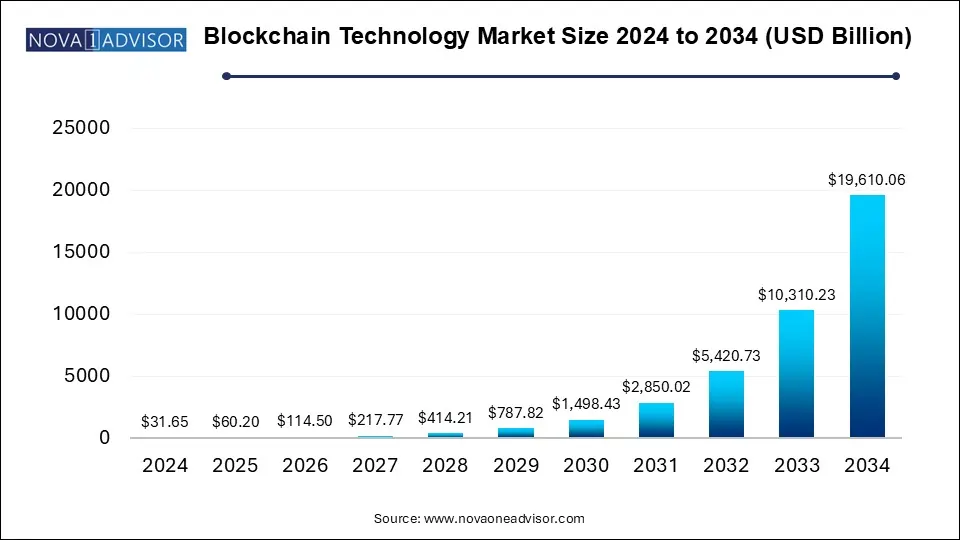

The blockchain technology market size was exhibited at USD 31.65 billion in 2024 and is projected to hit around USD 19610.06 billion by 2034, growing at a CAGR of 90.2% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 60.2 Billion |

| Market Size by 2034 | USD 19610.06 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 90.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Component, Offering, Application, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | IBM Corporation; Microsoft Corporation; The Linux Foundation; Blockchain Tech LTD; Chain; Circle Internet Financial, LLC; Deloitte Touche Tohmatsu Limited; Digital Asset Holdings, LLC; Global Arena Holding, Inc. (GAHC); Monax Labs; Ripple |

The escalating demand for secure and transparent transactions across many industries is driving the market growth. Blockchain's decentralized and immutable ledger system ensures the integrity and transparency of transactions, making it especially appealing to sectors such as finance, healthcare, and supply chain management. Businesses across these domains are increasingly integrating blockchain solutions to enhance security and transparency in their operations.

The adoption of blockchain technology for optimizing supply chain processes is witnessing a surge. The ability to trace and verify the origin and journey of products in real time curbs fraud and significantly improves traceability and overall supply chain efficiency. Consequently, an increasing number of enterprises are leveraging blockchain's potential to transform their supply chain management, driving the technology's growth. Moreover, the surging interest in cryptocurrencies and digital assets is another driver responsible for the growth.

Since blockchain serves as the underlying technology for most cryptocurrencies, the rising popularity of digital currencies like Bitcoin and Ethereum has inevitably directed considerable attention to the technology itself. Many organizations are now exploring how blockchain can be used to create and manage digital assets, including Central Bank Digital Currencies (CBDCs), further propelling the market's expansion. Furthermore, the escalating need for secure and efficient cross-border payments and remittances propels blockchain's adoption. Traditional international payment systems often involve multiple intermediaries, resulting in delays and exorbitant costs. In stark contrast, blockchain-based solutions offer faster, cost-effective, and transparent cross-border transactions, driving their adoption in the finance and remittance sectors.

Governments and regulatory bodies worldwide also recognize blockchain technology's transformative potential. They are actively introducing supportive policies and regulations that encourage its widespread adoption. This regulatory clarity not only attracts substantial investments but also fosters the development of innovative blockchain solutions across industries. In addition, the increasing engagement of major corporations and tech giants significantly influences the blockchain landscape.

One of the prominent restraints challenging the blockchain technology industry is the issue of scalability. As the adoption of blockchain technology grows across various industries, particularly in financial services and supply chain management, the networks are experiencing increased congestion, slower transaction speeds, and higher fees. This scalability challenge can hinder widespread adoption, especially when blockchain is expected to handle large volumes of transactions. To overcome this restraint, developers, and innovators in the blockchain space are actively working on scaling solutions. Layer 2 solutions, such as Ethereum 2.0, aim to improve scalability by processing transactions off the main blockchain, thus alleviating congestion and reducing fees.

The public cloud segment dominated the market in 2024 and accounted for a 62.0% share of the global revenue. Public cloud providers offer a scalable and cost-effective infrastructure for deploying blockchain solutions. This scalability is vital as blockchain networks grow and require additional resources to support increasing transaction volumes. Moreover, public cloud providers have invested significantly in security and compliance measures, which are crucial in blockchain applications, particularly in sectors like finance and healthcare, where data integrity is paramount.

The private cloud segment is anticipated to witness significant growth over the forecast period. Private cloud services include the provision of dedicated infrastructure and resources exclusively for organizations. The private cloud enables companies to reverse transactions at cost-effective transaction rates. This is driving the growth of the segment. Furthermore, the rise in the adoption of private cloud by large enterprises and small & medium enterprises is one of the major factors driving the segment growth.

The infrastructure & protocols segment dominated the market in 2024. The increasing demand for blockchain standards and protocols such as Ethereum, Openchain, and Hyperledger is driving the segment growth. The users demand protocols as they enable them to share information reliably and securely across cryptocurrency networks. Thus, the benefits offered by infrastructure and protocols are contributing to the segment's growth.

The middleware segment is expected to witness significant growth over the forecast period. Middleware helps developers build applications more efficiently. A middleware tool is mainly used in the healthcare sector to automate the authentication of clinical data. Growing investments in the healthcare sector are expected to drive the segment growth. Middleware tools track the laboratory performance metrics, which is also one of the factors driving the growth of the segment.

The platform segment dominated the market in 2024. The growth of the platform segment is driven by increasing demand for customizable and scalable blockchain infrastructure solutions across industries. Enterprises are leveraging these platforms to enhance operational efficiency, ensure data security, and streamline processes, especially in sectors like finance, supply chain, and healthcare.

The services segment is expected to witness significant growth over the forecast period. The segment's growth is driven by the increasing need for consulting, integration, and support services as businesses adopt blockchain solutions. Companies seek expert guidance to navigate blockchain implementation, ensure seamless integration with existing systems, and maintain ongoing operations. In addition, the rising demand for managed services is accelerating growth as organizations look to outsource blockchain management to focus on core business activities.

The payments segment dominated the market in 2024. Blockchain technology improves payment system efficiency, minimizes operating costs, and offers transparency. These benefits provided by blockchain technology are increasing its use in payment solutions, thus driving the segment growth. Furthermore, blockchain reduces the need for a middleman in payment processing, which is also a major factor driving the segment growth.

The digital identity segment is anticipated to grow at the fastest CAGR over the forecast period. The segment is experiencing rapid growth due to its potential to address critical challenges in the digital age. As our lives become increasingly digitized, the need for secure and portable digital identities has become paramount. Blockchain technology offers a unique solution by providing a decentralized and tamper-proof ledger to verify and manage digital identities. This innovation has garnered significant interest, especially in sectors like finance, healthcare, and government, where identity verification is crucial.

The large enterprises segment dominated the market in 2024. Large enterprises operating in sectors such as insurance, financial services, healthcare, and supply chain are increasingly making efforts to digitalize their offerings, which is creating a demand for blockchain technology among them. Large enterprises such as BBVA, Intesa Sanpaolo, Barclays, and HSBC are using blockchain technology to streamline their KYC and fund processes. They have access to adequate capital and different assets to adopt new technologies introduced in the market.

The small & medium enterprise segment is anticipated to grow at the fastest CAGR over the forecast period. Small & medium enterprises face difficulties in scaling their tasks, such as financing, processing payments, and selecting ancillary services essential for global expansion. Blockchain technology helps them reduce issues in the areas of subsidizing and exchanging accounts. Furthermore, secure and safe information exchanges and smart contracts offered by blockchain technology help small & medium enterprises streamline supply chains. Furthermore, blockchain-based storage applications enable small businesses to store data safely and cost-effectively, which is driving the demand for blockchain among small businesses.

The financial services segment dominated the market in 2024. Blockchain technology in BFSI is leveraged for managing financial transactions taking place in businesses. Blockchain technology provides secure and efficient transactions, and this is driving the demand for the technology in financial services. The technology is expected to be widely adopted in this vertical owing to factors such as rising cryptocurrencies, high compatibility with the industry ecosystem, rapid transactions, Initial Coin Offerings (ICOs), and reduced total cost of ownership.

The healthcare segment is anticipated to grow at the fastest CAGR over the forecast period. The growing number of regulations for protecting consumer data is increasing the adoption of blockchain technology in the healthcare market. Governments across the globe are implementing stringent regulations to protect consumer information owing to the growing incidents of data theft and breaches. For instance, the European Union data protection law, the General Data Protection Regulation (GDPR), became effective in May 2018. GDPR aims to safeguard EU citizens from privacy and data breaches. Such regulations are impelling companies across the globe to make investments in enhancing data security. Furthermore, the COVID-19 pandemic has increased the demand for digitalization across the healthcare sector, which thereby created the need for blockchain technology across the sector.

North America blockchain technology market dominated globally in 2024 and accounted for 37.4% share of the global revenue. The region boasts a robust ecosystem of tech startups, established corporations, and leading research institutions, creating a fertile ground for blockchain development. Silicon Valley, in particular, has been a hotspot for blockchain startups and venture capital investments. Moreover, North America is home to a diverse range of industries, from finance and healthcare to supply chain management and energy, all of which recognize the transformative potential of blockchain technology.

U.S. Blockchain Technology Market Trends

The blockchain technology market in U.S. is expected to grow at a significant CAGR from 2025 to 2034. It is driven by the country's advanced regulatory advancements and increasing government interest in leveraging blockchain for secure digital identity and supply chain traceability. In addition, the U.S. benefits from a highly mature tech ecosystem, with substantial venture capital investments and collaborations between blockchain startups and established financial institutions, fostering innovation and adoption at scale.

Asia Pacific Blockchain Technology Market Trends

APAC blockchain technology market is expected to grow at the fastest CAGR over the forecast period. The governments of countries such as China, Japan, and India are promoting the use of blockchain technology in recent days. They are promoting the use of blockchain owing to benefits such as high transparency and increased efficiency provided to multiple industries. In 2019, the South Korean government announced an investment of USD 880 million in blockchain development projects.

The blockchain technology market in Japan is driven by its tech-savvy population and leading position in digital innovation, which also fosters rapid adoption of blockchain in areas like gaming, digital assets, and intellectual property management. Moreover, collaborations between Japanese corporations and global blockchain firms further accelerate market growth.

The China blockchain technology market growth is fueled by strong government support, including its inclusion of blockchain as a key pillar in the national digital economy strategy and the development of the Blockchain-based Service Network (BSN) to promote widespread adoption. China's focus on blockchain for improving trade finance, cross-border payments, and supply chain transparency aligns with its goals for global trade leadership under initiatives like the Belt and Road Initiative.

Europe Blockchain Technology Market Trends

The blockchain technology market in Europe is expected to grow at a significant CAGR from 2025 to 2034. It is driven by the European Union's comprehensive regulatory framework, such as the Markets in Crypto-Assets (MiCA) regulation, which fosters transparency and trust in blockchain applications. Europe's commitment to sustainability has also encouraged the adoption of blockchain for energy trading and carbon credit tracking. In addition, cross-border collaboration between EU member states supports the development of blockchain-based solutions in trade, logistics, and public services, strengthening regional innovation.

The blockchain technology market in the UK is driven by its position as a global financial hub, with strong adoption of blockchain in fintech for applications like digital asset trading and decentralized finance (DeFi). The UK government's focus on fostering innovation, including regulatory sandboxes for blockchain startups, further accelerates development.

The Germany blockchain technology market held a substantial market share in 2024. The market's growth in Germany is driven by its industrial leadership, particularly the adoption of blockchain in manufacturing and Industry 4.0 applications to enhance supply chain transparency and automate processes. Germany's commitment to renewable energy has also spurred blockchain integration for energy trading and decentralized energy management systems.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the blockchain technology market

By Type

By Component

By Offering

By Application

By Enterprise Size

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.2.1. Information Procurement

1.3. Information or Data Analysis

1.4. Methodology

1.5. Research Scope and Assumptions

1.6. Market Formulation & Validation

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Blockchain Technology Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.2.3. Industry Challenge

3.3. Blockchain Technology Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of the suppliers

3.3.1.2. Bargaining power of the buyers

3.3.1.3. Threats of substitution

3.3.1.4. Threats from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and social landscape

3.3.2.3. Technological landscape

3.4. Pain Point Analysis

Chapter 4. Blockchain Technology: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Blockchain Technology: Type Movement Analysis, 2024 & 2030 (USD Million)

4.3. Public Cloud

4.3.1. Public Cloud Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Private Cloud

4.4.1. Private Cloud Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Hybrid Cloud

4.5.1. Hybrid Cloud Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Blockchain Technology: Component Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Blockchain Technology: Component Movement Analysis, 2024 & 2030 (USD Million)

5.3. Application & Solution

5.3.1. Application & Solution Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Infrastructure & Protocols

5.4.1. Infrastructure & Protocols Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Middleware

5.5.1. Middleware Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Blockchain Technology: Offering Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Blockchain Technology: Offering Movement Analysis, 2024 & 2030 (USD Million)

6.3. Platform

6.3.1. Platform Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Services

6.4.1. Services Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Blockchain Technology: Application Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Blockchain Technology: Application Movement Analysis, 2024 & 2030 (USD Million)

7.3. Digital Identity

7.3.1. Digital Identity Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Exchanges

7.4.1. Exchanges Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Payments

7.5.1. Payments Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Smart Contracts

7.6.1. Smart Contracts Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Supply Chain Management

7.7.1. Supply Chain Management Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.8. Others

7.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Blockchain Technology: Enterprise Size Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Blockchain Technology: Enterprise Size Movement Analysis, 2024 & 2030 (USD Million)

8.3. Large Enterprises

8.3.1. Large Enterprises Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Small & Medium Enterprises

8.4.1. Small & Medium Enterprises Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Blockchain Technology: End Use Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. Blockchain Technology: End Use Movement Analysis, 2024 & 2030 (USD Million)

9.3. Banking & Financial Services

9.3.1. Banking & Financial Services Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.4. Government

9.4.1. Government Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.5. Healthcare

9.5.1. Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.6. Media & Entertainment

9.6.1. Media & Entertainment Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.7. Retail & eCommerce

9.7.1. Retail & eCommerce Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.8. Transportation & Logistics

9.8.1. Transportation & Logistics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.9. Travel

9.9.1. Travel Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.10. Manufacturing

9.10.1. Manufacturing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.11. IT & Telecom

9.11.1. IT & Telecom Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.12. Real Estate & Construction

9.12.1. Real Estate & Construction Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.13. Energy & Utilities

9.13.1. Energy & Utilities Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

9.14. Others

9.14.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 10. Blockchain Technology: Regional Estimates & Trend Analysis

10.1. Blockchain Technology Share, By Region, 2024 & 2030 (USD Million)

10.2. North America

10.2.1. North America Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.2.2. U.S.

10.2.2.1. U.S. Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.2.3. Canada

10.2.3.1. Canada Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.2.4. Mexico

10.2.4.1. Mexico Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.3. Europe

10.3.1. Europe Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.3.2. UK

10.3.2.1. UK Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.3.3. Germany

10.3.3.1. Germany Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.3.4. France

10.3.4.1. France Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4. Asia Pacific

10.4.1. Asia Pacific Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4.2. China

10.4.2.1. China Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4.3. Japan

10.4.3.1. Japan Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4.4. India

10.4.4.1. India Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4.5. South Korea

10.4.5.1. South Korea Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.4.6. Australia

10.4.6.1. Australia Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.5. Latin America

10.5.1. Latin America Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.5.2. Brazil

10.5.2.1. Brazil Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.6. Middle East and Africa

10.6.1. Middle East and Africa Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.6.2. UAE

10.6.2.1. UAE Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.6.3. KSA

10.6.3.1. KSA Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

10.6.4. South Africa

10.6.4.1. South Africa Blockchain Technology Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 11. Competitive Landscape

11.1. Company Categorization

11.2. Company Market Positioning

11.3. Company Heat Map Analysis

11.4. Company Profiles/Listing

11.4.1. IBM Corporation

11.4.1.1. Participant’s Overview

11.4.1.2. Financial Performance

11.4.1.3. Product Benchmarking

11.4.1.4. Strategic Initiatives

11.4.2. Microsoft Corporation

11.4.2.1. Participant’s Overview

11.4.2.2. Financial Performance

11.4.2.3. Product Benchmarking

11.4.2.4. Strategic Initiatives

11.4.3. The Linux Foundation

11.4.3.1. Participant’s Overview

11.4.3.2. Financial Performance

11.4.3.3. Product Benchmarking

11.4.3.4. Strategic Initiatives

11.4.4. Blockchain Tech LTD

11.4.4.1. Participant’s Overview

11.4.4.2. Financial Performance

11.4.4.3. Product Benchmarking

11.4.4.4. Strategic Initiatives

11.4.5. Chain

11.4.5.1. Participant’s Overview

11.4.5.2. Financial Performance

11.4.5.3. Product Benchmarking

11.4.5.4. Strategic Initiatives

11.4.6. Circle Internet Financial, LLC

11.4.6.1. Participant’s Overview

11.4.6.2. Financial Performance

11.4.6.3. Product Benchmarking

11.4.6.4. Strategic Initiatives

11.4.7. Deloitte Touche Tohmatsu Limited

11.4.7.1. Participant’s Overview

11.4.7.2. Financial Performance

11.4.7.3. Product Benchmarking

11.4.7.4. Strategic Initiatives

11.4.8. Digital Asset Holdings, LLC

11.4.8.1. Participant’s Overview

11.4.8.2. Financial Performance

11.4.8.3. Product Benchmarking

11.4.8.4. Strategic Initiatives

11.4.9. Global Arena Holding, Inc. (GAHC)

11.4.9.1. Participant’s Overview

11.4.9.2. Financial Performance

11.4.9.3. Product Benchmarking

11.4.9.4. Strategic Initiatives

11.4.10. Monax Labs

11.4.10.1. Participant’s Overview

11.4.10.2. Financial Performance

11.4.10.3. Product Benchmarking

11.4.10.4. Strategic Initiatives

11.4.11. Ripple

11.4.11.1. Participant’s Overview

11.4.11.2. Financial Performance

11.4.11.3. Product Benchmarking

11.4.11.4. Strategic Initiatives