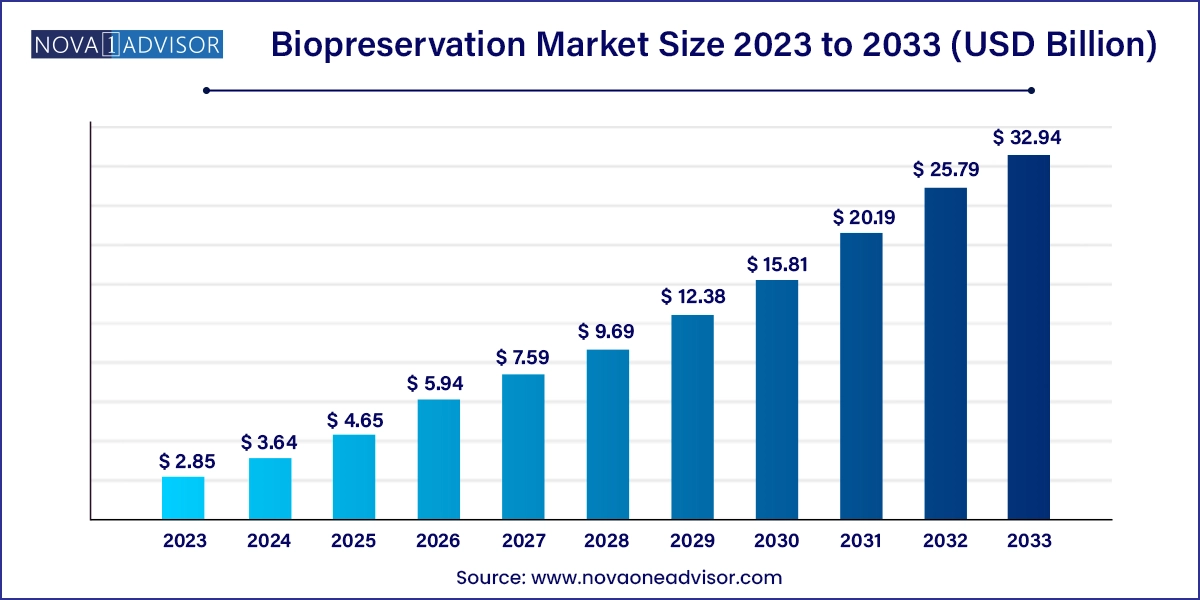

The global biopreservation market size was valued at USD 2.85 billion in 2023 and is anticipated to reach around USD 32.94 billion by 2033, growing at a CAGR of 27.73% from 2024 to 2033.

The biopreservation market plays a foundational role in the modern biomedical ecosystem, supporting critical processes such as cell therapy, gene therapy, regenerative medicine, drug discovery, and biobanking. Biopreservation refers to the extended storage and maintenance of biological samples ranging from cells, tissues, organs, and DNA/RNA to whole blood, plasma, and reproductive materials under controlled environmental conditions to preserve viability, stability, and functionality.

With the increasing dependence on biological specimens for diagnostic, therapeutic, and research purposes, biopreservation has transitioned from a laboratory-centric practice to an indispensable component of healthcare, biotechnology, and pharmaceutical infrastructure. The demand for highly efficient preservation methods has risen sharply with the surge in personalized medicine, cell-based immunotherapies, stem cell research, and fertility preservation programs.

Cutting-edge innovations in cryogenic technologies, freezing and thawing protocols, preservation media, and laboratory automation systems have pushed the market into a growth trajectory. Today’s solutions are not limited to ultra-low temperature storage but also encompass cryoprotectant agents, pre-formulated preservation media, liquid nitrogen systems, and integrated laboratory information management systems (LIMS) that enable traceability, inventory control, and compliance with regulatory standards.

This market is witnessing strong demand from both public and private sectors. Biobanks, clinical research organizations, stem cell repositories, and pharmaceutical companies are investing heavily in infrastructure to ensure long-term storage of biological materials used for clinical trials, therapeutic applications, and population genomics programs. As global interest in regenerative medicine and biologic therapies expands, biopreservation is expected to remain a vital enabler of innovation and patient care.

Rise of Cell-Based Immunotherapies and Stem Cell Banking: Demand for cryopreservation and long-term storage of iPSCs, MSCs, and immune cells is rapidly expanding.

Integration of AI and LIMS in Biobanking Operations: Artificial intelligence is improving tracking, temperature monitoring, and sample analytics.

Growth in Fertility Preservation Services: Increasing number of sperm and egg banks driven by delayed parenthood, cancer recovery, and LGBTQ+ family planning needs.

Adoption of Cryo Logistics and Cold Chain Management: Biopreservation is expanding into logistics with the need to transport samples across global clinical trial sites.

Customization of Preservation Media: Pre-formulated, serum-free, and chemically defined media are gaining traction over home-brew solutions for reproducibility and safety.

Miniaturization of Equipment and Automation: Small-scale, automated biopreservation systems are being developed for point-of-care and mobile research settings.

Expansion of Veterinary Biobanking and IVF Programs: Demand is rising for preservation tools in livestock genetics and pet reproductive services.

| Report Attribute | Details |

| Market Size in 2024 | USD 3.64 Billion |

| Market Size by 2033 | USD 32.94 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 27.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By Cell Providers Volume |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Biomatrica, Inc., Azenta US, Inc., MVE Biological Solutions, BioLife Solutions, LabVantage Solutions, Inc., Thermo Fisher Scientific, Inc., Taylor-Wharton, Panasonic Corporation, PrincetonCryo, X-Therma Inc., Stirling Ultracold, and Others. |

The rapid growth of regenerative medicine and cell therapy applications stands out as the most influential driver propelling the biopreservation market. From bone marrow transplants and gene-modified CAR-T cell therapies to organoid development and stem cell injections, regenerative treatments increasingly rely on preserved biological specimens to maintain viability and therapeutic potential until clinical application.

For example, CD34+ hematopoietic stem cells, commonly harvested from peripheral blood or bone marrow, must be preserved under cryogenic conditions for future transplantation in patients with leukemia or genetic blood disorders. Similarly, induced pluripotent stem cells (iPSCs) are stored in biobanks for differentiation into various tissue types on demand. These therapies often require the transportation of viable, non-degraded samples from manufacturing sites to clinical settings, making robust biopreservation systems indispensable.

Furthermore, ongoing FDA approvals for cell-based immunotherapies like Yescarta and Kymriah—used in blood cancers—illustrate the clinical importance of cryopreserved cells in approved and investigational pipelines. The increasing emphasis on off-the-shelf allogeneic cell therapies also enhances the need for high-volume, consistent, and long-term storage solutions.

Despite its growing utility, the high cost associated with biopreservation infrastructure and operations remains a significant barrier, particularly for small-scale research facilities, academic institutions, and developing countries. Maintaining ultra-low temperature freezers, liquid nitrogen tanks, backup power systems, and data-logging devices for long durations requires substantial capital investment and ongoing operational costs.

For instance, a -80°C freezer can cost over $10,000, not including the recurring expenses for energy, calibration, and maintenance. Similarly, liquid nitrogen storage tanks must meet stringent safety and redundancy standards, which further adds to installation and compliance costs. Additional costs are incurred for purchasing pre-formulated cryopreservation media, traceability systems, and LIMS platforms.

Moreover, staff training and regulatory compliance (e.g., GMP, GCP, and FDA/EMA guidelines) in handling and storing biological materials add further complexity. Smaller biobanks or labs with limited budgets may be forced to cut corners or rely on outsourcing, which may compromise data integrity and accessibility.

A major opportunity area lies in the growth of biobanking initiatives worldwide, especially those focused on population-scale genomics, rare disease studies, and precision medicine. National biobanks such as the UK Biobank, All of Us (USA), and Genomics England have led the way in collecting, preserving, and analyzing biological samples from millions of volunteers to study genetic correlations with diseases.

These projects require long-term cryogenic preservation of blood, DNA, plasma, urine, and other biological materials under strict quality control conditions. This, in turn, fuels demand for reliable equipment, preservation media, labeling, and inventory management tools. Many of these programs are expanding partnerships with private pharmaceutical companies and academic research centers, opening commercial pathways for biopreservation service providers.

Additionally, disease-specific biobanks—such as cancer tissue repositories and neurodegenerative disease biobanks—are being set up by hospitals, NGOs, and universities. These initiatives support translational research and clinical trial design, and they rely heavily on standardization of sample storage protocols to ensure consistency across centers and over time.

Equipment remains the dominant segment in the biopreservation market. This includes ultra-low temperature freezers, cryogenic freezers, refrigerators, and liquid nitrogen tanks. The critical nature of temperature regulation in biological storage drives the need for robust and reliable equipment across hospitals, blood banks, fertility clinics, and pharmaceutical labs. In particular, liquid nitrogen systems have become the gold standard for storing stem cells and reproductive materials for long durations without compromising viability. The demand is highest in cell therapy companies, IVF clinics, and centralized biobanks. The consumables segment, which includes vials, bags, straws, and microtiter plates, also plays a supportive role in maintaining sterility and sample integrity during storage and retrieval.

In contrast, cryopreservation media is the fastest-growing product category. Laboratories are increasingly moving away from custom, home-brew media in favor of pre-formulated, serum-free solutions that offer better consistency, scalability, and regulatory compliance. These formulations are tailored to different cell types, such as iPSCs, T-cells, or hESCs, and often include cryoprotectants like DMSO or trehalose. Vendors such as Thermo Fisher and BioLife Solutions are developing optimized preservation media that enhance post-thaw viability and reduce cytotoxicity. With the expansion of clinical-grade cell manufacturing, the importance of GMP-compliant cryomedia has become more prominent, positioning this segment for sustained growth.

Regenerative medicine is the dominant application of biopreservation, accounting for a significant share of the market. This includes preservation of cells used in gene therapy, cell therapy, and tissue engineering. As CAR-T therapies, stem cell-based bone regeneration, and engineered skin grafts become mainstream, there is growing reliance on advanced biopreservation techniques to support end-to-end workflows. For example, during CAR-T therapy, a patient’s immune cells are extracted, modified, frozen, and re-administered, requiring precise cryopreservation at multiple stages. The increase in FDA approvals and global clinical trials in regenerative medicine is directly linked to rising demand for ultra-low storage systems and preservation media.

While regenerative medicine leads, biobanking is the fastest-growing application. The expansion of sperm and egg banks, pediatric stem cell banks, and disease-specific tissue banks reflects the surging demand for secure, long-term preservation. Fertility clinics increasingly offer human sperm and egg cryopreservation services for individuals undergoing chemotherapy or pursuing late parenthood. Likewise, veterinary IVF programs are scaling rapidly in both livestock improvement and pet breeding domains. These applications require scalable freezers, automated inventory control, and stable transport systems. The rise in donor registries and international tissue exchanges further enhances the relevance of biobanking.

CD34+ hematopoietic stem cells dominate the cell provider volume segment, owing to their well-established use in bone marrow and blood-based transplants. These cells are critical in treating leukemia, lymphoma, and certain genetic blood disorders. Their cryopreservation is standardized and often required in bulk by stem cell banks and clinical centers. Leading transplant centers in the U.S., Germany, and Japan routinely maintain cryopreserved stocks of CD34+ cells sourced from donors and patients alike. These cells are also used in research to study hematopoiesis, immunology, and stem cell differentiation, further reinforcing their volume dominance.

However, iPSCs (induced pluripotent stem cells) are the fastest-growing subsegment. These cells can be reprogrammed from adult somatic cells and differentiated into any tissue type, offering tremendous potential in disease modeling, drug screening, and regenerative therapies. The ability to create patient-specific iPSCs opens new doors for personalized medicine, where preserved iPSCs can be differentiated on demand. Pharmaceutical companies and academic institutions are investing heavily in iPSC biobanks that require advanced, high-fidelity cryopreservation protocols. Moreover, the use of iPSCs in neurodegenerative and cardiovascular research is driving their demand and storage volume rapidly upward.

North America leads the biopreservation market, driven by strong research infrastructure, supportive regulatory frameworks, and widespread adoption of regenerative and precision medicine. The U.S., in particular, is home to hundreds of stem cell banks, fertility clinics, and NIH-funded biobanks. Leading companies such as Thermo Fisher Scientific, BioLife Solutions, and Brooks Life Sciences operate extensively in this region. The presence of FDA-approved cell therapies and an active clinical trials environment ensures continued demand for preservation systems. Moreover, collaborative programs such as All of Us (targeting one million genetic profiles) reinforce the need for scalable biopreservation technologies in genomic research.

Asia-Pacific is the fastest-growing region in the biopreservation market, fueled by expanding healthcare infrastructure, rising investments in biotech, and growing awareness of fertility preservation and regenerative medicine. Countries like China, India, Japan, and South Korea are advancing rapidly in stem cell therapy, gene editing, and population genomics. China, in particular, has seen significant government backing for biobanking initiatives and cell therapy startups. Meanwhile, India is emerging as a hub for affordable IVF and sperm banking services, driving demand for cryopreservation systems and media. As local companies expand capabilities and international firms enter the market, Asia-Pacific is expected to continue outpacing other regions in growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biopreservation market.

By Product

By Application

By Cell Providers Volume

By Region