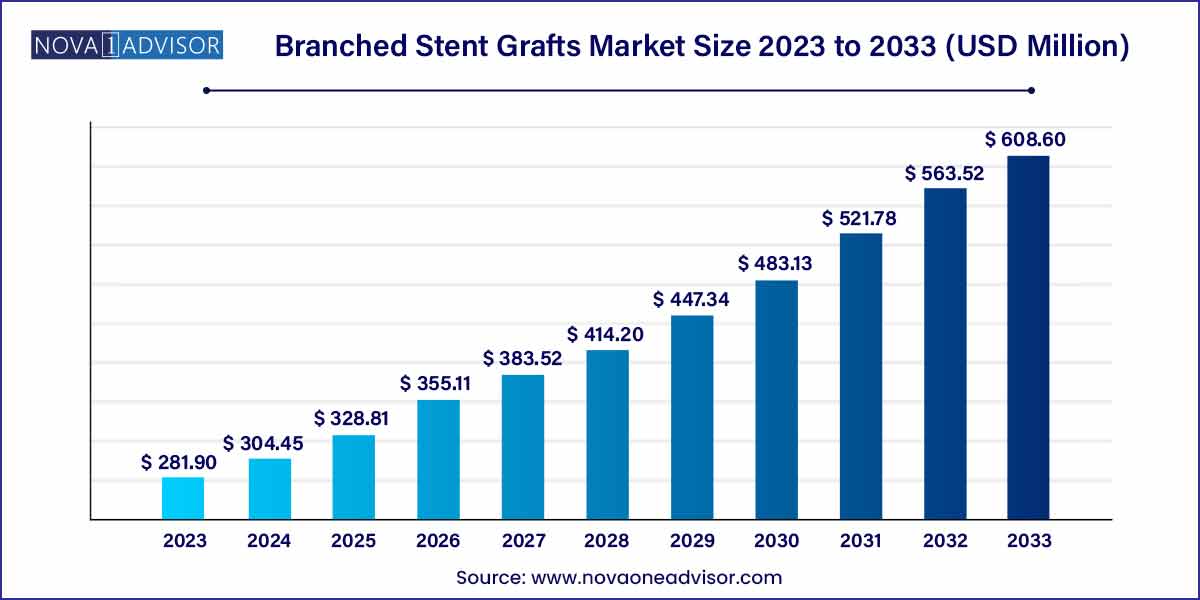

The global branched stent grafts market size was exhibited at USD 281.90 million in 2023 and is projected to hit around USD 608.60 million by 2033, growing at a CAGR of 8.0% during the forecast period of 2024 to 2033.

The branched stent grafts market is rapidly evolving as a critical segment within the endovascular repair industry. Branched stent grafts, used primarily to treat complex aneurysms involving branch vessels of the aorta, offer a minimally invasive alternative to traditional open surgical repair. These specialized devices are pivotal in managing thoracoabdominal aortic aneurysms (TAAA) and aortic arch aneurysms where the disease involves vital arteries branching off the main aorta.

Driven by the increasing prevalence of aortic aneurysms, aging populations, and growing acceptance of minimally invasive surgical procedures, the demand for branched stent grafts is escalating globally. The market is further propelled by advancements in stent design, material science, and imaging technologies that allow for patient-specific customization and improved clinical outcomes.

Moreover, collaborations between hospitals, research centers, and medical device manufacturers are accelerating innovation. As awareness and diagnosis rates for aneurysms rise, particularly in emerging economies, the branched stent grafts market is positioned for significant expansion in the coming years.

The Branched Stent Grafts market is experiencing robust growth, propelled by several key factors. A significant driver is the continuous wave of technological advancements in medical devices, leading to the development of highly sophisticated branched stent grafts. These innovations focus on enhancing precision, flexibility, and durability, thereby contributing to improved patient outcomes. Additionally, the rising incidence of aortic aneurysms, particularly among aging populations, plays a pivotal role in propelling market expansion. As patients and healthcare providers increasingly recognize the benefits of minimally invasive procedures, there is a growing preference for endovascular techniques, including the use of branched stent grafts. This shift is driving market growth, offering quicker recovery and reduced morbidity compared to traditional open surgeries. The aging global population and the prevalence of chronic diseases further amplify the demand for innovative medical interventions, positioning branched stent grafts as a critical solution to address complex anatomical challenges associated with aortic diseases. Overall, these factors collectively contribute to the flourishing growth trajectory of the Branched Stent Grafts market.

| Report Coverage | Details |

| Market Size in 2024 | USD 281.90 Million |

| Market Size by 2033 | USD 608.60 Million |

| Growth Rate From 2024 to 2033 | CAGR of 8.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Medtronic; Biotronik: Alvimedica; Endocor GmbH; Eucatech AG; Merit Medical Systems; Abbott; Cook Medical; Cardinal Health (Cordis); Boston Scientific Corp.; Terumo Corp. |

The Branched Stent Grafts market is propelled by continuous technological advancements, fostering innovation in medical devices. These advancements focus on refining the design and functionality of branched stent grafts, enhancing their precision and adaptability in addressing complex aortic anatomies. As manufacturers invest in research and development, the market witnesses the introduction of more advanced devices that offer improved outcomes for patients. The integration of cutting-edge technologies not only expands the capabilities of branched stent grafts but also underscores their relevance in modern healthcare, positioning them as a forefront solution for complex aortic diseases.

A key dynamic shaping the Branched Stent Grafts market is the increasing preference for minimally invasive endovascular procedures. Healthcare providers and patients alike are recognizing the benefits of these procedures, which include reduced recovery times and lower morbidity compared to traditional open surgeries. Branched stent grafts, as a crucial component of endovascular interventions, align with this trend by providing a less invasive alternative for treating complex aortic diseases. The growing acceptance of endovascular techniques contributes significantly to the market's expansion, with branched stent grafts at the forefront of enabling safer and more efficient procedures for both healthcare professionals and patients.

A notable restraint in the Branched Stent Grafts market is the high initial costs associated with these advanced medical devices. The sophisticated technology and materials used in the manufacturing process contribute to elevated pricing, making branched stent grafts less accessible, particularly in certain regions with limited financial resources. Affordability concerns pose a barrier to widespread adoption, limiting the market's potential impact on a global scale. Addressing this restraint requires strategic efforts such as increased awareness about the long-term cost-effectiveness of these devices and collaborative initiatives to make them more financially viable for a broader patient population.

The procedural complexity involved in deploying branched stent grafts, especially in challenging anatomies, presents a significant restraint for healthcare professionals. These devices require specialized training and expertise for precise placement and optimal patient outcomes. The learning curve associated with mastering the deployment techniques may limit the broader adoption of branched stent grafts. Overcoming this restraint necessitates ongoing education and training programs, ensuring that healthcare providers are proficient in utilizing these devices effectively. Collaborations between manufacturers and medical institutions can play a crucial role in addressing this challenge, ultimately contributing to the wider acceptance of branched stent grafts in clinical practice.

A compelling opportunity in the Branched Stent Grafts market lies in expanding into emerging markets and untapped regions. As healthcare infrastructure develops in these areas, there is a growing demand for innovative medical solutions. Strategic market penetration, along with partnerships with local healthcare providers, can pave the way for increased adoption of branched stent grafts. By understanding and addressing region-specific needs, manufacturers can capitalize on the untapped potential, fostering market growth and improving access to advanced medical interventions.

Continued investment in research and development represents a significant opportunity in the Branched Stent Grafts market. By focusing on innovation, manufacturers can introduce more advanced and cost-effective solutions. Collaborations between industry players and research institutions can drive the development of novel technologies, further enhancing the efficacy of branched stent grafts. This commitment to R&D not only ensures the evolution of cutting-edge devices but also positions companies favorably in a competitive market landscape, meeting the evolving needs of healthcare professionals and patients.

One of the significant challenges facing the branched stent graft market is the high initial costs associated with these advanced medical devices. The intricate design, specialized materials, and advanced technology contribute to elevated manufacturing expenses, resulting in a substantial price tag. This poses a barrier to widespread adoption, particularly in regions with constrained healthcare budgets. Overcoming this challenge requires strategic initiatives such as targeted pricing, collaborations to reduce production costs, and increased awareness about the long-term cost-effectiveness of branched stent grafts.

The procedural complexity involved in deploying branched stent grafts presents a notable challenge for healthcare professionals. Achieving optimal outcomes requires a high level of skill and expertise, and the learning curve associated with mastering deployment techniques can be steep. This challenge may limit the broader adoption of branched stent grafts, especially in settings where specialized training is not readily available. Addressing this issue necessitates ongoing education and training programs, as well as collaborative efforts between manufacturers and healthcare institutions to ensure healthcare providers are proficient in using these devices effectively.

Iliac stent grafts dominated the branched stent grafts market in 2024, driven by their extensive use in repairing iliac artery aneurysms and extending endografts into the iliac arteries during endovascular aneurysm repair (EVAR). Iliac branch devices (IBDs) offer a safe solution to preserve internal iliac artery flow while excluding aneurysmal segments, thus preventing complications like buttock claudication or sexual dysfunction.

Meanwhile, the "Others" category, encompassing thoracoabdominal and aortic arch branched stent grafts, is anticipated to grow at the fastest rate. Increasing adoption of fenestrated and branched endografts for complex aortic pathologies, coupled with growing clinician expertise and regulatory approvals, are driving growth in this segment. Advanced branched solutions are enabling minimally invasive treatment of challenging cases that were previously limited to open surgery.

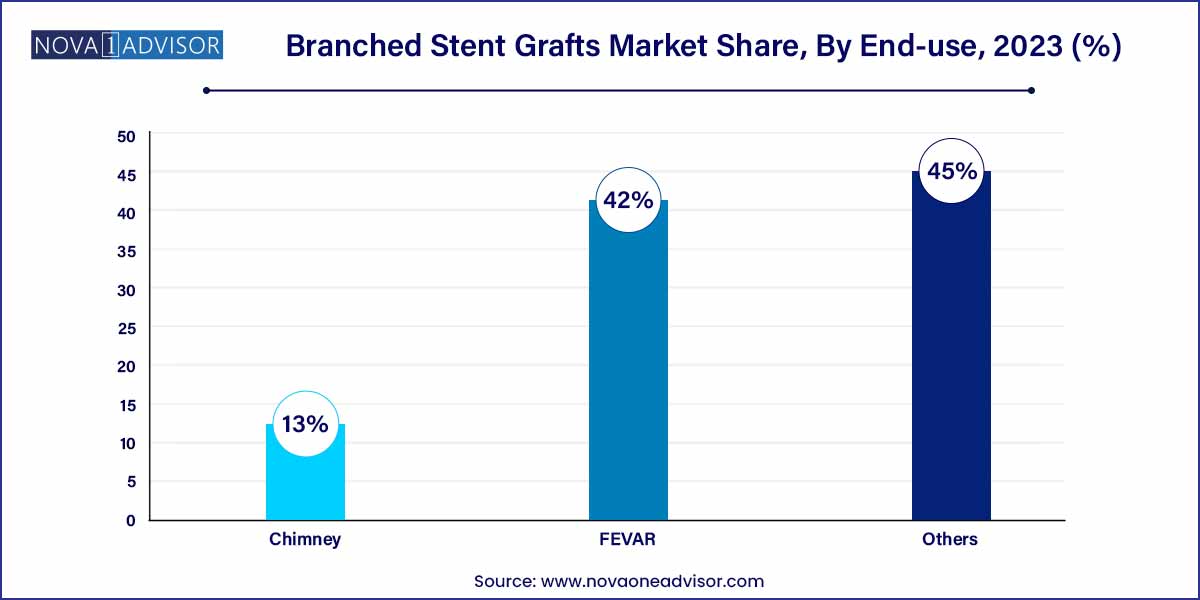

EVAR (Endovascular Aneurysm Repair) dominated the application segment in 2024, largely due to its widespread acceptance as a standard of care for abdominal aortic aneurysms. Technological improvements in stent graft design, coupled with physician preference for minimally invasive procedures, have solidified EVAR's market leadership.

Conversely, FEVAR (Fenestrated Endovascular Aneurysm Repair) is projected to experience the fastest growth. FEVAR allows for the repair of aneurysms involving branch vessels near the renal arteries or superior mesenteric artery. As device manufacturers develop modular and off-the-shelf fenestrated options, and clinical success rates improve, FEVAR is becoming increasingly accessible beyond tertiary centers, fueling rapid segmental growth.

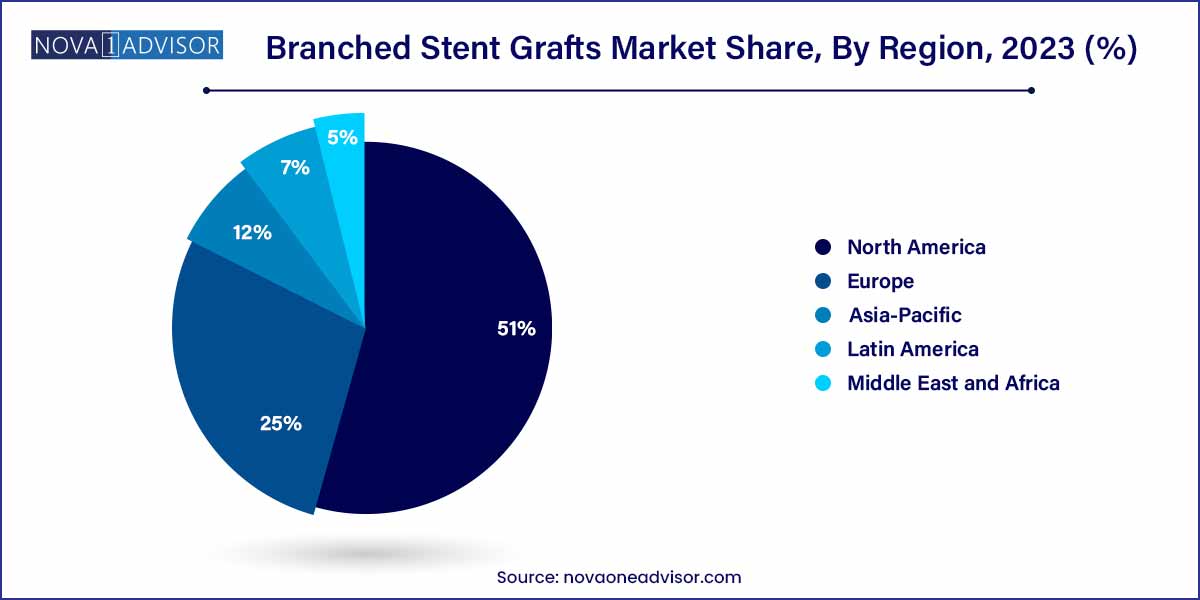

North America remained the largest regional market for branched stent grafts in 2024, owing to the high prevalence of abdominal and thoracic aortic aneurysms, advanced healthcare infrastructure, and early adoption of endovascular technologies. The U.S., in particular, benefits from favorable reimbursement policies, an extensive network of vascular centers of excellence, and significant investment in clinical trials and R&D.

Major companies such as Cook Medical, W.L. Gore & Associates, and Medtronic have established strong footholds in the region, consistently introducing next-generation branched devices and participating in investigator-initiated studies. Additionally, professional societies such as the Society for Vascular Surgery (SVS) actively promote awareness and education on complex endovascular repairs, bolstering market expansion.

Asia-Pacific is anticipated to be the fastest-growing region during the forecast period. Rising healthcare expenditures, expanding access to tertiary care centers, and increasing awareness of minimally invasive vascular treatments are driving demand for branched stent grafts.

Japan, China, and South Korea are leading the regional surge. Japan's aging population, in particular, is experiencing higher incidences of aortic aneurysms, while government initiatives to modernize healthcare infrastructure in China and India are fostering market growth. International companies are partnering with local distributors and establishing manufacturing facilities in Asia-Pacific to tap into these rapidly growing opportunities.

April 2025: Cook Medical announced the expansion of its Zenith Fenestrated AAA Endovascular Graft clinical trial to additional centers in the U.S. and Europe, targeting faster FDA approval.

February 2025: Terumo Aortic received CE mark approval for its RelayBranch Thoracic Stent Graft, expanding treatment options for aortic arch aneurysms.

December 2024: W.L. Gore & Associates launched an early feasibility study for its Gore EXCLUDER Thoracoabdominal Branch Endoprosthesis (TAMBE) in the U.S., signaling its commitment to branched solutions.

October 2024: Medtronic introduced the Valiant Navion stent graft system enhancements to support complex arch and thoracoabdominal aneurysm repairs.

August 2024: Jotec GmbH, a CryoLife Company, initiated trials for its E-nside multibranched stent graft, targeting off-the-shelf thoracoabdominal aneurysm repair solutions.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global branched stent grafts market.

Type

Application

By Region