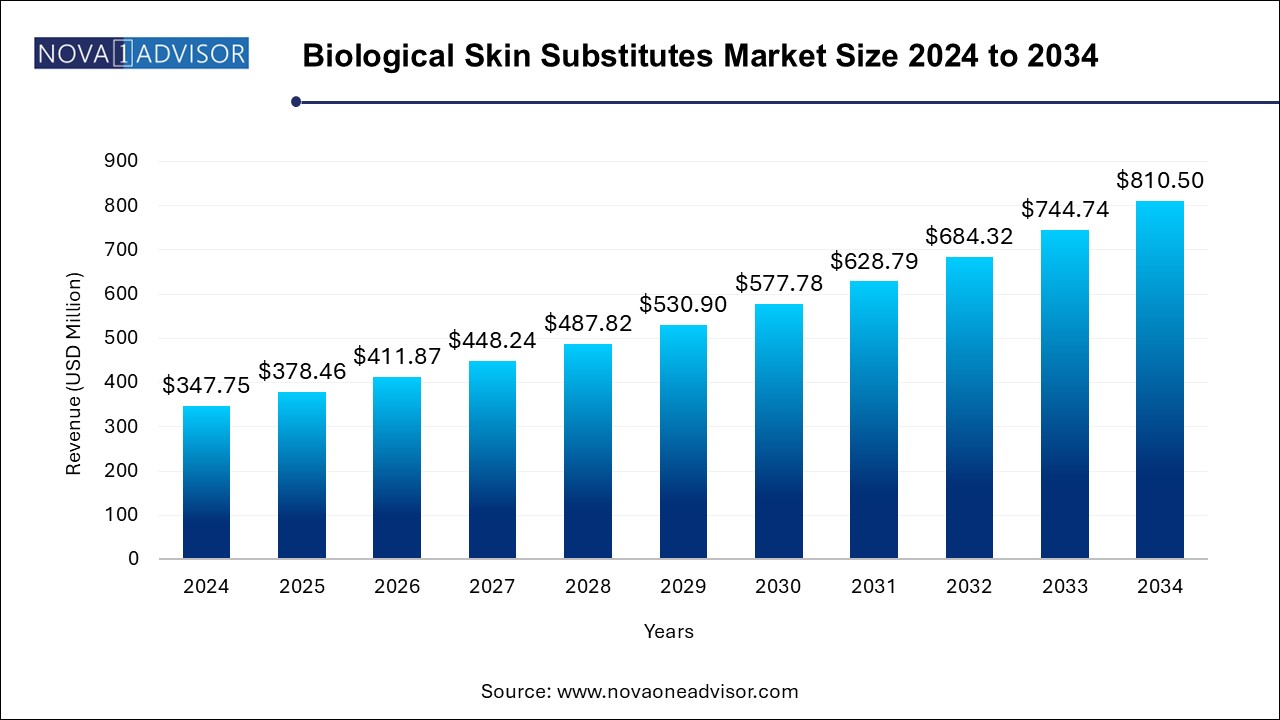

The biological skin substitute market size was exhibited at USD 347.75 million in 2024 and is projected to hit around USD 810.50 million by 2034, growing at a CAGR of 8.83% during the forecast period 2024 to 2034.

The biological skin substitutes market plays a crucial role in advancing the treatment of severe burns, chronic wounds, and skin injuries. Biological skin substitutes, derived from either human or animal tissues, are designed to support the body's natural healing process. These substitutes are typically used in conditions that require fast wound healing and tissue regeneration. The growing incidence of burn injuries, chronic conditions such as diabetes, and the need for effective wound care solutions are propelling the growth of the market. In addition, technological advancements in tissue engineering and regenerative medicine are enabling the development of more effective biological substitutes, which are expected to further enhance the adoption of these products across the globe.

| Report Coverage | Details |

| Market Size in 2025 | USD 378.46 Million |

| Market Size by 2034 | USD 810.50 Million |

| Growth Rate From 2024 to 2034 | CAGR of 8.83% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Organogenesis Inc.; Integra LifeSciences Corporation; Smith+Nephew; Tissue Regenix; MIMEDX Group, Inc.; Essity Aktiebolag (publ))( Essity Health & Medical); Stryker; Vericel Corporation; 3M; BioTissue |

Driver: Increasing Incidence of Chronic Wounds

The increasing prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, is one of the key drivers of the biological skin substitutes market. Chronic wounds are difficult to treat and often require long-term care, making them a major concern for healthcare providers. With the rise in lifestyle-related diseases like diabetes, the demand for advanced wound care solutions is escalating. Biological skin substitutes are particularly valuable in these cases as they promote faster healing, reduce infection rates, and improve the overall quality of life for patients. As the global population continues to age, the incidence of chronic wounds is likely to increase, further driving the growth of this market.

Restraint: High Cost of Biological Skin Substitutes

The high cost of biological skin substitutes is a significant restraint on the market’s growth. These products are derived from human or animal tissues, and their production requires specialized processes that drive up costs. For many healthcare providers, particularly in resource-constrained settings, the expense of these advanced substitutes can be prohibitive. Additionally, while biological skin substitutes offer improved outcomes compared to traditional treatments, their cost may limit their accessibility, especially in developing regions or for patients without adequate insurance coverage. This price sensitivity is expected to slow the widespread adoption of these products, posing a challenge to market expansion.

Opportunity: Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present a significant opportunity for the biological skin substitutes market. These regions are experiencing rapid advancements in healthcare infrastructure, increased healthcare spending, and rising awareness about advanced wound care solutions. As the number of chronic wound cases increases, there is a growing demand for effective treatments, including biological skin substitutes. For example, in countries like India and China, the large population base combined with rising healthcare access offers untapped market potential. Companies that invest in these regions by localizing production and distribution channels will be able to capitalize on this growing demand, providing an opportunity for significant market growth.

Human donor tissue-derived products held the largest revenue share of around 67.42% in 2024. These products account for the largest revenue share due to their high biocompatibility with human patients, which reduces the chances of immune rejection. The ability of human-derived products to closely mimic the structure and function of natural skin makes them ideal for treating a wide range of skin injuries, from burns to chronic wounds. With the increasing prevalence of chronic conditions like diabetes, which result in wounds that are difficult to heal, the demand for human tissue-derived skin substitutes is expected to continue growing.

The acellular animal-derived products segment is anticipated to grow from 2024 to 2034. These products, which are derived from animal tissues such as porcine or bovine sources and undergo decellularization, are gaining attention due to their ability to regenerate tissue without triggering immune responses. Recent studies, including one published in April 2024, highlighted the effectiveness of acellular fish skin grafts for diabetic wound treatment. The increasing positive results from clinical trials are expected to bolster the market acceptance of acellular animal-derived products, which in turn, will drive the growth of this segment over the forecast period.

The acute wounds segment dominated the market in 2024. driven by the increasing incidence of traumatic injuries, burns, and surgical wounds. Acute wounds require fast, efficient healing, and biological skin substitutes have proven effective in accelerating recovery. The market for acute wound treatment is expanding with the availability of advanced grafts like AlloSkin RT, a human tissue-derived allograft for dermal and epidermal healing, and Cytal Burn Matrix, a porcine-derived product for burn treatment. As demand for effective solutions in treating acute wounds continues to rise, this segment is expected to maintain strong market dominance.

The chronic wounds segment is anticipated to witness fastest growth at a CAGR of 9.13% over the forecast period Chronic wounds, such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are becoming increasingly prevalent, particularly due to the rising number of individuals living with diabetes. Research indicates that diabetic individuals have a 25% chance of developing diabetic foot ulcers, increasing the risk of complications like amputation. The growing need for advanced wound care solutions that address these persistent conditions, alongside innovations in stem cells, growth factors, and biomaterials, is fueling the segment’s rapid expansion.

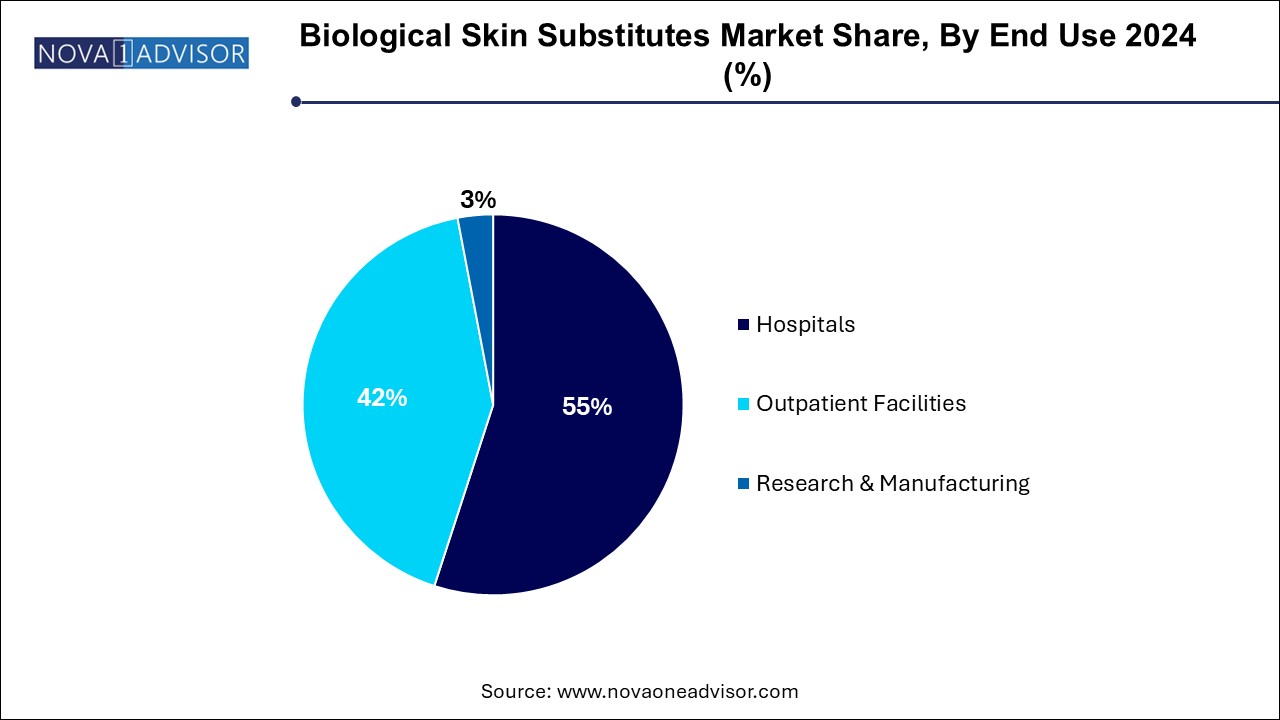

Hospitals held the largest revenue share of around 55.0% in 2024. Hospitals offer the infrastructure and expertise required to manage severe burns, chronic wounds, and surgical wounds. These facilities are equipped with advanced wound care technologies and specialized medical professionals, making them the preferred choice for patients requiring intensive care. Additionally, hospitals handle a high volume of patients with complex cases, further driving the demand for biological skin substitutes. With the growing incidence of burn injuries and the increasing number of hospitalizations due to chronic diseases, the hospital segment is expected to maintain its dominance in the coming years.

The outpatient facilities segment is expected to grow at the highest CAGR from 2024 to 2034. Are the fastest-growing end-use segment in the biological skin substitutes market. These facilities provide several advantages, including lower treatment costs, shorter recovery times, and the convenience of same-day discharge for patients. As the healthcare industry continues to focus on cost-effective treatments, outpatient facilities are becoming an attractive option for patients with less complex conditions. The increasing number of outpatient centers, coupled with the growing acceptance of biological substitutes for wound healing, is expected to drive significant growth in this segment over the forecast period.

North America biological skin substitute market dominated the global marker with a revenue share of 42.0% in 2024. The region's strong healthcare infrastructure, high levels of healthcare spending, and advanced medical research institutions provide a solid foundation for the growth of this market. The United States, in particular, accounts for a significant portion of the global market due to its large patient pool, high incidence of burn injuries, and prevalence of chronic diseases like diabetes. Furthermore, the increasing adoption of advanced wound care products and favorable reimbursement policies support the region's leadership in the market.

Asia-Pacific: The Fastest Growing Region

The Asia-Pacific region is experiencing the fastest growth in the biological skin substitutes market. Countries such as China and India are witnessing rapid improvements in healthcare infrastructure, increasing healthcare awareness, and rising demand for advanced wound care products. The growing aging population and increasing prevalence of chronic conditions in these regions are expected to drive demand for biological substitutes. Furthermore, as disposable income rises and access to healthcare improves, more patients will be able to benefit from advanced wound care solutions, further boosting market growth in the region.

March 2025: Integra LifeSciences announced a strategic partnership with a major hospital network in the Asia-Pacific region to expand its product availability, particularly for treating burns and chronic wounds. This move is expected to significantly increase market penetration in this fast-growing region.

October 2024: BioLab Sciences launched the “Tri-Membrane Wrap,” a human tissue allograft product designed to protect deep and poorly located wounds. This product highlights the ongoing innovation in the biological skin substitutes sector.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biological skin substitute market

Type

Application

End Use

Regional