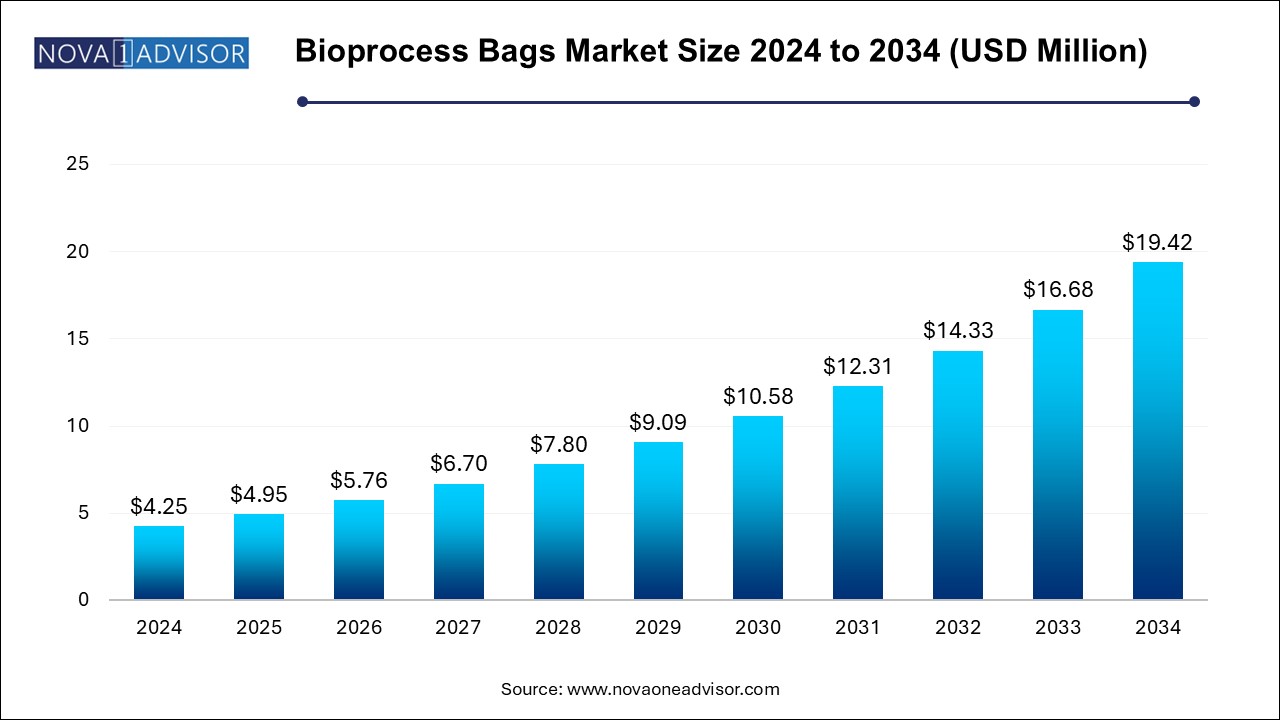

The bioprocess bags market size was exhibited at USD 4.25 Billion in 2024 and is projected to hit around USD 19.42 Billion by 2034, growing at a CAGR of 16.41% during the forecast period 2024 to 2034.

The bioprocess bags market is rapidly expanding as the life sciences and pharmaceutical sectors increasingly embrace single-use technologies for efficient, scalable, and cost-effective bioproduction. Bioprocess bags, designed for the storage, mixing, transport, and cultivation of cell cultures and media, have become essential components in upstream and downstream bioprocessing workflows. Their adoption is driven by the need to streamline biologics production, reduce contamination risks, and minimize the capital and operational expenditures associated with traditional stainless-steel systems.

Bioprocess bags are primarily made of multi-layer polymer films with high chemical resistance, flexibility, and gas permeability. They are utilized in various capacities, from small-scale research laboratories to large-scale commercial biomanufacturing plants. Their role is critical in applications such as media storage, buffer preparation, cell harvesting, vaccine production, monoclonal antibody synthesis, and viral vector purification. With the rise of personalized medicine, biosimilars, and rapid vaccine development (as seen during the COVID-19 pandemic), bioprocess bags have cemented their importance as key enablers of agile and modular production setups.

Furthermore, bioprocess bags align well with regulatory demands for cleanliness, validation, and standardization, particularly in cGMP-compliant environments. Their compatibility with automated systems and reduced reliance on cleaning validation make them ideal for high-throughput and multi-product facilities. As the biopharmaceutical sector shifts toward continuous and hybrid manufacturing models, the demand for high-quality, customizable bioprocess bags is set to grow exponentially.

Accelerated shift toward single-use technologies (SUTs) in biologics manufacturing, reducing risk and increasing flexibility.

Increased investment in modular biomanufacturing facilities, driving demand for disposable and easy-to-integrate processing components.

Customization of bag design and volume capacity, addressing application-specific workflows in cell culture, media storage, and cryopreservation.

Growth of cell and gene therapy manufacturing, requiring sterile, small-volume bags suitable for high-value, patient-specific products.

Advancements in polymer films and multilayer barrier materials, improving gas exchange, UV protection, and chemical compatibility.

Rising adoption among Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) seeking efficient scale-up options.

Automation and integration of sensors into bioprocess bags, allowing real-time monitoring of pH, temperature, and oxygen levels.

Focus on sustainability, with R&D efforts in recyclable polymers and reduced plastic waste from single-use systems.

Global expansion of biopharmaceutical capacity, particularly in emerging regions such as Asia Pacific and Latin America.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.95 Billion |

| Market Size by 2034 | USD 19.42 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 16.41% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Workflow, End user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Sartorius AG, Danaher Corporation; Merck KGaA; Saint-Gobain; Corning Incorporated; Entegris; Meissner Filtration Products, Inc.; PROAnalytics, LLC; CellBios Healthcare & Lifesciences Pvt Ltd. |

One of the core drivers of the bioprocess bags market is the surge in global biopharmaceutical production, particularly in the areas of monoclonal antibodies, vaccines, biosimilars, and advanced therapies. These biologics require highly controlled and contamination-free production environments. Traditional stainless-steel bioreactors and media containers often require rigorous cleaning, sterilization, and validation between batches—processes that are time-consuming and resource-intensive.

Bioprocess bags, as single-use components, eliminate the need for cleaning and reduce turnaround time between batches, increasing operational efficiency and facility utilization. They also enable greater flexibility in multi-product manufacturing facilities, supporting rapid scale-up or scale-down according to production needs. For instance, during the COVID-19 pandemic, bioprocess bags were instrumental in enabling fast-track vaccine manufacturing programs, where speed and scalability were paramount. Their utility in both upstream and downstream applications enhances their value across the entire bioproduction continuum.

Despite the advantages, a significant restraint in the bioprocess bags market is the environmental impact of single-use plastics, which are not biodegradable and contribute to waste accumulation. As sustainability becomes a central concern for pharmaceutical manufacturers, the disposal of non-recyclable polymer-based bioprocess bags poses reputational and operational challenges.

Bioprocess bags, especially those used in GMP environments, must meet stringent sterility and material compatibility requirements, making recycling technically complex. Most end-users currently rely on incineration as the primary method of disposal, which contributes to greenhouse gas emissions. The growing push for green manufacturing and circular economy models is placing pressure on manufacturers to innovate eco-friendly alternatives or establish viable recycling programs for used bioprocess materials. Without a clear, scalable solution to the environmental burden, adoption in certain geographies or under sustainable procurement mandates may be affected.

An emerging opportunity within the bioprocess bags market lies in the rapidly growing field of cell and gene therapy manufacturing, which demands high sterility, small-batch processing, and customization. These therapies, often personalized or autologous in nature, require flexible systems that can be quickly adapted to various patient-specific workflows. Bioprocess bags serve as ideal platforms for aseptic processing, cryopreservation, and fluid transfer in closed systems.

Companies operating in the regenerative medicine space increasingly rely on pre-sterilized, single-use bags for culturing and expanding cells, formulating viral vectors, and storing engineered biologics. The demand for gamma-irradiated, medical-grade bioprocess bags with low extractables and leachables is growing in tandem. As regulatory frameworks evolve and more therapies receive approvals, the commercial manufacturing of these high-value biologics will necessitate scalable and robust bioprocess bag solutions—offering significant growth potential for market participants.

The 2D bioprocess bags held the highest market share of over 46.28% in 2024. As they are widely used in buffer and media storage, cell culture applications, and transport processes. Their flat, compact design allows for easy integration into existing systems, especially in laboratory and small-scale production setups. These bags are particularly favored for ease of handling, lower cost, and suitability for horizontal mixers and benchtop systems. The versatility of 2D bags makes them a preferred choice in both research and pilot-scale manufacturing environments, covering a wide spectrum of upstream and downstream operations.

The 3D bioprocess bags segment is anticipated to grow at the fastest CAGR during the forecast period. These bags are designed to fit inside rigid containers or stainless-steel tanks, allowing for vertical mixing and higher capacity operations. They are increasingly deployed in commercial-scale manufacturing of vaccines, antibodies, and biologics, where batch sizes may range from hundreds to thousands of liters. The increased adoption of 3D bags reflects the industry's transition to scalable, modular, and continuous biomanufacturing workflows, where minimizing facility footprint and optimizing fluid dynamics are critical.

The upstream process segment held the highest market share of 43.76% in 2024. Bioprocess bags are integral in maintaining sterility during the preparation and transfer of cell culture media, supplements, and in-process fluids. In single-use bioreactor systems, they are also used as liners for disposable culture vessels, supporting efficient biomass growth and protein expression. Their sterility and adaptability to various bioreactor formats make them essential for upstream consistency and yield optimization.

The downstream process is anticipated to register fastest CAGR during the forecast period. driven by the increasing need for flexibility and scalability in early-stage drug development. Bioprocess bags enable rapid prototyping, testing of process parameters, and experimentation with different cell lines and conditions without requiring extensive facility modifications. As more biopharmaceutical companies and CDMOs pursue pipeline diversification and adaptive manufacturing, the ability to conduct small-scale, parallelized studies using disposable systems like bioprocess bags becomes indispensable. This trend is particularly relevant in emerging biologics, biosimilars, and personalized therapy development.

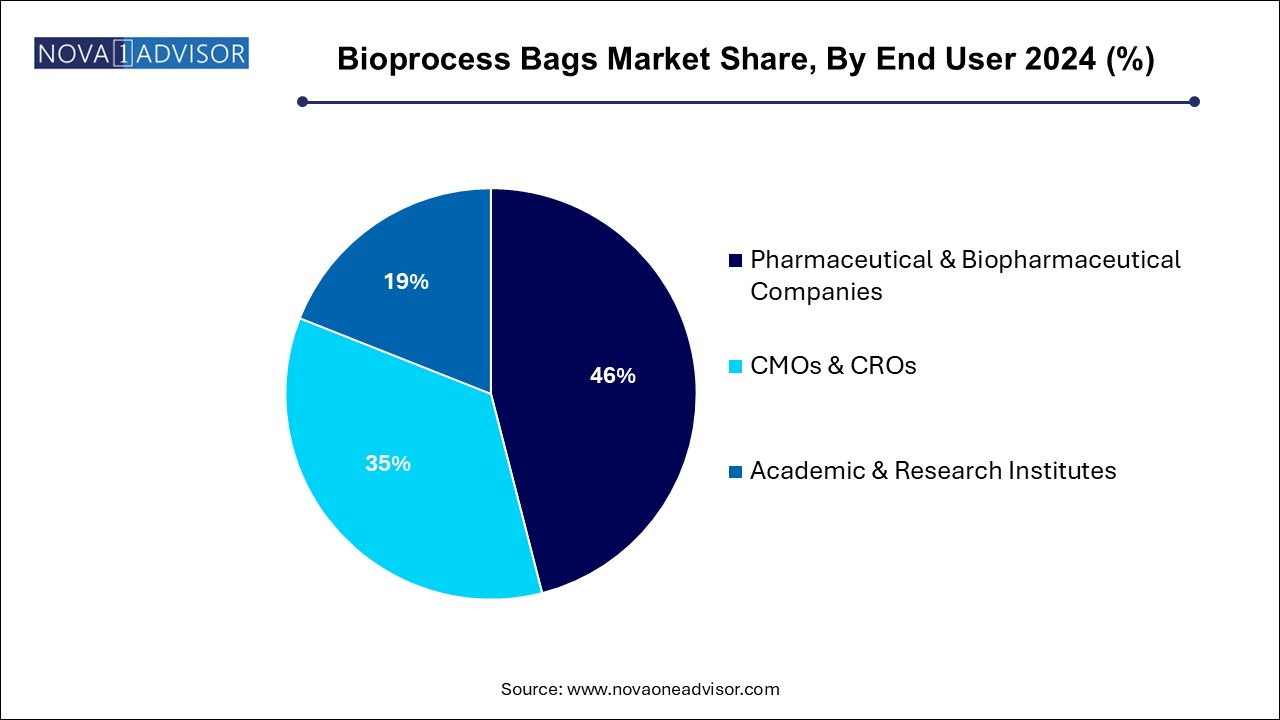

The pharmaceutical & biopharmaceutical companies segment held the highest market share of 46.0% in 2024. Accounting for a significant share of demand due to their high-volume biologics production and strict GMP requirements. These companies use bioprocess bags in nearly every stage of drug manufacturing—from seed train expansion to harvest, purification, and final formulation. The scalability, sterility, and regulatory compliance of bioprocess bags make them a preferred solution in multi-product and multi-facility operations. Their usage in vaccine production, mAbs, insulin, and recombinant protein manufacturing continues to rise.

Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) are the fastest growing user segment, reflecting the biopharmaceutical industry’s increasing reliance on outsourcing. These organizations prioritize flexible, fast-turnaround systems that can be adapted for multiple clients and product types. Bioprocess bags, with their plug-and-play compatibility and cost efficiency, are well-suited for outsourced research and manufacturing environments. As outsourcing of R&D, clinical production, and commercial batch processing expands, CMOs and CROs are driving demand for custom-designed, validated, and pre-sterilized bioprocess bag solutions.

North America leads the global bioprocess bags market, primarily driven by its robust biopharmaceutical ecosystem, advanced manufacturing infrastructure, and extensive investment in biologics research. The U.S. accounts for a significant portion of global biologic drug development, including monoclonal antibodies, vaccines, and cell therapies, which heavily rely on single-use technologies. Key players such as Thermo Fisher Scientific, Cytiva, and Pall Corporation have their production and R&D facilities located across the region, supporting both domestic and international supply chains.

Regulatory clarity from the U.S. FDA, combined with strong academic-industry collaboration, promotes the early adoption of innovative bioprocessing tools. Additionally, the presence of a large number of CDMOs and biomanufacturing startups fuels demand for flexible and scalable processing equipment, reinforcing North America’s dominance in the market.

Asia Pacific is the fastest growing region, spurred by increasing biologics manufacturing capacity, government investments in life sciences, and rapid adoption of single-use systems. Countries like China, India, South Korea, and Japan are expanding their biopharma footprint, establishing biotech hubs, and encouraging domestic production of advanced therapeutics. These developments have led to a surge in demand for bioprocess bags, particularly among contract manufacturers and research institutions.

Moreover, local suppliers and multinational players are investing in regional manufacturing facilities to cater to the growing demand, reduce import dependency, and comply with regulatory standards. With an expanding patient population, rising healthcare expenditures, and supportive biotech policies, Asia Pacific is poised to become a central growth engine for the global bioprocess bags market.

March 2025 – Sartorius Stedim Biotech unveiled a next-generation bioprocess bag line with embedded sensors for real-time monitoring of pH and dissolved oxygen in upstream processing applications.

January 2025 – Thermo Fisher Scientific expanded its single-use technology production facility in Massachusetts, increasing its capacity to manufacture 2D and 3D bioprocess bags for global distribution.

October 2024 – Cytiva launched a customizable, pre-sterilized 3D bioprocess bag designed specifically for viral vector production used in cell and gene therapy manufacturing.

July 2024 – Merck KGaA (MilliporeSigma) partnered with a biotech CDMO in South Korea to localize the supply of single-use bioprocess bags and reduce turnaround times for regional customers.

May 2024 – Pall Corporation introduced an eco-conscious bioprocess bag recycling program pilot in select facilities across North America and Europe.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the bioprocess bags market

By Type

By Workflow

By End user

By Regional