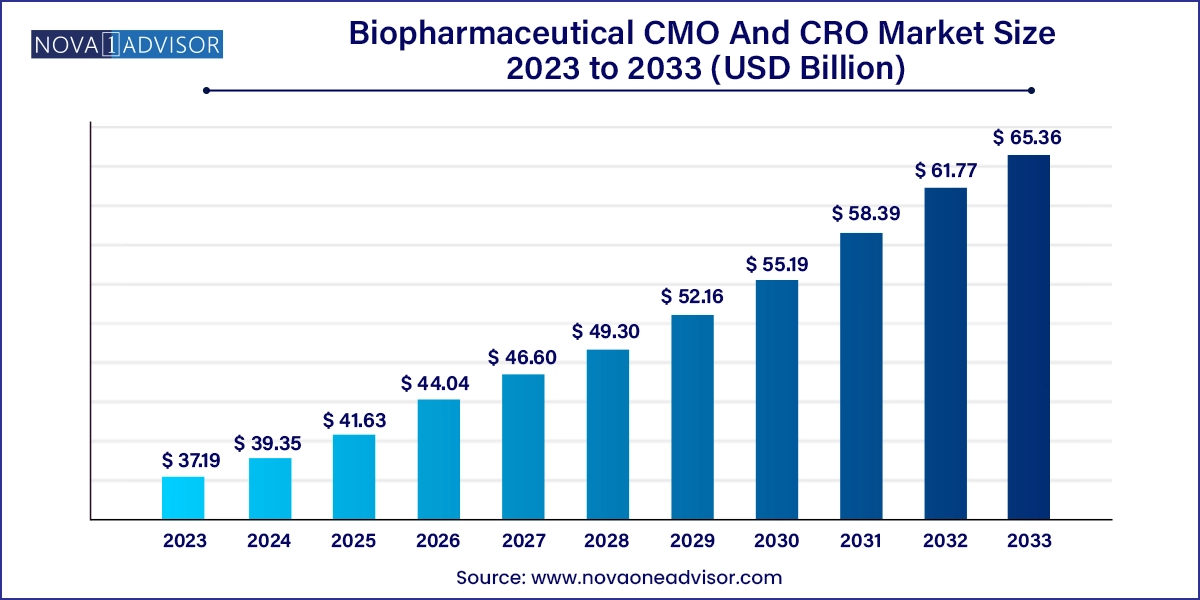

The global biopharmaceutical CMO And CRO market size was valued at USD 37.19 billion in 2023 and is anticipated to reach around USD 65.36 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

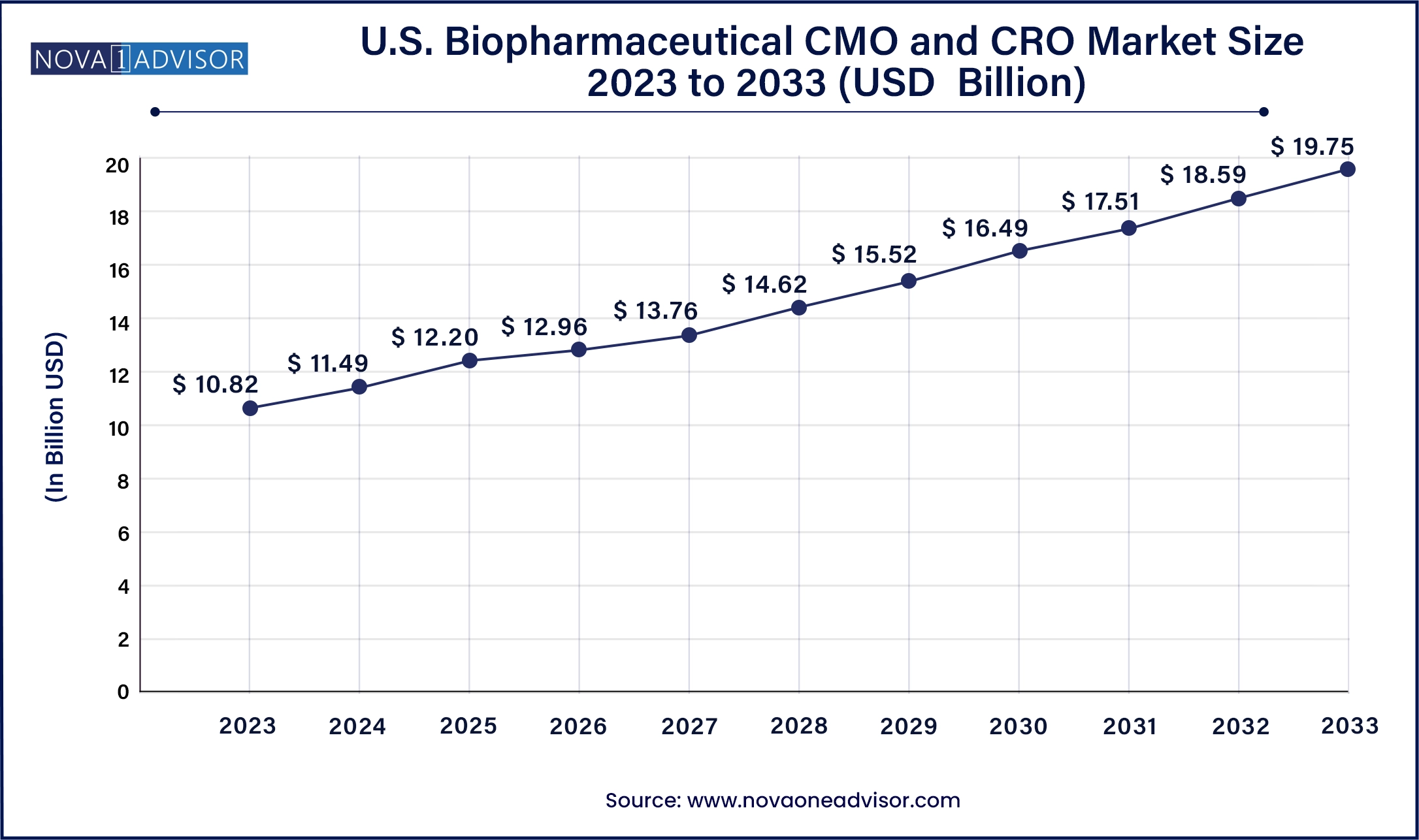

The U.S. Biopharmaceutical CMO And CRO market size was valued at USD 10.82 billion in 2023 and is projected to surpass around USD 19.75 billion by 2033, registering a CAGR of 6.2% over the forecast period of 2024 to 2033.

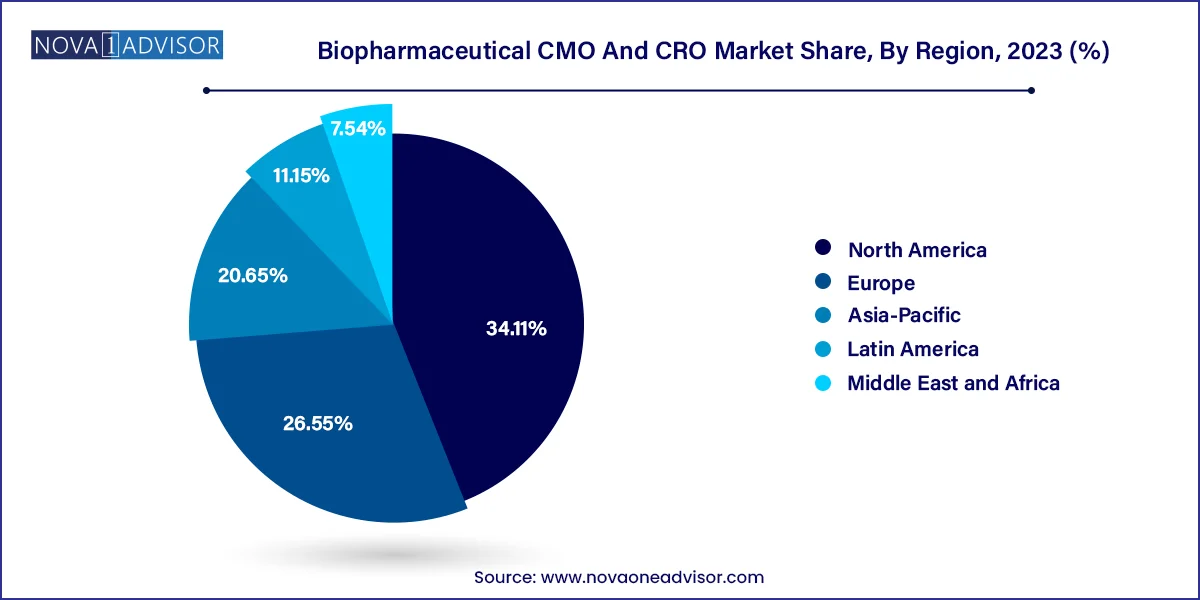

North America held a largest revenue share of 34.11% in 2023. This can be attributed to a local presence of several service providers in the region. Also, a significant number of approved products in the U.S. are being manufactured by CMOs. The presence of several small- and mid-size biopharmaceutical entities (SMEs) lack the resources and budget to establish facilities with well-equipped resources. This, in turn, has increased an inter-dependency between CMOs and SMEs in the U.S., resulting in the dominance of the U.S. market. Asia Pacific is expected to grow at a significant CAGR during a forecast period.

Increasing adoption and investment in advanced research and manufacturing technologies by CMOs & CROs based in the U.S. is propelling the growth of biopharmaceutical CMO & CRO Market in the country. In addition, quality services offered by service providers are driving the biopharma and CMO partnerships in the country. In addition, expansion of foreign CMOs and CROs into the country is expected to propel the market growth.

Asia Pacific biopharmaceuticals CMO & CRO Market is growing at a significant rate and the region is expected to emerge as the fastest-growing market for biopharmaceutical R&D and manufacturing. This growth can be attributed to various factors, such as regulatory changes, improving infrastructure, and presence of a large number of potential study subjects. Several biopharma companies from the U.S. are considering development of pharma products in Asian countries owing to growing cost of R&D in their home country.

China market held a notable share in 2023 due to increasing R&D activities. Increase in outsourcing of operations to Chinese market players by overseas biopharma firms is recognized as a major driver for the Chinese CMO & CRO Market. Global innovator companies outsource a significant portion of their research to restructure R&D and cut costs. Furthermore, biotechnology and its related aspects are significantly funded by the Chinese government. CRO and CMO capabilities are also strengthened by knowledge and quality management skills of a large number of people who have returned to the country after having worked in the U.S. and Europe.

There was unprecedented growth in 2020 due to the COVID-19 pandemic. The rising investments in the biopharmaceutical industry by the prominent participants to enhance their productivity and efficiency have driven the bio manufacturers to increase their focus on outsourcing activities. Currently, biopharma companies have begun outsourcing the resource and capital-intensive steps and, in a few cases, the entire chain of biomanufacturing, thereby boosting the demand for contract-based services.

With improvement in outsourced services, biopharmaceutical industry continues to show surge in number of biopharmaceutical firms opting for contract services. CMOs are making enormous investments for expansion of their manufacturing capabilities. For instance, in March 2022, Cambrex, an U.S. based CDMO expanded its biopharmaceutical testing services business with the addition of 11 cGMP laboratories in its U.S. facility. The expansion included the addition of instruments for nanoparticle size analysis, qPCR, imaging, mass spectrometry, immunoblotting, next-generation sequencing (NGS) and for other applications.

In recent years, the biopharmaceutical industry has witnessed a significant number of consolidations. These consolidations were mainly aimed at business expansion and to stay competitive in the biopharmaceutical contract manufacturing and services market. Although the biopharmaceutical CMO & CRO industry itself is relatively developed, the inception of new bioprocessing tools, novel therapeutics, and the priority shifts in the bio/pharmaceutical industry pertaining to products has increased the pressure on the contract biomanufacturers. As a result, CDMOs are adopting different business models for addressing the needs of their clients and stakeholders in the best possible way.

Furthermore, the integration of single-use systems in production facilities helps the CMOs to economically expand the manufacturing capacity. The single-use products offer fast turnaround and limit allied activities, such as cleaning and changeover validation. However, the contract negotiations between CMOs and customers are observed to be difficult owing to the regulatory landscape and complexity of service. Clients and CMOs are facing issues pertaining to the IP rights, warranty & liabilities, prices & timelines, which increases the complexity of negotiations.

| Report Attribute | Details |

| Market Size in 2024 | USD 39.35 Billion |

| Market Size by 2033 | USD 65.36 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Source, service, product, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Boehringer Ingelheim GmbH; Lonza Group AG; Inno Biologics Sdn Bhd; Rentschler Biopharma SE; JRS Pharma; Biomeva GmbH; ProBioGen AG; Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Toyobo Co., Ltd.; Samsung Biologics; Thermo Fisher Scientific Inc, CMC Biologics, WuXi Biologics, AbbVie Inc., Binex Co., Ltd., Charles River Laboratories International, Inc., ICON plc, Parexel International Corporation; Laboratory Corporation of America Holdings |

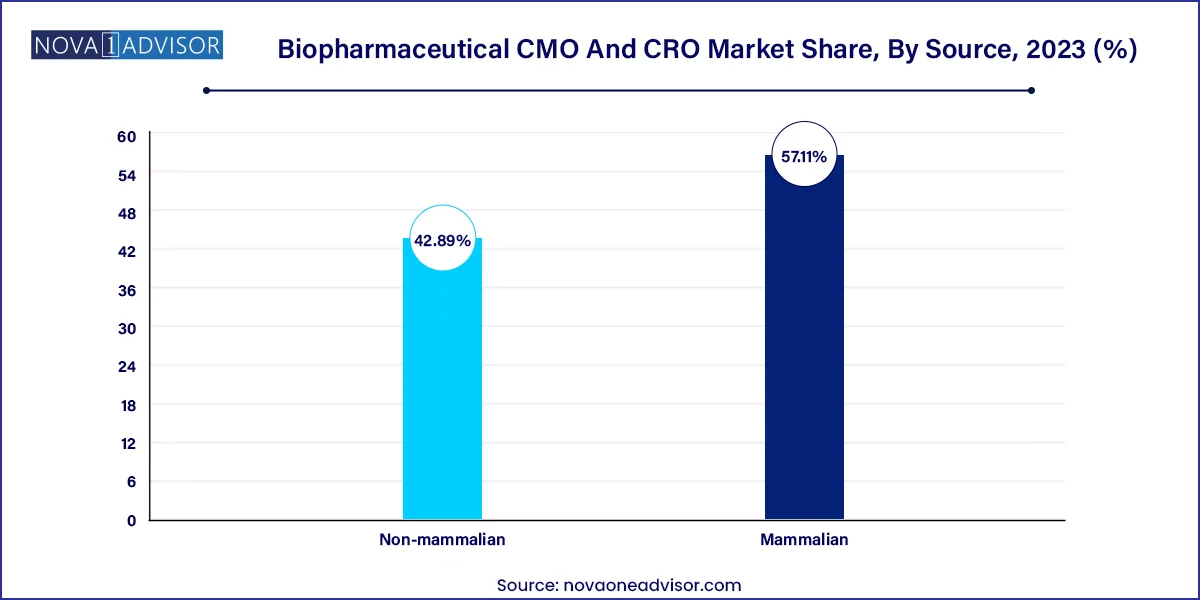

The mammalian segment held the highest market share of more than 57.11% in 2023 owing to the lack of internal expertise in the industry. This is attributed to their capabilities to add human-like post-translational modifications to complex protein therapeutics. Furthermore, the segment greatly benefited from the introduction of novel and enhanced expression systems, improved process monitoring solutions, cell line engineering tools, automated screening methods, and disposable devices.

Non-mammalian segment is projected to witness a rapid growth of 7.7% during the forecast period. Non-mammalian cell lines, such as microbial cell lines, are recognized as potent factories. Innovative strategies are being implemented to identify and explore the potential of various microbes. This, in turn, is anticipated to contribute to the non-mammalian biopharmaceutical manufacturing segment. Moreover, employment of Yeast Saccharomyces cerevisiae for production of several large volume products is aiding revenue generation for this segment.

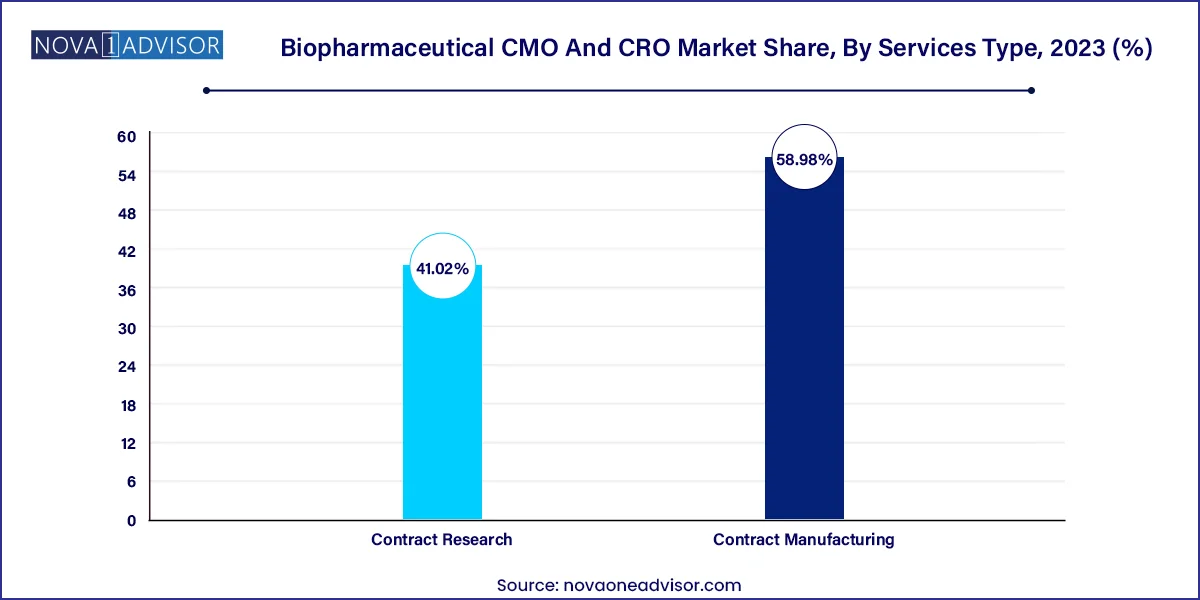

Contract Manufacturing segment held a dominant share of over 58.98% in 2023. This is attributed to the increasing outsourcing of research activities by biopharmaceutical companies. A substantial number of CMOs and opportunistic CMOs in this space are engaged in providing biopharma entities with plenty of services including end-to-end coverage from cell cultivation to fill/finish services. Furthermore, clients are investing heavily to outsource the manufacturing aspect of their product development program. These factors have resulted in the largest share of this segment.

Contract Research segment is anticipated to witness the fastest growth rate of 6.4% in biopharmaceutical CMO and CRO market over a forecast period. CROs are striving to capitalize on the potential avenues in the industry. New market entrants and small-scale players, which are focused on the development of biopharmaceuticals are anticipated to opt for the contract research services for their discovery programs of new candidates, thereby boosting the segment growth.Furthermore, stringent regulations for approval of biopharmaceuticals are anticipated to drive growth of this segment.

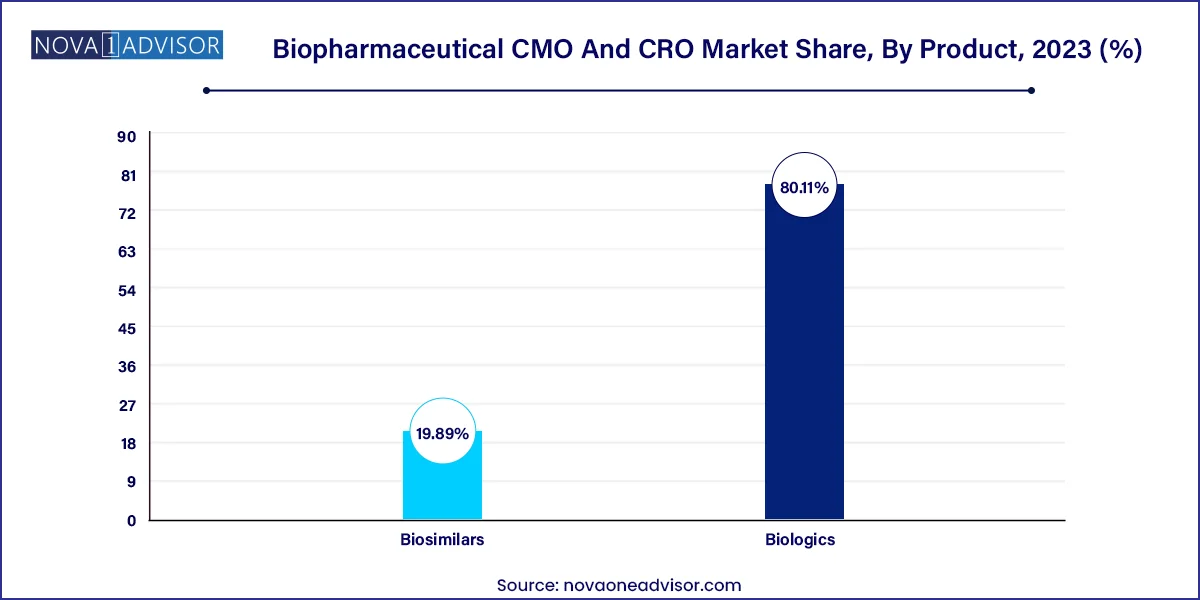

Biologics segment dominated a market with largest revenue share of over 80.11% in 2023. This growth is attributed to the high specificity of biologics, complex manufacturing steps, and a higher success rate as compared to other drug molecules. The use of single-use bioreactors, continuous purification processing, disposable plastic containers, and real-time quality analysis has enabled the CMOs to meet the increasing service demand for biologics production effectively. Moreover, increased outsourcing budget, directed toward biologics development, can be attributed to the large share held by this segment. With the growing biologics market, developers and regulators are struggling to keep up. This is expected to enhance adoption of CMO services, driving the segment.

Biosimilars segment is anticipated to witness a fastest growth rate of 8.7% in biopharmaceutical CMO and CRO market over a forecast period. Several companies are investing in biosimilar development to outperform the safety, efficacy, disposition, or cost of earlier in-class innovator drugs. This has increased the level of competition amongst innovator manufacturers, which in turn, is likely to benefit the CMOs.

The market is fragmented in nature with a substantial number of established as well as medium- to small-sized CMOs and CROs. Several market participants are privately held or are a part of private equity firms’ portfolios. CMOs are integrating automation and innovative technologies at their plants to improve their capabilities in terms of project throughput and product quality. This has driven the interest of large molecule manufacturers in the CMOs to meet the growing demand for biologics.

Charles River Laboratories International, Inc.; PRA Health Sciences; ICON plc.; Pharmaceutical Product Development, LLC; LabCorp; and Parexel International Corporation are engaged in offering contract research services for large molecule production. Market players focus on various business strategies including mergers, acquisitions, product launches, etc. For instance, in June 2022, FUJIFILM Corporation acquired cell therapy manufacturing facility from Atara Biotherapeutics, Inc. This acquisition is being made for expansion of its CMO business capabilities.

In June 2023, Lonza, a contract manufacturing services (CMO) in the biotechnology and pharmaceutical industries,acquired Synaffix B.V. (Synaffix), a biotechnology company dedicated to advancing its clinical-stage technology platform for Antibody-Drug Conjugate development. The acquisition is set to enhance Lonza's bioconjugates portfolio by incorporating Synaffix's proprietary technology platform and research and development capabilities.

In October 2023, Samsung Biologics and Kurma Partners entered in to strategic collaboration for the development and manufacturing of biologics intended for Kurma's portfolio companies.The multi-year collaboration is anticipated to foster the sustainable growth of the biopharmaceutical industry, enabling Samsung Biologics to extend its presence into the European market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biopharmaceutical CMO And CRO market.

By Source

By Service Type

By Product

By Region