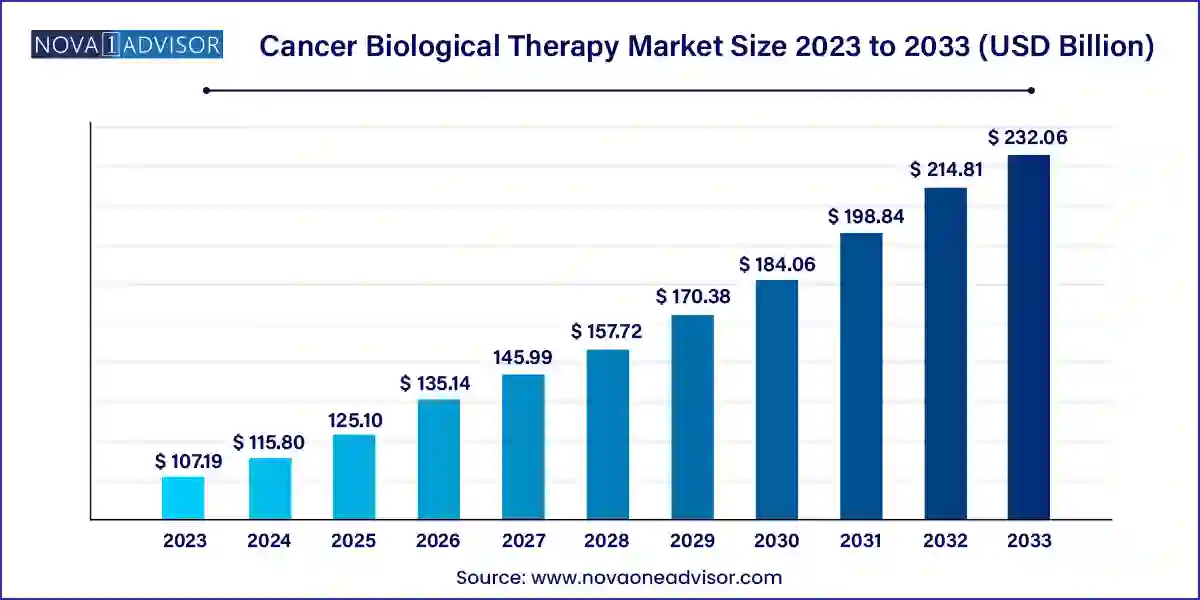

The global cancer biological therapy market size was valued at USD 107.19 billion in 2023 and is anticipated to reach around USD 232.06 billion by 2033, growing at a CAGR of 8.03% from 2024 to 2033.

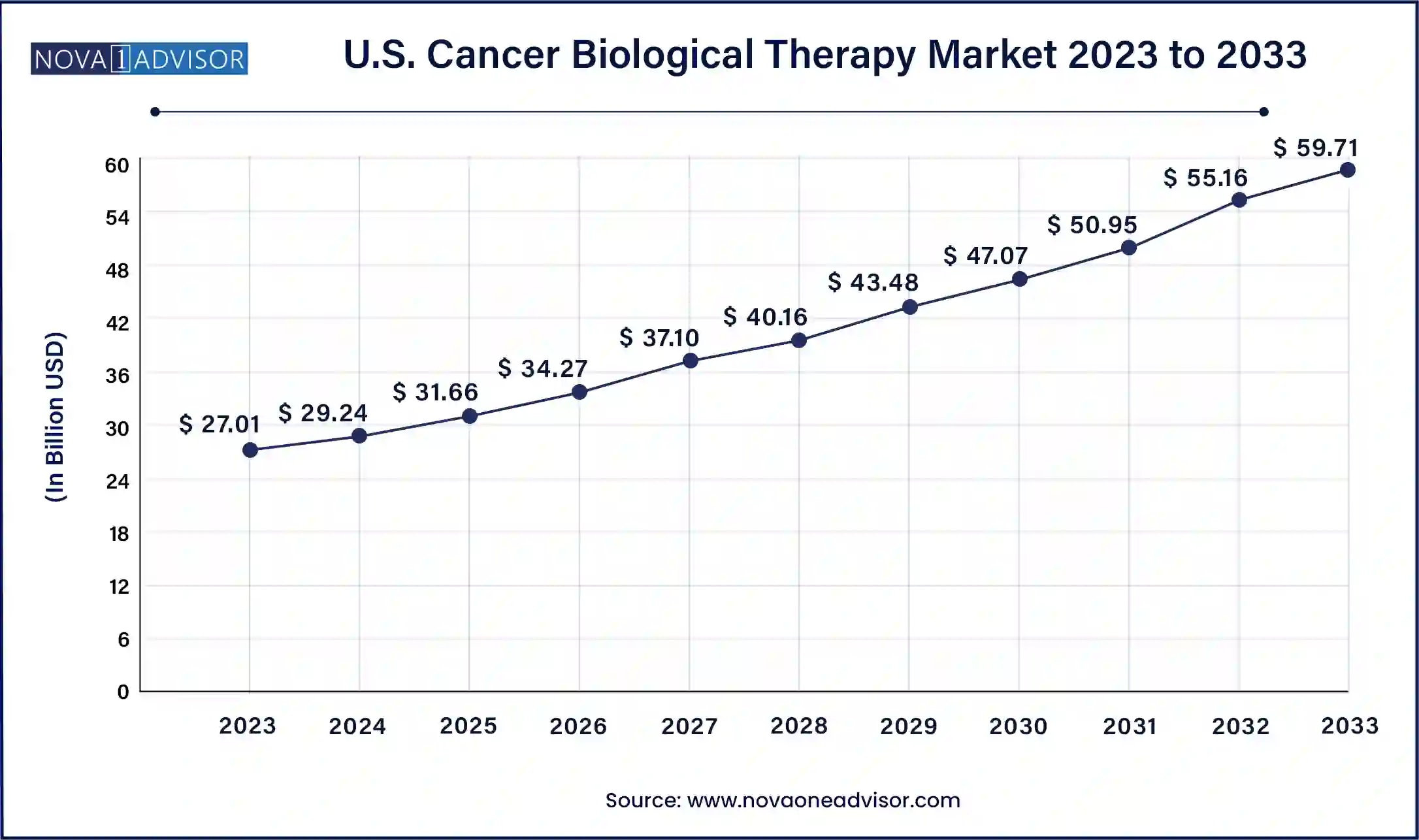

The U.S. cancer biological therapy market size was valued at USD 27.01 billion in 2023 and is expected to be worth around USD 59.71 billion by 2033, with a registered CAGR of 8.26% during forecast period 2024 to 2033.

North America dominated market with the largest revenue share of 36.00% in 2023. The market for cancer biological therapy in the United States has grown significantly. Affordable health insurance policies for life-threatening chronic conditions encourage people to seek treatment, which boosts market value. The Cancer Institute, Inc., a value-based oncology organization in the United States, announced an extended collaboration agreement with McKesson Corporation, which is anticipated to expand the market growth in this region.

Asia Pacific is anticipated to expand at a steady pace between 2024 to 2033. The key reasons for the APAC market's rapid growth include an increase in various cancer cases, government initiatives to raise awareness, and the number of patient assistance programs (PAPs). Due to the increasing incidence of ovarian cancer among women, there has been an increase in the demand for ovarian cancer biological therapy. The regions aging population, along with increased pollution and unhealthy eating habits, appear to be the leading causes of cancer, boosting demand for cancer biological therapy.

The Cancer Biological Therapy Market encompasses a diverse array of treatments that leverage biological substances to target and combat cancer cells. Unlike traditional therapies such as chemotherapy and radiation, which directly attack cancerous cells, biological therapies harness the body's immune system or specific molecules to inhibit cancer growth or destroy cancer cells selectively. This approach includes monoclonal antibodies, immune checkpoint inhibitors, cytokines, cancer vaccines, and adoptive cell transfer therapies, each designed to interact with distinct aspects of cancer biology or the immune response. The market's growth is driven by increasing research and development initiatives, advancements in biotechnology, rising cancer prevalence globally, and the demand for more effective and less invasive treatment options. Regulatory approvals for new therapies and ongoing clinical trials are pivotal in shaping the market landscape, promising continued innovation and improvements in patient outcomes.

| Report Attribute | Details |

| Market Size in 2024 | USD 115.80 Billion |

| Market Size by 2033 | USD 232.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By product, By Phases, By Distribution Channel, Route of Administration |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Incyte, ELI Lilly, Merck, Sanofi, Bayer, Novartis International, Roche, Pfizer, Bristol-Myers Squibb, Amgen, Seattle Genetics, Takeda Pharmaceuticals, Spectrum Pharmaceuticals, GlaxoSmithKline, Celgene Corporation, Otsuka, AstraZeneca, Plc., Abbvie, Eisai and Others. |

COVID-19 had brought the world to a pause. The world is still fighting this pandemic, which is putting an added burden on hospitals and medical workers. According to Blood cancer U.K., a UK-based charity organization, in March 2021, 47% of respondents said the pandemic had influenced their blood cancer consultations and treatment in some way, while 45% said it had impacted them due to appointment cancellations or delays.

Finally, Covid-19 has a negative impact on cancer drug development, affecting all critical aspects of the process. On the other hand, the Covid-19 wave has accelerated the adoption of new and innovative healthcare procedures such as remote monitoring. Furthermore, the pandemic may hasten regulatory approval pathways, encourage global trial collaborations, and lead to the development of novel therapeutic alternatives based on an improved understanding of mRNA technology.

This accelerates drug development in various segments, leading to more and better cancer treatments. This led to an expansion in the cancer biological therapy market.

Drivers

The rise in cancer cases globally boosts the global cancer biological therapy market in the forecast period As per the reports of the American Cancer Society Statistics in 2016, majority of cases of SCLC mostly occur in individuals between the age group of 60-80 years with an estimated global death rate being 30,000 per year. In addition to this, as per the reports of WHO, lung cancer is the second most dominant cancer in men and women causing 1.59 million deaths in 2012. This boost the market growth.

Awareness among patients as well as healthcare providers about the incidence of cancer is on the rise. Patients and doctors are now more actively participating in learning about the therapies available for treating these severe diseases. This is one of the most important drivers in the market. This creates more opportunity in the market.

Opportunities

The patent expiration of several previous companies can create enhanced opportunities for the new market players. The wide adoption of combination therapies is a major factor contributing to the growth of the cancer biological therapy market. Additionally, R&D fundings are an add-on to the market.

Researchers in the cancer biological therapy market primarily focus on the use of nanotechnology to offer advanced treatment to patients. Nanotechnology has the utmost potential to help in the cancer diagnosis. Furthermore, protein engineering and materials science advances are expected to help medical professionals target cancer cells more precisely. This is anticipated to provide new hope to cancer patients.

Restraints/Challenges

Lack of trained professionals who are unaware of the knowledge of the treatment methods for this disease could curb the growth of the global cancer biological therapy market over a forecast period.

The huge expenditure required for the treatment methods surely hamper the market growth. Many of the treatments involved in this disease require high cost and thus at times gets difficult for many people, especially the ones in the rural areas. Thus, this can act as a major hindrance factor for the market.

This global cancer biological therapy market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global cancer biological therapy market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Phase III: Capture the most market share

Clinical trials are divided into three phases: phase I, phase II, and phase III. In general, the success rate of clinical trials increases from phase I to phase II and finally to phase III, and thus phase III is anticipated to take over in the cancer biological therapy industry. In order to ensure the reliability of the results, phase 3 clinical trials involve a large number of candidates.

On the other hand, the phase II trial is anticipated to expand at the fastest rate in 2022. The phase II clinical trial is used to determine whether the new therapy affects specific cancer and evaluates how innovative treatment impacts the body and prevents cancer. The number of participants in the Phase II clinical trial is less than 100.

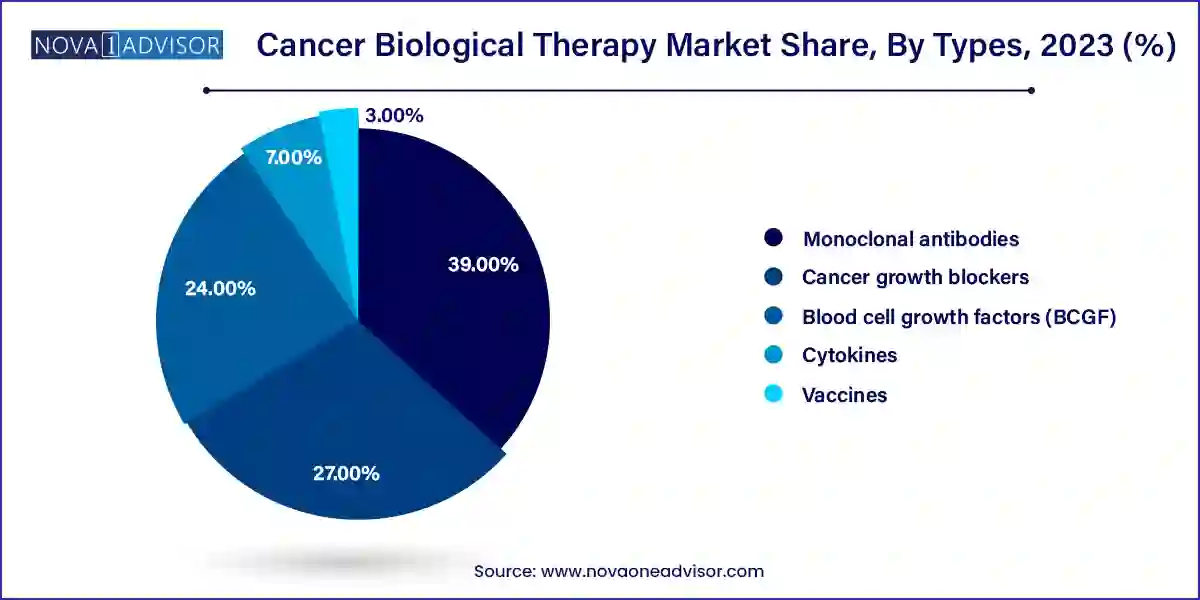

The Monoclonal antibodies sector is set to take the lead

Monoclonal antibodies are expected to grow the most in the coming years due to their ability to target specific proteins on the cell surface, resulting in increased use in cancer therapy. Additionally, increasing patient preference for advanced cancer biological therapy to avoid risks associated with anti-cancer drug therapy drives segmental growth in the coming years. These antibodies produced in the laboratory are thought to attack protein molecules expressed by malignant growth.

Antibody medications include rituximab, which is used to treat non-lymphoma, Hodgkin's alemtuzumab (Campath), which is used to treat chronic leukemia (CLL); and ipilimumab (Yervoy), which is used to treat malignant melanoma. Furthermore, an increased preference for advanced cancer biological treatments to lower the risk associated with anti-cancer drugs will result in significant expansion for the segment. For instance, the standard therapy for breast cancer is trastuzumab (Herceptin, Kanjinti, Ogivri). It is an example of a laboratory-created antibody. It inhibits the growth of cancer cells by adhering to specific areas of cancer cells.

Furthermore, the vaccine sector is anticipated to grow at the fastest pace between 2024 to 2033. Highly effective cancer vaccines have the ability to recognize and kill specific antigens while also improving immunity. These vaccines decrease the risk of developing cancer in the near future by building a strong immune system. These vaccines are widely used to treat breast, bladder, and cervical cancer. Increased incidence of cancer in developing countries such as India, as well as the widespread use of vaccines in cancer treatment, would expand the market's appeal.

The Injectable route is the most preferred treatment option and hence accounted for dominating the market

Based on the route of administration, the cancer biological therapy market is divided into oral and injectable. Among these types, the injectable is the leading segment and holds the maximum market share. The intravenous injectable type is well-known for its rapid action due to its 100% bioavailability, hence preferred most in emergencies.

The oral segment will be the fastest growing segment due to rising preferences among physicians and patients as they are easy to administer and eliminate unfavorable side effects such as fever, chills, and soreness at the injection site. The extensive R & D activities and conduct of clinical trials are expected to boost the segment growth.

Specialized cancer treatment centers dominate the cancer biological therapy industry. There is a significant expansion in the number of cancer research centers and laboratories, aided by substantial funding from governments and private companies worldwide.

The segment's expansion is due to the increased availability of treatment options as well as an increase in the number of cancer centers in some emerging nations. The segment is being propelled forward by the increasing worldwide oncology burden due to increased tobacco and alcohol consumption.

Hospitals and clinics are the fastest-growing sectors of the global industry due to their increasing prevalence in developing nations and the availability of a broad range of medical equipment for diagnosis and surgery.

North America is the leading region in the cancer biological therapy market between 2023 to 2032. Due to the favorable reimbursement scenario combined with significant healthcare expenditure, the United States has appeared as the market leader in North America and worldwide. In addition to the vast network of many cancers’ biological vaccines, and drug manufacturers, the U.S. market stands to benefit from increased R&D investments along with government campaigns.

Affordable health insurance policies for life-threatening illnesses encourage individuals to seek therapies, increasing market value. Given the robust pipeline for the treatment and the growing attention of various players on the invention of cutting-edge cancer gene therapies along with their vectors, the U.S. market for cancer gene therapy has seen significant growth over the years.

For instance, on June 27, 2022, the cancer Institute, Inc., a value-based oncology organization in the United States, announced the signing of an extended collaboration deal for drug distribution and clinical technologies with McKesson Corporation.

Europe is the second most profitable industry, owing to high disposable income and mass awareness. The major cancer burden, the presence of a large geriatric patient population, and increasing advances in cancer therapies may enhance the market growth in the coming years. The introduction of new molecular methods, advanced health sector, and technologically innovative approaches are also expected to enhance the European market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cancer Biological Therapy market.

By Product

By Phases

By Route of Administration

By Distribution Channel

By Region