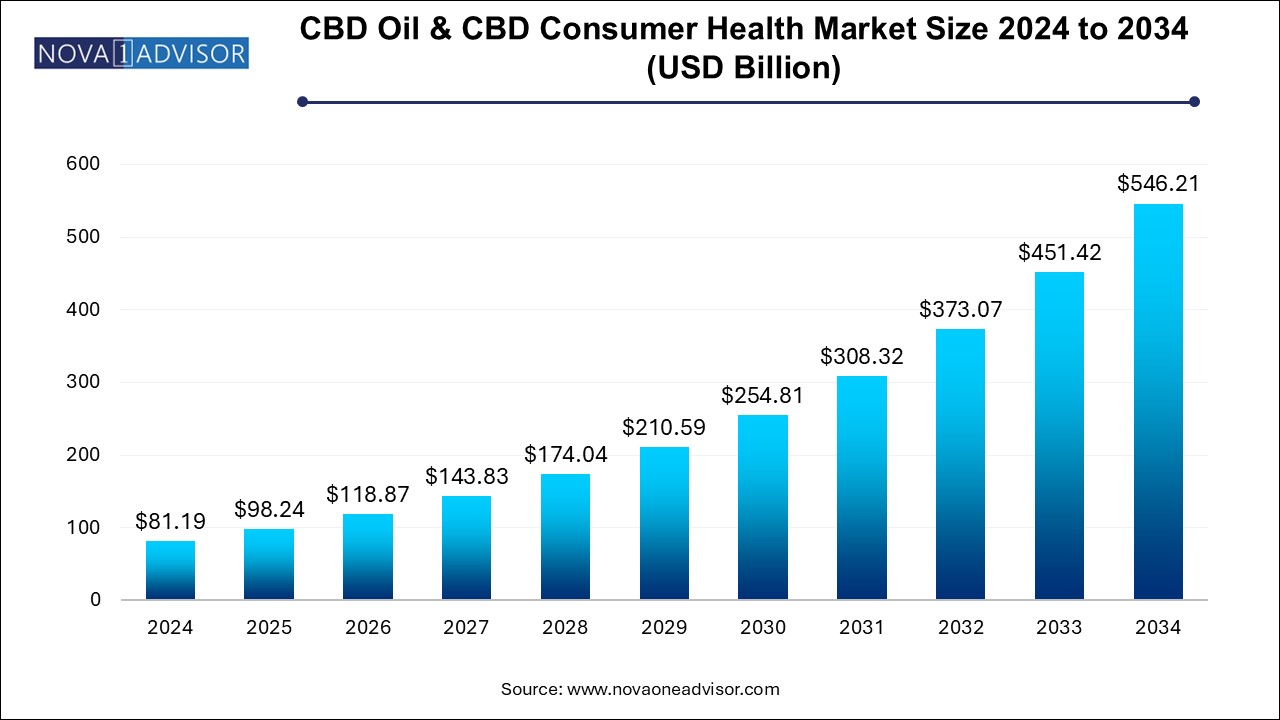

The CBD oil & CBD consumer health market size was exhibited at USD 81.19 billion in 2024 and is projected to hit around USD 546.21 billion by 2034, growing at a CAGR of 21.0% during the forecast period 2025 to 2034.

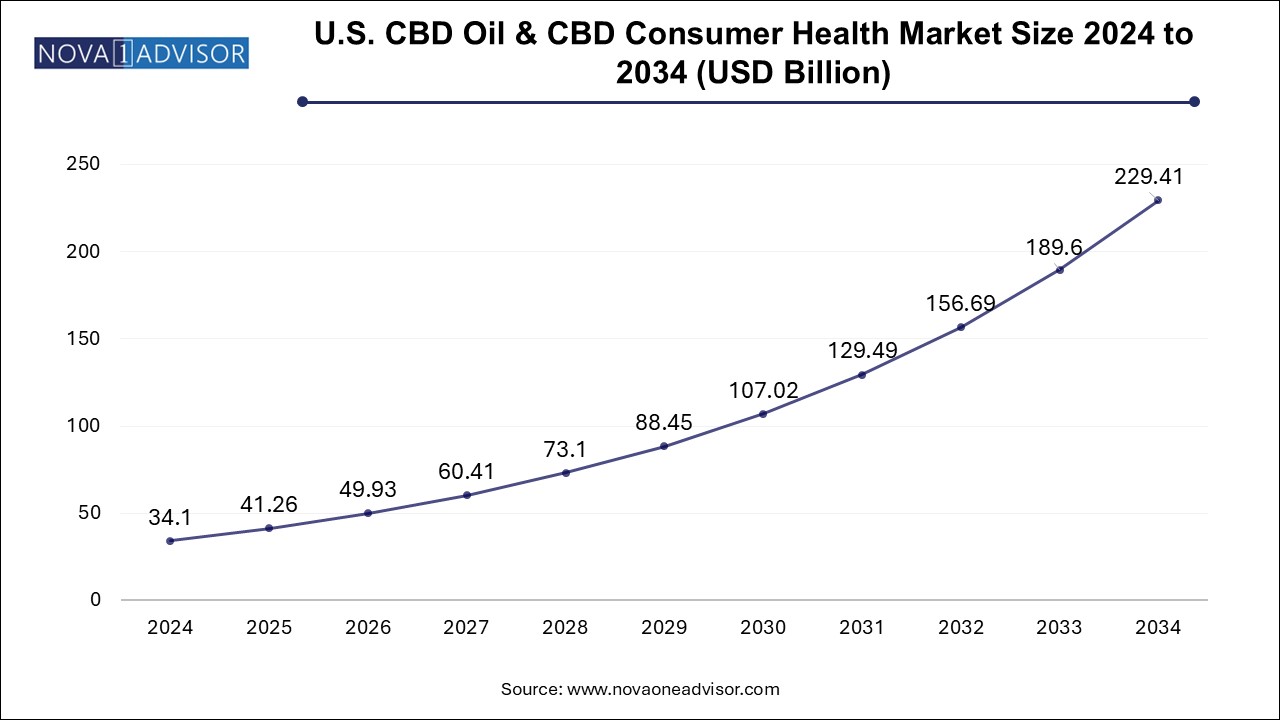

The U.S. CBD oil & CBD consumer health market size is evaluated at USD 34.1 billion in 2024 and is projected to be worth around USD 229.41 billion by 2034, growing at a CAGR of 18.92% from 2025 to 2034.

North America leads the global CBD oil and consumer health market, primarily driven by the United States and Canada. The U.S. Farm Bill of 2018 catalyzed exponential growth by legalizing hemp-derived CBD, unleashing a flood of investments, product launches, and retail expansions. A strong wellness culture, rising mental health awareness, and wide-ranging e-commerce availability continue to fuel consumer interest. The presence of key players, supportive distribution networks, and progressive state-level laws support North America's leadership.

Moreover, U.S.-based companies are pioneering R&D in synthetic CBD and expanding clinical trials for novel therapeutics. Canada’s legal recreational cannabis market also facilitates the development of CBD-based edibles, topicals, and pharmaceuticals, supported by a robust regulatory framework. The region's mature retail infrastructure—ranging from Whole Foods to Walgreens—ensures product availability across all consumer touchpoints.

Asia Pacific is emerging as the fastest-growing region in the CBD market, driven by evolving regulatory frameworks, rising healthcare needs, and growing middle-class wellness aspirations. Countries such as Japan, South Korea, Thailand, and Australia are gradually legalizing or relaxing restrictions on hemp-derived CBD, creating entry points for international and regional players. For instance, Thailand’s recent allowance for CBD use in food and cosmetics has opened up a large market with traditional herbal synergy.

Rapid urbanization, increasing mental health challenges, and a preference for plant-based traditional medicines create fertile ground for CBD integration. Asia Pacific’s burgeoning e-commerce sector allows direct-to-consumer sales, while localized brands are introducing culturally tailored formulations. As clinical research and consumer education improve, the region is expected to play a pivotal role in global CBD market expansion over the next decade.

The CBD Oil and CBD Consumer Health Market has rapidly transitioned from niche wellness to mainstream health and therapeutic applications, catalyzed by evolving legal frameworks, growing scientific validation, and a surging consumer demand for natural alternatives to conventional pharmaceutical and cosmetic products. Cannabidiol (CBD), a non-psychoactive compound derived from hemp or cannabis, has gained remarkable traction across several consumer health verticals due to its perceived benefits in managing pain, anxiety, sleep disorders, inflammation, dermatological issues, and general well-being.

As governments globally revise cannabis-related legislation and decriminalize or legalize hemp-derived products, new pathways are opening for product innovation and commercialization. The dual focus of the market—CBD Oil and CBD Consumer Health—reflects this dynamic transformation. CBD oil, available as isolate, full-spectrum, or synthetic formulations, remains a cornerstone of this market, while CBD-infused consumer health products are expanding across medical over-the-counter (OTC) categories, nutraceuticals, skincare, mental health, and food & beverages.

The convergence of health-conscious consumerism, wellness lifestyles, and integrative medicine is fueling this market’s upward trajectory. Strategic collaborations between pharmaceutical companies, cosmetic brands, and wellness startups, coupled with the surge in e-commerce and retail penetration, are propelling market visibility and accessibility. Despite regulatory ambiguities in some regions, rising public acceptance and scientific advancements are expected to underpin a steady global market growth trajectory through 2034.

Expansion of CBD-Infused Skincare and Beauty Products in Premium and Mass Segments

Emergence of Synthetic CBD for Scalable and Controlled Therapeutic Applications

Growing Interest in CBD for Mental Health Management and Sleep Aids

Integration of CBD into Functional Beverages and Clean-Label Nutraceuticals

Rise in Physician-Endorsed Medical OTC Products Featuring Cannabidiol

Development of Standardized Dosage Forms Like Softgels, Oral Sprays, and Capsules

Increased R&D for Personalized CBD Therapeutics Based on Genetic and Metabolic Profiling

Retail Expansion into Pharmacies, Wellness Chains, and Online Direct-to-Consumer Platforms

Partnerships Between Pharma and Cannabis Tech Firms to Explore New Delivery Systems

Regulatory Milestones in North America and Europe Supporting Market Formalization

| Report Coverage | Details |

| Market Size in 2025 | USD 98.24 Billion |

| Market Size by 2034 | USD 546.21 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 21.0% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | CVSciences, Inc.; Medical Marijuana, Inc.; Charlotte’s Web; ENDOCA; Isodiol International Inc; Elixinol; NuLeaf Naturals, LLC; Joy Organics; Kazmira; Lord Jones; AURORA CANNABIS INC.; Canopy Growth Corporation |

The strongest driver of the CBD oil and consumer health market is the rising global consumer preference for natural, plant-derived therapeutic and wellness products. In an age where preventive health and lifestyle wellness are becoming dominant paradigms, CBD is perceived as a safer, more holistic alternative to synthetic medications—particularly in managing chronic pain, stress, and sleep disorders.

Consumers today are highly educated and proactive about the contents of their supplements, topical treatments, and personal care items. CBD's non-intoxicating properties, coupled with a mounting body of anecdotal and clinical evidence supporting its efficacy, have made it a preferred ingredient in self-care regimens. The plant-based movement and clean-label trend are further reinforcing CBD's integration into wellness routines. This shift is evident across generations—from Gen Z and Millennials seeking mental wellness solutions to Baby Boomers using CBD for arthritis and joint pain—fueling consistent product adoption globally.

Despite promising market potential, a significant restraint impeding growth is the fragmented and inconsistent regulatory landscape governing CBD production, distribution, and marketing. While some countries and U.S. states have embraced clear policies supporting hemp-derived CBD, others maintain ambiguous or restrictive laws, leading to confusion among producers, retailers, and consumers.

Regulatory uncertainty affects everything from labeling requirements and permissible THC content to claims about health benefits. For example, while the U.S. FDA allows CBD in certain prescription medications (like Epidiolex), it has yet to fully approve its use in dietary supplements and food products. Similarly, in Europe, differences between member states’ interpretations of Novel Food Regulations hinder unified market access. These inconsistencies increase compliance burdens, discourage investment, and complicate cross-border product launches, creating significant barriers for global market harmonization.

A high-impact opportunity in the CBD market lies in the integration of cannabidiol into regulated pharmaceutical and clinical care pathways. As scientific studies continue to validate CBD's anti-inflammatory, neuroprotective, and analgesic properties, pharmaceutical companies are investing in cannabinoid-based drug development for conditions such as epilepsy, multiple sclerosis, PTSD, and cancer-related symptoms.

Synthetic and purified CBD, in particular, is gaining attention for its consistent potency, lack of contaminants, and scalability—key attributes in pharmaceutical applications. Beyond prescription drugs, there is growing potential for CBD to be included in physician-endorsed OTC remedies, such as analgesics, anti-anxiety supplements, and dermatology therapeutics. The combination of CBD with complementary ingredients—like melatonin for sleep or turmeric for inflammation—offers further potential for innovative, high-margin therapeutic formulations.

CBD consumer health products dominated the market and accounted for a share of 56.0% in 2024, broad consumer recognition, and foundational role across therapeutic and wellness applications. Within this segment, CBD isolate—the purest form devoid of THC—remains popular among consumers seeking targeted, legal-use assurance. However, full-spectrum and synthetic CBD are gaining ground due to their synergistic effects (entourage effect) and scalable production, respectively. CBD oil is widely used in standalone tinctures, blended topicals, and as a base for infused products, serving as a bridge between raw materials and end-user categories.

CBD oil products are expected to grow at the fastest CAGR of 20.9% over the forecast period. These include functional food & beverages, OTC medications, nutraceuticals, personal care, and cosmetics. Innovations in delivery forms, such as nanoemulsions and oral sprays, are increasing bioavailability and consumer convenience. As brand competition intensifies, companies are investing in branding, flavor enhancements, and targeted benefits (e.g., “CBD for Focus” or “CBD for Recovery”), further boosting market dynamism.

March 2025: Charlotte’s Web Holdings launched a new line of CBD-infused sleep aids combining melatonin and botanical adaptogens to target insomnia and jet lag.

February 2025: Canopy Growth and GSK Consumer Health announced a joint venture to develop OTC CBD analgesics and dermatology products, targeting U.S. and European markets.

January 2025: Elixinol Wellness expanded its product line in Asia with CBD-infused skincare and haircare products tailored for humid climates and sensitive skin.

December 2024: Aurora Cannabis Inc. received regulatory approval in Germany for a new synthetic CBD formulation intended for neuropathic pain treatment.

November 2024: CV Sciences Inc. introduced a line of CBD-infused sports nutrition supplements, including protein powder and recovery gels, distributed through health stores and gyms.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the CBD oil & CBD consumer health market

By Product

By Regional