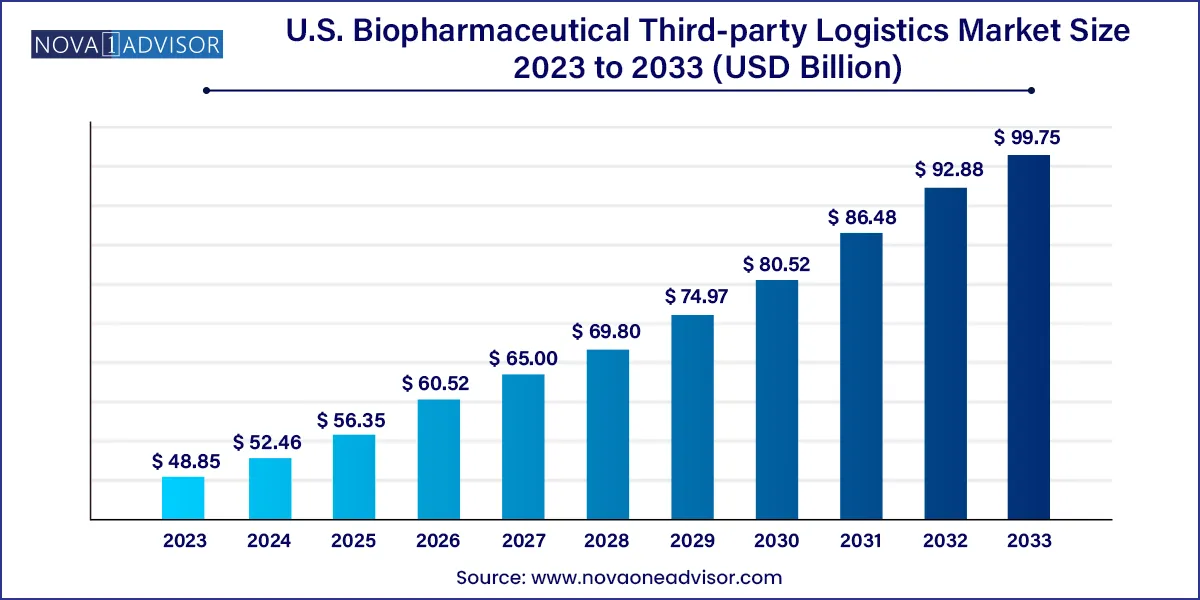

The U.S. biopharmaceutical third-party logistics market size was exhibited at USD 48.85 billion in 2023 and is projected to hit around USD 99.75 billion by 2033, growing at a CAGR of 7.4% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 52.46 Billion |

| Market Size by 2033 | USD 99.75 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Supply Chain, Service Type, Product Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | FedEx; DHL International GmbH; SF Express; United Parcel Service of America, Inc.; AmerisourceBergen Corporation; DB Schenker; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Agility |

The growth is majorly driven by the launch of innovative biopharmaceutical products including cell & gene therapies, creating more demand for cold chain storage, transport & distribution solutions. Besides, third-party logistics providers are also investing in technology due to fluctuating demand, capacity problems, and ongoing disruptions owing to COVID-19. The COVID-19 pandemic has led to restrictions on air travel & airfreight market disruption interrupted & delayed the supply of health products including vaccines to many countries. In the initial months of the COVID-19 pandemic, all the existing airfreight rates were suspended with UNICEF registering rate rises by as much as 500% but stabilizing at between 150 to 250%.

The COVID-19 pandemic has uncovered vulnerabilities within the supply chains, including the risk of just-in-time inventory & the likely benefits of relocating production near to the consumption point. A study looked at areas most impacted by the pandemic for shippers comprises international transportation & logistics (43%), sourcing & procurement (30%), and manufacturing (24%). The third-party logistics market was largely impacted by labor & workforce management (33%), manufacturing (24%), and international transportation & logistics (23%).

The COVID-19 pandemic has also enhanced the demand within the cold chain. Maximum shippers expect the demand for cold chain capacity to rise over the next three years. Hence, most third-party providers have speeded up their growth plans thus increasing their need for more cold chain capacity.

Besides, the industry players also play a key role in the pandemic to meet the growing demand. For instance, McKesson’s deep expertise in the healthcare supply chain is playing an important role in delivering medical supplies & pharmaceuticals to customers & patients during critical times. This comprises supporting the U.S. government as a centralized distributor of the COVID-19 vaccines & the ancillary supply kits required to administer them.

Non-cold chain logistics led the U.S. Biopharmaceutical Third-party Logistics (3PL) market with the largest revenue share of 80.2% in 2023. This is largely attributed to the fact that the majority of pharmaceutical drugs do not need temperature control and are shipped as general cargo. Besides, as temperature control solutions are costly to implement & maintain, companies are reluctant to adopt these practices.

Cold chain logistics is projected to witness a lucrative growth rate of 10.1% over the forecast period. This is largely due to the increasing demand for blood-related products as well as vaccines that require temperature-controlled environments for their transportation. Besides, the high adoption of cold chain products in both the developed & developing regions and continuous innovation in new drugs is supporting the growth.

The warehousing & storage segment led in terms of both revenue and volume share in 2023 and accounted for 43.4% of the market. This is owing to the large demand for third-party warehouse and storage services in the U.S. Increase in drug development activities and stringent regulations are anticipated to further boost the demand for third-party warehouse and storage services in the country.

The other services segment includes packaging, custom & duty management, procurement services, and a few more value-added services. These are anticipated to witness lucrative growth over the forecast period. Packaging is one of the crucial elements of the biopharmaceutical 3PL market since the transportation of drugs primarily depends on drug packaging. To maintain the standard and quality of products, biopharmaceutical companies pay a lot of attention to packaging quality to maintain uniformity, purity, integrity, and shelf life of biopharmaceutical products.

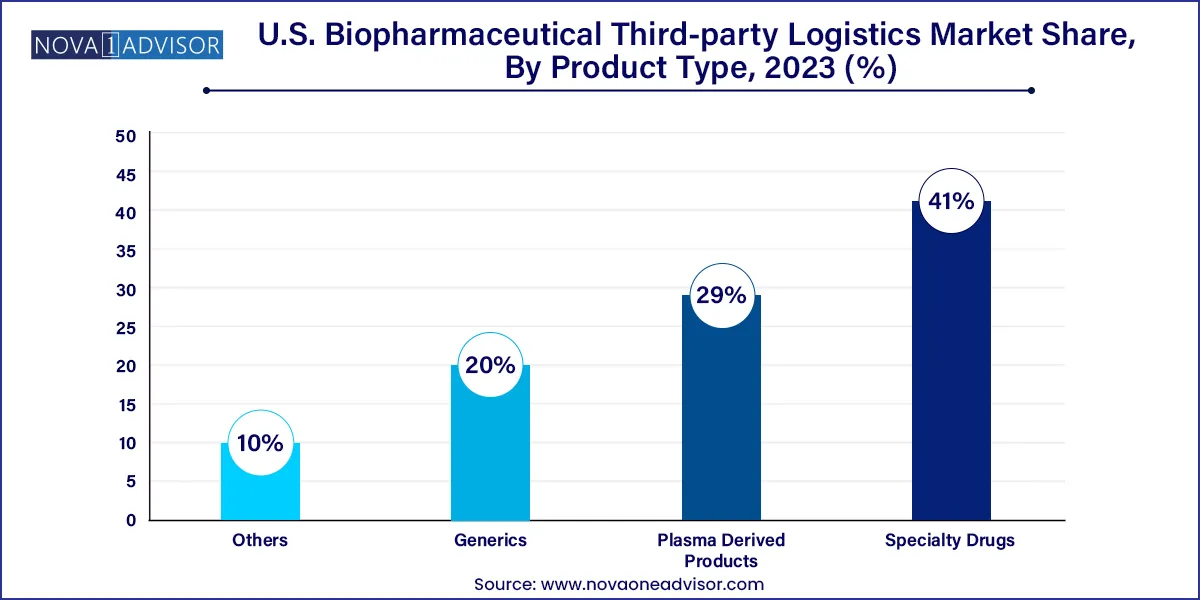

Specialty drug products alone contributed to 41.0% of the industry in 2023. The segment is also anticipated to witness the fastest growth rate of 7.7% over the forecast period. Growth in specialty pharma and easy availability of low-cost third-party logistics service offerings are expected to propel the growth of the specialty drugs market over the forecast period.

The product type segment also includes generics, plasma-derived products, and others. Others include products such as vaccines and nutraceuticals. Specialty drugs are high-cost prescription medications used to treat complex, chronic conditions like multiple sclerosis, rheumatoid arthritis, and cancer. They sometimes require special handling. These innovative, complex & high-priced specialty drugs are entering U.S. healthcare at a rapid rate. An increased amount of money is being devoted to specialty pharmacies. In the next five years, more than USD 100 billion is anticipated to be spent on developing generic specialty drugs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. biopharmaceutical third-party logistics market

Supply Chain

Service Type

Product Type