The cell analysis market size was exhibited at USD 31.18 billion in 2024 and is projected to hit around USD 80.14 billion by 2034, growing at a CAGR of 9.9% during the forecast period 2024 to 2034.

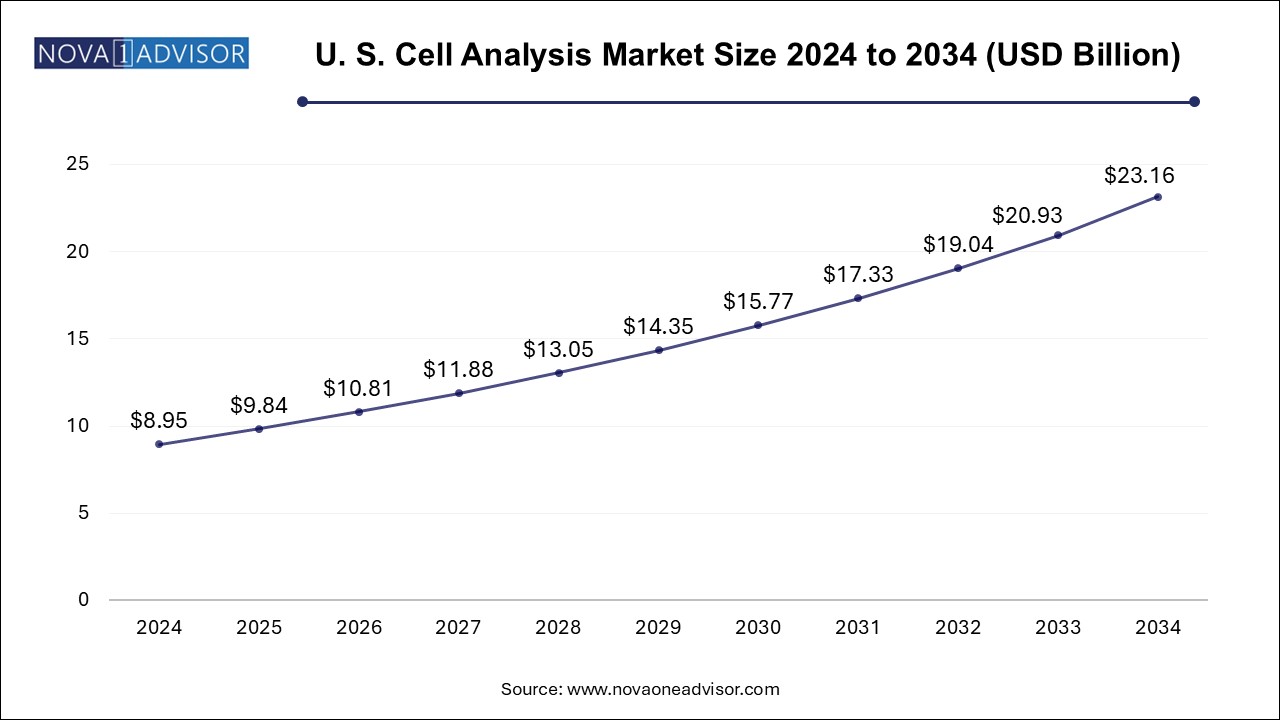

The U.S. cell analysis market size is evaluated at USD 8.95 billion in 2024 and is projected to be worth around USD 23.16 billion by 2034, growing at a CAGR of 8.95% from 2024 to 2034.

North America dominates the global cell analysis market, primarily due to its advanced healthcare infrastructure, large pharmaceutical base, and extensive R&D investments. The United States alone contributes a major share, with the presence of industry leaders, renowned research institutions, and substantial funding from organizations like NIH and FDA. The region is also an early adopter of technologies such as single-cell sequencing, AI-powered imaging platforms, and flow cytometry systems.

The strong presence of clinical laboratories and regulatory clarity for diagnostics and research tools further boosts adoption. Moreover, strategic collaborations between biotech startups and academic institutions in the U.S. and Canada are fostering innovation pipelines and commercial success, maintaining the region’s leadership status.

Asia Pacific is expected to be the fastest growing region, driven by rising investments in life sciences, expanding pharmaceutical R&D, and improving healthcare access. Countries like China, India, South Korea, and Japan are aggressively funding biotech innovation and developing local manufacturing capabilities. Government programs such as China’s “Made in China 2025” and Japan’s regenerative medicine initiatives have prioritized cellular research and product development.

Increasing clinical trials, rising incidence of chronic diseases, and growing adoption of personalized medicine across urban centers in Asia are pushing the demand for advanced cell analysis tools. In parallel, international companies are partnering with local players to penetrate the region’s vast and diverse market, making Asia Pacific a focal point for global expansion strategies.

The Cell Analysis Market is at the forefront of modern biological discovery and therapeutic development, offering vital insights into cell structure, behavior, function, and interactions. The global landscape of cell analysis is evolving rapidly as technological advances merge with the ever-expanding demands of genomics, proteomics, and personalized medicine. From deciphering cancer pathways to evaluating immune responses and stem cell behaviors, cell analysis tools are now indispensable across a wide array of applications.

Cell analysis comprises a broad spectrum of techniques and platforms, including flow cytometry, PCR, microscopy, spectrophotometry, and high-content screening, among others. These tools are used to perform essential processes such as cell viability testing, proliferation studies, cell signaling pathway analysis, and single-cell profiling. The increasing complexity of biological systems being studied—especially in the context of immunotherapy, gene therapy, and regenerative medicine—has dramatically increased the need for high-throughput and highly sensitive cell analysis solutions.

Additionally, the surge in chronic diseases, notably cancer, autoimmune conditions, and infectious diseases, has placed pressure on researchers and healthcare providers to gain faster and more precise cellular insights. This, coupled with rapid growth in clinical trials, has escalated demand for high-resolution cell analytics. The COVID-19 pandemic further highlighted the value of robust cellular analysis capabilities for vaccine development, diagnostic innovation, and immune monitoring.

The future of the market is being shaped by the convergence of automation, AI-powered analytics, single-cell technology, and integration with multi-omics platforms. These advancements are enabling researchers to analyze vast datasets and achieve cellular-level resolution, which is critical in unraveling disease mechanisms and identifying new drug targets. As healthcare systems globally transition toward personalized and precision-based models, the cell analysis market is expected to witness sustained double-digit growth through 2034.

Proliferation of single-cell analysis technologies to address cellular heterogeneity in cancer and immune research.

Integration of AI and machine learning into cell imaging and data interpretation platforms to improve accuracy and throughput.

Increasing use of flow cytometry and high-content screening in immuno-oncology and drug development pipelines.

Adoption of label-free technologies and real-time live-cell imaging for non-invasive monitoring of cellular events.

Growth in reagent and consumables demand due to recurring use in assays, diagnostics, and research studies.

Cloud-based and remote-access software solutions facilitating decentralized laboratory operations and real-time collaboration.

Rising demand for cell-based assays in toxicology testing as an alternative to animal testing.

Expansion of academic-industry research collaborations to accelerate translational cell biology studies.

Customization of instruments and software platforms for niche applications in neuroscience, hematology, and stem cell research.

| Report Coverage | Details |

| Market Size in 2025 | USD 34.27 Billion |

| Market Size by 2034 | USD 80.14 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 9.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product & Service, Technique, Process, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; Danaher; BD; Merck KGaA; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Miltenyl Biotech; Revvity; New England Biolabs; Avantor, Inc. |

A pivotal driver of the cell analysis market is the rapid expansion of cancer research and immunotherapy development. As cancer biology becomes increasingly understood at the cellular and molecular levels, the need for precise, multiparametric cell analysis tools has grown exponentially. Technologies like flow cytometry, PCR, and high-content imaging are essential in identifying immune biomarkers, tracking tumor progression, and evaluating drug efficacy.

Immune checkpoint inhibitors, CAR-T cell therapies, and tumor-infiltrating lymphocyte (TIL) therapies rely heavily on cell analysis to monitor patient response and predict outcomes. For example, flow cytometry enables researchers to quantify CD4+ and CD8+ T-cell populations during therapy. Additionally, single-cell RNA sequencing (scRNA-seq) is becoming standard in profiling tumor heterogeneity. With global investment in oncology drug development expected to exceed $300 billion over the next decade, the demand for cutting-edge cell analysis tools is set to soar.

While technological advancements are expanding the capabilities of cell analysis platforms, the high cost of instruments and associated technical complexity remain significant barriers to wider adoption—particularly in emerging economies and smaller research institutions. High-end tools like flow cytometers, automated microscopy systems, and high-content screeners can cost anywhere from $100,000 to over $1 million, often excluding the recurring costs of reagents, maintenance, and software licenses.

Moreover, operating these instruments requires specialized training and expertise, making it difficult for labs with limited human resources to implement them effectively. These challenges are further amplified in clinical settings where fast turnaround times are critical, but trained cytometrists or bioinformatics professionals may be in short supply. While innovations are addressing ease-of-use and automation, cost-related challenges will continue to restrict market penetration in certain regions.

One of the most promising opportunities in the cell analysis space is the increasing integration of single-cell technologies into precision medicine and personalized therapeutic strategies. Single-cell analysis allows scientists to investigate the genetic and phenotypic diversity of individual cells—critical for understanding heterogeneous diseases like cancer, autoimmune disorders, and neurodegenerative conditions.

This technology is driving breakthroughs in biomarker discovery, drug resistance mechanisms, and developmental biology. Companies are launching commercial kits and platforms that simplify single-cell sequencing, transcriptomics, and epigenomics, making them accessible to a broader base of researchers. Moreover, combining single-cell data with AI-driven analytics and CRISPR-based screening is opening new dimensions in cellular research. As healthcare systems move toward patient-specific interventions, single-cell platforms will play a crucial role in diagnostics, drug matching, and real-time disease monitoring, fueling growth across both academic and clinical end-users.

The reagents & consumables segment dominated the market with the largest revenue share of 49.0% in 2024. These include dyes, antibodies, buffers, enzymes, cell culture media, and assay kits—essential for nearly every cell analysis workflow. Their recurring nature ensures a steady revenue stream, especially as more researchers engage in cell viability, proliferation, and interaction studies. The growth in immunoassay development, cytotoxicity studies, and stem cell differentiation protocols is also driving demand for customized reagents and assay kits.

On the other hand, software solutions are the fastest-growing segment, driven by the complexity and volume of data generated in high-throughput studies. Advanced platforms now offer AI-based image analysis, real-time flow cytometry gating, and deep learning algorithms for classifying cell states. Cloud-enabled data sharing, integration with LIMS, and compatibility with multi-omics platforms are features gaining traction. As labs seek to optimize workflows and reduce analysis time, demand for smart, intuitive, and interoperable software tools is expected to rise exponentially.

The flow cytometry segment dominated the market with the largest revenue share in 2024. It is widely used in immunophenotyping, leukemia diagnostics, cell cycle analysis, and apoptosis studies. The versatility of flow cytometers, ranging from basic analyzers to high-throughput sorters, makes them indispensable in both research and clinical laboratories. Newer platforms are integrating spectral cytometry and advanced optics to improve sensitivity and resolution.

The high-content screening segment is expected to witness the fastest growth with a CAGR of 11.21% over the forecast period. High-content screening combines imaging with multiparametric data extraction, enabling deep analysis of cell morphology, protein expression, and intracellular interactions. Meanwhile, single-cell techniques like droplet-based sequencing and imaging cytometry provide insights into cellular heterogeneity and rare cell populations. These approaches are increasingly used in immuno-oncology, developmental biology, and stem cell research, with global demand projected to surge over the next decade..

Cell identification segment dominated the market with the largest revenue share of 4.81% in 2024. due to its foundational importance in toxicology, drug screening, and quality control. From simple dye exclusion assays to more advanced metabolic profiling, viability assays are used in nearly every stage of pharmaceutical development and biological research. Biotech companies and clinical laboratories rely on these tests to assess compound toxicity, stem cell potency, and therapeutic response.

Single-cell analysis is the fastest growing process, driven by its application in uncovering cellular heterogeneity and lineage tracing. The emergence of single-cell transcriptomics, proteomics, and epigenomics platforms is transforming our understanding of complex biological systems. The ability to capture minute changes at the individual cell level holds great promise for identifying disease mechanisms, early biomarkers, and patient-specific treatment pathways.

The pharmaceutical and biotechnology companies segment dominated the market with the largest share of 41.0%. leveraging cell analysis for drug development, target validation, toxicity testing, and biomarker discovery. These firms invest heavily in automation-friendly platforms, high-throughput screening tools, and multiplex assays to accelerate R&D workflows. The rise of cell and gene therapies has further expanded the use of specialized cell analysis techniques in quality control and process monitoring.

Hospitals and clinical testing laboratories are expected to witness the fastest growth over the forecast period. spurred by increased research funding and interest in translational biology. Universities and research hospitals are major contributors to innovations in stem cell science, immunology, and neuroscience—fields heavily reliant on cutting-edge cell analysis tools. Collaborations with industry players and open-access scientific initiatives are empowering these institutions to adopt sophisticated technologies previously limited to commercial enterprises.

February 2025 – BD Biosciences launched a next-generation spectral flow cytometry system with AI-enhanced analytics for multiplex immune profiling.

November 2024 – 10x Genomics introduced an upgraded Chromium X platform enabling ultra-high-throughput single-cell sequencing, enhancing scalability for clinical labs.

September 2024 – Thermo Fisher Scientific unveiled its CellInsight CX9 HCS Platform, combining high-content imaging with automated analysis software optimized for oncology screening.

June 2024 – Bio-Rad Laboratories announced a strategic partnership with Seegene Inc. to integrate PCR-based diagnostics with cell analysis workflows targeting infectious diseases.

April 2024 – Agilent Technologies completed the acquisition of Resolution Bioscience, enhancing its cell-based genomic profiling capabilities for precision oncology.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell analysis market

By Product & Service

By Technique

By Process

By End-use

By Regional