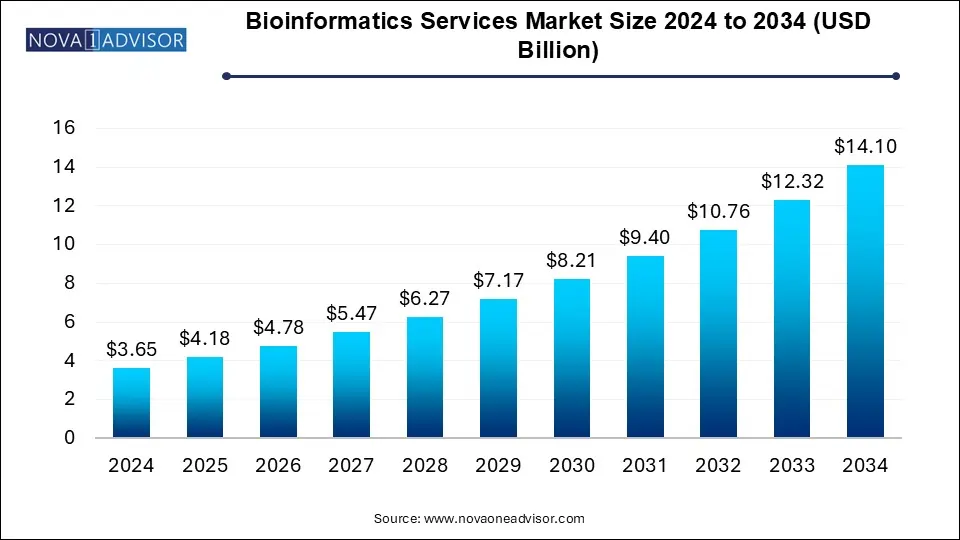

The bioinformatics services market size was exhibited at USD 3.65 billion in 2024 and is projected to hit around USD 14.10 billion by 2034, growing at a CAGR of 14.47% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.18 Billion |

| Market Size by 2034 | USD 14.10 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 14.47% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Application, Sector, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Agilent Technologies; BGI Group; Dotmatics; Labvantage - Biomax GmbH; CD Genomics; Creative Biolabs; DNAnexus Inc.; DNASTAR; Fios Genomics; Illumina, Inc.; PerkinElmer Inc.; QIAGEN; Thermo Fisher Scientific Inc. |

The pharmaceutical and biotechnology industries increasingly rely on bioinformatics services to accelerate drug discovery and development. Bioinformatics tools aid in understanding disease mechanisms, identifying potential drug targets, and predicting drug interaction outcomes. Integrating bioinformatics in drug discovery has become essential for companies aiming to reduce the time and cost of bringing new drugs to market. As these industries continue to expand, with the rise of biologics and biosimilars, the demand for bioinformatics services is expected to grow in the coming years.

Cloud computing offers scalable, flexible, and cost-effective platforms for storing and analyzing large datasets, making it easier for organizations of all sizes to access advanced bioinformatics tools. The shift towards cloud-based services benefits smaller companies and research institutions that need more resources to invest in expensive hardware and software infrastructure. Collaborating globally and sharing data in real time further enhances the utilization of cloud-based bioinformatics services, driving their adoption across various sectors.

The bioinformatics services industry is witnessing a surge in strategic partnerships and collaborations among companies, driven by the need to enhance their service offerings and expand their market reach. Leading bioinformatics firms are increasingly partnering with pharmaceutical companies, research institutions, and technology providers to leverage complementary strengths and address the growing demand for comprehensive data analysis solutions. These partnerships and collaborations focus on integrating advanced bioinformatics tools with cloud-based platforms, developing new algorithms for data interpretation, and co-developing personalized medicine applications.

For instance, in April 2024, SOPHiA GENETICS and Strand Life Sciences announced a strategic partnership to enhance the use of precision medicine globally. This collaboration leverages companies' strengths to provide access to advanced genomics technologies, innovative diagnostics solutions, and cutting-edge bioinformatics services.

The NGS segment accounted for the largest market revenue share of 34.85% in 2024 and is expected to register the largest CAGR during the forecast period. Personalized medicine relies on the detailed analysis of an individual's genetics to customize medical treatments to their specific needs. NGS provides the high-resolution genetic data required for such personalized approaches, but this data must be processed and interpreted using advanced bioinformatics tools. The increasing focus on developing targeted therapies, especially in oncology, further drives the demand for NGS-based bioinformatics services, as these services are essential for identifying genetic mutations and biomarkers that guide treatment decisions.

The scientific software testing segment is expected to register significant CAGR during the forecast period. As bioinformatics tools are adopted by broader users, including researchers with varying levels of computational expertise, their usability becomes a critical factor. Software testing aids ensure that bioinformatics applications are functionally robust, intuitive, and accessible to end users. This involves testing for user interface design, workflow integration, and overall user experience. As bioinformatics continues to expand into new fields and user bases, the emphasis on software quality and usability is driving the growth of scientific software testing services.

The drug discovery application segment accounted for the largest market revenue share of 24.68% in 2024. the increasing complexity of drug development, the rising demand for personalized medicine, and advancements in AI-driven data analysis. Pharmaceutical and biotech companies are leveraging bioinformatics to streamline target identification, lead optimization, and biomarker discovery, reducing time and costs associated with traditional methods. The integration of next-generation sequencing (NGS) and big data analytics enhances predictive modeling, accelerating the identification of potential drug candidates. Additionally, growing collaborations between bioinformatics firms and drug developers, along with regulatory support for data-driven drug discovery, are further fueling market growth.

The proteomics segment is expected to witness the highest CAGR over the forecast period. Biomarkers are essential for early disease detection, diagnosis, and personalized treatment strategies. Proteomics plays a crucial role in identifying and validating these biomarkers by analyzing protein expression patterns and modifications. The complexity of proteomics data necessitates using advanced bioinformatics tools to identify potential biomarkers and understand their biological significance. As the necessity for research focused on biomarkers escalates, the requirement for bioinformatics services capable of supporting this essential component of precision medicine also increases.

The academic segment accounted for the largest market revenue share of 40.0% in 2024. As bioinformatics becomes an integral part of modern biological and medical research, there is a rising demand for educational programs that equip students and researchers with the necessary skills. Universities increasingly offer specialized bioinformatics courses, degrees, and certifications to meet this demand. To support these educational initiatives, academic institutions require access to bioinformatics services that provide the tools and resources needed for teaching and hands-on training. This includes access to databases, software, and computational infrastructure, driving the academic demand for bioinformatics services.

The animal sector is expected to witness significant growth over the forecast period. Conservation efforts and wildlife genomics are emerging areas where bioinformatics services are becoming increasingly important. Researchers use genomics to study endangered species, understand population genetics, and develop conservation strategies. Bioinformatics plays a key role in analyzing genetic diversity, identifying at-risk populations, and assessing the impact of environmental changes on species. As conservation genomics evolves more data-intensively, the need for bioinformatics services to manage and interpret large-scale genomic data is growing.

North America bioinformatics services market dominated the industry in 2024 with market share of 46.0%. Companies in the North America region is at the forefront of innovations in genomics, proteomics, and other technologies, driving the demand for bioinformatics services. The region’s well-established infrastructure for biotechnology and life sciences research supports a robust ecosystem for bioinformatics, with continuous investments in advanced research and development. The presence of major players in the industry, coupled with collaborations between academic institutions and private companies, is driving demand for the bioinformatics services in the North America region.

U.S. Bioinformatics Services Market Trends

The U.S. bioinformatics services industry accounted for the largest revenue share in 2024. Precision medicine aims to customize treatments for individual patients based on their genetic, environmental, and lifestyle factors. This approach heavily analyzes large datasets, including genomic and clinical data, to identify personalized treatment strategies. Bioinformatics services are crucial for processing and interpreting this data, making them indispensable to precision medicine initiatives gaining momentum nationwide, driving demand for bioinformatics solutions.

Europe Bioinformatics Services Market Trends

The Europe bioinformatics services market is propelled by strong governmental funding, increasing collaborations between research institutions and biotech firms, and the rapid adoption of bioinformatics in clinical diagnostics. The rise in genomic studies, particularly in oncology and rare diseases, supports demand. Additionally, the implementation of AI and machine learning in bioinformatics tools enhances efficiency, further driving market growth.

The UK bioinformatics services market is expanding due to growing investments in genomics, AI-driven healthcare innovations, and government-backed initiatives such as Genomics England. The country's focus on precision medicine, supported by leading research institutions, is fueling demand for bioinformatics services. Additionally, increasing public-private partnerships and funding for AI integration in drug discovery boost market growth.

The bioinformatics services market in France is driven by government initiatives supporting biotech research, growing investments in genomic medicine, and strong collaboration between pharmaceutical companies and research institutions. The increasing demand for computational biology in personalized medicine and agricultural genomics also contributes to the market's expansion. Additionally, the rise of bioinformatics applications in microbiome research is shaping market growth.

Germany bioinformatics services market is expected to grow during the forecast period. Germany is a key player in the Europe market for bioinformatics services, supported by its strong pharmaceutical industry, advanced research infrastructure, and government investments in biotechnology. The country's emphasis on precision medicine, genomics-based diagnostics, and AI-powered drug discovery is fueling demand for bioinformatics services. Additionally, the rise of biotech startups specializing in computational biology enhances market growth.

Asia Pacific Bioinformatics Services Market Trends

The Asia Pacific bioinformatics services industry is expected to witness the fastest CAGR over the forecast period. Research in cancer genomics involves analyzing tumor-specific genetic mutations and identifying biomarkers that guide treatment decisions. Bioinformatics services are essential for managing and interpreting the large datasets generated in cancer genomics studies, including data from next-generation sequencing (NGS) and other high-throughput technologies. The increasing emphasis on personalized oncology and the development of precision cancer treatments are key factors contributing to the regional market expansion.

The China bioinformatics services market is expected to witness significant growth over the forecast period. The rising prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, in China, is fueling the need for bioinformatics services. In 2022, the prevalence of any chronic diseases was 81.1%, representing 179.9 million Chinese older adults. The prevalence increased with aging and peaked at 80 to 84 years old. As healthcare providers and researchers pursue understanding these diseases' genetic and molecular basis, bioinformatics tools are increasingly used to analyze patient data and identify biomarkers for early detection, diagnosis, and treatment. The growing number of chronic diseases drives investment in research and development efforts to find personalized and effective treatments, increasing the demand for bioinformatics services.

Growth of the bioinformatics services market in Japan is driven by its aging population, leading to increased demand for personalized medicine and genomic research. The country’s focus on regenerative medicine, combined with advancements in AI-driven bioinformatics, supports market growth. Additionally, government initiatives promoting biotech innovation and collaborations between academia and industry fuel further expansion.

MEA Bioinformatics Services Market Trends

The Middle Eastern bioinformatics industry is growing due to increasing investments in healthcare innovation, rising genomic research initiatives, and expanding partnerships with global biotech firms. The region’s focus on precision medicine, particularly in genetic disease research, is fueling demand for bioinformatics services. Additionally, the adoption of AI-powered bioinformatics tools in healthcare and agriculture supports market growth.

Saudi Arabia bioinformatics services market is expected to witness significant growth during the forecast period. Saudi Arabiais investing heavily in biotechnology and genomic medicine as part of its Vision 2030 initiative, driving the market growth. The establishment of genomic research centers and collaborations with global biotech firms are accelerating market growth. Additionally, the rising prevalence of genetic disorders and the growing adoption of AI in healthcare research contribute to market expansion.

Growth of the bioinformatics services market in Kuwait is driven by increasing government investments in healthcare research, rising demand for genomic studies in disease prevention, and growing adoption of bioinformatics in clinical applications. Collaborations with international biotech firms and research institutions are further enhancing market growth. Additionally, the increasing focus on AI-driven bioinformatics solutions supports the region's expanding life sciences sector.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Bioinformatics Services Market

By Type

By Application

By Sector

By Regional