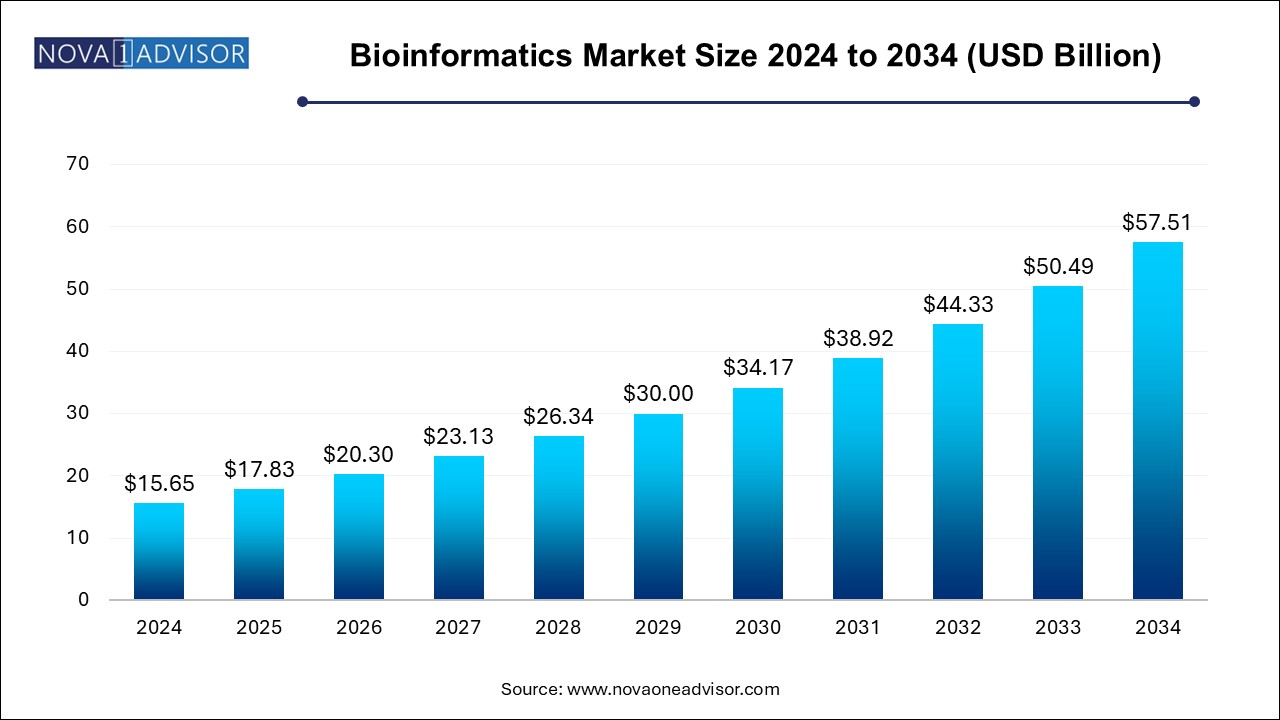

The global bioinformatics market size was estimated at USD 15.65 billion in 2024 and is projected to hit around USD 57.51 billion by 2034, growing at a CAGR of 13.9% during the forecast period from 2024 to 2034.

Growing demand in the process of novel drug R&D and private and public funding initiatives to support R&D activities are expected to be the key factors driving the market during the forecast period. Furthermore, the introduction of user-friendly and readily available bioinformatics software such as RasMol, AUTODOCK, BALL, and Bioclipse, and growing market usage of these tools for the accurate and effective analysis of biomarkers discovery programs that assist in toxicity detection during the initial stage of the drug development process are expected to drive industry growth over the forecast period.

Bioinformatics software and tools are being used as integrated solutions that provide algorithms and statistical methodologies for data analysis and help integrate data management and analysis for applications such as next-generation sequencing, genomic and proteomic structuring, modeling, and three-dimensional drug designing. Increasing R&D initiatives in the proteomics and genomics market, including other related ‘-omics’ fields, are further expected to support market growth to meet data storage and analysis demands.

According to an article published by Stanford Medicine in January 2023, research conducted by Stanford scientists showed that a DNA sequencing technique could sequence a human genome in about 8 hours. Such developments can boost demand for genomics and, consequently, the bioinformatics sector. Bioinformatics data storage and analysis applications are capable of storing a large amount of genomic and proteomic information to facilitate research activities in fields ranging from aging and carcinogenesis to preventive therapy for genetic diseases. This factor is also expected to significantly contribute to the growth of this industry over the forecast period.

The COVID-19 pandemic has significantly impacted the bioinformatics market. Researchers and physicians resorted to bioinformatics to help them comprehend the virus and create diagnostic tests and cures. As a result, the demand for bioinformatics tools and services showed a noticeable surge during this period.

Bioinformatics Market Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 17.83 Billion |

| Market Size by 2034 | USD 57.51 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 13.9% |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, application, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | DNAnexus Inc.; Seven Bridges Genomics; BGI Group; Partek Inc.; Thermo Fisher Scientific; Qiagen; Agilent Technologies; Illumina; PerkinElmer |

The genomics application segment accounted for a significant revenue share in 2024. Growing demand for pharmacogenomics in drug development and sequence screening and the introduction of technological advancements aimed at managing large sets of genomic data are key factors accounting for this large share. Based on application, the market is segmented into genomics, molecular phylogenetics, metabolomics, proteomics, transcriptomics, cheminformatics and drug designing, and others.

The cheminformatics segment is expected to expand substantially during the forecast period, wherein increasing demand for biomarker discovery and development is the primary reason for this expected growth. Cost reductions in the drug development process, reduced time for introducing a new drug in the market, and an increase in the success rate of drug discovery by cheminformatics and drug designing are expected to further boost this segment's growth.

Researchers may quickly analyze and interpret vast amounts of chemical and biological data by integrating bioinformatics with cheminformatics and drug designing, which results in more focused and successful drug development efforts. For instance, in June 2021, the U.S. Food and Drug Administration and the Center for Drug Evaluation and Research (CDER) sanctioned 26 new molecular entities (NMEs), which will drive the growth of research and development activities.

The area of proteomics has also experienced extensive R&D investments in recent years, and bioinformatics is integral in analyzing and managing the resultant data. Also, this makes it simpler to handle heterogeneous and large data sets, introduce new algorithms, and improve the knowledge discovery procedure.

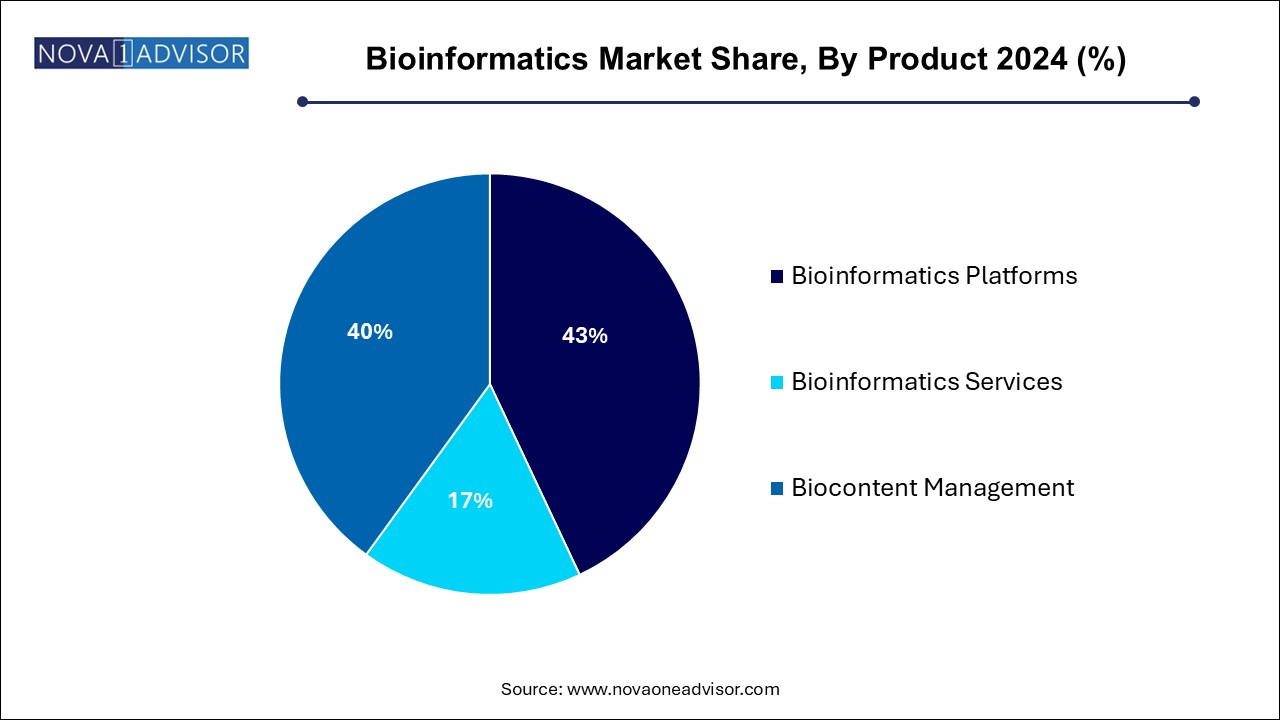

The bio-content management segment led the market with a revenue share of 43.0% in 2024. High usage rates of bioinformatics tools and software in database management are one of the primary reasons attributed to its large share, as it efficiently provides easy data sharing with external databases and resources and promotes data integration. The genetic sequence analysis platforms segment is also expected to witness significant growth during the forecast period due to the rapidly growing demand for whole-genome and exome sequencing technologies as a result of exponentially reduced costs of genetic sequencing.

Data compatibility and improved data sharing and collaboration are ensured by adherence to guidelines set out by organizations such as the Human Genome Variation Society (HGVS), Genomic Data Commons (GDC), and Minimum Information About a Microarray Experiment (MIAME). In April 2022, ATCC entered into an agreement with Qiagen to share sequencing data from its collection of animal and human cell lines and biological materials. Qiagen will form a database from this information and use it in the development and delivery of high-value content for the pharma and biotechnology industries, which helps in knowing about new diseases and the development of new therapeutic targets.

On the basis of product, the market is segmented into bioinformatics platforms, bioinformatics services, and bio-content management. The bioinformatics services segment is expected to expand at the fastest rate of 14.6% CAGR during the forecast period. The major application area in the bioinformatics sector has been genomics, which involves the analysis of an organism's entire DNA sequence.

The demand for bioinformatics tools and services has increased due to the growing availability of genetic data from many sources, including next-generation sequencing technologies, in genomics research and clinical applications. For instance, The National Institute of Technology, Rourkela, India, launched the Centre for Bioinformatics and Computational Biology (CBCB) in July 2021 to assist in the development of biomarkers and therapeutic strategies for various diseases using big data analytics. Launching these centers in growing markets helps companies in boosting market growth

The bioinformatics platforms segment is expected to grow significantly during the forecast period. Collaboration and data sharing between academics are frequently made easier by bioinformatics platforms. The increasing volume and complexity of biological data, growing demand for personalized medicine, and increasing availability of cloud computing are driving segment growth. The development of new sequencing technologies is also driving the growth of bioinformatics platforms.

Furthermore, the introduction of new and advanced technologies is expected to boost market growth over the forecast period. For instance, in June 2022, My Intelligent Machines (MIMs) launched its software for drug development in oncology. In another instance, in March 2022, ARUP launched Rio, which is a bioinformatics analytics platform that helps generate faster results for next-generation sequencing tests.

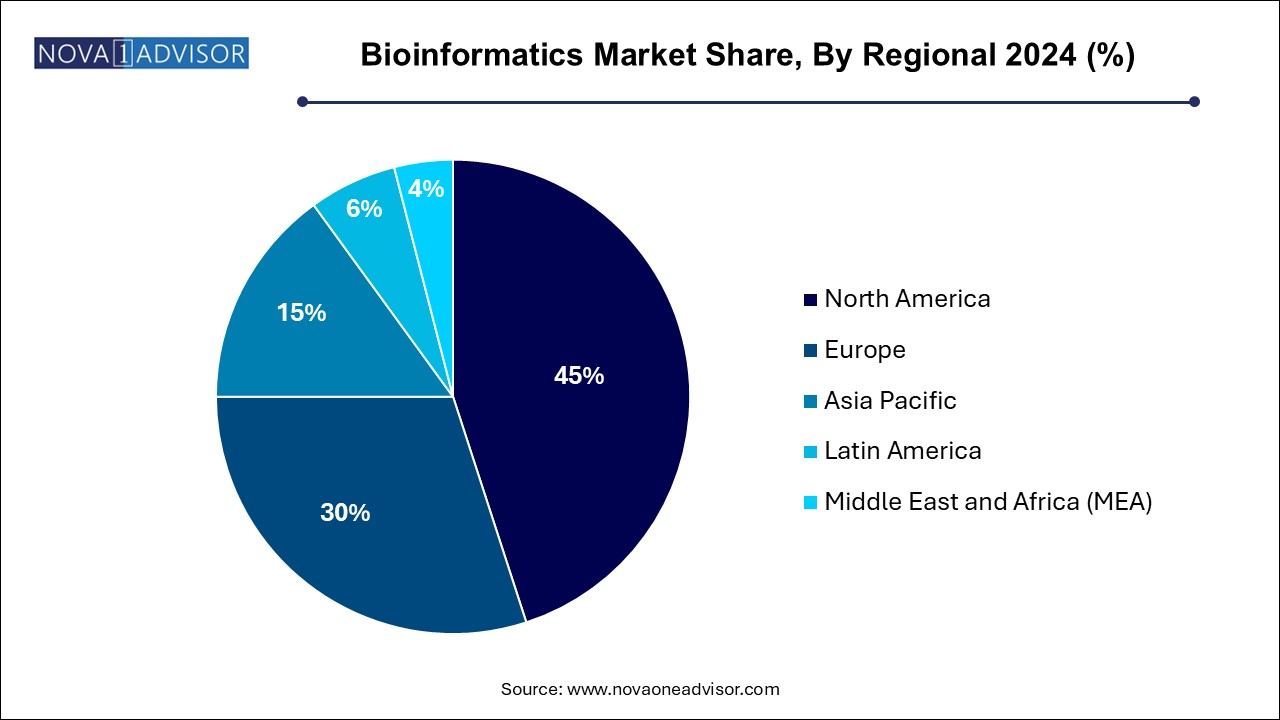

North America dominated the market and accounted for a revenue share of 45.0% in 2024. The majority of the revenue is generated from the U.S. and Canada, driven by the extensive presence of top research organizations, academic institutions, and bioinformatics businesses in the region. Increasing investments in the research & development of new and innovative technologies related to molecular biology and genome sequencing is expected to boost the regional market. For instance, in June 2022, LatchBio, California’s biotechnology research startup, launched an end-to-end bioinformatics platform that handles big biotech data to accelerate scientific discovery.

Asia Pacific is poised to be the fastest-growing regional market with a CAGR of 18.4% during the projection period. The presence of skilled and trained bioinformaticians and the expected strong development of the region’s IT sector are anticipated to enhance the capability of providing outsourcing services to developed economies. Supportive government policies are also expected to drive the growth of this region over the forecast period.

For instance, China has initiated programs such as the China Precision Medicine Initiative and the China National GeneBank that emphasize the application of bioinformatics to the areas of genomics research and healthcare. Similarly, nations such as India and South Korea have put in place programs to strengthen bioinformatics capabilities and encourage innovation in this space. Government funding and support encourage the adoption and expansion of bioinformatics solutions.

Industry participants are involved in the R&D of genetic and proteomic sequencing to enhance DNA and RNA sequencing capabilities to reduce genome sequencing costs. The development of next-generation sequencing technologies is expected to drive the bioinformatics industry over the forecast period. For instance, in March 2021, Agilent Technologies Inc. introduced a highly customizable and robust system ‘SureSelect’ for the analysis of human exome.

In another instance, in January 2020, Charles River Laboratories Inc. collaborated with Fios Genomics to gain access to the latter’s expertise in biology and bioinformatics. Furthermore, in January 2021, Illumina announced the launch of a cloud-based bioinformatics platform, as well as the Pan-Cancer IVD Test to improve its cancer detection efforts. Following are some of the major players in the global bioinformatics market:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Bioinformatics market.

By Product

By Application

By Region