates and forecast 2021 to 2034 (USD Million)

Chapter 5. Bifurcation Lesions Market: Regional Estimates & Trend Analysis by Application, and Region

5.1. Global Bifurcation Lesions Market: Regional Dashboard

5.2. Market Size & Forecasts Trend Analysis, 2021 to 2034

5.3. North America

5.3.1. Market Estimates and Forecasts 2021 to 2034 (USD Million)

5.3.2. U.S.

5.3.2.1. Key country dynamics

5.3.2.2. Regulatory framework/ reimbursement structure

5.3.2.3. Competitive scenario

5.3.2.4. U.S. market estimates and forecast, 2021 - 2034 (USD Million)

5.3.3. Canada

5.3.3.1. Key country dynamics

5.3.3.2. Regulatory framework/ reimbursement structure

5.3.3.3. Competitive scenario

5.3.3.4. Canada market estimates and forecast, 2021 - 2034 (USD Million)

5.3.4. Mexico

5.3.4.1. Key country dynamics

5.3.4.2. Regulatory framework/ reimbursement structure

5.3.4.3. Competitive scenario

5.3.4.4. Mexico market estimates and forecast, 2021 - 2034 (USD Million)

5.4. Europe

5.4.1. Market Estimates and Forecasts 2021 to 2034 (USD Million)

5.4.2. UK

5.4.2.1. Key country dynamics

5.4.2.2. Regulatory framework/ reimbursement structure

5.4.2.3. Competitive scenario

5.4.2.4. UK market estimates and forecast, 2021 - 2034 (USD Million)

5.4.3. Germany

5.4.3.1. Key country dynamics

5.4.3.2. Regulatory framework/ reimbursement structure

5.4.3.3. Competitive scenario

5.4.3.4. Germany market estimates and forecast, 2021 - 2034 (USD Million)

5.4.4. France

5.4.4.1. Key country dynamics

5.4.4.2. Regulatory framework/ reimbursement structure

5.4.4.3. Competitive scenario

5.4.4.4. France market estimates and forecast, 2021 - 2034 (USD Million)

5.4.5. Italy

5.4.5.1. Key country dynamics

5.4.5.2. Regulatory framework/ reimbursement structure

5.4.5.3. Competitive scenario

5.4.5.4. Italy market estimates and forecast, 2021 - 2034 (USD Million)

5.4.6. Spain

5.4.6.1. Key country dynamics

5.4.6.2. Regulatory framework/ reimbursement structure

5.4.6.3. Competitive scenario

5.4.6.4. Spain market estimates and forecast, 2021 - 2034 (USD Million)

5.4.7. Sweden

5.4.7.1. Key country dynamics

5.4.7.2. Regulatory framework/ reimbursement structure

5.4.7.3. Competitive scenario

5.4.7.4. Sweden market estimates and forecast, 2021 - 2034 (USD Million)

5.4.8. Norway

5.4.8.1. Key country dynamics

5.4.8.2. Regulatory framework/ reimbursement structure

5.4.8.3. Competitive scenario

5.4.8.4. Norway market estimates and forecast, 2021 - 2034 (USD Million)

5.4.9. Denmark

5.4.9.1. Key country dynamics

5.4.9.2. Regulatory framework/ reimbursement structure

5.4.9.3. Competitive scenario

5.4.9.4. Denmark market estimates and forecast, 2021 - 2034 (USD Million)

5.5. Asia Pacific

5.5.1. Market Estimates and Forecasts 2021 to 2034 (USD Million)

5.5.2. China

5.5.2.1. Key country dynamics

5.5.2.2. Regulatory framework/ reimbursement structure

5.5.2.3. Competitive scenario

5.5.2.4. China market estimates and forecast, 2021 - 2034 (USD Million)

5.5.3. Japan

5.5.3.1. Key country dynamics

5.5.3.2. Regulatory framework/ reimbursement structure

5.5.3.3. Competitive scenario

5.5.3.4. Japan market estimates and forecast, 2021 - 2034 (USD Million)

5.5.4. India

5.5.4.1. Key country dynamics

5.5.4.2. Regulatory framework/ reimbursement structure

5.5.4.3. Competitive scenario

5.5.4.4. India market estimates and forecast, 2021 - 2034 (USD Million)

5.5.5. Australia

5.5.5.1. Key country dynamics

5.5.5.2. Regulatory framework/ reimbursement structure

5.5.5.3. Competitive scenario

5.5.5.4. Australia market estimates and forecast, 2021 - 2034 (USD Million)

5.5.6. Thailand

5.5.6.1. Key country dynamics

5.5.6.2. Regulatory framework/ reimbursement structure

5.5.6.3. Competitive scenario

5.5.6.4. Thailand market estimates and forecast, 2021 - 2034 (USD Million)

5.5.7. South Korea

5.5.7.1. Key country dynamics

5.5.7.2. Regulatory framework/ reimbursement structure

5.5.7.3. Competitive scenario

5.5.7.4. South Korea market estimates and forecast, 2021 - 2034 (USD Million)

5.6. Latin America

5.6.1. Market Estimates and Forecasts 2021 to 2034 (USD Million)

5.6.2. Brazil

5.6.2.1. Key country dynamics

5.6.2.2. Regulatory framework/ reimbursement structure

5.6.2.3. Competitive scenario

5.6.2.4. Brazil market estimates and forecast, 2021 - 2034 (USD Million)

5.6.3. Argentina

5.6.3.1. Key country dynamics

5.6.3.2. Regulatory framework/ reimbursement structure

5.6.3.3. Competitive scenario

5.6.3.4. Argentina market estimates and forecast, 2021 - 2034 (USD Million)

5.7. MEA

5.7.1. Market Estimates and Forecasts 2021 to 2034 (USD Million)

5.7.2. Saudi Arabia

5.7.2.1. Key country dynamics

5.7.2.2. Regulatory framework/ reimbursement structure

5.7.2.3. Competitive scenario

5.7.2.4. Saudi Arabia market estimates and forecast, 2021 - 2034 (USD Million)

5.7.3. South Africa

5.7.3.1. Key country dynamics

5.7.3.2. Regulatory framework/ reimbursement structure

5.7.3.3. Competitive scenario

5.7.3.4. South Africa market estimates and forecast, 2021 - 2034 (USD Million)

5.7.4. UAE

5.7.4.1. Key country dynamics

5.7.4.2. Regulatory framework/ reimbursement structure

5.7.4.3. Competitive scenario

5.7.4.4. UAE market estimates and forecast, 2021 - 2034 (USD Million)

5.7.5. Kuwait

5.7.5.1. Key country dynamics

5.7.5.2. Regulatory framework/ reimbursement structure

5.7.5.3. Competitive scenario

5.7.5.4. Kuwait market estimates and forecast, 2021 - 2034 (USD Million)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Manufacturers

6.2. Company/Competition Categorization

6.3. Vendor Landscape

6.3.1. List of key distributors and channel partners

6.3.2. Key customers

6.3.3. Key company market share analysis, 2023

6.3.4. Boston Scientific Corp.

6.3.4.1. Company overview

6.3.4.2. Financial performance

6.3.4.3. Product benchmarking

6.3.4.4. Strategic initiatives

6.3.5. Abbott

6.3.5.1. Company overview

6.3.5.2. Financial performance

6.3.5.3. Product benchmarking

6.3.5.4. Strategic initiatives

6.3.6. Cardinal Health

6.3.6.1. Company overview

6.3.6.2. Financial performance

6.3.6.3. Product benchmarking

6.3.6.4. Strategic initiatives

6.3.7. Medtronic

6.3.7.1. Company overview

6.3.7.2. Financial performance

6.3.7.3. Product benchmarking

6.3.7.4. Strategic initiatives

6.3.8. C. R. Bard, Inc.

6.3.8.1. Company overview

6.3.8.2. Financial performance

6.3.8.3. Product benchmarking

6.3.8.4. Strategic initiatives

6.3.9. Johnson & Johnson Services, Inc.

6.3.9.1. Company overview

6.3.9.2. Financial performance

6.3.9.3. Product benchmarking

6.3.9.4. Strategic initiatives

6.3.10. Spectranetics

6.3.10.1. Company overview

6.3.10.2. Financial performance

6.3.10.3. Product benchmarking

6.3.10.4. Strategic initiatives

6.3.11. Terumo Medical Corp.

6.3.11.1. Company overview

6.3.11.2. Financial performance

6.3.11.3. Product benchmarking

6.3.11.4. Strategic initiatives

6.3.12. Tryton Medical Inc.

6.3.12.1. Company overview

6.3.12.2. Financial performance

6.3.12.3. Product benchmarking

6.3.12.4. Strategic initiatives