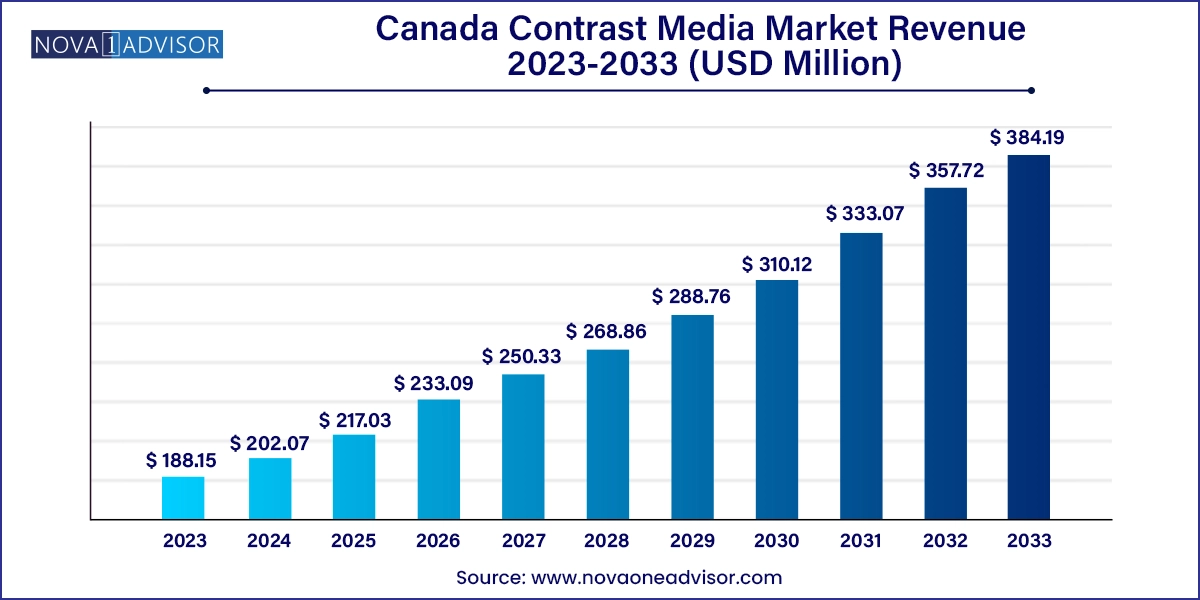

The Canada contrast media market size was exhibited at USD 188.15 million in 2023 and is projected to hit around USD 384.19 million by 2033, growing at a CAGR of 7.4% during the forecast period 2024 to 2033.

The Canada contrast media market is a pivotal component of the country’s broader medical imaging and diagnostic landscape. As Canada continues to prioritize early disease detection and precision medicine, the demand for contrast media—also referred to as contrast agents—has surged across diagnostic imaging modalities such as MRI, CT, and ultrasound. These substances enhance the visibility of internal organs, tissues, and blood vessels by altering how imaging technologies interact with bodily structures, ultimately enabling more accurate diagnoses of complex medical conditions.

In 2024, the Canadian contrast media market stood as a high-value segment, backed by public healthcare investments, a steadily aging population, and the rise in chronic and lifestyle diseases including cancer, cardiovascular conditions, and kidney disorders. Imaging volumes in Canadian hospitals and clinics are steadily increasing, and advanced radiological procedures are now considered essential across multiple specialties, including cardiology, neurology, oncology, and nephrology.

Unlike many other healthcare markets, Canada's healthcare delivery is predominantly public, and much of the demand for contrast agents is driven by the procurement decisions of provincial health authorities and imaging centers. Despite this, innovation remains dynamic, with global contrast media developers introducing new low-osmolar and microbubble-based products aimed at improving patient safety, diagnostic precision, and operational efficiency. As imaging technologies continue to evolve toward greater accuracy and non-invasiveness, contrast media remain central to diagnostic workflows across the country.

Rising Use of Low- and Iso-osmolar Contrast Agents: These agents are replacing traditional high-osmolar media due to lower adverse reaction profiles and improved patient tolerance.

Increased Demand for Non-invasive Imaging: As clinicians seek to reduce patient exposure to radiation and invasive techniques, the use of contrast-enhanced MRIs and ultrasounds is increasing.

Microbubble Contrast Agents Gaining Ground: Especially in echocardiography and liver imaging, microbubbles provide enhanced resolution and diagnostic performance without radiation.

Gadolinium Safety Driving Demand for Safer Formulations: Canadian providers are adopting macrocyclic gadolinium agents due to their better stability and lower risk of deposition in body tissues.

Shift Toward AI and Contrast Optimization Software: Integration of AI tools that assist in dose modulation and enhance contrast visualization is gaining adoption in advanced hospitals.

Expansion of Mobile Imaging Services in Remote Regions: As mobile diagnostic units grow, particularly in underserved northern communities, portable and safe contrast agents are in high demand.

Growth of Outpatient Imaging Clinics: The proliferation of privately-run diagnostic imaging centers is increasing demand for fast-acting, easy-to-administer contrast agents.

| Report Coverage | Details |

| Market Size in 2024 | USD 202.07 Million |

| Market Size by 2033 | USD 384.19 Million |

| Growth Rate From 2024 to 2033 | CAGR of 7.4% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Modality, Product, Route of Administration, Application, End use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Canada |

| Key Companies Profiled | Bayer AG; GE HealthCare; Guerbet; Lantheus Holdings, Inc. ; Bracco ; Voyageur Pharmaceuticals, Ltd; Grupo Juste |

The key driver propelling the Canada contrast media market is the rising burden of chronic and complex diseases, especially cardiovascular conditions, cancer, and neurological disorders, which require timely and accurate imaging for diagnosis, treatment planning, and monitoring. According to the Canadian Cancer Society, nearly 230,000 new cancer cases are diagnosed annually, and cardiovascular diseases remain the second leading cause of death in the country. These statistics underline the importance of diagnostic imaging in everyday clinical practice.

Contrast media are crucial in improving the visibility of tumors, vascular anomalies, or brain lesions. For instance, in stroke detection, a CT angiogram using iodinated contrast media is often the first step to locate the clot or hemorrhage. Similarly, MRIs with gadolinium-based agents are standard in detecting and staging tumors and evaluating demyelinating neurological conditions. The increasing need to localize, characterize, and monitor such conditions with precision is expanding the volume and sophistication of contrast-enhanced imaging across Canadian healthcare facilities.

A significant restraint affecting the market is the ongoing concern regarding the long-term safety of certain contrast agents, especially gadolinium-based and iodinated compounds. Regulatory bodies like Health Canada and the FDA have raised alerts about gadolinium retention in the brain and other tissues following repeated use of linear gadolinium agents. Although no direct clinical harm has been confirmed, this has prompted widespread shifts to more stable macrocyclic formulations, which come at a higher cost.

Similarly, iodinated contrast media used in CT scans can pose risks for patients with pre-existing kidney conditions, potentially leading to contrast-induced nephropathy (CIN). As a result, radiologists must carefully evaluate risk factors and often delay or limit contrast-enhanced scans. This risk profile slows adoption in vulnerable patient populations and mandates investment in alternative diagnostics or pre-treatment hydration protocols, adding complexity and cost to imaging workflows.

A transformative opportunity for the Canada contrast media market lies in the integration of contrast-enhanced imaging into precision medicine and functional diagnostics. As Canada continues to invest in personalized healthcare models, imaging is playing a central role in guiding clinical decisions tailored to an individual’s disease biology, rather than symptomology alone. Contrast-enhanced MRI and CT scans are being increasingly used to evaluate tissue perfusion, angiogenesis, and metabolic activity in tumors—pivotal factors in precision oncology.

Moreover, as pharmaceutical companies expand clinical trials for targeted therapies and immunotherapies, advanced imaging with specialized contrast agents is being adopted to assess therapeutic response more accurately. The development of tissue-specific or receptor-targeted contrast agents, although still in early phases, presents a breakthrough frontier for future diagnostics. Canadian academic and research hospitals, particularly in provinces like Ontario and British Columbia, are already piloting imaging strategies that align with genomic and proteomic profiling to advance personalized treatments—offering a fertile ground for innovation in contrast media applications.

The X-ray/Computed Tomography (CT) held the dominant share of the Canadian contrast media market in 2024, driven by its widespread use across diagnostic departments for cardiovascular, oncological, and trauma-related imaging. Iodinated contrast agents, primarily used with CT scans, are valued for their rapid imaging capabilities and detailed anatomical visualization. The high throughput of CT machines in both hospitals and outpatient centers, along with relatively lower cost per scan compared to MRI, reinforces this dominance. Provinces like Ontario and Quebec, with dense urban healthcare networks, conduct tens of thousands of contrast-enhanced CTs monthly, underscoring this modality’s ubiquity.

Magnetic Resonance Imaging (MRI) is projected to be the fastest-growing modality, particularly as MRI scanners become more accessible outside major urban hospitals. Gadolinium-based agents used in MRI scans are favored for their superior soft tissue contrast and safety in avoiding ionizing radiation. Their application in diagnosing neurological conditions like multiple sclerosis, brain tumors, and spinal injuries has led to strong demand. In parallel, newer macrocyclic gadolinium agents are expanding use cases among patients previously contraindicated for older formulations. As health networks continue to invest in 3T MRI scanners and outpatient MRI clinics, the growth trajectory for contrast-enhanced MRI procedures is expected to accelerate.

Iodinated contrast agents dominated the market, due to their extensive use in CT and angiography. These agents are critical in cardiac imaging, trauma diagnostics, and gastrointestinal visualization. Among iodinated subtypes, Iohexol and Iopamidol are particularly prominent, known for their low osmolality and broad compatibility across procedures. These agents are frequently selected for their balance between diagnostic clarity and reduced nephrotoxicity risk. Manufacturers such as GE Healthcare and Bracco Imaging have a strong presence in the Canadian supply chain for these formulations.

Microbubble-based contrast agents are the fastest-growing product category, particularly in contrast-enhanced ultrasound (CEUS) applications. These agents, composed of gas-filled bubbles encased in biocompatible shells, are gaining popularity due to their minimal renal burden and ability to provide real-time perfusion imaging. Microbubbles are increasingly used in echocardiography to assess cardiac chamber function, as well as in liver imaging for detecting focal lesions. Their safety in patients with kidney impairment or allergic profiles makes them ideal in several high-risk populations. As CEUS becomes mainstream, especially in point-of-care and pediatric settings, microbubbles are set for exponential growth.

Intravenous contrast administration is the dominant route, as it ensures rapid systemic distribution and high-quality enhancement of vascular and organ structures. Nearly all CT and MRI procedures involving contrast rely on intravenous injection, making it a standard in hospitals and diagnostic centers. Automated injectors, patient safety protocols, and IV-compatible contrast formulations are widely available across Canadian institutions, reinforcing this route’s primacy.

Oral contrast agents, while less dominant, are commonly used in abdominal CT scans, particularly for bowel imaging and ruling out obstructions. Their growth is steady but limited compared to intravenous agents. However, rectal administration is niche, used selectively in colorectal evaluations. The scope for innovation remains highest in intravenous agents due to their broader diagnostic applications.

Cardiovascular disorders represented the leading application for contrast media in 2023, given the widespread prevalence of heart disease in Canada. Coronary CT angiography, cardiac MRI, and stress perfusion imaging rely heavily on iodinated and gadolinium-based agents to visualize coronary arteries, myocardial viability, and blood flow patterns. In acute care settings, contrast-enhanced imaging plays a life-saving role in identifying blockages, aneurysms, and ischemic events. As cardiovascular screening expands and intervention protocols become more image-guided, this application is expected to retain its leadership.

Cancer imaging is the fastest-growing application, driven by the increasing cancer incidence in Canada and the shift toward early detection. Contrast-enhanced CT and MRI are critical in staging tumors, guiding biopsies, and evaluating post-treatment responses. Emerging use of perfusion imaging and functional MRI with contrast agents provides oncologists with data beyond tumor size, such as vascularity and tissue metabolism. Radiologists at academic centers like Toronto General and Princess Margaret Hospital are pioneering protocols that leverage contrast-enhanced imaging to personalize cancer management, which is expected to boost this segment’s future growth.

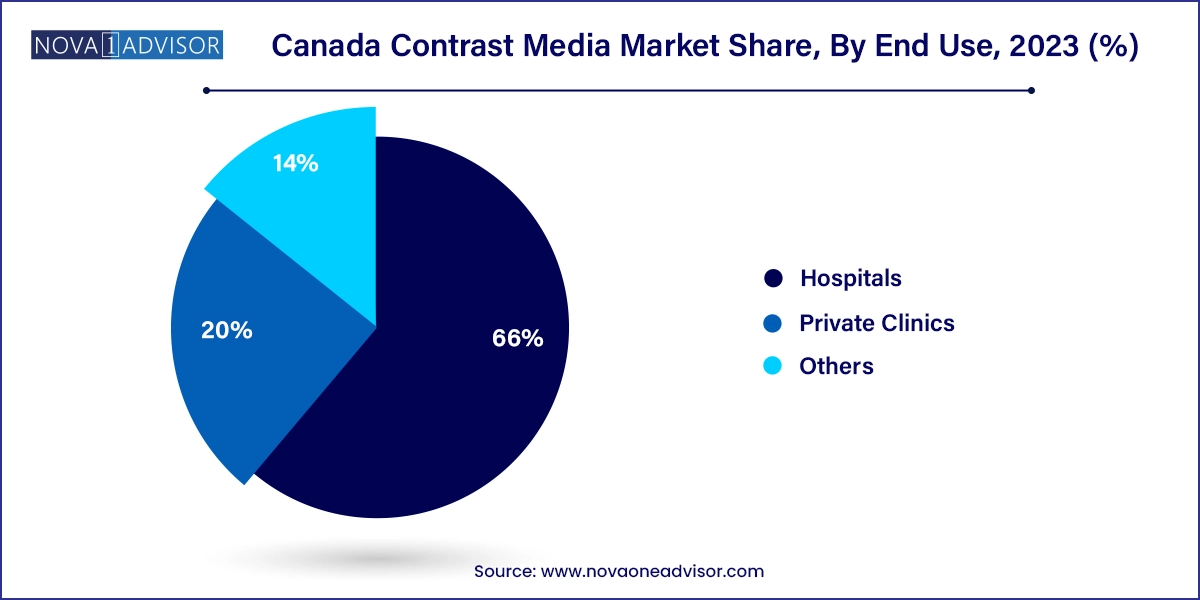

Hospitals dominated the market, being the primary setting for complex, high-volume imaging procedures. Large tertiary care hospitals and teaching institutions conduct contrast-enhanced scans for emergency, in-patient, and oncology services. Centralized imaging suites in public hospital networks handle a substantial portion of the country’s diagnostic load, supported by government funding for both equipment and consumables like contrast media.

Private clinics are the fastest-growing end-user segment, fueled by rising demand for faster diagnostics, especially for non-urgent cases. Wait times in public hospitals have led many Canadians to seek scans at private imaging centers, which are expanding across urban areas. These clinics often partner with insurance providers and focus on outpatient diagnostics, where contrast-enhanced MRIs and CTs are core services. The convenience and accessibility of these facilities make them major consumers of advanced contrast agents tailored for quick turnaround and improved patient comfort.

Canada’s contrast media market is intricately shaped by its universal healthcare system, regional disparities in imaging infrastructure, and regulatory frameworks. Provinces like Ontario, British Columbia, and Quebec account for the highest imaging volumes, with well-established diagnostic hubs and teaching hospitals. Northern and rural regions, in contrast, face limited access to advanced imaging technologies, creating opportunities for mobile diagnostic units and compact imaging systems that use safer contrast agents with broader patient tolerability.

The Canadian Agency for Drugs and Technologies in Health (CADTH) plays a crucial role in evaluating contrast agents for reimbursement, ensuring that clinical effectiveness and cost-efficiency remain central to procurement decisions. Meanwhile, research universities are collaborating with imaging technology firms to develop contrast protocols optimized for Canada’s diverse patient populations, including Indigenous communities and seniors. As demand for imaging expands across public and private systems, the contrast media market is poised for steady growth, supported by strong clinical demand and ongoing healthcare modernization.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Canada contrast media market

Modality

Product

Application

Route of Administration

End Use