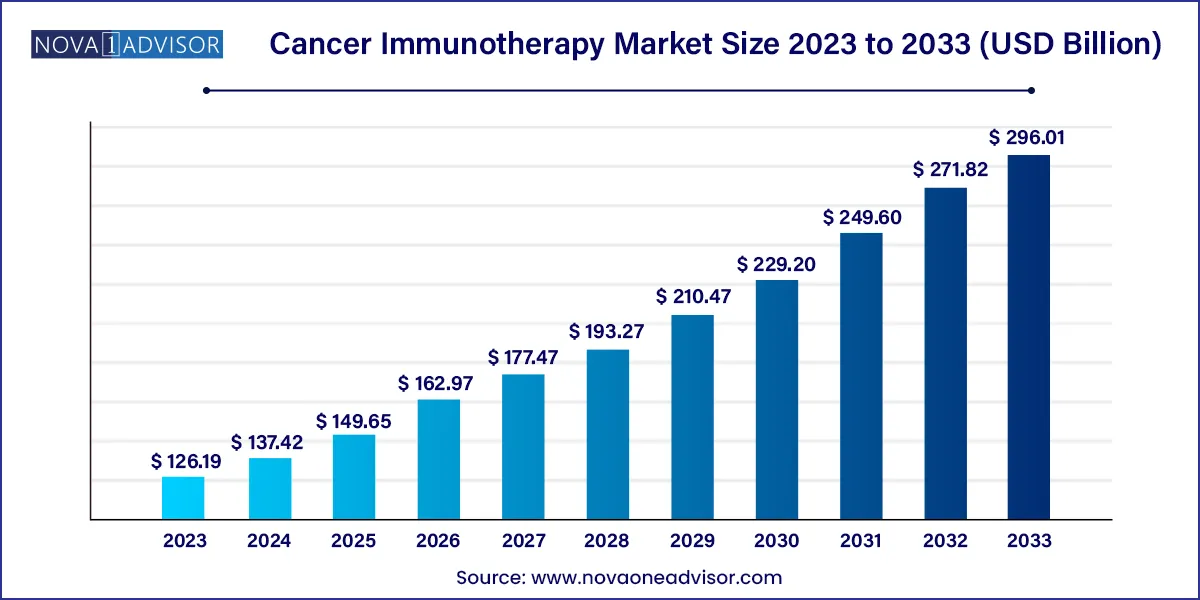

The global cancer immunotherapy market size was valued at USD 126.19 billion in 2023 and is projected to surpass around USD 296.01 billion by 2033, registering a CAGR of 8.9% over the forecast period of 2024 to 2033.

The U.S. Cancer Immunotherapy market size was valued at USD 50.19 billion in 2023 and is anticipated to reach around USD 109.47 billion by 2033, growing at a CAGR of 8.11% from 2024 to 2033.

.webp)

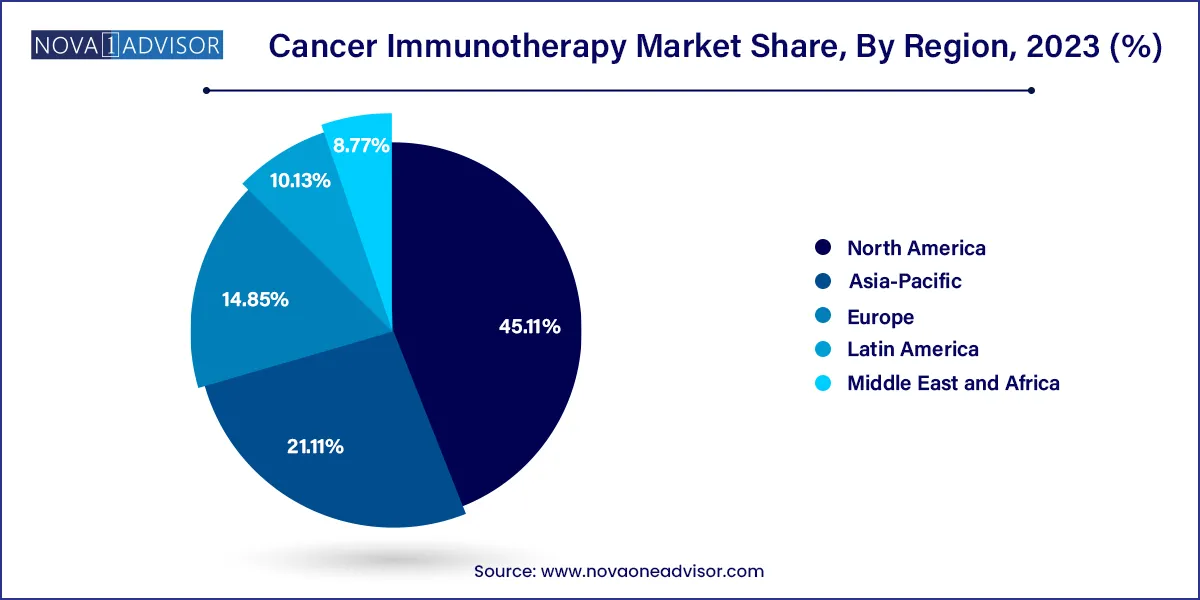

North America dominated the market and accounted for 45.11% share in 2023, driven by rising patient awareness, high disease burden, proactive government measures, technological advancements, and improvements in healthcare infrastructure. The presence of key players in this region is a key propeller of market growth. According to Elsevier Ltd. article published in April 2023, The US National Cancer Institute has published its expected national cancer plan, a roadmap, and call to action on improving all stages of care for those suffering from cancer, including prevention, detection, diagnosis during the course of treatment and recovery.

Asia Pacific is anticipated to witness the fastest CAGR in the global market. One of the primary factors driving this growth is an increase in the elderly population, a high number of patients with targeted diseases and improved healthcare infrastructure. Furthermore, the expansion of this region is being aided by an increasing legal acceptance of immunotherapeutics in these regions. According to the MJH Life Sciences article published in November 2023, durvalumab (Imfinzi) plus gemcitabine and cisplatin for frontline use in adult patients with locally advanced or metastatic biliary tract cancer is approved by China’s National Medical Products Administration.

Increasing prevalence of cancer is a major factor contributing to the market growth. According to the American Cancer Society journal, in the U.S. about 1,958,310 new cancer cases and 609,820 cancer deaths are estimated to occur in the year 2023. Growing R&D activities by pharmaceutical companies, and technological advancements and introduction of novel drugs are factors expected to drive cancer immunotherapy market growth in the forecast period.

Increasing prevalence of cancer is boosting the demand for this market. According to the International Agency for Research on Cancer (IARC) estimates, in the year 2020, there were about 19.29 million cancer cases which is estimated to increase to 24.58 million cases by 2030. This significant increase in the disease burden on the population is expected to drive the global market during the forecast period.

Rising approval of novel immunotherapies is expected to propel the market growth over the forecast period. According to the American Association for Cancer Research article in July 2023, FDA approved the quizartinib (Vanflyta) for treating different phases of newly diagnosed acute myeloid leukemia (AML). Quizartinib focuses on FLT3, a kinase that goes twisted in about one-third of AML cases. The usual glitch in (FMS like tyrosine kinase 3) FLT3 is an internal tandem duplication, where parts of the FLT3 gene get copied multiple times in a row.AML treatment generally follows a three-step process: induction, consolidation, and maintenance. During induction, powerful chemotherapy is administered to eliminate the majority of leukemia cells. The next phase, consolidation, involves further chemotherapy to eradicate any remaining cancer cells. Finally, maintenance treatment aims to prevent a recurrence of the disease.

For individuals with FLT3 internal tandem duplication, the treatment approach has evolved. Quizartinib can now be integrated into both induction and consolidation regimens, offering an enhanced therapeutic strategy. Moreover, it is employed as a standalone therapy for maintenance, contributing to a more targeted and comprehensive treatment plan for AML patients with this specific genetic mutation.

Various Strategic initiatives undertaken by major players are also anticipated to facilitate the market demand. For instance, in September 2023, Immatics and Moderna strategically collaborated to develop the Oncology Therapeutics. The collaboration includes an assessment of Immatics investigational PRAME203 TCRT in combination with the MARTE mRNA cancer vaccine being developed by Moderna. Moreover, in August 2023, FBD Biologics Limited and Shanghai Henlius Biotech, Inc. entered into strategic collaboration to boost the development of new immunotherapies. These aspects are boosting the market.

| Report Attribute | Details |

| Market Size in 2024 | USD 137.42 Billion |

| Market Size by 2033 | USD 296.01 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, application, distribution, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Pfizer Inc.; AstraZeneca; Merck & Co. Inc; F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; Novartis AG; Lilly; Johnson & Johnson Services, Inc; Immunocore, Ltd |

Hospital Pharmacy segment dominated the market in 2023. The rising demand for immunotherapies in hospitals and the increasing number of hospitalizations due to an increase in cancer diseases drive hospital pharmacy growth. The difficulty of the treatment and patients affected aged over 65 years increased the hospitalization rate of cancer patients. This has resulted in a high share of the segment. As a result, the segment's share in this market is large.

Online pharmacy segment is estimated to register a significant CAGR over the forecast period,the growing demand of the internet pharmacy segment is a chief factor, e.g. a surge in internet penetration, an increasing adoption of telemedicine, greater use of technology and convenience & time efficiency. Moreover, in the forecast period, the presence of prominent e-pharmacy players and their discounts also help to increase demand for the segment. These aspects are boosting the market.

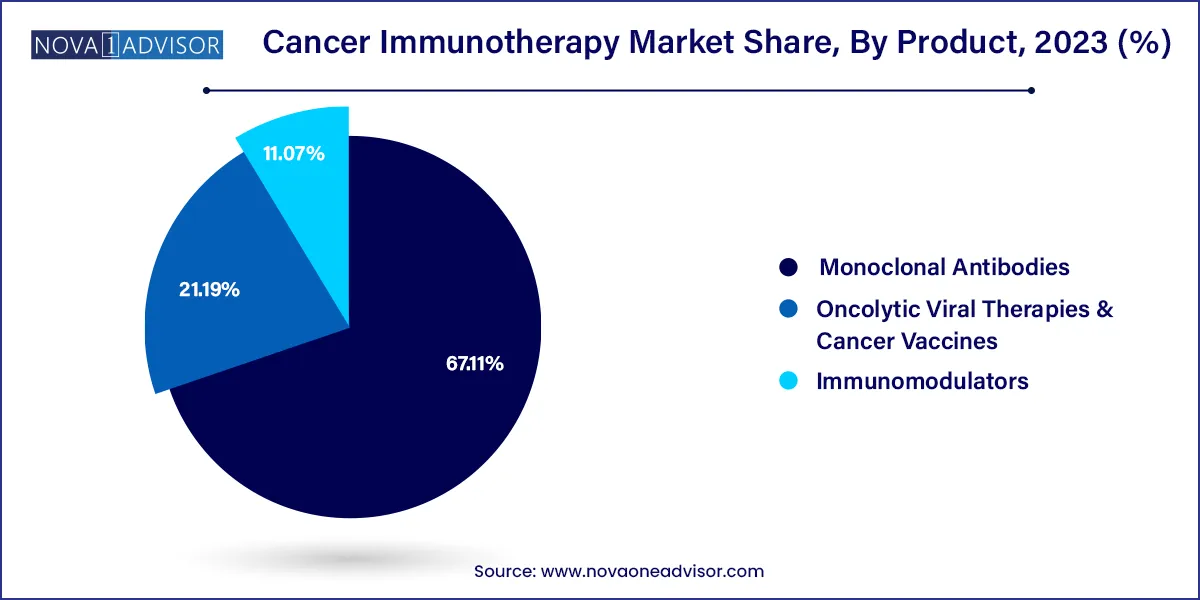

Monoclonal Antibodies segment led the market and accounted for the largest revenue share of 67.11% in 2023, Increasing investment for R&D of monoclonal antibodies—such as bispecific antibodies, conjugated monoclonal antibodies, and naked antigen binding antibodies—has opened new avenues for the growth of companies in the oncology therapeutics space. New-age monoclonal antibodies are designed to impart or possess adaptive immunity, antibody dependent cellular toxicity, and antigen specificity. Monoclonal antibodies are being largely studied for their therapeutic effects against various types of cancers. For instance, in August 2023, FDA has approved Talvey to treat adult patients with relapsed or refractory multiple myeloma who have received at least four prior lines of treatment, including proteasome inhibitors, immunomodulatory agents and an antiCD38 monoclonal antibody.

Oncolytic Viral Therapies and Cancer Vaccines is anticipated to witness a significant market growth over the forecast period. The development of cancer vaccines, which are subject to significant obstacles such as lack of immunogenicity and immunosuppression effects within the tumor microenvironment, must succeed. According to American Association for Cancer Research in June 2023, the US Food and Drug Administration has only approved a limited number of therapeutic vaccines. Some of the choices available include sipuleucel-T (Provenge), which is a vaccine made from cells and is authorized as a treatment for unconventional prostate cancer, laherparepvec talimogene (Imlygic or T-VEC), which is a vaccine derived from a virus and is approved for Bacillus Calmette Guerin and treating metastatic melanoma, a weakened strain of bacteria used to prevent the recurrence of early-stage bladder cancer following surgery. These aspects are boosting the market.

Lung Cancer segment accounted for the largest revenue share in 2023, the increasing prevalence of lung malignancies, growing awareness programs, increasing adoption of immunotherapy, and presence of a robust pipeline of investigational candidates are some of the key factors expected to drive the segment's growth. Furthermore, rising product approval and product launches are fueling the demand forward.For instance, in November 2023, the US Food and Drug Administration (FDA) granted marketing authorizations to Augtyro (Bristol, Inc.) for the treatment of locally refractory or metastatic Non-Small Cell Lung Cancer (NSCLC) with Repotrectinib.

Breast Cancer segment is estimated to register a significant CAGR over the forecast period. The high prevalence of the disease, ongoing research and development activities, and growing investments by leading players to develop novel therapeutics for breast malignancies are expected to accelerate segment expansion. For instance, in November 2023, AstraZeneca got FDA approval for their breast cancer drug capivasertib with fulvestrant.

Hospitals & Clinics segment accounted for the largest revenue share in 2023. In addition to rising incidence of diseases, increased treatment rate, higher awareness and malignancy diagnosis as well as a large number of hospitals offering immunotherapies is contributing to an increase in the number of patients treated. To treat cancer, hospitals are adopting immunotherapies. According to the National Cancer Institute article published in April 2023, in the U.S. 25% of patients died in a hospital, with 62% hospitalized at least once in the last month of life for the cancer treatments.

Cancer Research Centers segment is estimated to register a significant CAGR over the forecast period. Increased research on cancer and ongoing supportive activities carried out by government or national organizations in the form of grant funding have contributed to segment growth with a view to stimulating demand. According to Becker's Healthcare article published in November 2023, to expand research into cancer, Texas Oncology has recently revealed its Amarillo Comprehensive Cancer Center, a state-of-the-art facility representing a significant investment of USD 150 million. This cutting-edge center is poised to enhance cancer care, providing advanced and comprehensive services in the Amarillo region. These aspects are boosting the market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cancer Immunotherapy market.

By Product

By Application

By Distribution Channel

By End Use

By Region