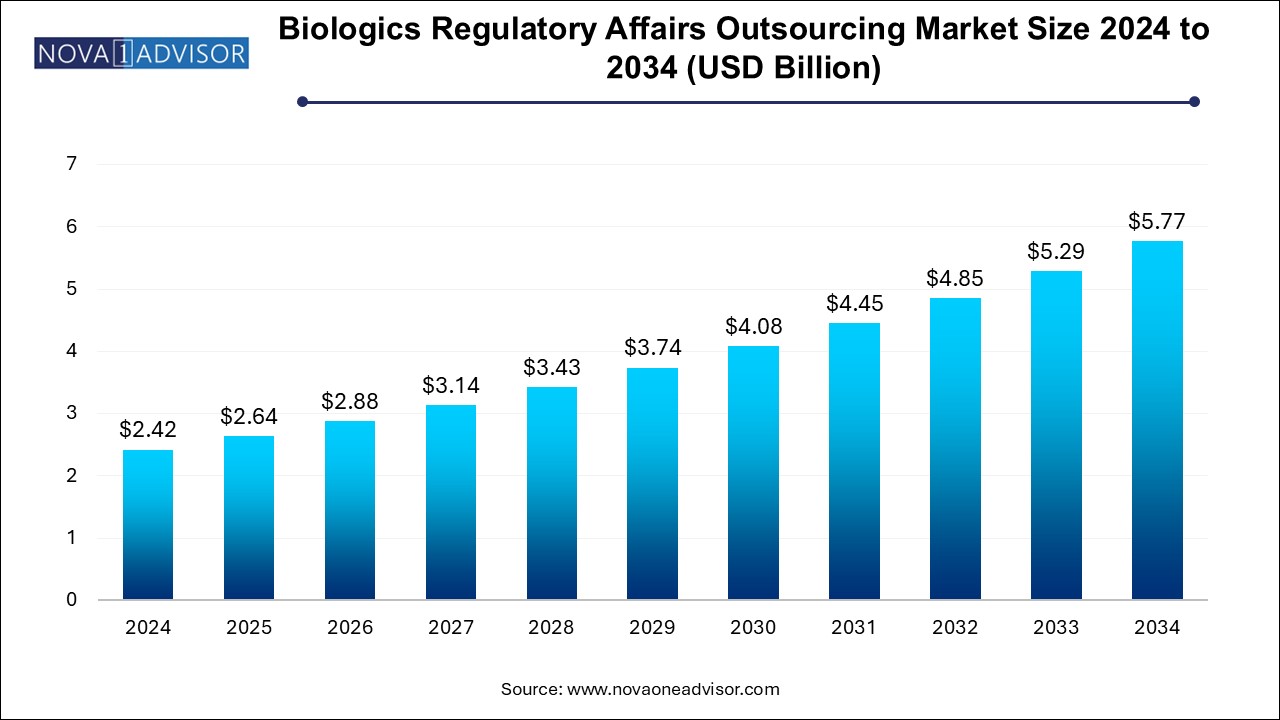

The global biologics regulatory affairs outsourcing market size was valued at USD 2.42 billion in 2024 and is anticipated to reach around USD 5.77 billion by 2034, growing at a CAGR of 9.07% from 2025 to 2034.

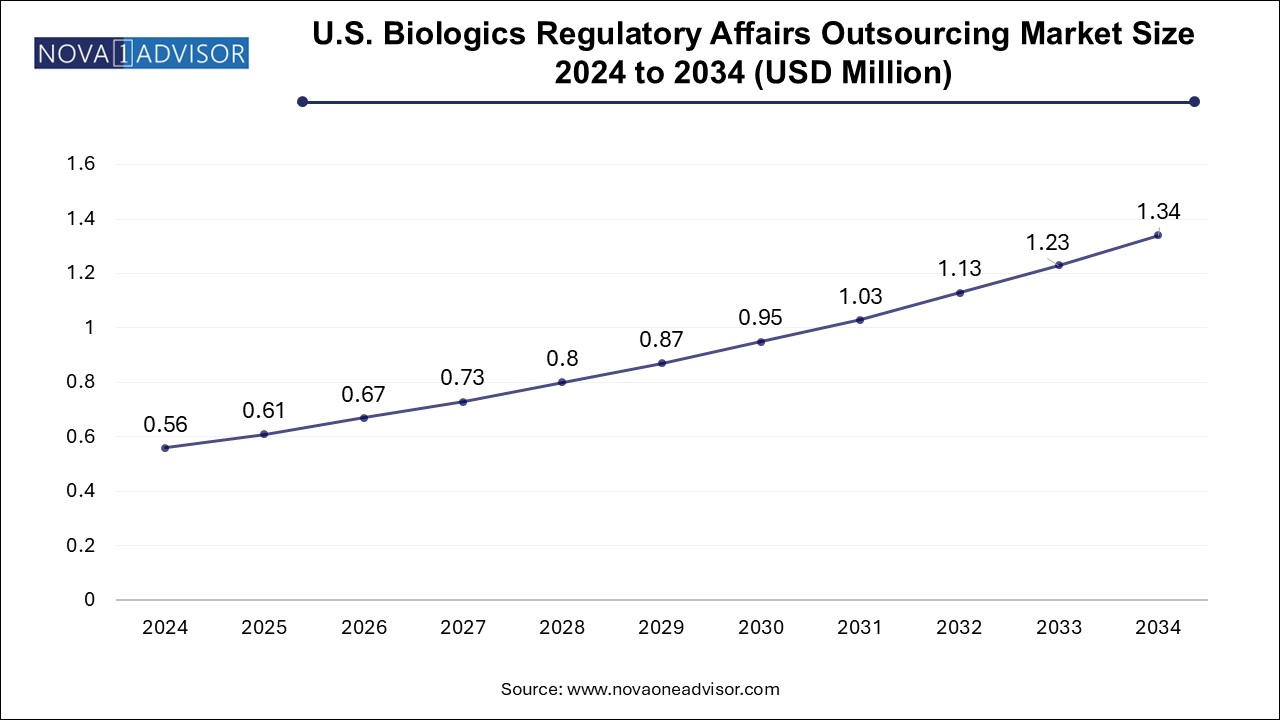

The U.S. biologics regulatory affairs outsourcing market size is evaluated at USD 0.560 million in 2024 and is projected to be worth around USD 1.34 million by 2034, growing at a CAGR of 8.25% from 2025 to 2034.

The North America accounted for the largest share of the biologics regulatory affairs outsourcing market in 2024, led by the United States’ dominance in biologics R&D and FDA’s global influence on regulatory science. Biotech innovation hubs such as Boston, San Diego, and the Bay Area fuel a constant stream of biologics requiring strategic regulatory support. The complexity of FDA requirements—including breakthrough therapy, fast track, and Orphan Drug designations—necessitates expert outsourcing partners.

Moreover, regulatory outsourcing firms based in the U.S. often support multinational submissions and serve as lead agents for global product filings. U.S. government programs like the Oncology Center of Excellence and Project Orbis have increased regulatory collaboration and outsourcing relevance.

Asia-Pacific is projected to be the fastest-growing region, driven by a booming biotech ecosystem, increasing drug development investments, and enhanced regulatory frameworks. Countries like China, India, South Korea, and Singapore are not only hosting clinical trials but also building local filing capabilities.

Regulatory consultancies are expanding in the region to assist sponsors with China’s NMPA, Japan’s PMDA, and India’s CDSCO submissions. Additionally, local CROs are partnering with global firms to offer end-to-end regulatory support tailored to regional standards. The combination of low-cost expertise and evolving ICH alignment makes APAC a hotspot for future growth.

The biologics regulatory affairs outsourcing market is evolving as a vital pillar within the biologics development and commercialization lifecycle. As biologics—including monoclonal antibodies (mAbs), recombinant proteins, cell and gene therapies, and biosimilars—become more complex and central to modern medicine, navigating their regulatory pathways has grown increasingly sophisticated. The intricate and region-specific compliance landscape demands specialized expertise, prompting biopharmaceutical companies to outsource regulatory affairs functions to external partners with proven track records and global reach.

Regulatory affairs outsourcing refers to delegating specialized tasks such as consulting, legal representation, regulatory submissions, clinical trial applications, writing and publishing, and operations management to third-party vendors. These services span the full product lifecycle—from preclinical development and Investigational New Drug (IND) submissions to New Drug Applications (NDA), Biologics License Applications (BLA), and post-market surveillance. Companies seek outsourcing to accelerate timelines, reduce costs, navigate multi-country submissions, and ensure alignment with ever-changing regulatory frameworks.

The biologics sector is growing at an exceptional pace. According to the U.S. FDA, biologics now account for over 40% of all newly approved drugs. With accelerated approvals, fast-track designations, and novel modalities like mRNA and CRISPR-based therapeutics gaining ground, regulatory challenges are becoming increasingly data-intensive and multidisciplinary. Outsourcing offers agility, scalability, and access to highly trained regulatory experts familiar with global filing standards such as FDA, EMA, PMDA, NMPA, and Health Canada.

Mid-sized and small biotech firms, which often lack internal regulatory infrastructure, are the primary adopters of outsourcing models. Even large pharma players are turning to outsourcing for specialized services or regional support. This market is poised to expand robustly over the next decade, driven by biologics pipeline growth, global regulatory harmonization efforts, and increasing pressure to bring innovative therapies to market faster and more efficiently.

Rising Complexity of Biologics Regulations: Enhanced regulatory scrutiny and evolving global standards are increasing demand for specialized outsourcing.

Acceleration of Cell and Gene Therapy Approvals: CGTs are driving high-value outsourcing across IND submissions and post-market compliance.

Decentralized Clinical Trials and Globalization: Sponsors need region-specific regulatory support to manage multi-jurisdictional filings and ethics approvals.

AI-Enabled Regulatory Intelligence: Tools for data extraction, submission tracking, and comparative dossier analysis are reshaping regulatory operations outsourcing.

Surge in Biosimilars Approvals: With patents expiring on major biologics, biosimilar developers are outsourcing dossier management and pharmacovigilance services.

Growth in Regulatory Writing & Publishing Services: High-quality medical writing, electronic Common Technical Document (eCTD) submissions, and labeling updates are being increasingly outsourced.

Hybrid Outsourcing Models: Partnerships now involve embedded resources, flexible retainer models, or project-based outsourcing tailored to product development timelines.

Global Expansion of Regulatory Hubs: Regulatory consultancies are expanding footprint in emerging markets like India, Singapore, and Brazil to support local filings.

| Report Attribute | Details |

| Market Size in 2025 | USD 2.64 Billion |

| Market Size by 2034 | USD 5.77 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 9.07% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, phase, modality, phase by service, phase by modality, modality by service, and region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Lonza AG; Wuxi Apptec Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; Freyr solutions; Catalent Inc.; Piramal Group; AGC Biologics; ICON Plc; Charles River Laboratories International, Inc.; Labcorp; Parexel International; Medpace Holdings, Inc.; IQVIA; Syneos Health; SGS SA (SGS) |

The most significant driver of the biologics regulatory affairs outsourcing market is the rapid growth in the number and complexity of biologic drug candidates, especially in therapeutic areas such as oncology, autoimmune disorders, rare diseases, and infectious diseases. Monoclonal antibodies, bispecifics, ADCs, CAR-T therapies, and gene-editing technologies are leading the innovation charge, but they come with unique manufacturing, validation, and safety documentation requirements.

As regulatory agencies introduce expedited pathways (e.g., breakthrough therapy designation, accelerated approval, conditional marketing authorization), companies are under pressure to prepare comprehensive submissions quickly while maintaining quality. Outsourcing allows sponsors to access global regulatory knowledge, scale resources, and manage multi-region filings simultaneously. Regulatory outsourcing partners also provide cross-functional support on CMC documentation, risk management plans, and regulatory strategy adaptation—ensuring alignment with regulatory science and agency expectations.

Despite strong growth, the market is constrained by concerns over data confidentiality and potential loss of control over regulatory functions. Biologics development involves highly sensitive intellectual property (IP), and companies may be reluctant to share proprietary data, especially regarding novel cell lines, vector designs, or clinical safety results with external vendors.

Additionally, coordination between internal teams and outsourced vendors requires stringent project management. Miscommunication, data handling discrepancies, or delays in deliverables may disrupt regulatory timelines. While outsourcing offers flexibility, lack of oversight or vendor inefficiency can lead to substandard submissions or agency rejections. Sponsors must invest in vendor qualification, governance frameworks, and secure data sharing platforms to mitigate such risks.

A promising opportunity for market expansion is the increased regulatory harmonization across major jurisdictions, driven by international collaborations such as the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). As agencies move toward digital-first submissions, risk-based assessments, and data interoperability, outsourcing vendors that specialize in cross-regional regulatory affairs can offer substantial value.

Companies developing biologics with global commercialization strategies need support in aligning their dossiers to regional expectations while minimizing rework and duplication. Regulatory outsourcing providers with a global presence, multilingual capabilities, and multi-agency experience can streamline filings and reduce launch timelines. This opportunity is further amplified by the rise of eCTD mandates, electronic labeling, and centralized pharmacovigilance systems that demand regulatory tech integration.

The Regulatory consulting dominated the market in 2024, accounting for the highest revenue share due to the strategic importance of early-stage regulatory planning. Within this segment, subcategories such as strategy & development planning and QA consulting are the most sought-after. These services help define regulatory pathways, align preclinical/CMC strategies with agency expectations, and anticipate potential approval challenges. Regulatory consultants also assist in agency meeting preparation (e.g., pre-IND, scientific advice meetings) and filing timelines, reducing the risk of regulatory delay.

Regulatory writing and publishing services are projected to grow fastest, particularly with the rise in documentation-heavy biologics such as biosimilars and CGTs. From investigator brochures, clinical study reports, and risk management plans to eCTD-compliant submissions and formatting, writing services are increasingly being outsourced due to their technical nature and need for compliance precision. With agencies tightening quality expectations on readability and document standardization, skilled medical writers are in high demand.

The Clinical phase outsourcing held the majority market share, especially in Phase II and Phase III stages, where regulatory activities peak due to global trial expansion, protocol amendments, and submission planning. Regulatory partners play a critical role in managing IND amendments, site approvals, investigator communications, and adverse event reporting.

Preclinical outsourcing is expected to grow rapidly, as companies aim to de-risk regulatory strategy earlier in development. Outsourcing regulatory operations during preclinical phases—particularly for CGTs and novel biologics—helps sponsors ensure that toxicology, manufacturing, and analytical plans align with global expectations. This early engagement often results in smoother clinical entry and fewer surprises during regulatory review.

The Monoclonal antibodies (mAbs) dominated the market, driven by the sheer volume of mAb-based therapies in late-stage pipelines and approved products. mAbs require detailed CMC documentation, long-term stability studies, and analytical comparability dossiers. With rising demand for biosimilar mAbs, regulatory support around extrapolation of indications and post-approval variations is also surging.

Cell and gene therapies are the fastest-growing modality, given the heightened regulatory scrutiny and unique approval pathways these therapies demand. Regulatory partners provide critical support in manufacturing scale-up, potency assay validation, comparability testing, and long-term follow-up plans. The novelty of these therapies creates a high demand for regulatory expertise not widely available in-house.

In the clinical phase by service matrix, regulatory submissions and operations dominate due to the intensity of activities leading up to BLA/NDA filings. Dossier compilation, eCTD publishing, agency correspondence, and post-submission query resolution are labor-intensive and often outsourced to ensure continuity and quality.

In the preclinical phase by service, strategy and development planning leads due to the need to define go-to-market and global regulatory pathways. Cell lines, toxicology programs, and initial manufacturing protocols all require strategic alignment early in the lifecycle to ensure regulatory feasibility.

In clinical-stage cell and gene therapy, regulatory affairs services are heavily focused on submissions, trial monitoring, and safety data compilation. These therapies often face rolling submissions or conditional approvals, requiring dynamic regulatory support.

For preclinical monoclonal antibodies, emphasis lies in writing and publishing services and legal representation for IP protection during cross-border trials and early collaborations.

Across modalities, regulatory consulting remains a high-value service. For instance, biosimilars rely heavily on comparative analysis dossiers and regulatory strategy adaptation for each target market. In vaccines, the focus shifts to regulatory writing and global submission harmonization, especially during pandemic preparedness or expedited review programs.

Regulatory operations is becoming increasingly prominent for mAbs and recombinant proteins, where document volume and update frequency are high.

In March 2025, Parexel launched a new AI-powered platform to accelerate regulatory operations outsourcing, enhancing submission timeline predictability.

In January 2025, Freyr Solutions opened a regulatory support center in Singapore to serve Southeast Asian biotech clients with regional filings and eCTD submissions.

In October 2024, ICON plc partnered with a major U.S. gene therapy firm to manage their FDA and EMA BLA submissions, covering writing, operations, and post-submission queries.

In September 2024, PharmaLex merged with VCLS to expand global biologics consulting and regulatory writing services under a unified platform.

In July 2024, IQVIA launched a Regulatory Intelligence Suite aimed at helping sponsors track evolving biologics requirements across 70+ countries.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Biologics Regulatory Affairs Outsourcing market.

By Service

By Phase

By Modality

By Phase by Service

By Phase by Modality

By Modality by Service

By Region