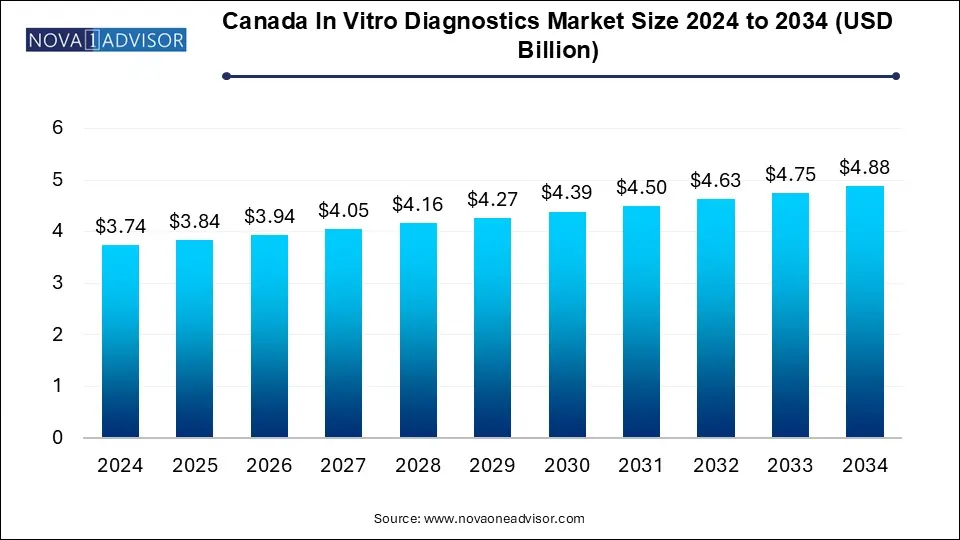

The Canada in vitro diagnostics market size was exhibited at USD 3.74 billion in 2024 and is projected to hit around USD 4.88 billion by 2034, growing at a CAGR of 2.7% during the forecast period 2025 to 2034.

The increasing prevalence of chronic diseases such as cancer, inflammatory conditions, autoimmune disorders, and infectious diseases is one of the major factors expected to drive growth. According to the Global Cancer Observatory, approximately 274,364 Canadians were diagnosed with cancer in 2020 and about 86,684 deaths were reported from cancer in the country. Moreover, the rise in the geriatric population and technological advancements in In-vitro diagnostics (IVD) devices are also expected to drive the market.

The outbreak of COVID-19 has increased the market growth significantly. In the years 2020 and 2021, the Canada in vitro diagnostics (IVD) market experienced exponential growth due to the increase in demand for COVID-19 infection testing. According to the Government of Canada, until 23 March 2024, there were around 3.41 million COVID-19 cases reported in the country and the country has performed around 59.1 million tests for the detection of SARS-CoV-2 infection. However, a decrease in the incidence of SARS-CoV-2 infection and increasing vaccination against COVID-19 is expected to decrease the market growth for immunoassays and molecular diagnostics testing over the forecast period.

Prevalence of various diseases such as cancer, autoimmune diseases, and inflammatory conditions is increasing in Canada which is expected to drive demand for IVD testing. For instance, according to the Global Cancer Observatory, approximately 274,364 Canadians were diagnosed with cancer in 2020. About 86,684 Canadian deaths were reported from cancer. Cancer is responsible for around 30% of total deaths in the country.

Moreover, according to the Canadian Congenital Heart Alliance, about 1 in 80–100 children in Canada are born with Congenital Heart Disease (CHD). It is estimated that around 257,000 Canadians have congenital heart disease. The increasing prevalence of chronic diseases and increasing awareness about early diagnosis of diseases among people is anticipated to increase the demand for in vitro diagnosis services in the country.

Geriatric population in Canada is increasing gradually. The population above 65 years of age is expected to grow by 68% and is expected to reach 10.4 million in 2037. The growth of the geriatric population is reported in all provinces and territories of Canada. With age, the immune system is affected, which increases susceptibility to acquiring various diseases. Hence, a large geriatric population requires better healthcare, especially for chronic diseases.

In addition, the geriatric population is more likely to suffer from COVID-19 due to decreased immune function, multimorbidity, and physiological changes associated with aging. Therefore, the increasing elderly population is expected to be one of the high-impact rendering drivers for the growth of the Canada IVD industry over the forecast period.

Based on product, the reagents segment dominated the Canada IVD market with a revenue share of 63.07% in 2024 and is estimated to grow at the fastest CAGR over the forecast period. The growth of the reagent segment is attributed to factors such as the rising R&D initiatives by the market players to develop novel biomarker kits along with the increasing commercialization of reagents are expected to spur the demand for reagents during the forecast period. Moreover, the reagent segment is anticipated to grow at a positive rate owing to the introduction of novel reagents and increasing R&D initiatives undertaken by major market players.

The instruments segment held the second largest share in 2024. The growth of the instrument segment is augmented by technological advancements in the products and high demand for advanced in vitro diagnostic devices. For instance, the introduction of portable instruments such as Cobas 4800 developed by Roche Diagnostics and GeneXpert by Cepheid, may fuel the Canada IVD market growth over the forecast period.

The molecular diagnostics segment held the largest market share of 26.39% in 2024. The large market share is attributed to various organic and inorganic developments made by key market players, rising product approvals and launches, and technological advancements in diagnostics. Moreover, the outbreak of COVID-19 has increased the demand for molecular diagnostic testing. For instance, in January 2024, Seegene Inc received the approval of its Allplex from Health Canada for diagnosis of SARS CoV-2, Flu A & B, and RSV. The Assay is a multiplex real-time PCR assay that allows simultaneous differentiation and amplification of respiratory symptoms.

The coagulation segment is expected to witness the fastest CAGR over the forecast period. The increasing prevalence of cardiovascular diseases, blood-related disorders, and autoimmune diseases is expected to boost the demand for coagulation testing, using IVD instruments. Moreover, instruments are getting updated and handheld coagulation analyzers, such as the Xprecia stride coagulation analyzer, such instruments are anticipated to enhance the overall workflow of detection.

In 2024, the infectious disease segment held the largest market share of 58.37% owing to factors such as the high prevalence of infectious diseases, and the rising geriatric population. Moreover, increased demand for novel COVID-19 tests in the last two years has increased the segment share at a significant rate. Furthermore, key market players are entering into a collaboration to improve access to high-quality and reduce the burden of infectious diseases in the country.

The oncology segment is expected to experience the fastest growth during the forecast period. The rising prevalence of cancer and increasing awareness about early diagnosis of life-threatening diseases among people are the major factors driving the growth of the oncology segment. The incidence of prostate cancer, breast cancer, lung cancer, and bladder cancer is higher in the country. Moreover, the number of cancer cases is expected to increase in the coming years due to increasing incidence and aging of the population, contributing to the segment’s growth.

Laboratories held the largest share of 58.69% of the Canada IVD market in 2024. The segment is expected to maintain its dominance throughout the forecast period. The higher accuracy of laboratory-based tests makes them more reliable when compared to PoC and home tests, giving these tests a competitive edge over the other two segments.

The home care segment, on the other hand, is expected to experience the fastest growth rate during the forecast period. Government initiatives and increasing adoption of self-tests are some of the key factors anticipated to boost the segment’s growth over the forecast period. Regulatory authorities rigorously evaluate the performance of diagnostic tests to meet global standards of safety, performance, and quality.

The hospitals segment held the largest market share of 34.0% in 2024 owing to factors such as rising hospitalizations and high demand for IVDs in hospitals as most hospitals have their own diagnostic units. Furthermore, the ongoing development of healthcare infrastructure is anticipated to enhance the existing hospital facilities. Thus, the demand for IVD tests in hospitals is increasing. In addition, the increasing development of PCR kits for hospitals to detect coronavirus is expected to drive the growth of Canada’s IVD market. For instance, in January 2020, BGI developed real-time fluorescent RT-PCR kits.

The home-care segment is expected to witness a robust growth rate during the forecast period. The growth of the homecare IVD segment is catered by the rising geriatric population in the country, and the surge in demand for point-of-care IVD tests. Moreover, due to the increasing demand for molecular diagnosis, there is a growing need for molecular diagnostic platforms that can assist patients in conducting self-tests.

The Ontario province dominated the Canada IVD market with a revenue share of 31.39% in 2024, followed by the West Canada. The growth of Ontario province is attributed to the changes in lifestyle, the rising geriatric population, and the increasing prevalence of cancer across the province. For instance, according to Statistics Canada, in 2018, 82,980 new cancer cases were reported in Ontario. Moreover, the cancer incidence rate was 579.9 per 100,000 population.

East Canada is expected to register the fastest growth rate during the forecast period. The growth of the eastern Canada is attributed to the increasing prevalence of chronic diseases, availability of advanced technologies, and high healthcare spending. Moreover, the rising prevalence of target diseases and increasing adoption of rapid diagnostic options are anticipated to drive the market’s growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Canada in vitro diagnostics market

By Product

By Technology

By Application

By End-use

By Test Location

By Province