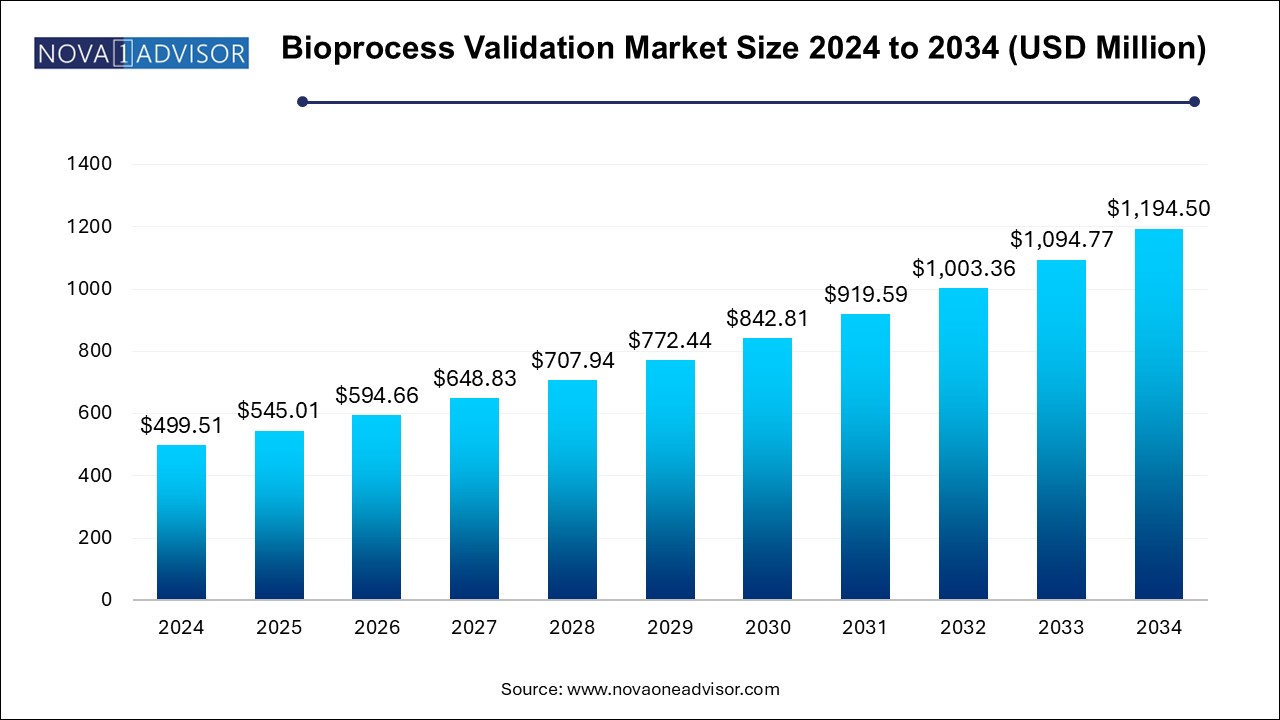

The bioprocess validation market size was exhibited at USD 499.51 million in 2024 and is projected to hit around USD 1194.5 million by 2034, growing at a CAGR of 9.11% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 545.01 Million |

| Market Size by 2034 | USD 1194.5 Million |

| Growth Rate From 2025 to 2034 | CAGR of 9.11% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Testing Type, Stage, Mode, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Eurofins Scientific, Inc.; Sartorius AG; Merck KGaA; Thermo Fisher Scientific Inc.; Lonza; Thermo Fisher Scientific Inc.; Danaher Corporation; Charles River Laboratories; SGS S.A.; Toxikon Corporation; Cobetter Filtration Equipment Co., Ltd. |

Bioprocess validation is the process of documenting all the procedures, activities, and evidence of the process of biological and biopharmaceutical product formation. The documentation is done as per the US FDA guidelines and cGMP regulations. It ensures the maintenance of compliance in all the stages of the product testing procedure. The assessment of APIs and impurities is a crucial part of bioprocess validation. The major principle of validation is to ensure that every process of the bioproduct processing is evaluated and quality products are delivered maintaining scientifically documented evidence. Quality, safety, and efficacy of bioproducts are maintained during the bioprocess validation. The market is propelled by stringent regulatory guidelines for the production of safe and quality vaccines and drug products. The increasing collaboration among the key market players for the product launch also boosts the market. Moreover, the rising expenditure on R&D also boosts the market growth.

The COVID-19 outbreak has adversely affected the world economy with the imposed lockdown, business shutdown, and travel restrictions. This has severely affected the manufacturing plants of various industries and factories negatively affected the product supply chain and sales. However, COVID-19 has had a positive impact on the global bioprocess validation industry. This is due to the growing demand for the production of vaccines and therapeutics for treating the novel SARS-CoV-2 virus. This led to the mergers, collaboration, and acquisitions between the key players of the industry for the development of safety and regulatory-approved products complying with the cGMP and FDA guidelines.

The increase in COVID-19 infections worldwide has led to the development of precision medicines and biosimilars that eventually increased the demands for the bioprocess validation process and outsourcing services. Market key players have also started implementing and enhancing the validation process for the bioprocess of biologics and drug developments. For instance, in November 2020, SGS invested in the Biosafety Centre of Excellence located at Glasglow for the expansion of its vaccine manufacturing, medicines, and R&D portfolio.

The bioprocess residuals testing segment dominated the market with a share of 28.65% in 2024. Residual testing includes impurities such as cell culture-derived upstream and downstream impurities, buffer contents, and anti-foam agents. There is a huge demand for impurity-free, safe, quality drug, vaccine, and therapeutics products manufactured by the biotechnology, biopharmaceutical, and pharmaceutical industries.

The extractables and leachables is the fastest growing segment. This is due to the presence of the current good manufacturing practice guidelines and US FDA regulations. Due to this, there is a demand for certified quality bioproducts. The biopharmaceutical and biotechnology companies are engaged in producing cGMP-certified bioproducts, which boosts the market. Moreover, in the drug discovery process, it is essential to identify the hazards caused by leachables obtained from the closed processing systems, and packaging which damages the bioproducts goods. This propels global industry growth.

The continued process verification segment dominated the market, with a share of 43.0% in 2024. It includes collecting the data collection, storage, processing, and analysis of every batch. Moreover, automation in this process boosts segment growth. For instance, in May 2021, Aventior implemented the digitization of the CPV process using the CPV-Auto solution, which complies with 21 CRF Part 11, which alters the traditional batch record process and image processing with automated digitization. This trend will continue to drive the growth of the segment in the forecast period.

The process design segment exhibits the fastest rate during the projected period. Process design is the most essential step of bioprocess validation. Stringent protocols with concepts and pathways for the manufacturing of the process are crucial aspects to run a process efficiently. Strict protocol and process design aim in delivering quality products, which is a driving factor to make the segment as fastest growing.

The in-house segment held the larger industry share in 2024. The majority of industries and biopharmaceuticals manufacture raw materials and tools for the bioprocess validation process for product manufacturing. The increasing funding, mergers, and collaboration among the market players for developing life science tools have a positive impact on the segment.

The outsourced segment is expected to grow at 10% CAGR in the forecast period. The biopharmaceutical and biotechnology companies producing bio-products and conducting bioprocess validation are in huge demand for testing services. Outsourcing services for biopharma drug and therapeutics manufacturing propels the market. Moreover, the increase in the expenditure for healthcare and the supply of raw materials required by the market key players also boosts industry growth.

In addition, the increase in the number of CDMOs providing drug development services and manufacturing services to the pharma and biopharma industries also boosts the market. The segment will acquire a significant share and dominate the market in the upcoming forecast.

North America dominated the regional market with a share of 39.0% in 2024. This is due to the presence of the major outsourcing services in this region. This leads to the rise in life science research and the increasing production of biologics, which drives the global market. Moreover, North America also has a large number of FDA-approved biopharmaceutical and biotechnology industries. Along with this increased government funding for the bioprocess validation process and the conduct of clinical trials boosts the market. North America also has the presence of the majority of the key players such as Thermo Fisher Scientific Inc., Danaher Corporation, Europhins among others propels the market. For instance, in June 2024, Jefferson Institute of Bioprocessing announced the launch of its bio technician training and bioprocess validation program in the U.S. at Budd Bioworks research space in Philadelphia.

In the upcoming years, the market in the Asia Pacific region will be the fastest-growing region for the bioprocess validation market in the upcoming forecast. This is due to the advancements, increased expenditure in healthcare, and funding for R&D set up by government agencies. In addition to this, there is a rise in awareness about the benefits and advantages of vaccines, and biopharmaceutical drugs to treat chronic diseases, which promotes the government initiatives for the growth and development of the biopharmaceutical industries in the Asia Pacific region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the bioprocess validation market

By Testing Type

By Stage

By Mode

By Regional

Chapter 1 Research Methodology

1.1 Market Segmentation & Scope

1.1.1 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.1.2 Approach 2: Country-Wise Market Estimation Using Bottom-Up Approach

1.7 Global Market: CAGR Calculation

1.8 Research Assumptions

1.9 List Of Secondary Sources

1.10 List Of Primary Sources

1.11 Objectives

1.11.1 Objective 1

1.11.2 Objective 2

1.12 List Of Abbreviations

Chapter 2 Market Definitions

Chapter 3 Executive Summary

3.1 Market Summary

Chapter 4 Global Bioprocess Validation Market Variables, Trends, & Scope

4.1 Bioprocess Validation Market Lineage Outlook

4.1.1 Parent Market Outlook

4.2 Penetration And Growth Prospect Mapping

4.3 Regulatory Framework

4.4 Market Driver Analysis

4.4.1 Increase In The Number Of Clinical Trials For Vaccine Development

4.4.2 Rise In R&D Expenditure

4.5 Market Restraint Analysis

4.5.1 Issues Related To Extractables & Leachables

4.5.2 High Cost Of The Advanced Technology

4.6 Porter’s Five Forces Analysis

4.7 Swot Analysis

4.8 Covid-19 Impact Analysis

Chapter 5 Bioprocess Validation Market - Segment Analysis, By Testing Type, 2021 - 2034 (USD Million)

5.1 Global Bioprocess Validation Market: Testing Type Movement Analysis

5.2 Extractable & Leachables Testing

5.2.1 Extractables & Leachables Testing Market Estimates And Forecast, 2021 - 2034 (USD Million)

5.3 Bioprocess Residuals Testing

5.3.1 Bioprocess Residuals Testing Market Estimates And Forecast, 2021 - 2034 (USD Million)

5.4 Viral Clearance Testing

5.4.1 Viral Clearance Testing Market Estimates And Forecast, 2021 - 2034 (USD Million)

5.5 Filtration & Fermentation Systems Testing

5.5.1 Filtration & Fermentation Systems Testing Market Estimates And Forecast, 2021 - 2034 (USD Million)

Chapter 6 Bioprocess Validation Market - Segment Analysis, By Stage, 2021 - 2034 (USD Million)

6.1 Global Bioprocess Validation Market: Stage Movement Analysis

6.2 Process Design

6.2.1 Process Design Market Estimates And Forecast, 2021 - 2034 (USD Million)

6.3 Process Qualification

6.3.1 Process Qualification Market Estimates And Forecast, 2021 - 2034 (USD Million)

6.4 Continued Process Verification

6.4.1 Continued Process Verification Market Estimates And Forecast, 2021 - 2034 (USD Million)

Chapter 7 Bioprocess Validation Market- Segment Analysis, By Mode, 2021 - 2034 (USD Million)

7.1 Bioprocess Validation Market: Mode Movement Analysis

7.2 In House

7.2.1 In-House Market Estimates And Forecast, 2021 - 2034 (USD Million)

7.3 Outsourced

7.3.1 Outsourced Market Estimates And Forecast, 2021 - 2034 (USD Million)

Chapter 8 Bioprocess Validation Market: - Segment Analysis, By Region, 2021 - 2034 (USD Million)

8.1 Bioprocess Validation Market: Regional Movement Analysis

8.2 North America

8.2.1 Swot Analysis

8.2.1.1 North America Bioprocess Validation Market, 2021 - 2034 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 Competitive Scenario

8.2.2.3 U.S. Bioprocess Validation Market, 2021 - 2034 (USD Million)

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Competitive Scenario

8.2.3.3 Canada Bioprocess Validation Market, 2021 - 2034 (USD Million)

8.3 Europe

8.3.1 Swot Analysis

8.3.1.1 Europe Bioprocess Validation Market Estimates And Forecast, 2021-2034, (USD Million)

8.3.2 Uk

8.3.2.1 Key Country Dynamics

8.3.2.2 Competitive Scenario

8.3.2.3 Germany Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.2 Competitive Scenario

8.3.3.3 France Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 Competitive Scenario

8.3.4.3 Uk Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Competitive Scenario

8.3.5.3 Italy Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Competitive Scenario

8.3.6.3 Spain Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.7 Denmark

8.3.7.1 Key Country Dynamics

8.3.7.2 Competitive Scenario

8.3.7.3 Denmark Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.8 Sweden

8.3.8.1 Key Country Dynamics

8.3.8.2 Competitive Scenario

8.3.8.3 Sweden Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.9 Norway

8.3.9.1 Key Country Dynamics

8.3.9.2 Competitive Scenario

8.3.9.3 Norway Bioprocess Validation Market, 2021-2034, (USD Million)

8.3.10 Rest Of Europe

8.3.10.1 Key Country Dynamics

8.3.10.2 Competitive Scenario

8.3.10.3 Rest Of Europe Bioprocess Validation Market Estimates And Forecast, 2021-2034 (USD Million)

8.4 Asia Pacific

8.4.1 Swot Analysis

8.4.1.1 Asia Pacific Bioprocess Validation, 2021-2034, (USD Million)

8.4.2 Japan

8.4.2.1 Key Country Dynamics

8.4.2.2 Competitive Scenario

8.4.2.3 Japan Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 Competitive Scenario

8.4.3.3 China Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.4 India

8.4.4.1 Key Country Dynamics

8.4.4.2 Competitive Scenario

8.4.4.3 India Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.5 Australia

8.4.5.1 Key Country Dynamics

8.4.5.2 Competitive Scenario

8.4.5.3 Australia Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.6 South Korea

8.4.6.1 Key Country Dynamics

8.4.6.2 Competitive Scenario

8.4.6.3 South Korea Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.7 Thailand

8.4.7.1 Key Country Dynamics

8.4.7.2 Competitive Scenario

8.4.7.3 Thailand Bioprocess Validation Market, 2021-2034, (USD Million)

8.4.8 Rest Of Asia Pacific

8.4.8.1 Key Country Dynamics

8.4.8.2 Competitive Scenario

8.4.8.3 Rest Of Asia Pacific Bioprocess Validation Market, 2021-2034 (USD Million)

8.5 Latin America

8.5.1 Swot Analysis

8.5.1.1 Latin America Bioprocess Validation Market, 2021-2034, (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Competitive Scenario

8.5.2.3 Brazil Bioprocess Validation Market, 2021-2034, (USD Million)

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Competitive Scenario

8.5.3.3 Mexico Bioprocess Validation Market, 2021-2034, (USD Million)

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Competitive Scenario

8.5.4.3 Argentina Bioprocess Validation Market, 2021-2034, (USD Million)

8.5.5 Rest Of Latin America

8.5.5.1 Key Country Dynamics

8.5.5.2 Competitive Scenario

8.5.5.3 Rest Of Latin America Bioprocess Validation Market, 2021-2034 (USD Million)

8.6 Middle East & Africa (Mea)

8.6.1 Swot Analysis

8.6.1.1 Mea Bioprocess Validation Market Estimates And Forecast, 2021-2034, (USD Million)

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.2 Competitive Scenario

8.6.2.3 South Africa Bioprocess Validation Market Estimates And Forecast, 2021-2034, (USD Million)

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Competitive Scenario

8.6.3.3 Saudi Arabia Bioprocess Validation Market Estimates And Forecast, 2021-2034 (USD Million)

8.6.4 Uae

8.6.4.1 Key Country Dynamics

8.6.4.2 Competitive Scenario

8.6.4.3 Uae Bioprocess Validation Market Estimates And Forecast, 2021-2034 (USD Million)

8.6.5 Kuwait

8.6.5.1 Key Country Dynamics

8.6.5.2 Competitive Scenario

8.6.5.3 Kuwait Bioprocess Validation Market Estimates And Forecast, 2021-2034 (USD Million)

8.6.6 Rest of MEA

8.6.6.1 Key Country Dynamics

8.6.6.2 Competitive Scenario

8.6.6.3 Rest Of Mea Bioprocess Validation Estimates And Forecast, 2021-2034 (USD Million)

Chapter 9 Competitive Landscape

9.1 Participant’s Overview

9.1.1 Eurofins Scientific, Inc.

9.1.2 Sartorius Ag

9.1.3 Thermo Fisher Scientific Inc.

9.1.4 Lonza

9.1.5 Danaher Corporation

9.1.6 Charles River Laboratories

9.1.7 Sgs S.A.

9.1.8 Toxicon Corporation

9.1.9 Epigenomics Ag

9.1.10 Cobetter Filtration Equipment Co., Ltd.

9.2 Financial Performance

9.3 Participant Categorization

9.3.1 Market Leaders

9.3.1.1 Bioprocess Validation Market Share Analysis, 2022

9.3.2 Strategy Mapping

9.3.2.1 Expansion

9.3.2.2 Acquisition

9.3.2.3 Collaborations

9.3.2.4 Stage/Service Launch

9.3.2.5 Partnerships

9.3.2.6 Others