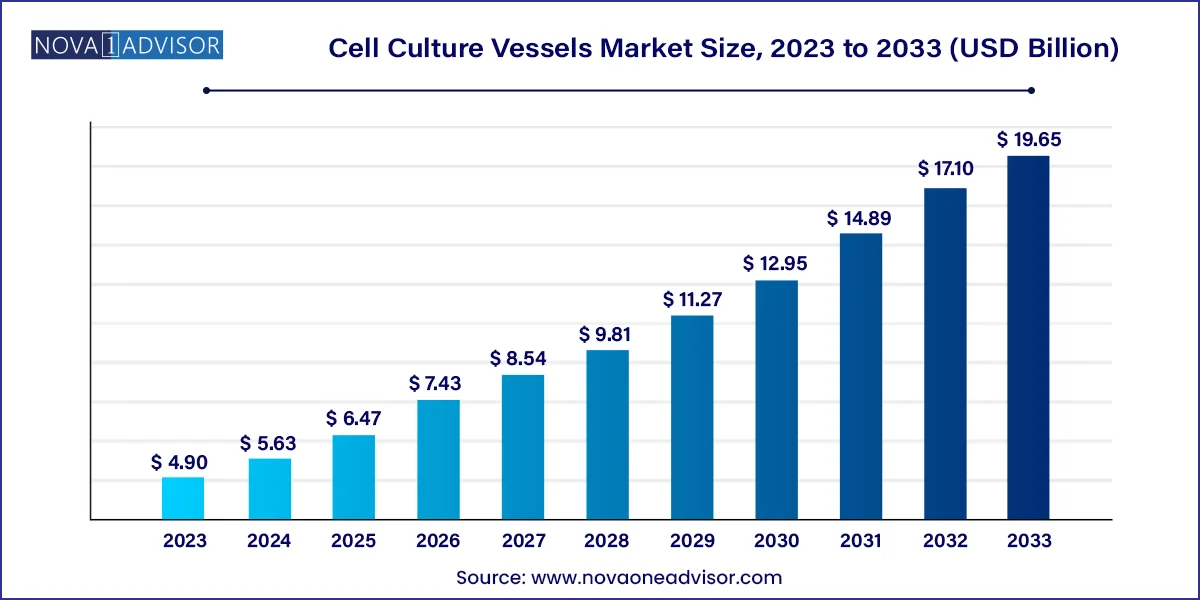

The global cell culture vessels market size was valued at USD 4.90 billion in 2023 and is anticipated to reach around USD 19.65 billion by 2033, growing at a CAGR of 14.9% from 2024 to 2033.

The global cell culture vessels market plays a critical role in the life sciences ecosystem, serving as a foundational component for biological research, drug development, and regenerative medicine. Cell culture vessels are containers specifically designed to support the in vitro growth of cells in a controlled, sterile environment. These vessels enable scientists to replicate physiological conditions and conduct complex biological experiments or large-scale production of cell-derived therapeutics. The market has expanded significantly in recent years, fueled by increasing demand for biologics, stem cell research, cancer biology, and vaccine development.

The application of cell culture technologies is becoming increasingly sophisticated. From monoclonal antibody production to gene therapy and tissue engineering, the growing reliance on cell-based experiments is pushing the need for high-performance, scalable, and contamination-resistant vessels. The rise of personalized medicine and the development of 3D culture systems have also elevated the importance of specialized vessel formats, including spinner flasks, gas-permeable membrane flasks, and flexible culture bags.

As biotechnology and pharmaceutical industries ramp up their R&D spending, the demand for reliable, easy-to-use, and disposable cell culture solutions is accelerating. Academic institutions and contract research organizations (CROs) also form a significant part of the customer base, further expanding the market’s reach. Meanwhile, the COVID-19 pandemic highlighted the critical importance of rapid vaccine development and biologics manufacturing, spotlighting the utility of single-use culture systems and bioprocessing vessels.

Despite the market’s robust trajectory, challenges such as standardization, scalability, and environmental impact of disposables remain areas of concern. Nonetheless, with ongoing innovations in materials science, automation, and bioreactor integration, the cell culture vessels market is poised for strong growth over the next decade.

Shift Toward Single-Use Systems: The biopharmaceutical industry is increasingly adopting disposable vessels to reduce cross-contamination risks and streamline manufacturing workflows.

Advancement of 3D Cell Culture and Organoid Research: Growing interest in 3D cellular models is driving demand for specialized vessels like spinner flasks and scaffold-compatible plates.

Integration with Automated and High-Throughput Systems: Cell culture vessels are now designed to support robotic platforms and real-time monitoring systems.

Sustainability-Driven Material Innovation: Vendors are exploring biodegradable polymers and recycling programs to address the environmental impact of plastic disposables.

Customization and Modular Vessel Design: Flexible vessel configurations that cater to diverse cell types and experiment types are gaining popularity.

Rising Use in Cell and Gene Therapy Manufacturing: The need for precision, sterility, and scalability in regenerative medicine is creating new vessel requirements.

Growing Investment in Biomanufacturing Infrastructure: Expansion of cell culture production facilities is pushing demand for bulk-scale culture containers.

Increased Collaboration Between Manufacturers and Research Institutes: Co-development of advanced vessels tailored to specific research applications is on the rise.

| Report Attribute | Details |

| Market Size in 2024 | USD 5.63 Billion |

| Market Size by 2033 | USD 19.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 14.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, type, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Greiner Bio-One International GmbH; Corning Incorporated; Wilson Wolf; DWK Life Sciences; Cell Culture Company, LLC; VWR International, LLC.; Danaher, Sartorius Stedim Biotech |

Expansion of Biopharmaceutical R&D and Biologics Manufacturing

A major driver propelling the cell culture vessels market is the rapid expansion of biopharmaceutical R&D and the increasing production of biologics. With monoclonal antibodies, vaccines, recombinant proteins, and gene therapies gaining prominence, pharmaceutical companies are investing heavily in upstream bioprocessing infrastructure. Cell-based systems—such as CHO cells and HEK293—form the backbone of these manufacturing processes, necessitating a continuous supply of reliable and scalable culture vessels.

For instance, biologics now constitute more than 40% of drugs in the development pipeline globally. This surge has intensified the demand for vessels that support high-density cultures, enable sterility assurance, and integrate with closed-loop bioreactor systems. The adoption of single-use bioreactors and companion culture vessels has helped improve production speed while minimizing downtime. Moreover, cell culture is not limited to drug production—it is pivotal in early-stage screening, toxicity profiling, and mechanism-of-action studies, making vessels indispensable across multiple stages of drug development.

Environmental Concerns Linked to Disposable Plastic Use

While single-use cell culture vessels offer considerable advantages in terms of sterility and workflow efficiency, they present a significant environmental challenge. The widespread use of disposable plastics in research and manufacturing has contributed to increased biohazard and non-biodegradable waste. Many cell culture products, including flasks, plates, and bags, are made from petroleum-derived polymers like polystyrene, polyethylene, or polypropylene—materials that are not easily recyclable and are often incinerated or landfilled after use.

In regions with stringent environmental regulations, such as the European Union, this issue is particularly pressing. Academic institutions and biotech firms are facing growing pressure to reduce their carbon footprint and adopt sustainable lab practices. However, alternatives such as biodegradable vessels or high-performance reusables are still relatively limited in supply and are often costlier. Thus, the environmental impact of disposable culture systems poses a barrier to sustainable growth and highlights the need for green innovation in this space.

Rising Adoption in Cell and Gene Therapy Manufacturing

A powerful growth opportunity lies in the rapidly expanding field of cell and gene therapy (CGT), which demands highly controlled, sterile, and scalable culture systems. Unlike traditional biomanufacturing that produces proteins, CGT involves cultivating live cells that are directly administered to patients. As such, the sensitivity and complexity of these applications require advanced vessel formats that support precise control over oxygenation, nutrient delivery, and waste removal.

Emerging therapies such as CAR-T cell treatments and ex vivo gene editing have created a demand for vessels that can scale from benchtop to clinical-grade production while maintaining cell viability and genetic integrity. Biotech companies and CDMOs (Contract Development and Manufacturing Organizations) are investing in modular vessel systems that enable closed, automated, and GMP-compliant workflows. As regulatory approvals for advanced therapies increase globally, the need for customizable, high-performance culture vessels in CGT is expected to grow exponentially.

Based on product, the market is segmented into bags, flasks, plates, bottles, and others. The bags segment dominated the market with a share of 40% in 2023 and is anticipated to grow at the fastest CAGR from 2024 to 2033. driven by their rising use in biomanufacturing and clinical production. Single-use bags, such as those used in wave bioreactors, provide a closed system ideal for large-scale suspension culture. They offer several benefits including reduced risk of contamination, faster setup times, and scalability. Additionally, culture bags are increasingly used in stem cell expansion, gene-modified cell processing, and vaccine development due to their high oxygen transfer rates and compatibility with automated systems. Vendors are introducing pre-sterilized, gamma-irradiated bag formats tailored to specific workflows, further propelling growth in this segment.

The flasks segment is expected to register significant CAGR over the forecast period. primarily due to their widespread use in academic laboratories, biopharma R&D, and diagnostic workflows. Among flask types, T-flasks remain the most commonly used vessels for adherent cell culture. Their simple design, ease of handling, and compatibility with a wide range of cell lines make them indispensable for monolayer cultures. Spinner flasks and gas-permeable membrane flasks are also gaining traction for high-density cultures and long-term viability studies, especially in advanced therapeutic applications. These flasks are preferred for their enhanced aeration and adaptability to shaking incubators or perfusion systems.

The single use segment dominated the market with a share of 70.98% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. owing to their ability to minimize contamination, eliminate cleaning and sterilization steps, and streamline workflow in regulated environments. These vessels are particularly valued in clinical-grade production where maintaining sterility and compliance is critical. The proliferation of single-use bioreactors and automated cell processing platforms has led to a corresponding rise in demand for disposable vessels compatible with integrated systems. Additionally, many small- and mid-sized biotechs prefer single-use systems to avoid the capital costs and complexity associated with stainless-steel alternatives.

Reusable vessels are experiencing steady demand, especially in academic and basic research labs that emphasize cost-efficiency. Glass and autoclavable plastic flasks and bottles remain standard for long-term culture of stable cell lines. Reusable vessels are also preferred in situations where temperature control and reusability are critical, such as continuous perfusion cultures or large-scale microbial fermentation. However, the cleaning and sterilization process can be labor-intensive, and the risk of cross-contamination remains a concern in shared research settings.

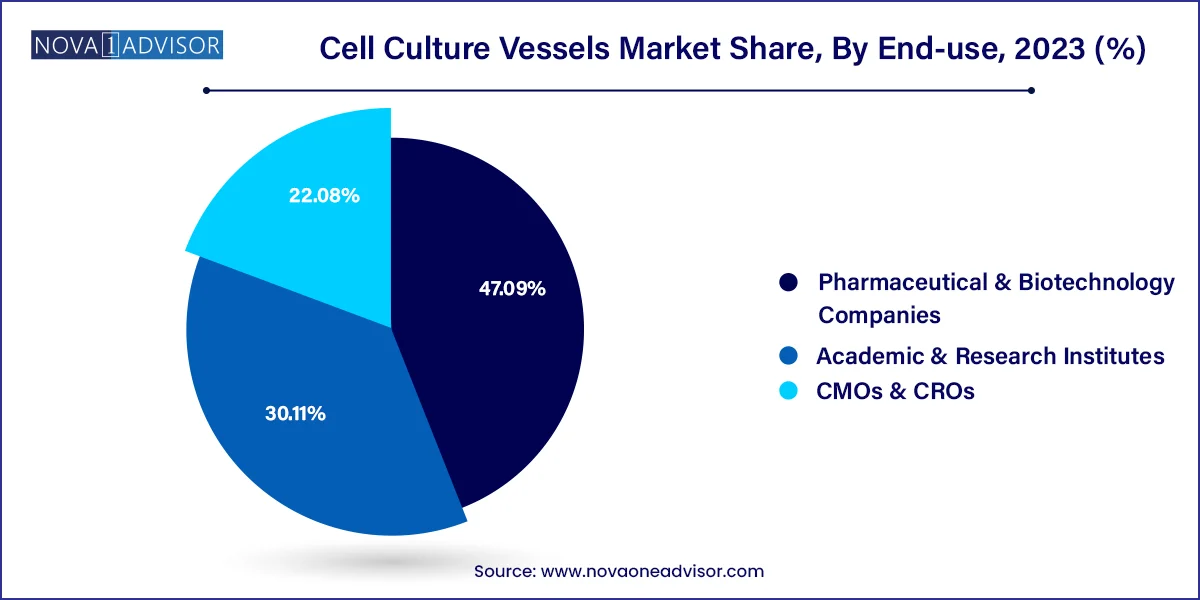

Based on end use, the market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, and CMOs & CROs. The pharmaceutical & biotechnology companies segment dominated the market with a share of 47.09% in 2023. reflecting the growing use of cell culture in biologics production, vaccine development, and drug screening. These companies rely heavily on vessels for upstream cell expansion, viral vector production, and recombinant protein expression. Regulatory compliance, batch traceability, and sterility assurance are key requirements, prompting the adoption of high-quality, validated vessel systems. Furthermore, biopharma firms are investing in scalable vessel solutions to support the transition from lab-scale experiments to commercial manufacturing.

CMOs and CROs are the fastest-growing end-use segment, as outsourcing becomes an integral part of the biopharmaceutical value chain. These organizations require flexible, multipurpose vessels to accommodate diverse client needs. Single-use systems, modular bag setups, and automated cell processing platforms are in high demand among CMOs for their ability to manage multiple projects with minimal downtime. CROs also use a variety of vessels in preclinical research, assay development, and cell-based screening programs. As small and virtual biotech firms increasingly rely on outsourced services, the demand from this segment is projected to grow significantly.

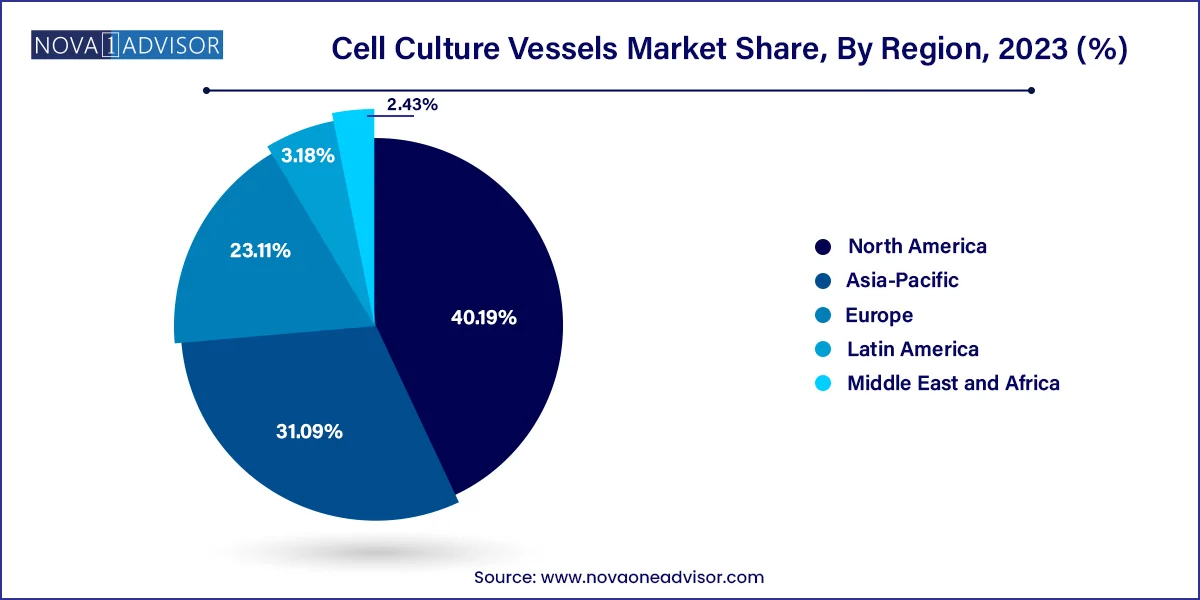

North America accounted for the largest market share of 40.19% in 2023 for the cell culture vessel market. driven by robust investments in biopharmaceutical research, advanced healthcare infrastructure, and strong academic research networks. The United States, in particular, is home to leading biotech firms, top-tier research institutions, and a high concentration of CDMOs. The region’s regulatory agencies, including the FDA, also actively support the advancement of cell-based therapies, further boosting demand for high-performance culture vessels.

The presence of key players such as Thermo Fisher Scientific, Corning Inc., and Pall Corporation, along with a mature supply chain and favorable government funding for biomedical innovation, contributes to North America’s leadership. Moreover, initiatives like the U.S. Cancer Moonshot and Operation Warp Speed have accelerated the use of single-use culture systems in both research and production environments.

Asia Pacific is witnessing the fastest growth in the cell culture vessels market, fueled by the rapid expansion of biotechnology sectors in countries like China, India, South Korea, and Japan. Rising investments in life sciences research, expanding pharmaceutical manufacturing infrastructure, and increasing government support for biologics development are key growth drivers. The establishment of biosimilar production hubs and the entry of global players into regional markets are further accelerating adoption.

China’s aggressive push toward biopharma innovation and India’s emergence as a global vaccine manufacturing hub highlight the region’s strategic importance. Domestic companies are also investing in automated, single-use vessel systems to support large-scale manufacturing. Additionally, the growing prevalence of cancer, infectious diseases, and chronic disorders is increasing demand for cell-based diagnostics and therapeutics, thereby strengthening the market outlook in Asia Pacific.

The following are the leading companies in the cell culture vessels market. These companies collectively hold the largest market share and dictate industry trends.

March 2024: Thermo Fisher Scientific launched a new line of single-use spinner flasks designed for high-density stem cell expansion, featuring optimized gas exchange membranes and improved ergonomic design.

February 2024: Corning Inc. unveiled an expanded range of gas-permeable culture flasks with integrated vent caps for seamless integration into automated incubators and robotic cell culture platforms.

January 2023: Sartorius AG announced a strategic acquisition of a South Korean disposable bioprocessing vessel manufacturer to expand its footprint in Asia and address rising demand for single-use systems.

December 2023: Eppendorf introduced an eco-friendly cell culture plate series made from recycled medical-grade plastics as part of its sustainability initiative, targeting academic and clinical research labs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cell Culture Vessels market.

By Product

By Type

By End Use

By Region