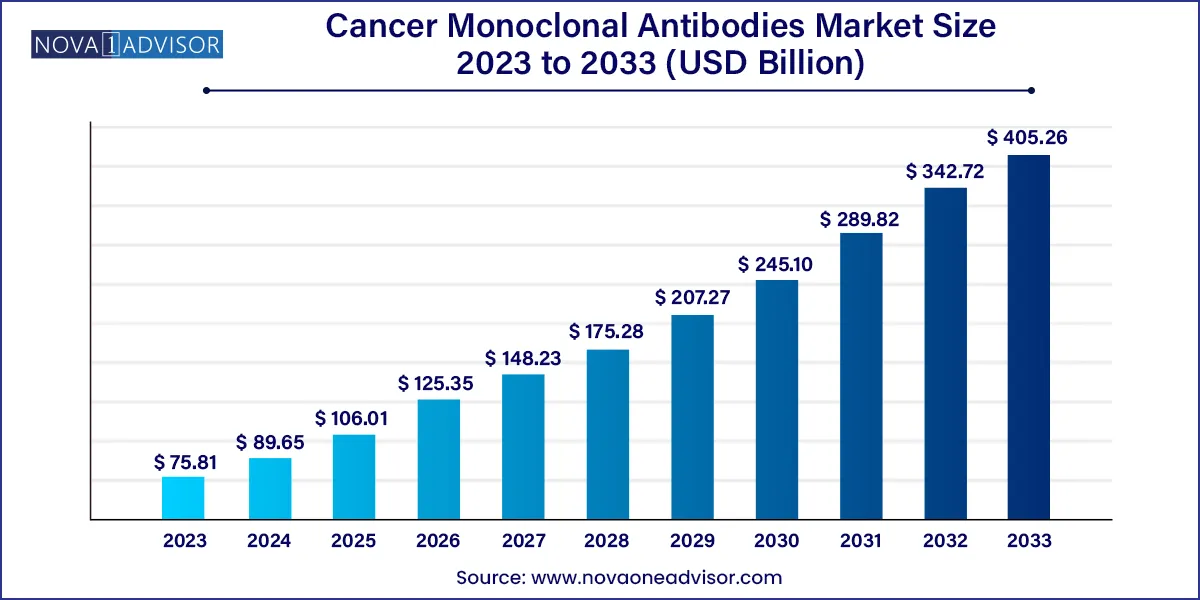

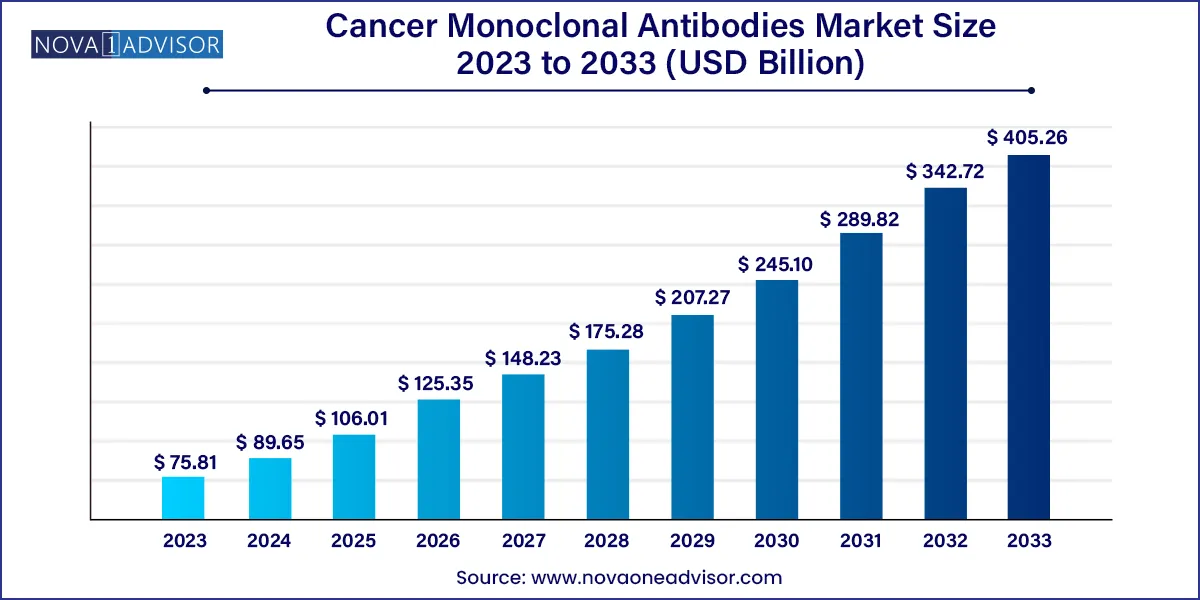

The global cancer monoclonal antibodies market size was exhibited at USD 75.81 billion in 2023 and is projected to hit around USD 405.26 billion by 2033, growing at a CAGR of 18.25% during the forecast period 2024 to 2033.

Key Takeaways:

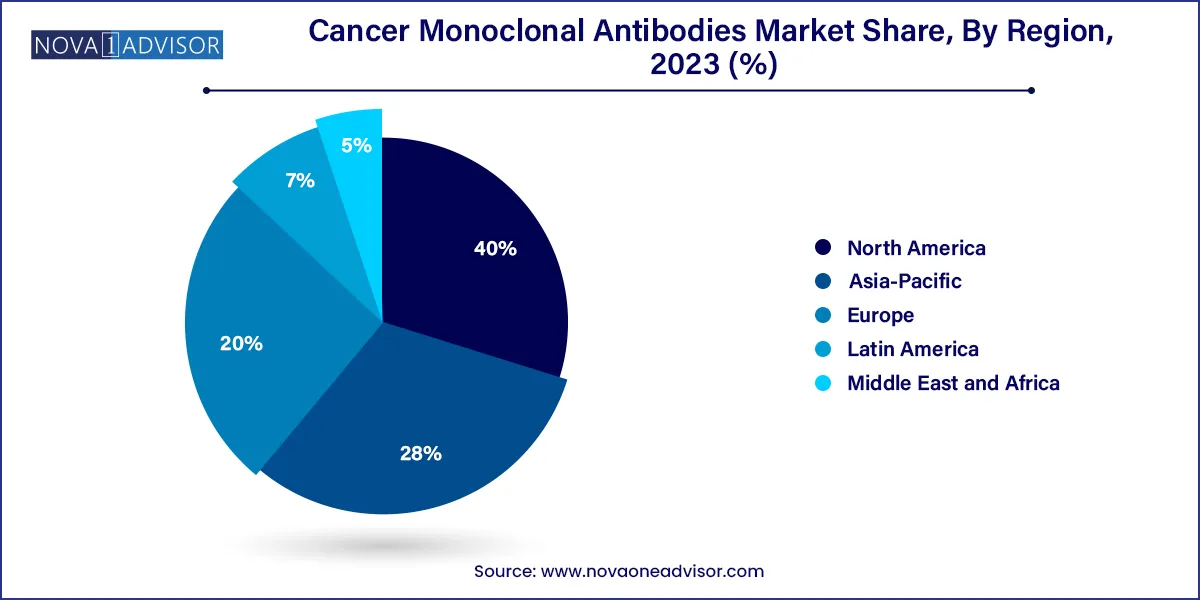

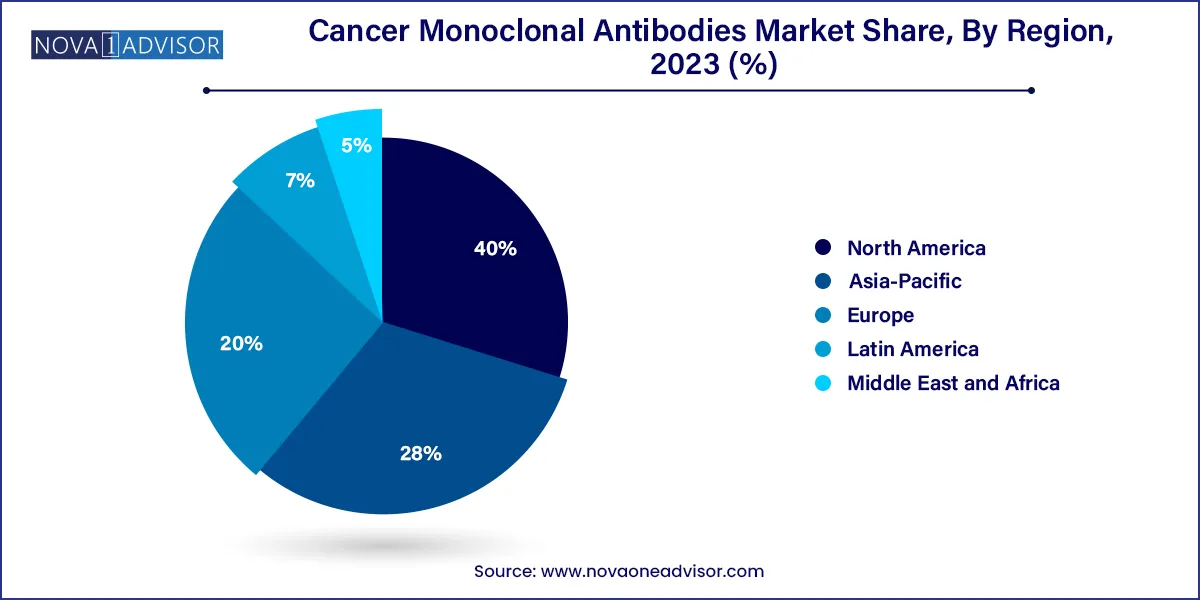

- North America dominated the cancer monoclonal antibodies market with a share of 40.0% in 2023.

- The humanized segment held the highest market share of 40.58% in 2023.

- The blood cancer segment held the highest market share of 23.94% in 2023.

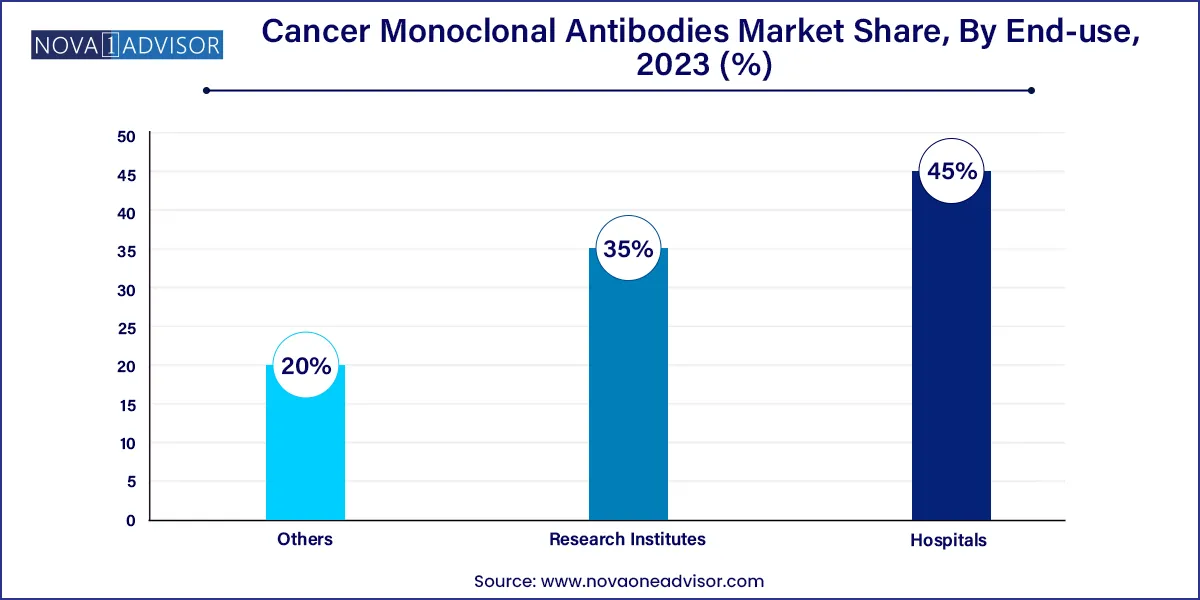

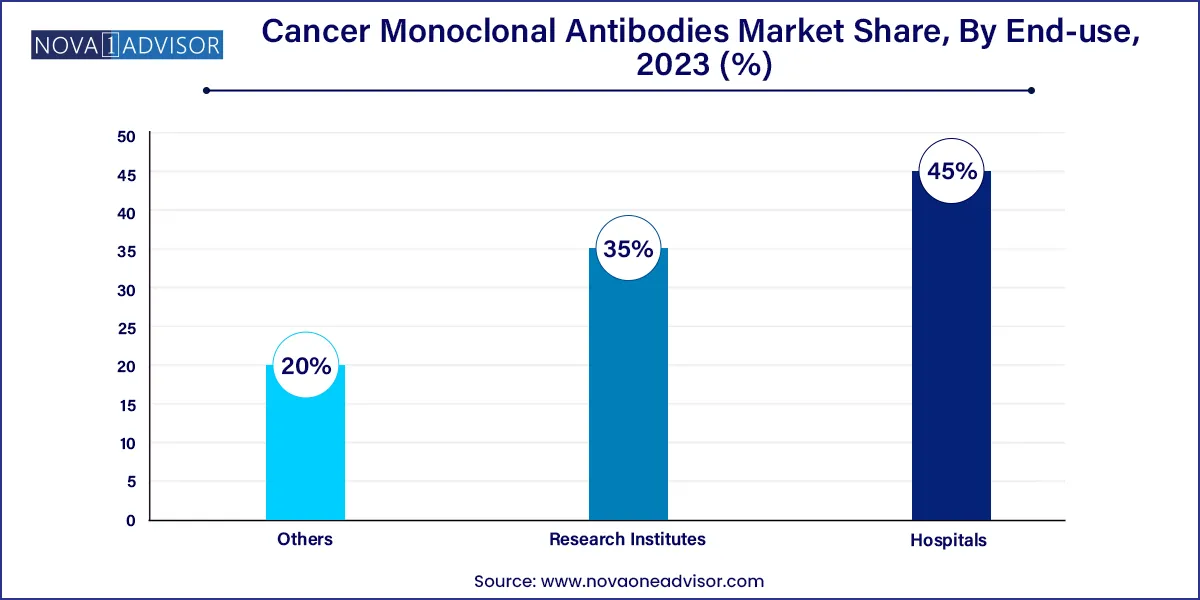

- The hospitals segment held the highest market share of 45.0% in 2023.

Market Overview

The Cancer Monoclonal Antibodies (mAbs) market represents one of the most innovative and rapidly expanding sectors in oncology therapeutics. Monoclonal antibodies are laboratory-engineered molecules designed to act as substitute antibodies that can restore, enhance, or mimic the immune system's attack on cancer cells. Their specificity in targeting tumor-associated antigens has transformed cancer treatment by offering a precision medicine approach that reduces harm to healthy tissues and improves outcomes. These biologics have significantly improved survival rates in various cancers and are now embedded in standard-of-care protocols globally.

In recent decades, monoclonal antibodies have evolved from murine origins to more advanced humanized and fully human formats, minimizing immunogenicity and enhancing therapeutic efficiency. The success of blockbuster drugs such as Rituximab (Rituxan), Trastuzumab (Herceptin), Bevacizumab (Avastin), and Pembrolizumab (Keytruda) has validated this modality, paving the way for broader research pipelines. They have been approved across a range of malignancies, including blood, breast, colorectal, lung, and liver cancers. Many of these agents function through immune checkpoint inhibition, antibody-dependent cell-mediated cytotoxicity (ADCC), and complement-dependent cytotoxicity (CDC).

The global burden of cancer expected to reach over 30 million cases by 2040 continues to drive demand for safer and more effective therapies. Monoclonal antibodies offer a beacon of hope in this evolving landscape. Fueled by technological advancements, strategic collaborations, and an increasingly favorable regulatory environment, the cancer monoclonal antibodies market is poised for robust and sustained growth.

Major Trends in the Market

-

Transition from Chimeric to Humanized and Fully Human Antibodies: To minimize immune responses and improve efficacy, developers are shifting towards advanced antibody types.

-

Rise of Bispecific Antibodies and Antibody-Drug Conjugates (ADCs): Combining the precision of monoclonal antibodies with cytotoxic payloads or dual-targeting mechanisms enhances therapeutic potential.

-

Immuno-oncology Synergy: Checkpoint inhibitors and monoclonal antibodies are increasingly being co-administered to improve immune system response against tumors.

-

Increasing FDA Breakthrough Therapy Designations: Regulatory bodies are expediting approval pathways for innovative mAbs targeting critical cancers.

-

Companion Diagnostics Integration: Development of diagnostics to identify patients who are most likely to benefit from specific monoclonal therapies is becoming mainstream.

-

Subcutaneous and Long-acting Formulations: There is a growing emphasis on patient-centric drug delivery innovations to improve compliance and accessibility.

-

Rising Focus on Emerging Markets: Pharmaceutical giants are expanding their footprint in Asia-Pacific and Latin America to meet unmet cancer treatment needs.

Cancer Monoclonal Antibodies Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 89.65 Billion |

| Market Size by 2033 |

USD 405.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.25% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Bristol Myers Squibb Co.; Merck & Co.; GlaxoSmithKline plc; Johnson & Johnson; Amgen, Inc.; Novartis AG; AstraZeneca plc; Eli Lilly and Company; AbbVie |

Key Market Driver: Advancements in Antibody Engineering Technologies

The single most powerful driver of the cancer monoclonal antibodies market is the technological evolution in antibody engineering. The leap from murine to humanized and fully human monoclonal antibodies has significantly reduced immunogenicity, a critical barrier to their initial adoption. Techniques such as phage display, transgenic mouse models, and recombinant DNA technology have revolutionized the field. For example, Regeneron’s VelocImmune and Adimab’s yeast-based platforms allow the rapid development of fully human antibodies with enhanced affinity and specificity. This technological maturation has allowed pharmaceutical companies to design antibodies that are not only more effective but also have extended half-lives, improved safety profiles, and even multi-targeting capabilities. These innovations have resulted in the successful clinical translation of therapies that are transforming cancer care paradigms.

Key Market Restraint: High Cost of Monoclonal Antibody Therapies

A significant restraint hampering broader adoption is the high cost associated with monoclonal antibody-based cancer therapies. For instance, therapies like Trastuzumab and Nivolumab can cost thousands of dollars per dose, with full treatment courses running into tens of thousands. These high costs are attributed to complex manufacturing processes, stringent quality control, and prolonged R&D timelines. For healthcare systems in low- and middle-income countries, this often results in limited accessibility or complete unavailability. Moreover, even in developed nations, insurance coverage disparities can pose hurdles for patients. As healthcare expenditure pressures mount globally, pricing debates around biologics and biosimilars are intensifying, challenging market players to justify value through outcomes-based pricing models.

Key Market Opportunity: Growth in Personalized Oncology and Biomarker-driven Therapies

A transformative opportunity lies in the integration of monoclonal antibodies with personalized medicine. Increasingly, monoclonal antibodies are being developed in tandem with biomarker diagnostics that help identify patients most likely to respond positively. For example, HER2 testing in breast cancer helps clinicians decide on the administration of Trastuzumab. Similarly, PD-L1 expression guides the use of immune checkpoint inhibitors like Pembrolizumab. As genomic profiling becomes more accessible, companies are capitalizing on molecular tumor signatures to create tailored antibody treatments. This not only improves patient outcomes but also enhances cost-efficiency by avoiding ineffective treatments. With rising adoption of next-generation sequencing (NGS) and liquid biopsy platforms, personalized monoclonal antibody therapies will likely become the standard in precision oncology.

Segments Insights:

Type Insights

Humanized monoclonal antibodies dominated the market in 2024, driven by their reduced immunogenicity and broader therapeutic application. Humanized antibodies, such as Trastuzumab and Bevacizumab, have shown remarkable efficacy in breast and colorectal cancer, respectively. These antibodies retain the specificity of their murine origin but are modified to be over 90% human, significantly lowering adverse immune reactions. The popularity of humanized antibodies is further supported by their inclusion in several treatment regimens and clinical guidelines across cancer types. Their adaptability and relatively established production processes also make them more commercially viable for developers compared to murine or fully chimeric types.

Human monoclonal antibodies are projected to be the fastest-growing segment during the forecast period, owing to their exceptional safety profiles and improved tolerance. Products like Pembrolizumab and Nivolumab—entirely human in origin—represent the vanguard of immuno-oncology therapies. These antibodies, created through recombinant DNA technology or phage display, are at the forefront of treating hard-to-target malignancies like melanoma and non-small cell lung cancer (NSCLC). Their success has also spurred a wave of biosimilar development and clinical trials exploring novel indications. As developers increasingly shift toward patient-centric, next-generation biologics, the growth trajectory of fully human mAbs is set to accelerate.

Application Insights

Breast cancer accounted for the highest revenue share in 2024, largely due to the widespread use of Trastuzumab, Pertuzumab, and other HER2-targeted therapies. These drugs have revolutionized breast cancer management, especially in HER2-positive subtypes, improving survival outcomes significantly. Beyond these, newer agents such as Trastuzumab deruxtecan (Enhertu) have pushed the boundaries of efficacy in metastatic settings. The robust diagnostic ecosystem, patient awareness, and inclusion in multiple lines of therapy ensure that breast cancer remains a key application area for monoclonal antibodies.

Lung cancer is emerging as the fastest-growing application area, with monoclonal antibodies like Nivolumab, Durvalumab, and Atezolizumab being integrated into both first-line and second-line settings. Non-small cell lung cancer (NSCLC), which accounts for the majority of lung cancer cases, has seen a paradigm shift from chemotherapy to immunotherapy. These mAbs target PD-1/PD-L1 checkpoints, restoring T-cell functionality to combat tumor progression. As smoking-related cancers remain prevalent and molecular subtyping improves, lung cancer represents a major opportunity for further mAb-driven innovation.

End-user Insights

Hospitals constituted the largest end-user segment in 2023, as they are the primary settings for cancer diagnosis, treatment administration, and clinical trial enrollment. Most monoclonal antibody therapies require intravenous infusion and intensive patient monitoring, services that are largely hospital-based. Hospitals also house multidisciplinary teams that ensure appropriate treatment planning, making them central hubs in oncology care delivery. Additionally, large hospitals are often the first adopters of newly approved therapies due to their research affiliations and advanced pharmacy infrastructure.

Research institutes are expected to register the highest growth among end-users, driven by increasing academic-industry collaborations, government funding, and the proliferation of early-phase clinical trials. Leading institutes, such as Dana-Farber Cancer Institute and MD Anderson, are engaged in cutting-edge mAb research, focusing on bispecifics, novel antigen targets, and combination therapies. The growing importance of translational research—linking lab discoveries with clinical applications—is cementing the role of research institutions in shaping the future of cancer monoclonal antibody therapies.

Regional Insights

North America led the global market in 2024, driven by the presence of leading pharmaceutical companies, advanced clinical trial infrastructure, and strong regulatory frameworks. The U.S. alone accounts for a significant share of global mAb revenues, with institutions like the FDA offering fast-track designations to expedite drug development. Market penetration is high due to strong insurance coverage, awareness campaigns, and wide availability of diagnostic tools that guide mAb usage. Moreover, the region benefits from a robust ecosystem of contract manufacturing organizations (CMOs), CROs, and biotech startups that continually innovate within the space.

Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, fueled by a rapidly growing cancer population, increased healthcare spending, and strategic investments by global pharmaceutical companies. Countries like China, India, and South Korea are enhancing their biotech capabilities, backed by favorable government initiatives. Notably, China’s NMPA (National Medical Products Administration) has accelerated its drug approval process, enabling faster entry of novel cancer therapeutics. Domestic firms like BeiGene and Innovent Biologics are developing homegrown monoclonal antibodies, challenging the global players and expanding access. As affordability and infrastructure improve, Asia-Pacific is set to become a major hub for monoclonal antibody deployment.

Some of the prominent players in the Cancer monoclonal antibodies market include:

- F. Hoffmann-La Roche Ltd.

- Bristol Myers Squibb Co.

- Merck & Co.

- GlaxoSmithKline plc

- Johnson & Johnson

- Amgen, Inc.

- Novartis AG

- AstraZeneca plc

- Eli Lilly and Company

- AbbVie

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cancer monoclonal antibodies market.

Type

- Humanized

- Human

- Chimeric

- Murine

Application

- Blood Cancer

- Breast Cancer

- Lung Cancer

- Melanoma

- Colorectal Cancer

- Liver Cancer

- Others

End-user

- Hospitals

- Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)