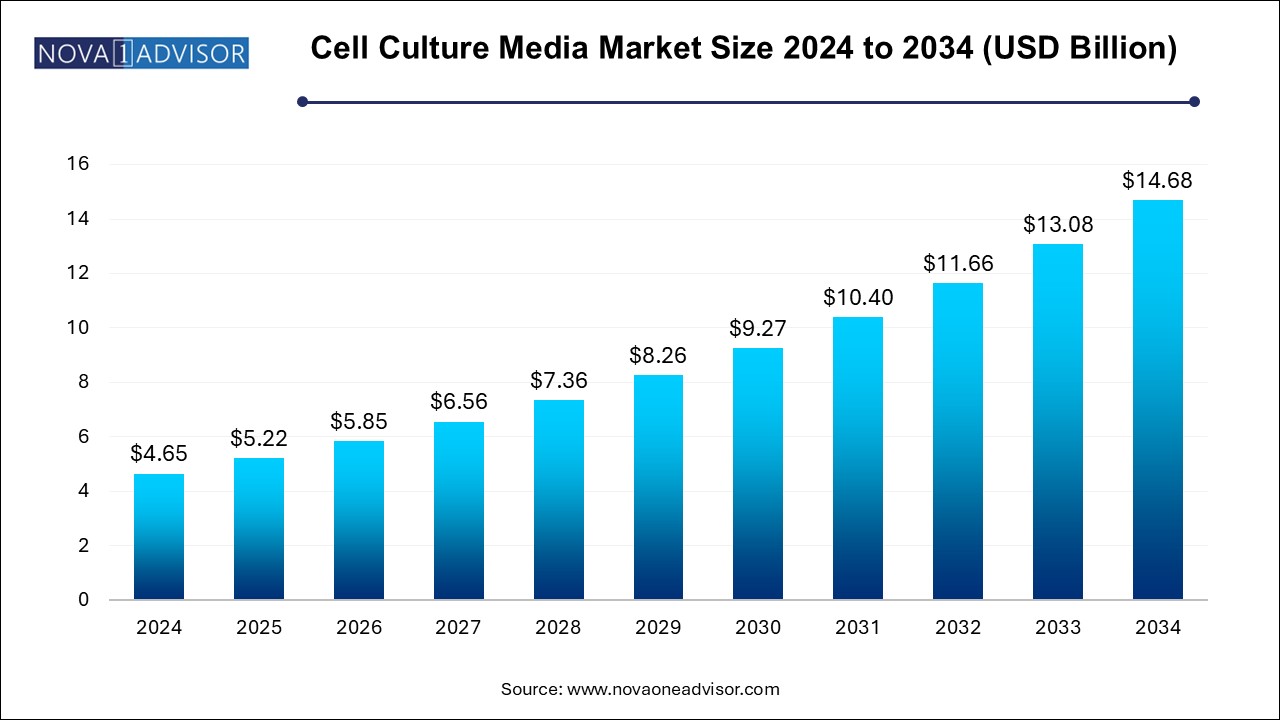

The cell culture media market size was exhibited at USD 4.65 billion in 2024 and is projected to hit around USD 14.68 billion by 2034, growing at a CAGR of 12.18% during the forecast period 2025 to 2034.

The Cell Culture Media Market stands as a pivotal segment within the broader life sciences industry, facilitating critical applications in biotechnology, pharmaceutical R&D, diagnostics, and regenerative medicine. Cell culture media provides the necessary nutrients, growth factors, and environmental conditions required for the in vitro cultivation and maintenance of cells. From vaccine development to gene editing, and from cancer therapeutics to stem cell expansion, the formulation and quality of culture media directly influence experimental outcomes, product efficacy, and cell viability.

With the explosion of biologics, personalized medicine, and advanced therapeutic technologies, the global demand for specialized, high-performance culture media has surged. Researchers and biomanufacturers require precisely defined media that are optimized for specific cell lines like CHO (Chinese Hamster Ovary), HEK 293, Vero, and BHK cells, each with unique nutritional and environmental needs.

The COVID-19 pandemic highlighted the strategic importance of cell culture systems, particularly in vaccine production and antibody screening, prompting emergency expansion of manufacturing capacities across the globe. Furthermore, the rise in stem cell research, cell and gene therapies, and organoid development continues to push the boundaries of media innovation, calling for serum-free, xeno-free, and chemically defined media that ensure consistency, scalability, and regulatory compliance.

As the complexity of cellular applications grows, so too does the diversity of media products, encompassing liquid, semi-solid, and solid formats, tailored for suspension or adherent cell cultures, and built for scalability from benchtop to industrial bioreactors.

Growing demand for chemically defined and xeno-free media to ensure regulatory compliance in therapeutic manufacturing.

Customization of media formulations for specific cell lines and applications, especially in biologics and stem cell research.

Increased use of single-use bioprocess systems, encouraging parallel growth in ready-to-use media formats.

Expansion of 3D cell culture and organoid models, creating demand for advanced media with complex microenvironmental mimicry.

Integration of AI and computational biology in optimizing media compositions for higher productivity and cell viability.

Surging investments in cell and gene therapy, particularly for autologous and allogeneic stem cell expansion.

Shift toward serum-free and animal component-free (ACF) formulations to minimize contamination risks and batch variability.

Strategic collaborations between media manufacturers and biotech firms to accelerate clinical-grade media development.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.22 Billion |

| Market Size by 2034 | USD 14.68 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.18% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Sartorius AG; Danaher; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH |

A major driver of the cell culture media market is the booming biopharmaceutical industry, particularly the rapid expansion in the production of monoclonal antibodies (mAbs), vaccines, and therapeutic proteins. These biologics require robust upstream processing workflows, in which cell culture media play a critical role. CHO cells, the workhorse for mAb production, thrive in media optimized for high yield, longevity, and post-translational fidelity.

The transition toward continuous manufacturing and perfusion-based systems has also increased the demand for high-density culture media capable of supporting long-term cell viability without compromising productivity. Additionally, biosimilar development in emerging markets has created new waves of demand for cost-effective, scalable media solutions. Given the global pipeline of biologics in various stages of development, this driver is expected to remain one of the most influential growth factors.

Despite its central role in bioprocessing and research, the market faces a significant restraint in the cost and complexity of producing specialty and chemically defined media. While traditional serum-based formulations are inexpensive, they carry risks of variability and contamination. In contrast, chemically defined media though reproducible and regulatory-friendly are more expensive due to stringent manufacturing protocols, raw material sourcing, and extensive validation processes.

For small-to-mid-sized research facilities and emerging biotech firms, these costs can be prohibitive, particularly in early-stage R&D when large volumes of media are required for screening and optimization. Additionally, switching from serum-based to chemically defined media often necessitates changes in downstream protocols, training, and infrastructure, creating a barrier to adoption.

A compelling opportunity for market expansion lies in the growing field of cell and gene therapies, which depend heavily on optimized media formulations for the expansion, maintenance, and differentiation of patient-specific or donor-derived cells. Stem cells, T-cells, NK cells, and iPSCs all require tailored nutritional environments that must be free of animal-derived components and compatible with Good Manufacturing Practices (GMP).

Recent advancements in CAR-T cell therapies, autologous stem cell transplantation, and CRISPR-based interventions have spotlighted the need for serum-free, defined media that preserve phenotype and functionality over multiple passages. Media developers that can offer scalable, cGMP-grade, and prevalidated formulations aligned with therapy-specific workflows stand to gain a strong foothold in this burgeoning therapeutic domain.

Serum-free media dominated the product segment, accounting for the largest share owing to its increasing adoption in both research and industrial applications. Serum-free formulations offer greater control over experimental variables, reduce risk of contamination, and are compliant with regulatory requirements, especially in biopharma manufacturing. CHO-specific serum-free media are among the most in-demand, supporting high cell densities and protein yields in antibody production. Similarly, media tailored for HEK 293 or Vero cells are widely used in viral vector and vaccine development.

Meanwhile, chemically defined media is expected to grow at the fastest rate, especially in therapeutic production and stem cell research. These media eliminate the need for animal serum, reducing immunogenicity risks and batch variability—critical for clinical applications. Stem cell culture media, too, are growing in prominence, fueled by global research into regenerative medicine and personalized treatments. Specialty media designed for specific pathways or engineered cells are also gaining attention in high-content screening and tissue modeling.

Biopharmaceutical production remains the leading application, driven by high-volume demands from the production of monoclonal antibodies, recombinant proteins, and vaccines. With the growing prevalence of chronic diseases and the emergence of novel biologics, this segment continues to expand. The scale of operations—from small-scale lab work to industrial bioreactors—requires a wide variety of media formats and formulations, boosting demand across categories.

However, tissue engineering and regenerative medicine applications are growing fastest, supported by increasing clinical trials, regulatory approvals, and funding initiatives. Media that support the maintenance and differentiation of stem cells into specialized tissues (e.g., neural, cardiac, hepatic) are in high demand. Subsegments such as cell and gene therapy are particularly dynamic, requiring tightly controlled, customized media environments for cell expansion and viral transduction.

Liquid media dominate the type segment, owing to their convenience, ease of automation, and suitability for both suspension and adherent cultures. Most laboratories and biomanufacturing facilities rely on pre-prepared liquid formulations to ensure consistency and sterility.

In contrast, semi-solid and solid media are growing in relevance, especially in microbiology, clonogenic assays, and organoid culture. These formats provide spatial organization and are often used in conjunction with scaffolds or hydrogels for 3D culture. Their application in cancer biology, drug screening, and developmental studies supports their growing adoption in research-heavy segments.

Pharmaceutical and biotechnology companies are the primary end-users, utilizing cell culture media at scale for biologics development, cell therapy production, and quality control testing. These entities require consistent, validated media that integrate seamlessly with upstream and downstream systems.

Research and academic institutes represent the fastest-growing end-user group, as governments and funding bodies continue to invest in basic and translational research. Media optimized for primary cells, stem cells, and neuronal cultures are particularly popular in academic settings. Diagnostic labs and hospitals also contribute to growth, particularly in applications such as cytogenetics and clinical assay development.

North America leads the global cell culture media market, underpinned by a sophisticated biotechnology infrastructure, top-tier research institutions, and a strong regulatory framework for biotherapeutics. The U.S. alone houses hundreds of biopharma companies, including global leaders in monoclonal antibody and vaccine production. Academic institutions such as MIT, Stanford, and the NIH continue to drive innovation, while companies like Thermo Fisher, Corning, and Cytiva supply a robust pipeline of advanced media solutions. The region also benefits from early adoption of synthetic and xeno-free media across clinical and commercial settings.

Asia Pacific is projected to be the fastest-growing region, driven by rising investments in biotechnology, healthcare infrastructure, and contract research manufacturing. China, India, and South Korea are emerging as major players in stem cell research, biologics production, and diagnostics. For example, India’s Biotech Industry Research Assistance Council (BIRAC) and China’s National Stem Cell Research Program have catalyzed the development of GMP-compliant cell therapy hubs. Local and international media suppliers are expanding manufacturing and distribution networks in the region to cater to growing demand across research, pharma, and academic sectors.

In March 2025, Thermo Fisher Scientific launched a new line of Gibco Cell Therapy Systems (CTS) media, tailored for human T-cell expansion in gene therapy applications.

Corning Incorporated introduced a next-generation stem cell culture media kit in February 2025, optimized for mesenchymal stem cell (MSC) proliferation under xeno-free conditions.

Merck KGaA (MilliporeSigma) expanded its media manufacturing capabilities in Singapore in January 2025 to support growing demand from Asia-Pacific biomanufacturers.

Cytiva partnered with Korean biopharma startup GeneX BioTech in December 2024 to co-develop custom serum-free media for CAR-T therapy pipelines.

In November 2024, Lonza Group announced a collaboration with a U.S. academic institute to develop chemically defined organoid culture media for personalized cancer models.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell culture media market

By Product

By Application

By Type

By End-use

By Regional