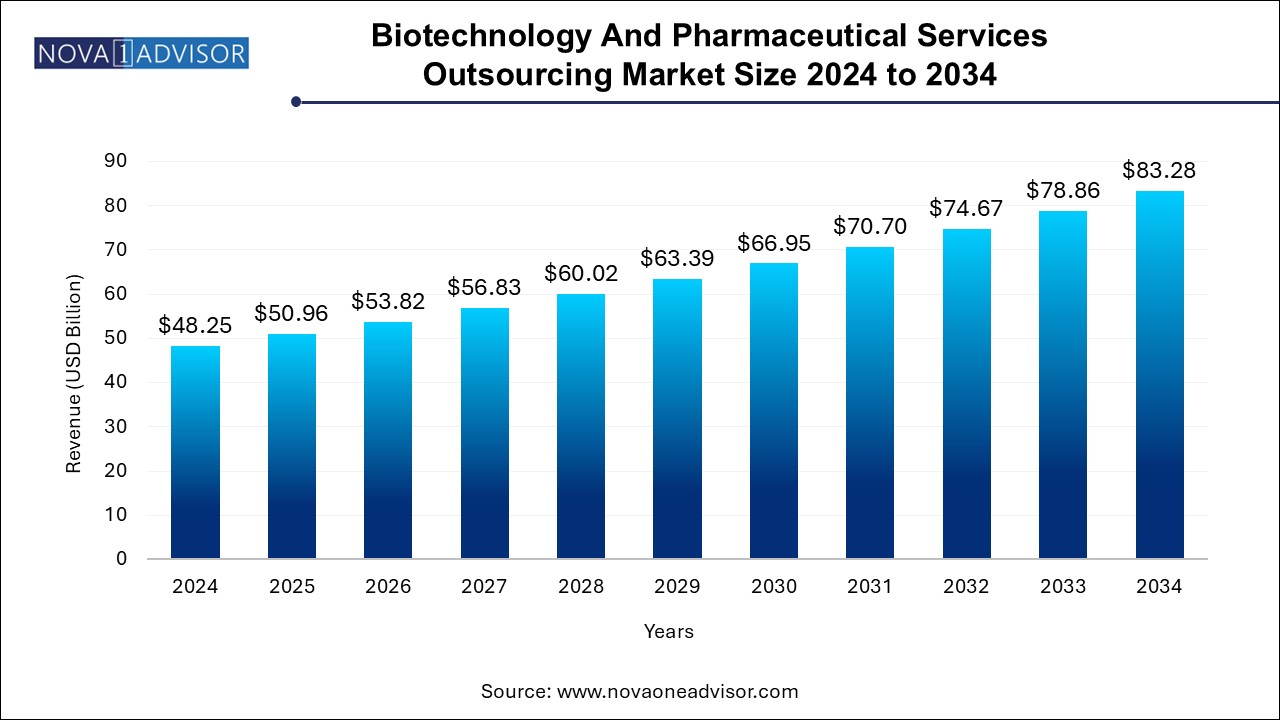

The biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 48.25 billion in 2024 and is projected to hit around USD 83.28 billion by 2034, growing at a CAGR of 5.61% during the forecast period 2024 to 2034.

The biotechnology and pharmaceutical services outsourcing market has emerged as a cornerstone of modern drug development, driven by escalating R&D expenditures, increasing complexity in drug pipelines, and rising regulatory pressures. As biotechnology and pharmaceutical companies focus on improving time-to-market and reducing operational costs, outsourcing service providers are playing an increasingly strategic role. These outsourcing companies offer a broad spectrum of services including regulatory affairs, product design and development, consulting, auditing, and training.

In recent years, both small and large-scale biopharmaceutical firms have leaned toward outsourcing to access specialized expertise, advanced technologies, and global market knowledge. This has created a competitive, yet collaborative ecosystem where Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and specialized consultancies thrive by offering scalable and flexible services.

Furthermore, the adoption of digital transformation in drug discovery and clinical trials has prompted outsourcing partners to invest in AI, big data analytics, cloud-based platforms, and decentralized clinical trials. These tech-enabled solutions allow for improved efficiency, better data transparency, and real-time collaboration across geographies. Outsourcing is no longer a cost-saving measure—it is now a vital strategy for managing innovation, compliance, and business agility.

Increased strategic collaborations and partnerships: Major pharmaceutical players are forming alliances with outsourcing firms to co-develop therapeutic solutions, particularly in oncology and rare diseases.

Surge in demand for regulatory consulting services: As global regulatory frameworks become more intricate, pharmaceutical firms are outsourcing regulatory submissions and operations to ensure timely compliance.

Growth in decentralized clinical trials (DCTs): Enabled by digital technologies and remote monitoring tools, DCTs are reshaping clinical development strategies.

Adoption of AI and big data analytics: AI-powered tools for clinical data management, drug repurposing, and trial optimization are becoming mainstream within outsourcing arrangements.

Expansion of services beyond traditional roles: CROs and CDMOs are expanding to include training, commercialization support, and end-to-end consulting services.

Rising preference for niche CROs: Biotech companies, especially startups, prefer smaller, specialized CROs for personalized attention and agility.

Regulatory harmonization in emerging markets: Asia-Pacific countries are aligning their regulatory practices with ICH-GCP and FDA/EMA norms, attracting outsourcing contracts.

Focus on quality and risk-based approaches: Service providers are implementing quality risk management systems to comply with evolving global quality standards.

| Report Coverage | Details |

| Market Size in 2025 | USD 50.96 Billion |

| Market Size by 2034 | USD 83.28 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.61% |

| Base Year | 2024 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; Concept Heidelberg GmbH; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics |

A primary force propelling the biotechnology and pharmaceutical services outsourcing market is the rising cost and complexity of R&D activities. With drug discovery becoming increasingly sophisticated—owing to the advent of genomics, precision medicine, and biologics—organizations are facing mounting pressure to deliver innovative products faster and more cost-effectively.

In-house infrastructure development for such high-end R&D is both capital-intensive and time-consuming. As a result, firms are outsourcing various phases of drug development, from early-stage molecule screening to post-marketing surveillance, to achieve scalability and access cross-disciplinary expertise.

For instance, Pfizer’s strategic collaboration with CRO ICON plc for global drug development operations has been a benchmark for cost-effective outsourcing. Through this approach, companies can focus on their core competencies while leveraging third-party providers for specialized functions, thus improving productivity and accelerating product timelines.

Despite its growth trajectory, the market is restrained by concerns surrounding data privacy, intellectual property protection, and regulatory compliance across borders. Biotechnology and pharmaceutical companies handle highly sensitive information, including clinical trial data, proprietary drug formulas, and genetic research.

Outsourcing services, especially those spanning multiple geographies, raise concerns about safeguarding IP rights and adhering to data protection regulations such as GDPR in Europe or HIPAA in the United States. Any breach or misuse can lead to reputational damage, legal liabilities, and financial losses.

For example, in 2021, a major breach involving a CRO exposed sensitive clinical trial data of several clients, triggering widespread industry concern and prompting regulatory reviews. These issues necessitate stringent service-level agreements (SLAs), cybersecurity protocols, and compliance audits, which can increase the cost and complexity of outsourcing contracts.

Emerging markets, particularly in Asia-Pacific and Latin America, represent a significant opportunity for growth in biotechnology and pharmaceutical services outsourcing. With favorable regulatory reforms, increasing government investments in healthcare R&D, and a skilled labor pool, these regions are becoming preferred outsourcing hubs.

Countries such as India, China, Singapore, and South Korea are not only offering cost-effective services but are also rapidly advancing in terms of technical capabilities and regulatory sophistication. Government initiatives like “Make in India” and China's “Made in China 2025” are incentivizing local production, research infrastructure, and foreign collaborations.

For example, Wuxi AppTec in China and Syngene International in India have become global names in CRO/CDMO services, drawing contracts from top-tier pharmaceutical companies worldwide. These markets present a dual advantage: access to untapped patient populations for trials and substantial cost savings, thus attracting long-term strategic investments.

The consulting services segment dominated the market with the largest revenue share of over 24% in 2024. driven by the increasing need for strategic insights during early-stage planning and development. Pharmaceutical and biotech firms seek specialized consulting services to navigate market entry strategies, product lifecycle management, and regulatory pathways. Within this category, Regulatory Consulting and Strategic Planning & Business Development Consulting emerged as high-demand sub-segments. For example, strategic partnerships between consulting firms and midsize biopharma players have facilitated smoother FDA approvals and faster commercialization timelines. These services allow companies to mitigate regulatory risks while aligning development efforts with commercial potential.

The regulatory affairs segment is expected to witness the highest CAGR of 8.37% over the forecast period. owing to the rising adoption of advanced simulation tools, rapid prototyping, and integrated process development frameworks. Companies are increasingly outsourcing design verification, process validation, and manufacturing transfer to ensure smooth transition from concept to commercialization. This segment benefits from innovations such as digital twins, AI-based modeling, and automated testing platforms. The evolution of complex biologics and personalized therapies has further accentuated the demand for design expertise, particularly in areas like cell and gene therapies, wearable drug delivery systems, and companion diagnostics.

The pharmaceutical companies segment dominated the market with the largest revenue share 60.0% in 2024. accounting for the largest share due to their substantial outsourcing needs across regulatory affairs, auditing, and product lifecycle management. The pressure to maintain competitive pipelines while complying with stringent global regulations has pushed even the largest pharma firms to establish long-term outsourcing contracts. For example, Novartis and Roche have embraced strategic outsourcing to access decentralized clinical trial technologies and pharmacovigilance systems. These companies often require a mix of global and local expertise, which outsourcing providers are well-positioned to deliver through hybrid delivery models.

The biotechnology companies segment is expected to witness the fastest CAGR over the forecast period. fueled by the surge of startups and venture capital investments in precision medicine, immunotherapy, and genetic engineering. These companies usually lack in-house capabilities for complex regulatory and clinical processes, prompting them to rely heavily on outsourcing partners. The lean structure of biotech firms allows for faster decision-making and stronger collaboration with specialized CROs or CDMOs. For instance, emerging biotechs in North America and Europe are outsourcing end-to-end product development—from molecule screening to commercialization support—to gain market entry and investor confidence quickly.

The biotechnology and pharmaceutical services outsourcing market of North America held a significant market share in 2024. owing to its well-established biopharmaceutical industry, robust regulatory frameworks, and high adoption of outsourced services. The U.S., in particular, is home to major pharmaceutical companies and CROs such as IQVIA, Parexel, and Charles River Laboratories, which have extensive experience in managing global trials, regulatory submissions, and product development. Additionally, the region's focus on innovation and digital transformation has encouraged investment in AI-driven clinical research, cloud-based data sharing, and remote patient monitoring. Strategic outsourcing contracts, often valued in hundreds of millions, are increasingly common in this region.

Asia Pacific is the fastest-growing region, propelled by its expanding biotech ecosystem, cost-efficient services, and favorable regulatory reforms. Countries like China and India are at the forefront, with rapidly growing CRO/CDMO industries, strong government backing, and an increasing volume of clinical trials. For instance, in March 2024, India launched a regulatory reform initiative to align its clinical trial process with international standards, significantly boosting foreign investments. Moreover, companies like Wuxi AppTec (China) and Syngene (India) are expanding their service offerings to cater to global demand, making Asia Pacific a hotspot for end-to-end outsourcing solutions.

January 2025: Thermo Fisher Scientific announced the acquisition of a clinical research unit from a leading European pharmaceutical firm to expand its capabilities in end-to-end drug development services.

March 2024: Parexel entered into a strategic partnership with a Japan-based pharmaceutical company to offer regulatory consulting and clinical development support for oncology drugs.

October 2023: Syneos Health launched a new decentralized clinical trial platform in partnership with Microsoft Azure to enhance remote trial execution and data security.

July 2023: ICON plc signed a multi-year agreement with Pfizer to manage global clinical trials and regulatory submissions for its rare disease portfolio.

May 2023: Charles River Laboratories opened a new facility in Shanghai to strengthen its presence in the Asia Pacific region and cater to local biotech firms.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biotechnology and pharmaceutical services outsourcing market

Service

End-use

Regional