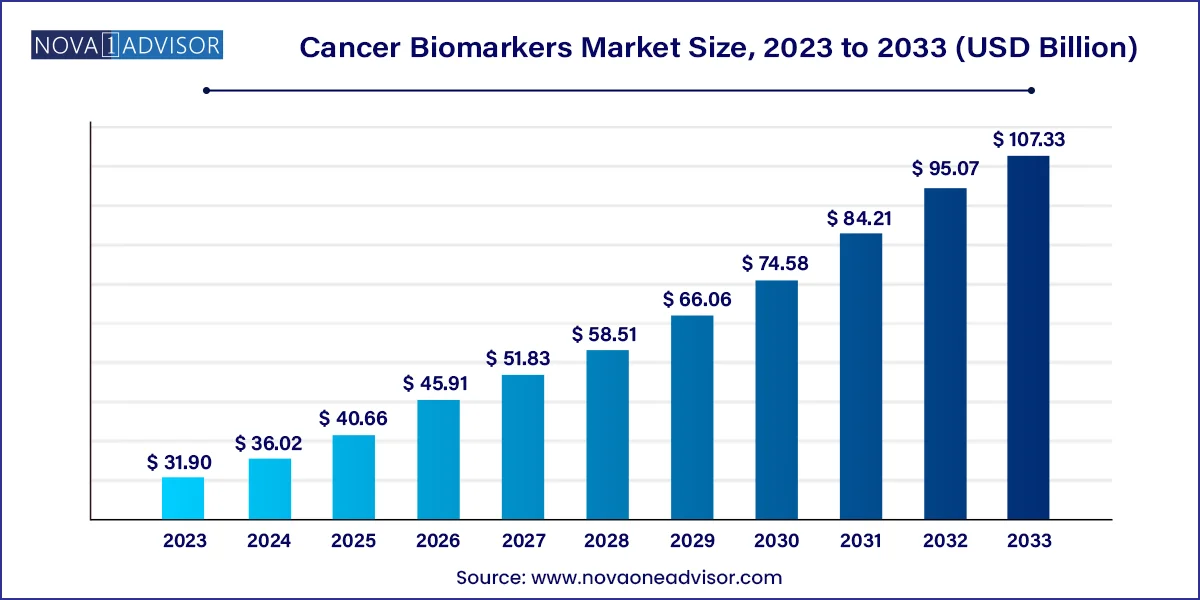

The global cancer biomarkers market size was USD 31.90 billion in 2023, calculated at USD 36.02 billion in 2024 and is expected to reach around USD 107.33 billion by 2033, expanding at a CAGR of 12.9% from 2024 to 2033.

The Biomarkers can help determine the prognosis of cancer patients and play a significant role in the diagnosis and treatment of nearly every patient. The main drivers of growth in this market are the increasing incidence of cancer worldwide, growing research on cancer biomarkers, growing use of biomarkers in drug discovery and development, and individualized treatment approaches and technical developments.

The rising global incidence of cancer is fueling the growth of the cancer biomarkers market as the demand for early detection and personalized treatment options increases. This trend underscores the crucial role of biomarkers in improving cancer diagnosis and therapy. For instance, in 2022, around 20 million people were diagnosed. While many (53.5 million) survived for at least 5 years, nearly 10 million people died from cancer in 2022. Furthermore, a World Health Organization (WHO) survey identified a critical gap in healthcare access, with less than 40% of countries providing basic cancer care and palliative services.

The expanding research on cancer biomarkers is propelling the cancer biomarkers market forward as advancements in this field enhance early detection, diagnosis, and personalized cancer treatment. This growing focus underscores the vital role of biomarkers in improving cancer care outcomes. For instance, a clinical trial, OPTIC RCC, was testing a way to personalize treatment for kidney cancer. Doctors were expected to analyze the patient's tumor genes to see which treatment is likely to work best. This builds on the knowledge from past studies and aims to improve patient outcomes.

The increasing use of biomarkers in drug discovery and development is driving the growth of the cancer biomarkers market. These biomarkers enhance the precision and effectiveness of cancer treatments, highlighting their critical role in advancing personalized medicine and improving patient outcomes.

The increasing use of biomarkers in drug discovery and development drives the growth of the cancer biomarkers market. These biomarkers enhance the precision and effectiveness of cancer treatments, highlighting their critical role in advancing personalized medicine and improving patient outcomes. According to the Alliance for Patient Access, Biomarkers are genetic indicators that predict which medications will be effective for individual patients, making them essential for personalized cancer treatment. For cancer patients, biomarker testing is a crucial initial step toward customized therapy.

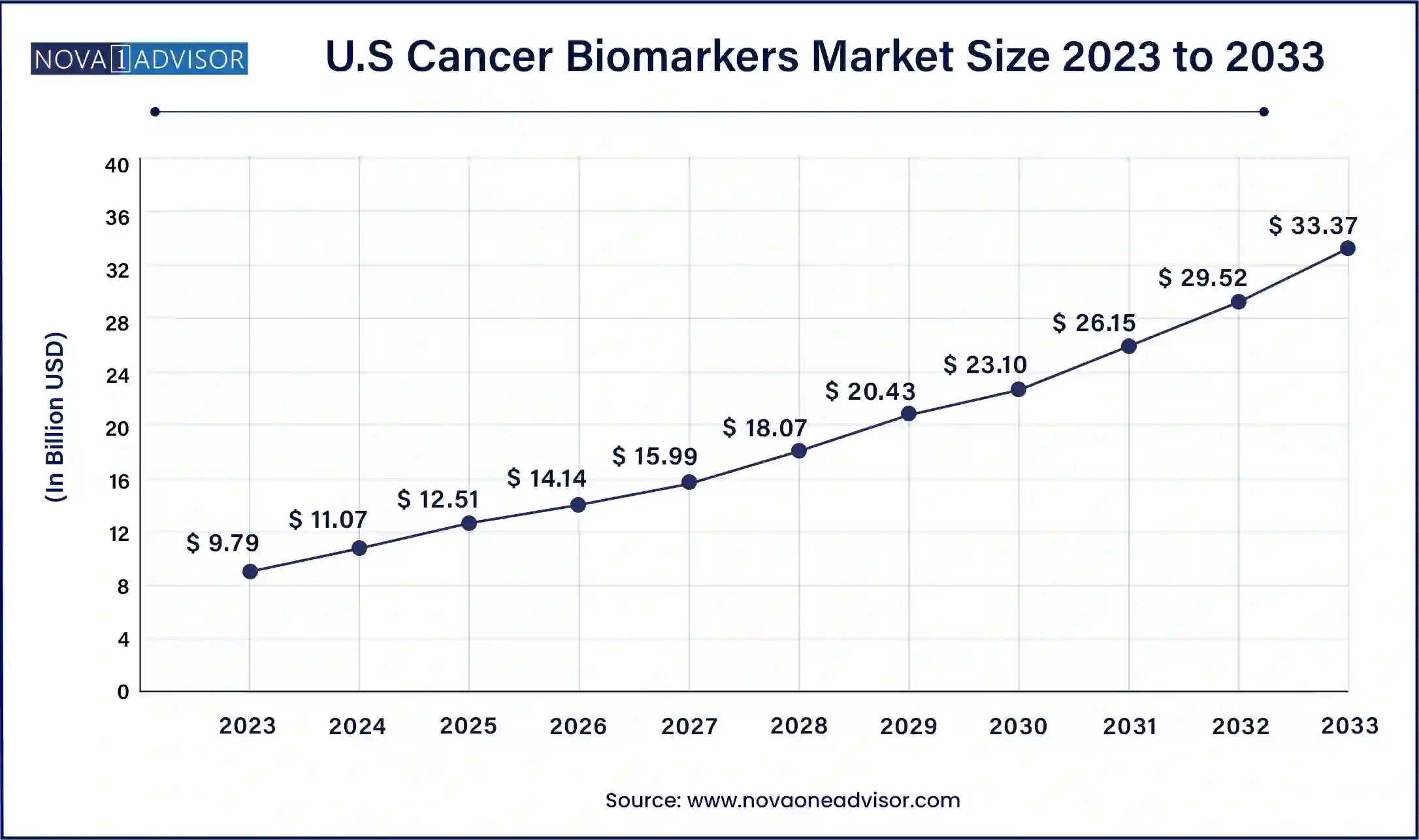

The U.S. cancer biomarkers market size was exhibited at USD 9.79 billion in 2023 and is projected to be worth around USD 33.37 billion by 2033, poised to grow at a CAGR of 13.05% from 2024 to 2033.

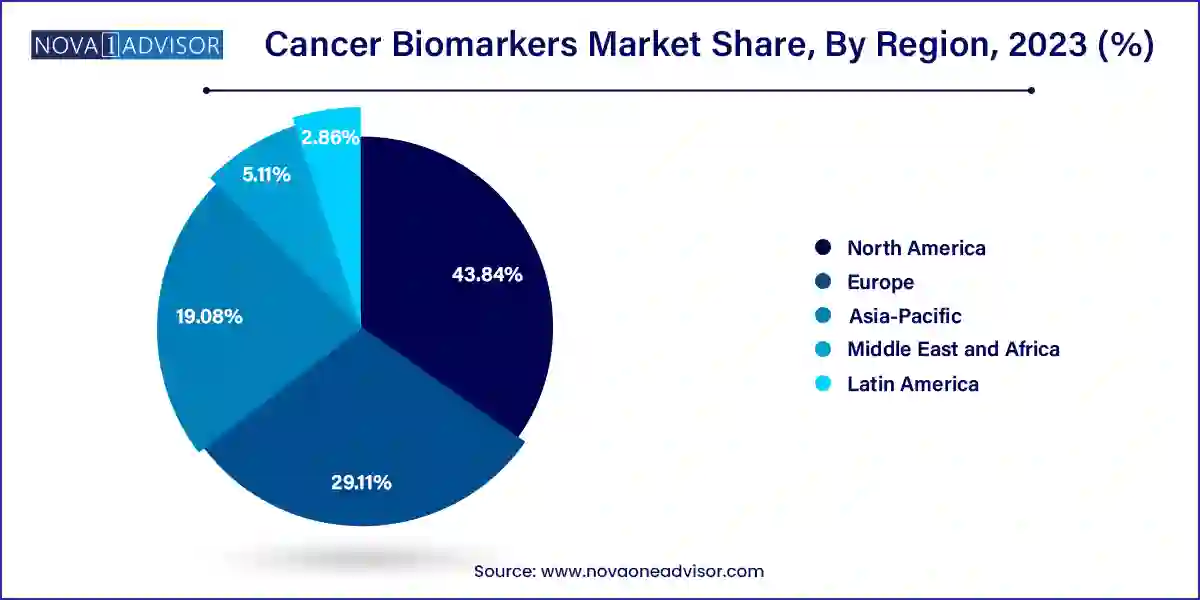

North America dominated the cancer biomarkers market with revenue share of 43.84% in 2023. This dominance is due to the presence of numerous market players dedicated to cancer biomarkers and substantial investments by the U.S. government in research and development efforts, which foster innovation. Moreover, the implementation of advanced technologies further propels market expansion in North America. For instance, in June 2024, Cizzle Biotechnology Holdings plc, a UK-based diagnostics developer, announced its collaboration with its licensing partner, Cizzle Bio Inc., in the U.S. Their proprietary test for the CIZ1B biomarker was chosen for inclusion in a major study at a prominent cancer center in the U.S.

U.S. Cancer Biomarkers Market Trends

The cancer biomarkers market in the U.S. dominated with a share of 85.8% in 2023 due to the market growth is largely driven by factors such as the availability of new drugs, the presence of a strong pipeline, and the rise in the incidence of renal cancer due to the growing geriatric population and more prominent smoking habits. For instance, in August 2023, Quest partnered with Envision Sciences to introduce a new prostate cancer biomarker test aimed at identifying patients with aggressive forms of the disease. This innovative test incorporates biomarkers Appl1, Sortilin, and Syndecan-1, which were researched by investigators at the University of South Australia, Adelaide, and subsequently developed and validated for commercial use.

Asia Pacific Cancer Biomarkers Market Trends

Asia Pacific cancer biomarkers market is anticipated to witness the fastest growth at a CAGR of 14.3% over the forecast period. The growth in the prevalence of cancer is driving the market in the region. Furthermore, the government is constantly funding development activities to develop new products. Thus, rising awareness of cancer biomarkers is also boosting the market's growth in the region. For instance, in 2023, Asia Pacific accounted for 45% of global breast cancer cases and 58% of cervical cancer deaths worldwide. Investments toward achieving cervical cancer elimination goals could generate a return of over USD 3 to the economy for every dollar spent. Regional governments in the Asia Pacific could implement various actionable measures to mitigate the impact of cancer on women, fostering significant improvements in public health outcomes.

| Report Attribute | Details |

| Market Size in 2025 | USD 40.66 Billion |

| Market Size by 2033 | USD 107.33 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, biomolecule, application, technology, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott; QIAGEN; Thermo Fisher Scientific Inc; Affymetrix Inc; Illumina, Inc.; Agilent Technologies; F. Hoffmann-La Roche AG; Merck & Co. Inc; Hologic, Inc., and Sino Biological Inc. |

The breast cancer segment held a significant market share in terms of revenue in 2023 and it is also expected to be the witness the fastest CAGR over the forecast period. The driving factors for breast cancer in the cancer biomarkers market include the disease's high prevalence, advancements in genomic and proteomic technologies, increased funding for breast cancer research, and the growing emphasis on personalized medicine. These factors contribute to developing more precise diagnostic tools and targeted therapies, improving patient outcomes. For instance, in 2022, breast cancer caused 670,000 deaths worldwide, with about half of all cases occurring in women without specific risk factors beyond sex and age. It was the most common cancer among women in 157 out of 185 countries.

The others segment held a notable share in 2023 pertaining to the increased research on rare cancers, advancements in genomics and proteomics, the rising incidence of cancers such as pancreatic and ovarian, and the growing demand for personalized medicine. These developments enhance early diagnosis, improve treatment strategies, and improve patient outcomes for various cancers. For instance, the incidence rate of pancreatic cancer was 13.5 per 100,000 men and women annually, with a death rate of 11.2 per 100,000. In 2021, an estimated 100,669 people were living with pancreatic cancer in the U.S.

The genetic biomarkers segment dominated the market in terms of revenue share in 2023. Genetic biomarkers are crucial in the cancer biomarkers market due to several driving factors. These include advancements in genomic technologies allowing for more precise identification of genetic mutations linked to cancer susceptibility and progression. In addition, the growing adoption of personalized medicine emphasizes the need for biomarkers to guide treatment decisions based on individual genetic profiles.

The increasing prevalence of cancer and the quest for early detection methods also fuel the demand for genetic biomarkers, enhancing their role in improving patient outcomes through targeted therapies and tailored treatment approaches. For instance, in April 2024, the California Institute for Regenerative Medicine (CIRM) granted USD 11.8 million to Denovo Biopharma LLC (Denovo) to advance DB107, Denovo's DGM7 biomarker-guided gene therapy for high-grade glioma (HGG), including glioblastoma (GBM), a severe form of brain cancer. Was expected to support a Phase 1/2 clinical trial investigating DB107 in newly diagnosed HGG patients.

The epigenetics segment is expected to be the fastest growing segment over the forecast period. One of the key drivers boosting the growth of the segment is the growing research for the development of novel biomarkers. Furthermore, market players are collaborating with pharmaceutical companies, which is contributing to the segment growth. For instance, in February 2024, C-Biomex Ltd. and the University of Texas MD Anderson Cancer Center announced a strategic research collaboration to jointly develop CBT-001, a radioligand targeting the CA9 cancer biomarker. This partnership leverages MD Anderson’s expertise in translational radiopharmaceutical research alongside C-Biomex’s unique radioligand. The collaboration was expected to involve conducting preclinical evaluations of CBT-001, advancing it toward early-phase clinical trials, and supporting an anticipated Investigational New Drug (IND) application to the FDA.

The diagnostics segment dominated the market in terms of revenue share in 2023. Factors such as the growing development of cancer biomarkers based on oncology tests that are highly efficient and effective and growing government initiatives may drive the segment's growth. For instance, in July 2024, Genoks GDHM and healthcare technology firm Velsera formed a strategic partnership to advance cancer diagnostics and treatment across Turkey and neighboring regions. This collaboration was expected to integrate Velsera’s Clinical Genomics Workspace (CGW) with Genoks’s expertise in genomics, enhancing the detection and characterization of various cancer types. Velsera’s CGW platform supports comprehensive analysis of solid tissue, liquid tumors, and hematological cancer samples, specifically designed for oncologists and specialists in inherited diseases to foster the expansion of next-generation sequencing (NGS) testing initiatives. Genoks aims to utilize Velsera’s genomic analysis and data interpretation capabilities to bolster its oncology diagnostic capabilities within Turkey.

The personalized medicine segment is the fastest growing segment during the forecast period. Personalized medicine in the market is advancing due to breakthroughs in genomic and proteomic technologies, pinpointing biomarkers that forecast how patients will respond to treatments, thereby enhancing treatment precision and outcomes. With cancer rates rising globally, the demand for therapies that offer targeted effectiveness is growing, emphasizing the significance of personalized approaches.

The imaging technologies segment dominated the market share in 2023 due to its high-throughput nature, accuracy, and broad applicability in biomarker discovery and diagnosis. For instance, in October 2023, Koninklijke Philips N.V. and Quibim partnered to integrate artificial intelligence (AI), which has enabled MR imaging and image analysis software to facilitate quicker and more efficient prostate cancer diagnosis and treatment. This collaboration addresses challenges such as staffing shortages and cost reduction in healthcare delivery.

The OMICS segment is expected to grow at the fastest CAGR over the forecast period. OMICS technologies are pivotal in the cancer biomarkers market because they provide comprehensive molecular insights into tumors through genomics, proteomics, and metabolomics. These advancements facilitate the discovery of novel biomarkers essential for early diagnosis, prognosis, and personalized treatment selection. In addition, the increasing sophistication of bioinformatics tools enhances the interpretation and application of OMICS data, driving their integration into clinical practice and accelerating advancements in cancer research and therapy.

Some of the key companies in the Cancer Biomarkers market include Abbott Laboratories QIAGEN;Thermo Fisher Scientific Inc;Affymetrix Inc;Illumina, Inc.;Agilent Technologies;F. Hoffmann-La Roche AG;Merck & Co. Inc;Hologic, Inc and Sino Biological Inc. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cancer Biomarkers market.

By Type

By Biomolecule

By Application

By Technology

By Region