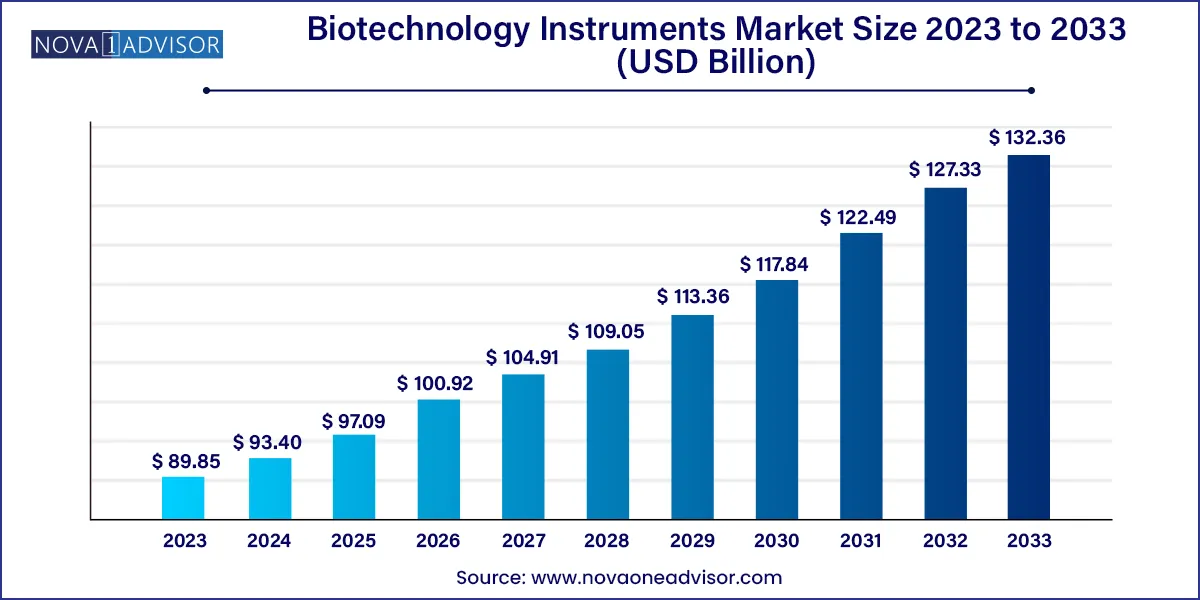

The global biotechnology Instruments market size was valued at USD 89.85 billion in 2023 and is projected to surpass around USD 132.36 billion by 2033, registering a CAGR of 3.95% over the forecast period of 2024 to 2033.

The growing adoption of precision medicine, growing knowledge of molecular biologics & genomics, and rising demand for spectroscopy techniques for drug development are a few of the factors that are anticipated to fuel the growth of the market. In addition, the increasing prevalence of chronic conditions, including diseases like COVID-19, cardiovascular disorders, diabetes, cancer, and others, is anticipated to drive the market growth. The pandemic impacted the market significantly due to the rise in demand for vaccine development and diagnostics, causing disruptions in supply chains & laboratory access, accelerating the adoption of automation and data analysis techniques.

Researchers and scientists from various laboratories are using nanopore sequencing, which is anticipated to facilitate the rapid allocation of sequence data from COVID-19. Researchers have been sharing sequenced genomes on public databases, including GenBank and GISAID, to analyze public health responses. Due to the high number of cases, laboratories have built the capacity to sequence genomes from a large number of samples. Owing to these efforts, sequencing data of a wide range of samples are available in public databases. In April 2023, scientists and researchers developed a mobile printer that is used for producing thumbnail-sized patches, which delivers mRNA COVID-19 vaccines.

This device aims to utilize the tabletop device to immunize individuals in remote areas. Due to the growing number of COVID-19 cases, companies offered their expertise in nucleic acid purification, collaborative technical assistance, amplification solutions, and labeling technologies. These technologies are anticipated to simplify the workflow and accelerate the work of researchers engaged in the development of vaccines during pandemics, such as COVID-19. For instance, in April 2023, Mawi DNA Technologies, a biotech company, was granted by the FDA for the clearance of the iSWAB-RC-EL collection device. These devices are used for stabilizing and deactivating human upper respiratory and saliva samples potentially containing SARS-CoV-2.

In January 2023, Qiagen announced the launch of the EZ2 Connect MDx IVD platform to offer automated sampling for diagnostic labs. The device allows labs to simultaneously purify RNA and DNA from up to 24 samples within 30 minutes. Thus, the launch of various technologies is anticipated to impel the growth of the market over the forecast period. Moreover, in June 2023, Waters and Sartorius, manufacturers of instruments and software, collaborated to provide integrated process analytics for chromatography columns. This partnership was built upon their existing alliance, which now extends from upstream to encompass downstream analytics.

In August 2023, Thermo Fisher Scientific introduced a new chromosomal microarray aimed at enhancing productivity, efficiency, and profitability in cytogenetic research labs. The array sets a new standard with a two-day turnaround time. Catering to prenatal, postnatal, and oncology research, the Applied Biosystems CytoScan HD Accel array comprehensively examines the entire human genome and offers enhanced coverage across over 5,000 vital genome regions, delivering insights into chromosomal variations. Thus, such collaboration and partnership activities are anticipated to propel the growth of the global market over the forecast period.

| Report Attribute | Details |

| Market Size in 2024 | USD 93.40 Billion |

| Market Size by 2033 | USD 132.36 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.95% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Waters Corp.; Shimadzu Corp.; Danaher; Agilent Technologies, Inc.; Bruker Corp.; PerkinElmer, Inc.; Mettler Toledo; Zeiss Group; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Eppendorf SE; F. Hoffmann-La Roche AG; Sartorius AG; Avantor, Inc. |

On the basis of product, the analytical instruments segment accounted for the largest market share of 64.92% in 2023. These instruments, encompassing technologies, such as mass spectrometry, chromatography, and spectroscopy, play a crucial role in enabling precise analysis and characterization of biological samples, supporting applications ranging from drug discovery to genetic research. Their widespread utilization underscores their significance in driving advancements within the biotechnology industry, contributing significantly to research, development, and innovation. In March 2023, Illumina Inc., a U.S.-based global DNA sequencing and array-based technologies collaborated with the French company, GenoScreen, to introduce a package that integrates Illumina products with the GenoScreen Deeplex Myc-TB assay.

This assay utilizes targeted next-generation sequencing (NGS) to swiftly and comprehensively identify drug resistance in cases of tuberculosis. Thus, such collaborative initiatives are anticipated to boost the growth of the segment over the forecast period. The cell culture instruments segment is expected to grow at the fastest CAGR of 9.98% from 2023 to 2030. These instruments including bioreactors, incubators, and culture media, are facilitating the growth and manipulation of cells for various applications, including drug development, tissue engineering, and regenerative medicine.

The increasing demand for personalized medicine and the growing significance of cell-based therapies are driving the expansion of this sector, making cell culture instruments a key driver of innovation and progress in the biotechnology industry. In May 2023, HiMedia Laboratories, a Mumbai-based firm, and Advanced Instruments, a U.S.-based firm, collaborated to introduce their newest advancement in microbiology research: the Anoxomat III Anaerobic Culture System. Thus, such strategic initiatives are expected to propel the growth of cell culture instruments from 2024 to 2033.

On the basis of end-use, the pharmaceutical & biotechnology companies segment dominated the market with a revenue share of 41.10% in 2023. These industries heavily rely on a diverse range of instruments, such as gene sequencers, protein analyzers, and high-throughput screening systems, to drive drug discovery, development, and production processes. The relentless pursuit of novel therapies, precision medicine, and advanced research methods continues to fuel the demand for cutting-edge biotechnology instruments, solidifying their pivotal role in shaping the trajectory of scientific and medical advancements.

The academic & research institutions segment is expected to grow at the fastest CAGR of 5.08% from 2024 to 2033. Various academic & research institutions and laboratories are increasingly adopting a wide array of biotechnology instruments, such as DNA synthesizers, flow cytometers, and microarray systems. This growth is driven by a surge in interdisciplinary research, collaborations, and the pursuit of breakthrough discoveries across fields like genomics, proteomics, and synthetic biology. The research activities are expected to emphasize innovation, and the generation of fundamental knowledge positions academic & research institutions as key contributors to the dynamic evolution of biotechnology instrument technologies. Thus, this is anticipated to speed up drug research & development, as well as bring significant advancements to the field.

North America held the largest share of 49.95% of the global market in 2023 due to the high demand and affordability of biotechnology instruments. Growth in R&D efforts and growing public-private investments in research also strengthen demand, contributing to market growth. For instance, in August 2023, the U.S. Department of Health and Human Services through the Administration for Strategic Preparedness and Response was funded with over USD 1.4 billion for Project NextGen. This initiative aims to foster the creation of advanced tools and technologies that would provide long-term protection against COVID-19.

Thus, continuous advancements and growing government investments in biotechnology instruments, coupled with the affordable adoption of innovative systems solidify the U.S. as the world's most lucrative market. The regional market in Asia Pacific is anticipated to register the fastest growth rate of 5.37% from 2024 to 2033. This trend is mainly due to the rapid growth of the biotechnology sectors in emerging economies like China and India. Robust government backing for biotechnology in these nations also fuels market expansion. Continuous R&D investments further boost demand for biotechnology instruments.

For instance, in March 2023, the Australian government announced an investment of USD 400 million, which would support medical research projects, including projects to improve First Nation Health. In August 2023, the Indian government announced a new Anusandhan National Research Foundation (ANRF), which would empower the nation's scientists to play a pivotal role in tackling worldwide challenges. The government plans to allocate a budget of ₹500 billion (USD 6.05 billion) to the ANRF for the period spanning 2023 to 2028. Hence, increasing research spending and growing government investments are anticipated to propel the market growth in the Asia Pacific region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biotechnology Instruments market.

By Product

By End-use

By Region