CAR T-Cell Therapy Market Size and Growth 2024 to 2033

The global CAR T-Cell therapy market size was valued at USD 9.11 billion in 2023 and is projected to surpass around USD 127.53 billion by 2033, registering a CAGR of 30.2% over the forecast period of 2024 to 2033.

.webp)

CAR T-Cell Therapy Market Key Takeaways

Remarkable success in treating blood cancers, such as acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma (NHL) has increased the adoption of CAR T-cell therapy and is anticipated to boost the industry's growth. CAR T-cell therapy provides a highly targeted treatment that specifically targets cancer cells and leaves the healthy cell unharmed. Such advantages are projected to further fuel growth. The COVID-19 pandemic resulted in a negative impact on the usage and manufacturing of CAR T-cells. It was owing to the management of the therapy and the extensive time required throughout the process, requiring specialized personnel and coordinated work systems, which were hampered during the pandemic.

Additionally, the closing of borders and reduction of transit of people affected the use of CAR T-cell Therapy. Lastly, throughout 2020, access to life-saving drugs was negatively impacted, which curated negative impacts for CAR T-cell therapy recipients. Lastly, the COVID-19 pandemic disrupted many clinical trials, including those for CAR T-cell therapy. This resulted in a reduced number of clinical trial participants and delays in the development of new treatments.

CAR T-cell Therapy represents a strong paradigm treatment shift in the overall cancer treatment approach. The CAR T-cell approach utilizes genetically modified cytotoxic immune T-cells to approach tumor-specific antigens, which helps in durable remissions of relapsed or refractory B-Cell Lymphoma. B-Cell lymphoma is the most common type of malignant lymphoma, and relapsed or refractory lymphoma has shown a higher cause of treatment failure. For instance, as per Cancer Network 2022, diffuse large B-cell lymphoma (DLBCL) holds a significant presence under the category of Non-Hodgkin Lymphoma and approximately 30-40% of the patients develop relapsed/refractory DLBCL during the first 2 years. Thereby, the introduction of CAR T-cell therapy has shown immense promise for cancer treatment, and the side effects of the therapy can be properly managed.

The growing cases of cancer malignancies continue to propel the market for CAR T-cell therapy. Additionally, various product launches and approvals provide significant traction to the market players. CAR T-cell Therapy is immunotherapy using genetically modified T cells to attack cancer cells in the body. The process involves using the patient’s T cells and engineering them to express chimeric antigen receptors (CAR) on the surface. The following CARs are specifically designed to recognize and bind to specific proteins in cancer cells, which in turn triggers the T cells to kill the cancer cells.

Product launches and timely approvals have led to strategic competencies in the utilization of CAR T-cell therapy. For instance, in May 2023, Bristol Myers Squibb received approval for its CD19-directed CAR T-cell therapy, Breyanzi, from the European Commission. The therapy has application in the treatment of diffuse large B-cell lymphoma in adult patients. Similarly, in February 2022, Cltacabtagene autoleucel (Carvykti) for adults suffering from multiple myeloma was approved by the U.S. FDA. The following approval is second in line and provides an alternative for people suffering from multiple myeloma via CAR T-cell therapy.

CAR T-Cell Therapy Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 11.86 Billion |

| Market Size by 2033 | USD 127.53 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 30.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drug Type, By Indication and By End User |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Johnson & Johnson Services, Inc., ALLOGENE THERAPEUTICS, Lonza, Aurora Biopharma, Cartesian Therapeutics, Inc., Novartis, Bristol-Myers Squibb company, Gilead Sciences, Curocell Inc, JW Therapeutics and Others. |

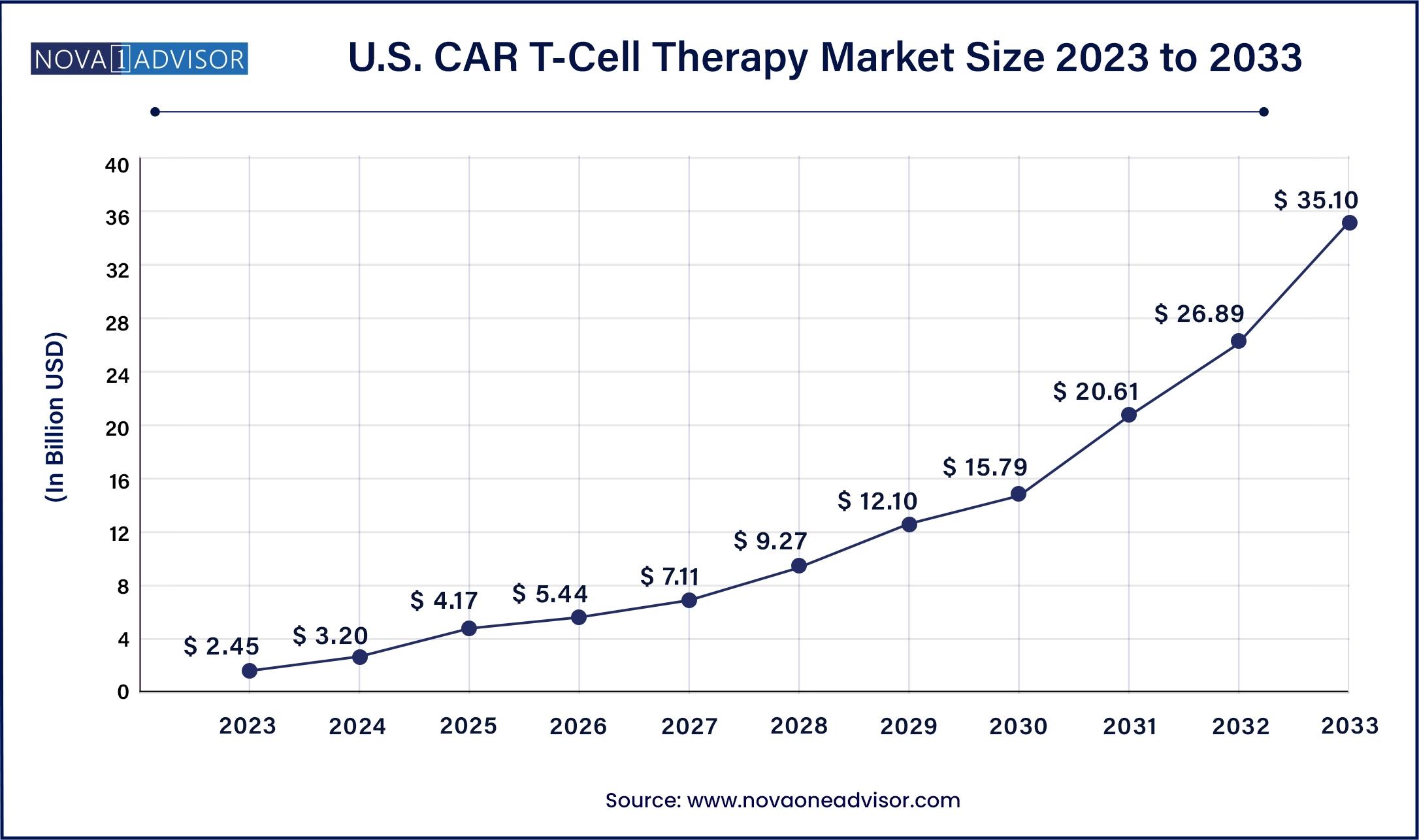

U.S. CAR T-Cell Therapy Market Size, Industry Report, 2033

The U.S. CAR T-Cell therapy market size was valued at USD 2.45 billion in 2023 and is anticipated to reach around USD 35.10 billion by 2033, growing at a CAGR of 30.5% from 2024 to 2033.

North America dominates the CAR T-Cell therapy market owing to the large number of life sciences companies focusing on developing and commercializing CAR T-Cells and advancements in quality control systems in North America.

From 2024 to 2033, the Asia Pacific CAR T-Cell therapy market is expected to multiply. This can be attributed to developing countries with commercial centers, developing business organizations, increased awareness of CAR T-Cell therapy, improved healthcare infrastructure, and increased company investments.

.webp)

The funds and regulatory support from government bodies and regulatory agencies have greatly aided growth. For example, the South Korean government passed the Act on the Safety and Support of Advanced Regenerative Medical Treatment and Medicine in August 2020 to establish a regulatory system for patient safety during quality control and clinical trials and strengthen regulatory support for regenerative medicine development.

CAR T-Cell Therapy Market Dynamics

Drivers

Increased prevalence of cancer

The CAR-T cell therapy market is expanding due to increasing patient assistance programs (PAPs), growing government measures to raise cancer awareness, rising cancer prevalence globally, and robust R&D investments from major companies. As the demand for cell-based therapy grows, manufacturers have begun to invest in its development.

An increase in cancer incidence is estimated to fuel the expansion of the global CAR T-Cell treatment market during the projected period. Cancer is the leading cause of death in the world. Most cancer cases are caused by lifestyle factors such as drinking alcohol and smoking and some dietary components such as nitrites and polyaromatic hydrocarbons.

Another primary driver of the requirement for CAR T-Cell therapy products is the robust product pipeline. For instance, AUTO1, an innovative product from Autolus Therapeutics plc, is undergoing a phase I trial to treat adult acute lymphoblastic leukemia. An investigational cell therapy, AUTO1 containing a CD19 CAR T-Cell, is designed to overcome clinical safety and activity limitations associated with existing CD19 CAR T-Cell therapies.

Opportunities

Rising awareness and increase in approval of novel medications.

The development of new technology and increasing awareness regarding CAR-T cells generates "armored CARs" that co-express pro-inflammatory cytokine like IL-12 or IL-15. It increases CAR T-Cell proliferation and persistence at the beginning of tumor-mediated immunosuppression.

Restraints

Side effects of CAR-T cell therapy

Like all cancer treatments, CAR T-Cell therapies have serious side effects, such as a mass death of antibody-producing B cells and infections. Cytokine release syndrome (CRS) is one of the most common and severe side effects. T cells release chemical messengers (cytokins) which stimulate and direct immune responses as part of immune-related duties.

In the case of CRS, the infused T cells flood the bloodstream with cytokines, resulting in serious side effects such as highly elevated fevers and sudden drops in blood pressure. Severe CRS can be fatal in some cases. Another primary concern with CAR T-Cell therapies is neurologic side effects such as extreme confusion, seizure-like activity, and impaired speech. The exact cause of these neurologic side effects (immune effector cell-associated neurotoxicity syndrome, or ICANS) is unknown.

Impact of Covid-19:

The coronavirus pandemic has significantly impacted the administration of adoptive cell treatments, particularly CAR T-Cell therapy. The decline in the transportation of human organs, border closures, and population confinement disrupted supply networks for these critical medicines. As a result of the ongoing pandemic, the market for CAR T-Cell treatment is expected to grow more slowly.

While stakeholders in the CAR T-Cell therapy industry are stepping up efforts to ensure treatment continuity, hospitals have been forced to change their typical workflows to deal with hospitalized patients' saturation of health services. This situation affects patients with relapsed/refractory hematologic malignancies the most.

Furthermore, the rapid expansion of telemedicine services will drive market growth. Telemedicine promotes early intervention of tocilizumab-based neurotoxicity or cytokine release syndrome and prophylactic/preventive infection.

CAR T-Cell Therapy Market By Drug Type Insights

Based on drug type in the global CAR T-Cell therapy market was dominated by axicabtagene ciloleucel in 2023, and this trend is predicted to continue throughout the coming years. Yescarta is a medication that contains the active ingredient axicabtagene ciloleucel. The need for Yescarta in treating diffuse large B-cell lymphoma and follicular lymphoma is expected to drive segment growth during the estimated period.

In terms of growth rate, tisagenlecleucel is expected to be the fastest segment between 2024 and 2033. An increased need for Kymriah for acute lymphoblastic lymphoma therapy and product approval in various countries drives the segment expansion. It is also approved for adult patients with diffuse large B-cell lymphoma (DLBCL), high-grade B-cell lymphoma, and DLBCL arising from follicular lymphoma.

CAR T-Cell Therapy Market Revenue, By Drug Type, 2020 to 2023 (US$ Million)

| Drug Type | 2020 | 2021 | 2022 | 2023 |

| Axicabtagene Ciloleucel | 321.2 | 542.5 | 1,118.3 | 2,472.3 |

| Tisagenlecleucel | 279.8 | 471.9 | 971.1 | 2,143.5 |

| Brexucabtagene Autoleucel | 232.2 | 393.7 | 814.8 | 1,808.5 |

| Others | 270.2 | 452.0 | 922.8 | 2,020.3 |

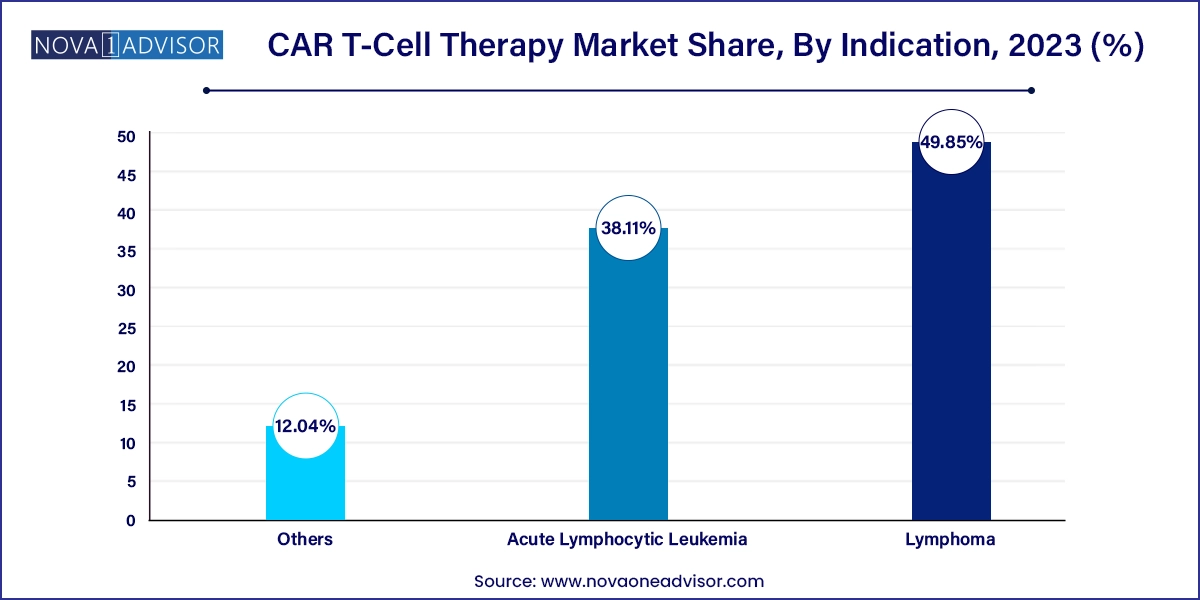

CAR T-Cell Therapy Market By Indication Insights

Based on indication, the worldwide CAR T-Cell therapy industry has been segmented into lymphoma, acute lymphocytic leukemia, chronic lymphocytic leukemia (CLL), multiple myeloma (MM), and others. The lymphoma segment dominates the market and is estimated to grow during the projected period due to an increase in non-Hodgkin lymphoma cases.

According to WHO, approximately 544,352 new non-Hodgkin lymphoma cases were recorded globally in 2020. Furthermore, the growing geriatric population, which is more susceptible to such ailments, is propelling segment growth.

The acute lymphocytic leukemia segment is anticipated to grow the fastest due to increased awareness of CAR-T cell therapeutics for treating acute leukemia and the anticipated introduction of these drugs for treating acute lymphoblastic leukemia involving blood cell cancer testing. Along with this, key factors expected to drive the segment growth are an increase in Acute Lymphoblastic Leukemia (ALL) and initiatives undertaken by public and private organizations.

Technological advancements for detecting affected cells are also regarded as one of the market's growth drivers. For instance, Novartis AG's Chimeric Antigen Receptor (CAR)-T cell therapy is a cutting-edge treatment. This therapy is in phase II clinical trials and is anticipated to be approved by the FDA.

CAR T-Cell Therapy Market Revenue, By Indication, 2020 to 2023 (US$ Million)

| Indication | 2020 | 2021 | 2022 | 2023 |

| Lymphoma | 545.7 | 917.1 | 1,881.0 | 4,137.9 |

| Acute Lymphocytic Leukemia | 415.7 | 703.8 | 1,454.4 | 3,223.1 |

| Others | 142.0 | 239.1 | 491.6 | 1,083.6 |

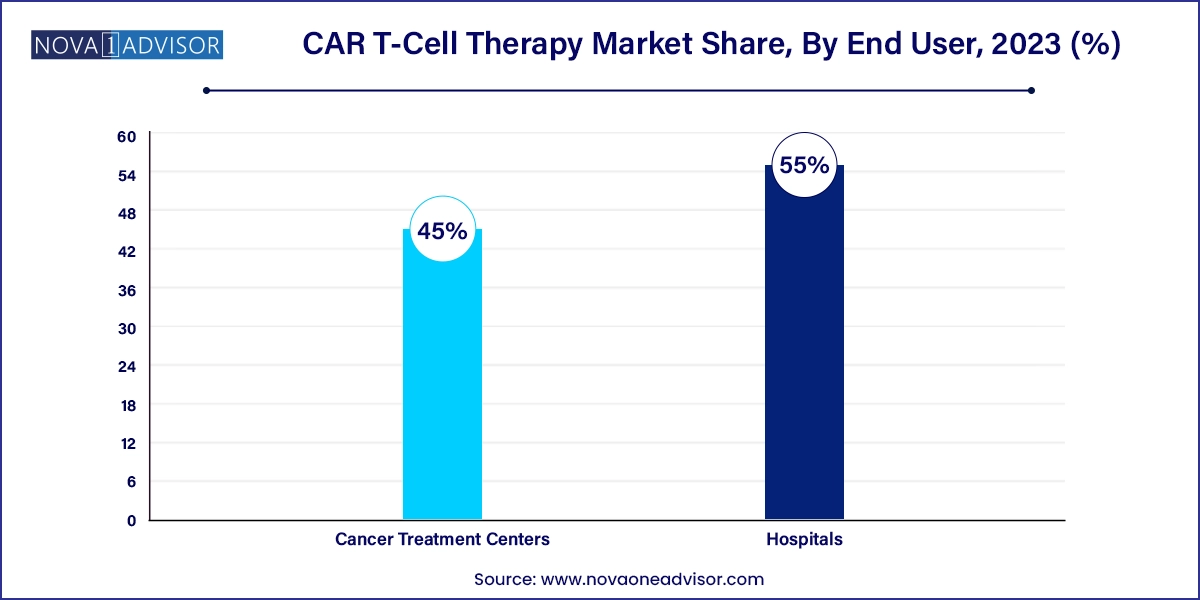

CAR T-Cell Therapy Market By End User Insights

The global CAR T-Cell therapy market is categorized into cancer treatment centers and hospitals based on end-users. The hospital segment led the market and generated more than 55.58% revenue share in revenue in 2023, and this development is projected to continue during the anticipated period. Hospitalization for cancer therapy is expected to drive hospital growth. The increased application of CAR T-Cell therapy in cancer treatment also promotes the segment's large market share. The segment is being accelerated by an increased number of cancer patients seeking treatment in hospitals.

The cancer treatment center segment is anticipated to witness the highest CAGR during the predicted period due to the availability of an extensive range of treatment choices and the rise in cancer centers in some developing countries. The growing global oncology burden caused by increased alcohol and tobacco consumption propels the segment forward. In the report GLOBOCAN, the International Agency for Research on Cancer (IARC) stated that approximately 19.3 million new cancer cases and about 10 million cancer-related deaths were recorded globally in 2020.

CAR T-Cell Therapy Market Revenue, By End User, 2020 to 2023 (US$ Million)

| End User | 2020 | 2021 | 2022 | 2023 |

| Hospitals | 591.7 | 1,003.3 | 2,076.4 | 4,608.8 |

| Cancer Treatment Centers | 511.7 | 856.7 | 1,750.6 | 3,835.8 |

CAR T-Cell Therapy Market Recent Developments

CAR T-Cell Therapy Market Top Key Companies:

CAR T-Cell Therapy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the CAR T-Cell Therapy market.

By Drug Type

By Indication

By End User

By Region