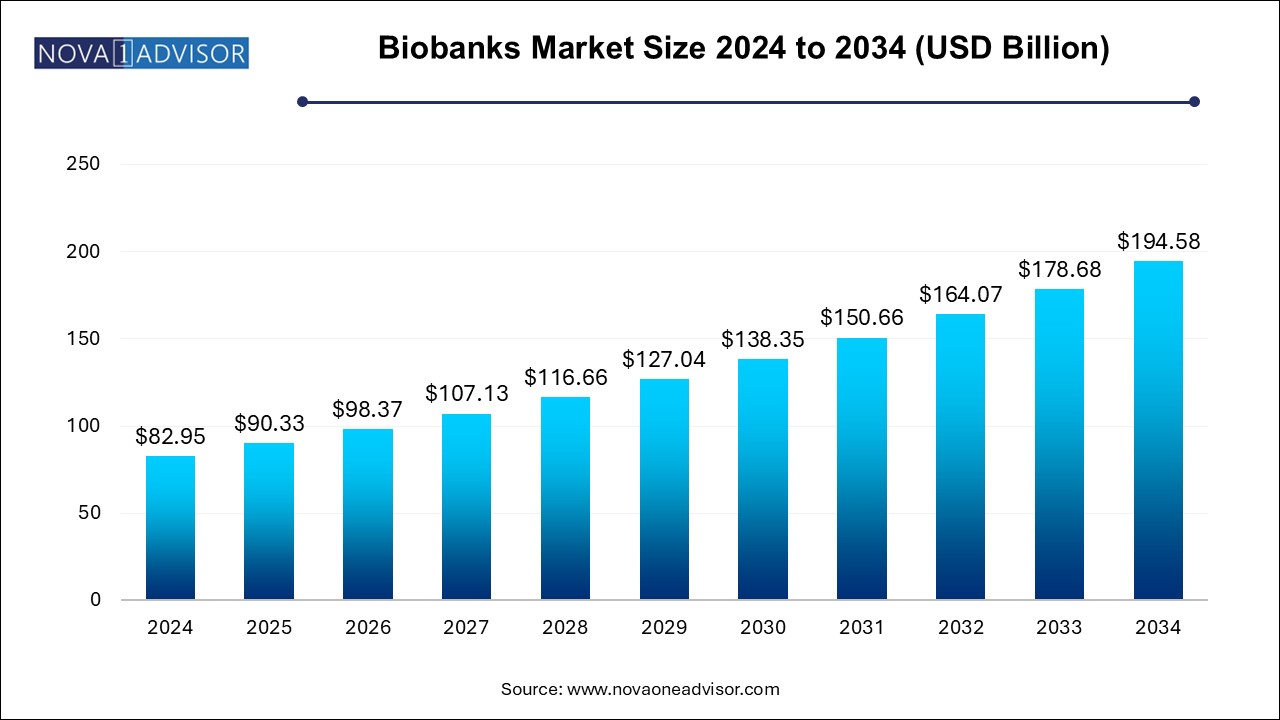

The biobank market size was exhibited at USD 82.95 billion in 2024 and is projected to hit around USD 194.58 billion by 2034, growing at a CAGR of 8.9% during the forecast period 2025 to 2034.

The global biobanks market has emerged as a cornerstone in modern biomedical research, translational medicine, and clinical trials. Biobanks are structured repositories that collect, process, store, and distribute biological samples such as blood, tissues, DNA, stem cells, and other biospecimens for use in scientific research and clinical applications. Their growing relevance in genomics, personalized medicine, regenerative therapies, and pharmacogenomics has significantly accelerated market growth.

As medical science continues to embrace data-driven methodologies, the demand for well-preserved and high-quality biospecimens has intensified. Biobanks provide a bridge between clinical research and healthcare by enabling the long-term storage and retrospective analysis of biosamples, which are critical for understanding disease etiology, identifying biomarkers, and facilitating therapeutic development. The shift toward precision medicine and the increasing number of clinical trials globally are key catalysts driving the market forward.

Additionally, collaborations between academia, government health departments, and private organizations have fostered the development of public-private partnerships, enhancing the infrastructure and scope of biobanking. With technological innovations such as AI-powered Laboratory Information Management Systems (LIMS), automated freezing, and cryogenic storage, the operational efficiency of biobanks is reaching new heights.

Rise of Population-Based Biobanks: Large-scale longitudinal biobanks such as the UK Biobank and China Kadoorie Biobank are setting new standards in epidemiological research.

Integration of Artificial Intelligence: AI and machine learning are being employed for predictive analytics, biospecimen classification, and efficient data management.

Increased Focus on Virtual Biobanks: Digital repositories are on the rise, providing data access without the need for physical storage or logistics.

Personalized Medicine Adoption: A surge in personalized medicine and genomics-based treatment protocols is fueling the need for diverse and high-quality biospecimen repositories.

Public-Private Partnerships: Government and private sector collaborations are accelerating infrastructure development and boosting global biobanking capacity.

Sustainability and Green Biobanking: Emerging interest in reducing energy usage and implementing eco-friendly storage solutions.

Global Harmonization Initiatives: Regulatory bodies are pushing for standardized biobanking practices to promote interoperability and ethical compliance.

COVID-19-Driven Biobanking Surge: The pandemic led to the rapid creation of COVID-19 specimen repositories, highlighting the market’s critical role in global health crises.

| Report Coverage | Details |

| Market Size in 2025 | USD 90.33 Billion |

| Market Size by 2034 | USD 194.58 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Service, Biospecimen Type, Biobanks Type, Application, Ownership, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Merck KGaA; Qiagen; Hamilton Company; Tecan Trading AG; Danaher Corporation; Becton, Dickinson, and Company (BD); Biocision, LLC.; Taylor-Wharton; Charles River Laboratories; Lonza; Stemcell Technologies; Biovault Family; Promocell Gmbh, Precision Cellular Storage Ltd. (Virgin Health Bank) |

One of the most compelling growth drivers in the biobanks market is the rapid expansion of precision medicine. Precision medicine aims to tailor treatments based on the individual characteristics of each patient, including genetic makeup, lifestyle, and environment. This personalized approach requires extensive data derived from biospecimens such as DNA, RNA, and tissues.

Biobanks serve as the backbone of this initiative by offering diverse and well-annotated sample libraries necessary for genomic sequencing, biomarker validation, and therapeutic targeting. Initiatives such as the All of Us Research Program in the U.S., which aims to enroll over one million participants for genetic research, exemplify the demand for high-capacity biobanking infrastructure. These programs rely heavily on biobanks to store and process the samples securely and efficiently. The direct correlation between personalized care and biobank utilization ensures a steady rise in market demand.

Despite significant advancements, ethical and legal issues surrounding the use of human biological samples present a notable restraint to the market. Issues such as consent, ownership of genetic data, data sharing across borders, and privacy infringement are complex challenges that need to be addressed. Many individuals are wary of donating their biological samples due to concerns that the data could be misused or commercialized without their consent.

Moreover, differing regulatory frameworks across countries can complicate international collaborations and hinder sample sharing. For example, the General Data Protection Regulation (GDPR) in the European Union imposes strict limitations on the processing of personal data, including that from biobanks. Ensuring compliance across global jurisdictions requires significant legal resources and may slow down research progress.

A transformative opportunity lies in integrating biobanks with artificial intelligence (AI) and big data analytics. The enormous datasets derived from genomics, proteomics, and metabolomics require powerful analytical tools to draw actionable insights. AI can expedite sample classification, optimize storage logistics, and even predict sample degradation timelines, significantly enhancing biobank operational efficiency.

For instance, AI-driven platforms can assist in identifying the most suitable samples for specific research goals, reducing trial-and-error costs. Cloud-based LIMS systems integrated with machine learning capabilities are becoming integral to managing the sheer scale of biospecimen data. Companies and institutions that can harness AI tools to manage and extract value from biospecimen databases will enjoy a strategic edge, creating a compelling growth avenue for the market.

Biobanking equipment dominated the market, primarily due to the indispensable role of temperature control systems, freezers, and cryogenic storage in maintaining sample viability. These systems are crucial for long-term storage of tissues, DNA, and other sensitive biological materials. Freezers and cryogenic units alone account for a major share owing to their usage in both public and private biobanks. For example, LN2-based cryopreservation chambers are standard in stem cell research and regenerative medicine applications. Additionally, thawing equipment and incubators ensure the retrieval and processing of stored specimens with minimal quality loss, making these instruments essential across end-user verticals.

Meanwhile, Laboratory Information Management Systems (LIMS) are the fastest-growing product segment. With digital transformation sweeping through healthcare and life sciences, LIMS has become vital for managing sample metadata, traceability, and compliance documentation. Its adoption has surged in virtual biobanks and hybrid infrastructures, especially with cloud-based and AI-enabled capabilities. These systems significantly improve efficiency and help manage the complexities of large-scale biobanking operations, paving the way for widespread adoption.

Biobanking and repository services hold the lion’s share of the market, driven by the rising need for standardized and scalable sample collection and storage solutions. These services are the cornerstone of both physical and virtual biobanks, providing everything from sample retrieval to archiving. Hospitals, research institutes, and pharmaceutical firms increasingly outsource repository functions to centralized biobanks, improving cost-efficiency and access to diverse sample types.

Cold chain logistics is the fastest-expanding service segment, fueled by the globalization of clinical trials and sample sharing. The need to maintain optimal temperatures during sample transportation, especially for stem cells and other temperature-sensitive materials, has brought cold chain logistics to the forefront. Advanced packaging solutions, GPS-enabled tracking, and automation in transport have added value to this segment.

Human tissues emerged as the dominant biospecimen type, widely used in cancer research, biomarker discovery, and histopathological studies. Tissue-based biobanks provide critical resources for understanding disease progression and therapeutic efficacy. Institutions like the National Cancer Institute (NCI) maintain vast tissue repositories supporting global oncology research.

Conversely, stem cells are the fastest-growing biospecimen segment, particularly due to the rising interest in regenerative medicine and gene therapy. Sub-categories such as induced pluripotent stem cells (iPSCs) and adult stem cells are being heavily utilized in drug screening and personalized treatment modeling. The demand for ethically sourced and high-quality stem cells has created lucrative opportunities for biobanks focused on cellular research.

Physical or real biobanks dominate the market, providing tangible infrastructure for storage, sample handling, and processing. Disease-based biobanks, in particular, play a significant role in chronic disease and cancer research. Real-world examples include Mayo Clinic’s Biobank and Harvard’s Biorepository, which host millions of biosamples with detailed clinical annotations.

However, virtual biobanks are emerging as the fastest-growing segment, owing to their ability to democratize data access. These platforms facilitate global collaborations without the need for physical transportation. Virtual repositories are often linked with AI-driven data platforms and cloud computing, enabling secure and decentralized sample access for researchers worldwide.

Drug discovery and clinical research represent the leading application area, due to the role of biobanks in early-phase research and development. Pharmaceutical companies rely on biospecimens to validate targets, identify biomarkers, and test therapeutic compounds. For instance, Roche and Novartis integrate biobank data to streamline their clinical pipelines.

On the other hand, therapeutics is the fastest-growing segment, as biobanked samples are increasingly used for developing cell-based therapies, including CAR-T cell therapies and regenerative interventions. This has gained momentum with regulatory approvals and market adoption of personalized therapies in oncology and neurology.

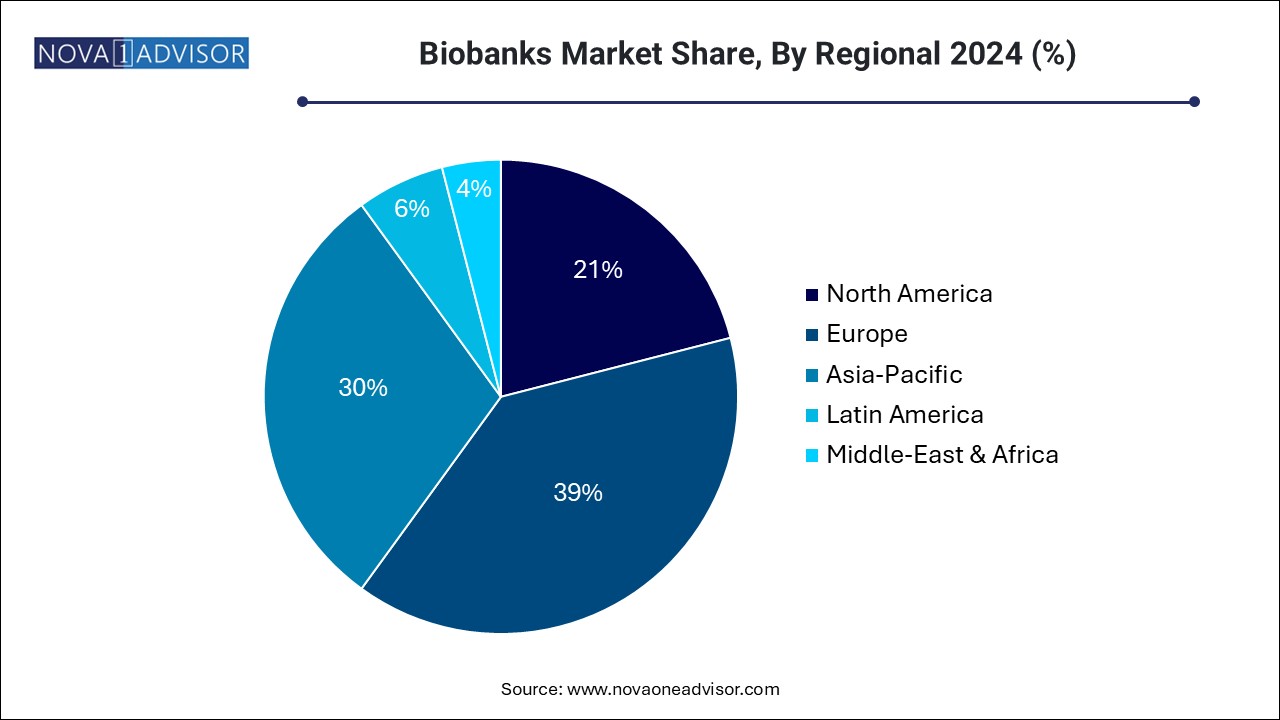

North America dominates the global biobanks market, driven by its well-established healthcare infrastructure, high R&D spending, and favorable regulatory environment. The U.S., in particular, leads the region with numerous high-capacity biobanks, such as the NIH Biobank and All of Us Research Program. The country’s strong focus on genomics, precision medicine, and the presence of key industry players like Thermo Fisher Scientific and BioLife Solutions further strengthen its position.

Asia Pacific is the fastest-growing regional market, fueled by increasing investments in life sciences, expanding biopharmaceutical sectors, and growing participation in clinical research. Countries like China, India, and South Korea have made significant strides by establishing national biobanks and promoting government-funded projects. For instance, the China National GeneBank has become one of the largest biobanks globally, supporting large-scale genomics and agriculture-based research. The region’s demographic diversity and rapid adoption of healthcare innovations provide ample growth opportunities.

January 2025: Thermo Fisher Scientific announced the launch of its advanced LIMS for biobanks, integrating AI-driven sample tracking and cloud-based analytics for decentralized biobanking.

November 2024: UK Biobank partnered with DeepMind to apply AI models in predicting disease risk factors from biospecimen data, setting a precedent for next-gen data utilization.

August 2024: BioIVT expanded its stem cell biobank in Massachusetts, focusing on supporting regenerative medicine research through increased cryogenic capacity.

May 2024: India’s Department of Biotechnology initiated a national project to establish a virtual biobank linking all public health research institutions through a unified platform.

March 2024: Brooks Life Sciences and Azenta Life Sciences merged their biobanking operations, aiming to create an integrated cold-chain and LIMS ecosystem.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biobank market

By Product

By Service

By Biospecimen Type

By Biobanks Type

By Application

By Ownership

By End-use

By Regional