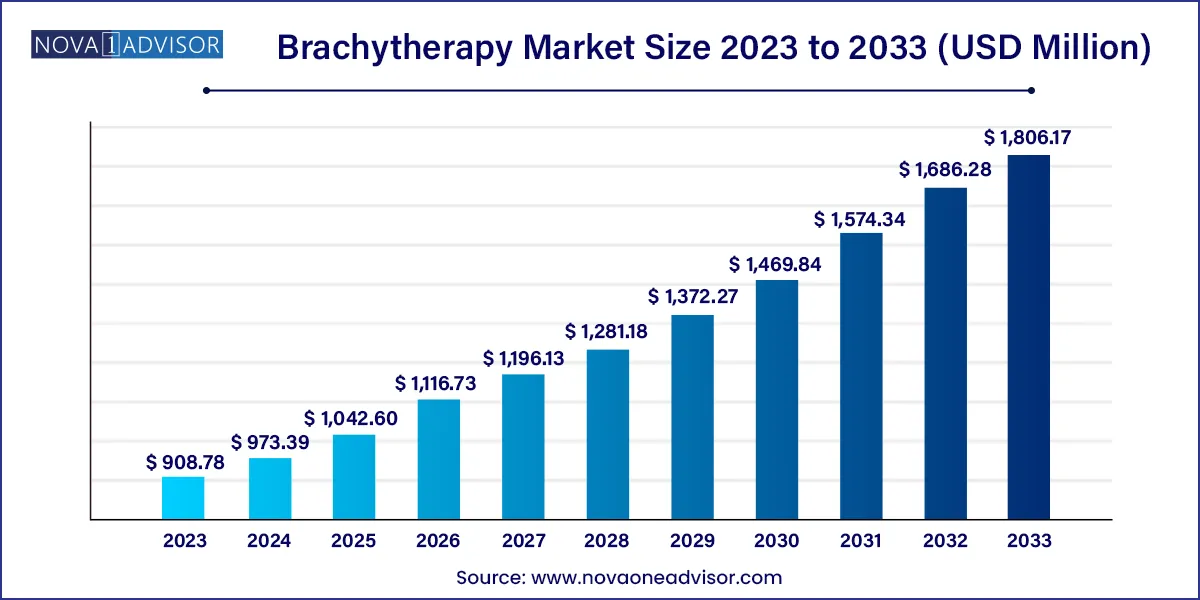

The global brachytherapy market size was exhibited at USD 908.78 million in 2023 and is projected to hit around USD 1,806.17 million by 2033, growing at a CAGR of 7.11% during the forecast period of 2024 to 2033.

Key Takeaways:

Brachytherapy Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 973.39 Million |

| Market Size by 2033 | USD 1,806.17 Million |

| Growth Rate From 2024 to 2033 | CAGR of 7.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Dosage Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Varian Medical Systems, Inc.; Becton, Dickinson & Company; Elekta AB; Isoray Medical, Inc.; Eckert & Ziegler BEBIG; iCAD, Inc.; CIVCO Medical Solutions; Theragenics Corporation |

The increasing prevalence of cancer, technological advancements, and a significant rise in the adoption of brachytherapy are expected to drive the growth of the market during the forecast period. Brachytherapy is a type of radiation therapy used for the treatment of cancer. The radioactive materials are placed inside the body with the help of catheters. It is an excellent treatment for localized tumors. Currently, artificially produced radionuclides such as Caesium-137, Iridium-192, Gold-198, Iodine-125, and Palladium-103 are routinely used.

According to the American Cancer Society, in the U.S., there were 609,360 cancer deaths and an estimated 1.9 million new cancer cases in 2023. This is expected to increase to 24.6 million by 2030. The increasing cancer burden is one of the major factors driving market growth.

Radiation therapy can be used for prophylactic, palliative, or curative treatment. It can also be used as monotherapy or as an adjuvant with surgery, immunotherapy, and chemotherapy. The wide range of applications of radiotherapy has increased its adoption by physicians. The latest advancements in radiation therapy allow the delivery of a high amount of dose to the target area with minimum damage to nearby healthy tissues. This has increased the chances of localized tumor control and has improved cure rates, leading to an increase in demand for radiation therapy.

However, the lack of skilled radiotherapy professionals and access to technologically advanced products, particularly in developing countries is expected to be a major restraining factor for this market. According to the IAEA’s Directory of Radiotherapy Centres (DIRAC), there are around 3300 brachytherapy systems installed across radiation therapy centers globally, as of 2020. Around 60% of the cancer cases occur in LMICs and 80% of patients in these countries lack access to treatment due to limited access to technologically advanced systems. Around 60%-80% of the radiotherapy needs are met in the European countries, however, in LMICs, only 3%–4% of the radiotherapy needs are met.

Segments Insights:

Product Insights

The applicators & afterloaders segment dominated the market for brachytherapy and accounted for the largest revenue share of 44.5% in 2023. Applicators are more effective than others and are minimally intrusive, granting them a high level of patient preference. The radioactive sources are transported to the treatment site by a device called an afterloader. During HDR brachytherapy, a single radioactive source is momentarily inserted inside the tumor and then expelled.

The electronic brachytherapy segment is expected to grow at a significant CAGR over the forecast period. This technique is suitable for treating skin lesions and enables radiation shielding, thereby eliminating the challenges associated with radioisotope handling. Various advantages of electronic brachytherapy such as no leakage of radiation in off-state, less shielding, low dose to organs at risk, and no radioactive waste make it a preferable treatment in the region. ELEKTA AB and Xoft, Inc. are some of the prominent companies in this market.

Recently, encouraging results have emerged from clinical trials for new products being developed in this domain. For instance, in August 2021, iCAD, Inc.’s Xoft Axxent Electronic Brachytherapy System for the treatment of recurrent glioblastoma showed significant improvements in the overall survival of patients who received this treatment.

Application Insights

The prostate cancer segment accounted for the largest revenue share of 32.91% of the market for brachytherapy in 2023. The prostate cancer brachytherapy industry is expected to grow at a lucrative rate due to various advantages over other types of treatments. These advantages include safely increasing the dose to the tumor while minimizing the dose to the surrounding organs such as the rectum, bladder, and urethra; shorter duration of treatment; faster recovery; minimal risk of side effects due to the accurate and precise delivery of radiation dose; and effective treatment for patients with prostate cancer recurrence.

The breast cancer segment is expected to grow at the fastest CAGR during the forecast period. Accelerated Partial Breast Irradiation (APBI) is an innovative method of radiation therapy, which is employed after a lumpectomy.Brachytherapy APBI includes two methods. The first method involves multicatheter brachytherapy and the second method involves a single catheter, which inflates into a balloon once placed inside the breast. The single catheter method is not prescribed for all breast cancer patients. Multicatheter brachytherapy offers great flexibility and is said to be the most targeted APBI treatment. The presence of a wide range of products & instruments, such as SagiNova and Breast CT/MR template set is expected to boost the breast cancer brachytherapy industry’s growth.

Dosage Type Insights

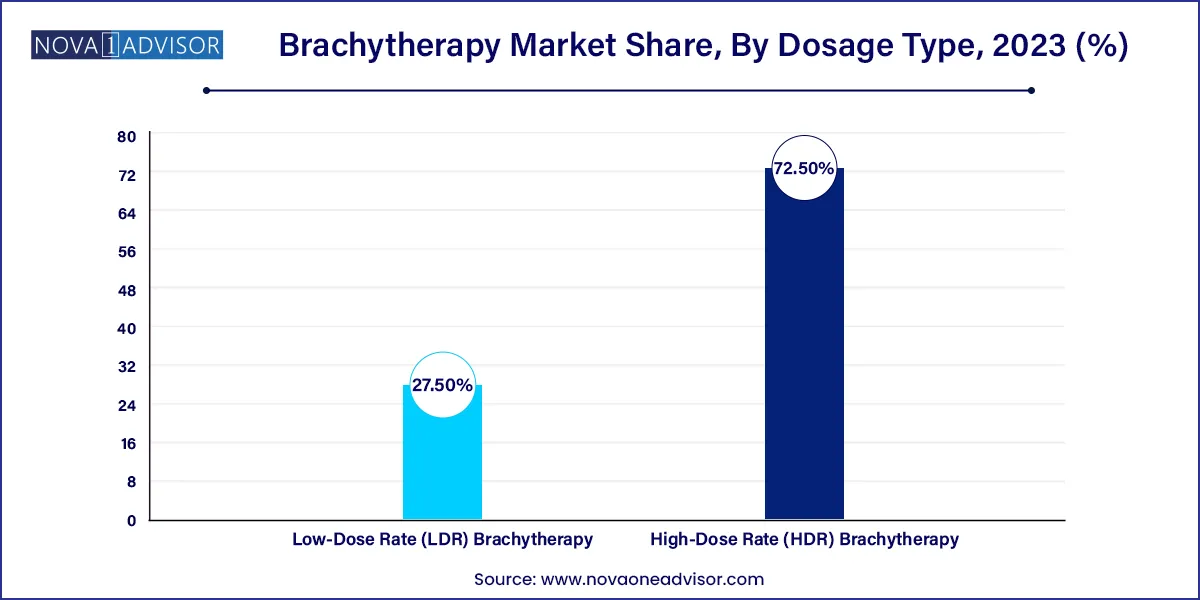

The High-Dose Rate (HDR) brachytherapy segment dominated the market and accounted for the largest revenue share of 72.5% in 2023. HDR brachytherapy is an outpatient procedure and can be used as a standalone treatment or after surgical removal of tumors. The pain-free treatment may require one session or multiple sessions depending on the type of cancer being treated. Eckert & Ziegler BEBIG, Varian Medical Systems, and ELEKTA AB are some of the prominent companies in the HDR brachytherapy industry.

Low-Dose Rate (LDR) brachytherapy is primarily used for the treatment of prostate cancer. The introduction of new products such as GammaTile for the treatment of brain cancer is expected to drive the growth of this segment. According to the recent technological advancements mentioned in a report published on Elsevier in May 2023, LDR brachytherapy has made it possible to administer precise doses and has excelled at treating aggressive prostate tumors.

Regional Insights

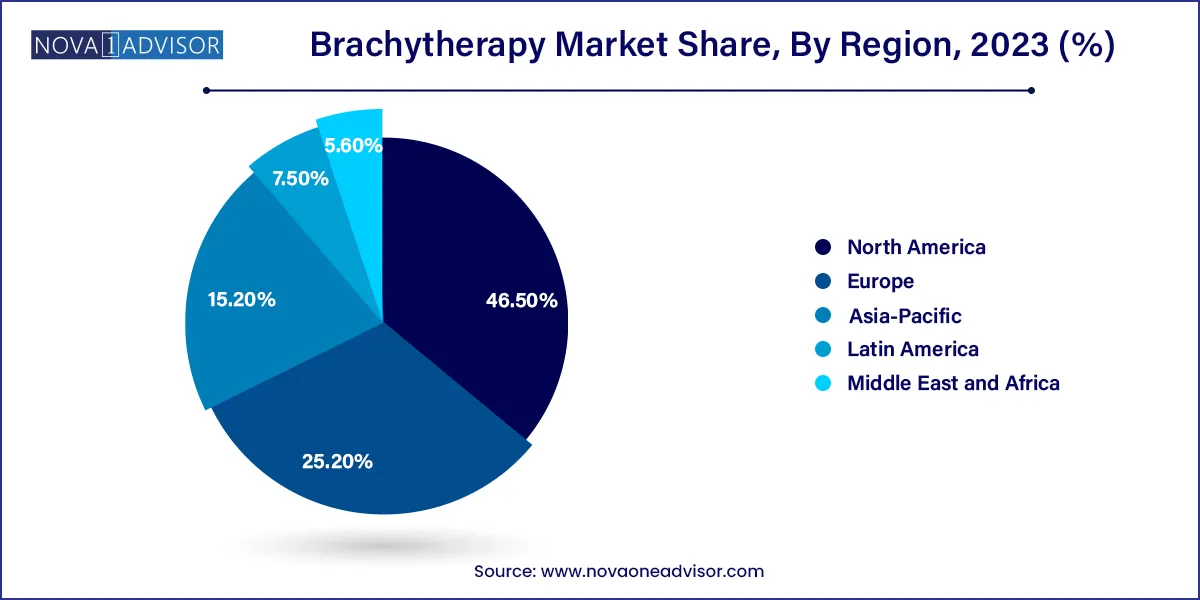

North America led the market for brachytherapy and accounted for the largest revenue share of 46.5% in 2023. Brachytherapy procedure offers various advantages over traditional methods including efficiency and safety of the treatment, hence, it is widely used in the North American region. Favorable regulatory and reimbursement scenario further supports regional growth. Additionally, the investment scenario has drastically changed in the region and companies are now investing in developing new products and collaborating with emerging companies to maintain their market share and presence.

In Asia Pacific, the market is estimated to witness the highest CAGR over the forecast period. The high disease burden and the rising awareness amongst the target population are some major factors responsible for the forecasted growth. In addition, limited access to technologically advanced cancer treatments offers various opportunities for the market players. Additionally, the launch of various brachytherapy systems in developing economies such as India is expected to impact the market positively. For instance, in November 2023, Medicover Hospitals launched Asia’s first TrueBeam Identify system. The system is also Telangana’s (an Indian state) first SGRT making treatment more accessible for patients.

Some of the prominent players in the Brachytherapy market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global brachytherapy market.

Dosage Type

Product

Application

By Region