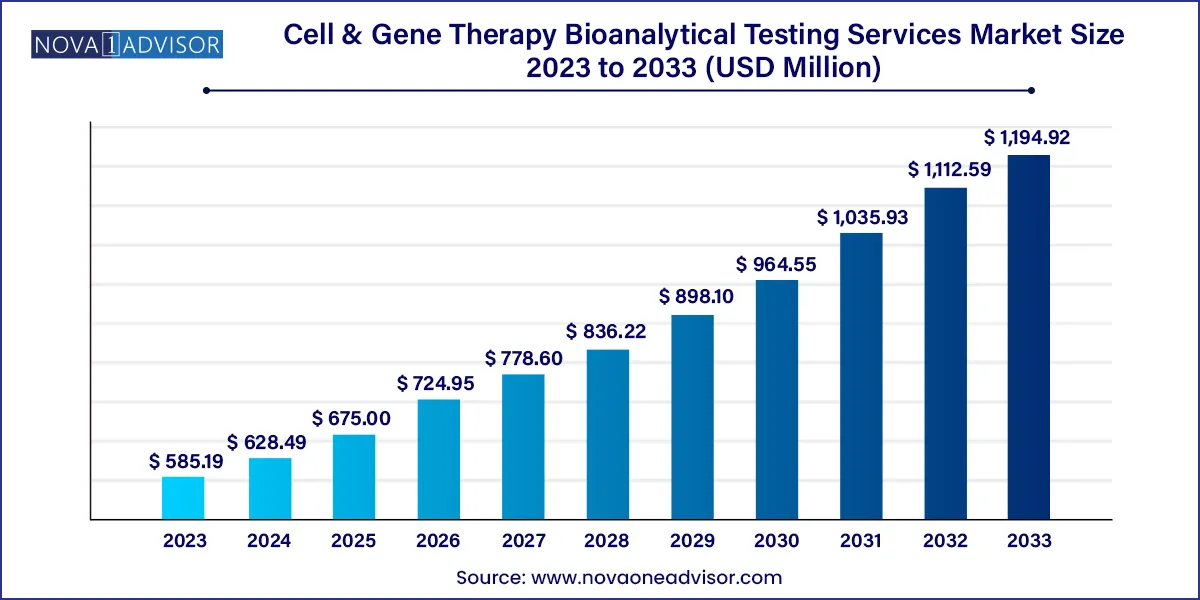

The global cell & gene therapy bioanalytical testing services market size was valued at USD 585.19 million in 2023 and is projected to surpass around USD 1,194.92 million by 2033, registering a CAGR of 7.4% over the forecast period of 2024 to 2033.

The cell and gene therapy (CGT) bioanalytical testing services market has rapidly evolved into a pivotal component of the life sciences ecosystem. With the global cell and gene therapy industry reaching new milestones each year from regulatory approvals to blockbuster therapies the demand for specialized bioanalytical services is surging. These services play a crucial role in ensuring the efficacy, safety, and quality of these next-generation therapeutics through every phase of development, from preclinical evaluation to clinical trials and post-marketing surveillance.

Unlike traditional small-molecule drugs, cell and gene therapies are complex, personalized, and biologically dynamic products. They require customized bioanalytical testing strategies that can assess potency, identity, purity, immunogenicity, transgene expression, vector shedding, and other pharmacokinetic (PK) and pharmacodynamic (PD) parameters. Moreover, regulatory bodies such as the U.S. FDA and EMA mandate stringent characterization of these products using validated and standardized bioanalytical assays.

The market has expanded significantly in recent years, largely due to the explosion in pipeline candidates—especially in oncology, rare genetic diseases, and neurodegenerative conditions. With over 2,000 active CGT clinical trials globally (a large share of which are based in North America and Europe), outsourcing bioanalytical services to specialized contract research organizations (CROs) has become essential.

Major pharmaceutical companies, biotech startups, and academic institutions increasingly depend on bioanalytical testing partners for high-throughput, compliant, and timely data to advance their CGT programs. This dynamic, science-driven market is expected to continue its upward trajectory, propelled by ongoing innovation, regulatory reforms, and an increasing number of commercial launches.

Shift Toward Multi-Omics Analysis: Integrating genomics, proteomics, and metabolomics in bioanalysis is improving the understanding of CGT mechanisms.

Increased Outsourcing of Bioanalytical Testing: Biopharma companies are partnering with CROs to access specialized expertise, infrastructure, and regulatory knowledge.

Rising Use of Next-Generation Sequencing (NGS): NGS is increasingly being used to detect off-target effects, insertion sites, and vector persistence in gene therapies.

Focus on Potency Assays and Vector Quantification: Developing robust, reproducible potency and biodistribution assays is becoming central to regulatory compliance.

Automation and Digitalization in Labs: High-throughput platforms and AI-powered data analytics are streamlining bioanalytical workflows.

Expansion in Viral Vector Testing Capabilities: A growing need for testing of AAV, lentivirus, and retrovirus vectors is fueling investments in assay development.

Adoption of Platform-Based Testing Models: Standardized assay platforms for similar therapy classes (e.g., CAR-T cells) are reducing time-to-market.

Increased Emphasis on Immunogenicity Testing: Evaluating immune response to vectors, payloads, and cell products is gaining regulatory importance.

Regulatory Alignment Across Regions: Global harmonization efforts by agencies are shaping consistent testing standards and accelerating international trials.

Rise in Testing for Rare and Neurological Diseases: Expanding therapeutic focus is broadening the scope of assay development and sample handling.

| Report Attribute | Details |

| Market Size in 2024 | USD 628.49 million |

| Market Size by 2033 | USD 1,194.92 million |

| Growth Rate From 2024 to 2033 | CAGR of 7.4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Test type, product type, stage of development, indication, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | BioAgilytix Labs; KCAS Bioanalytical Services; IQVIA, Inc.; Laboratory Corporation of America Holdings; Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.); Prolytix; Pharmaron; Charles River Laboratories; Syneos Health; SGS SA; Intertek Group Plc |

Pharmacokinetics (PK) testing dominates the market, as it is essential for determining the distribution, metabolism, and persistence of therapeutic genes and cells in the body. PK testing provides vital insights into vector biodistribution, transgene expression timelines, and the optimal dosing frequency. In gene-modified cell therapies such as CAR-T, PK testing helps evaluate the expansion and persistence of modified T-cells in the patient’s bloodstream.

Pharmacodynamics (PD) is the fastest-growing segment, fueled by increasing demand for mechanistic insights and biomarker-based efficacy endpoints. PD studies assess the biological response induced by the therapy, often using cytokine profiling, gene expression assays, or functional immune assays. As more CGTs enter the clinic, PD biomarkers are playing a growing role in dose optimization and patient stratification, driving investment in specialized assay development.

Clinical-stage testing dominates, as most CGT sponsors require extensive support during Phase I–III trials to meet regulatory filing requirements. At this stage, assays must be fully validated and performed under Good Laboratory Practices (GLP) or GMP conditions. Sponsors often outsource to CROs with track records of regulatory inspection readiness and high-throughput capabilities.

Non-clinical stage testing is the fastest-growing segment, as drug developers seek to accelerate preclinical programs for IND submission. The early-stage testing typically includes biodistribution studies, off-target effects, and vector integration assessments in animal models. With a wave of preclinical CGT programs advancing to IND-enabling studies, this segment is gaining significant traction.

Gene-modified cell therapies, particularly CAR-T cell therapies, dominate the market, owing to the success of products like Kymriah, Yescarta, and Tecartus. These therapies require extensive bioanalytical testing across multiple parameters, including cell viability, transduction efficiency, persistence, and cytokine release. Each batch of patient-derived cells undergoes detailed analytics, necessitating sophisticated in-process and release testing protocols.

Gene therapy (in-vivo) is the fastest-growing segment, reflecting growing FDA approvals for therapies such as Luxturna and Zolgensma. These therapies involve direct delivery of gene constructs into the patient’s body, typically via viral vectors. As a result, they require comprehensive biodistribution, vector shedding, and immunogenicity testing. The anticipated approval of dozens of in-vivo gene therapies over the next five years is expected to fuel this segment's exponential growth.

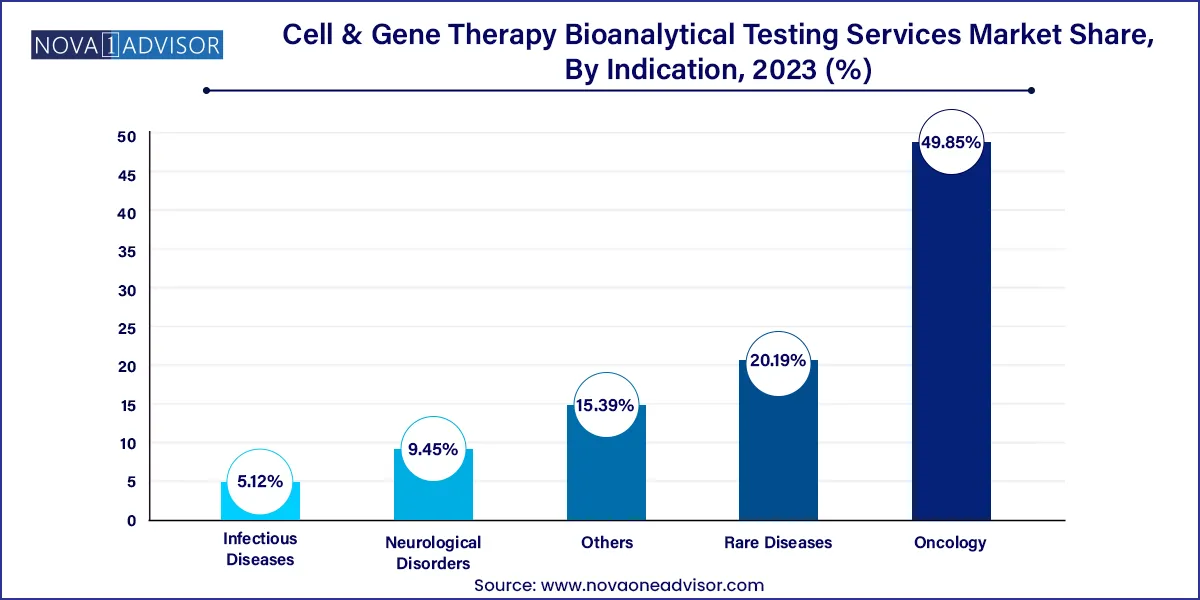

Oncology leads the indication segment, supported by the widespread development of CAR-T and TCR-T therapies for hematologic and solid tumors. Bioanalytical testing in oncology focuses on immune response markers, tumor infiltration studies, and monitoring minimal residual disease (MRD). The aggressive nature of cancer pipelines drives a continuous need for assay refinement and novel biomarker discovery.

Rare diseases represent the fastest-growing indication segment, due to the high number of gene therapies targeting monogenic disorders. These include conditions like hemophilia, SMA, and lysosomal storage diseases. Testing for these indications often requires custom assays adapted for small patient populations and unique biological pathways, contributing to the growth in specialized bioanalytical platforms.

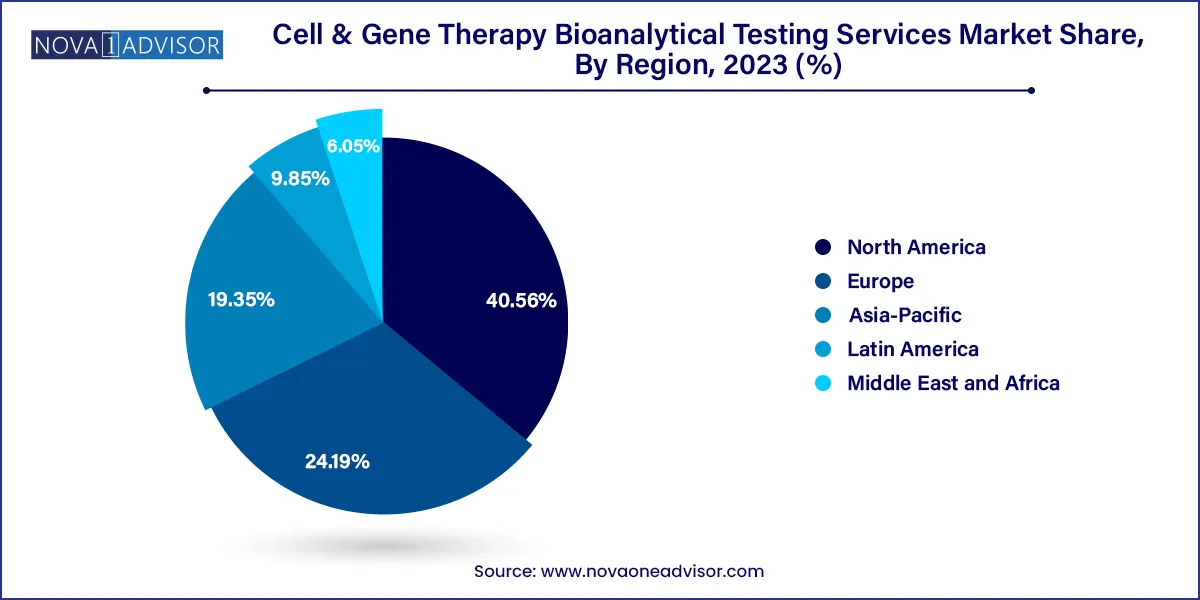

North America, especially the United States, dominates the market, accounting for the largest share of cell & gene therapy clinical trials and commercial activity. The region’s leadership is supported by world-class research institutions, substantial federal funding, and a favorable regulatory landscape. The FDA has approved several CGT products and provides accelerated pathways for rare disease indications.

Leading CROs and bioanalytical labs including Labcorp, Charles River, and PPD are headquartered in the U.S., offering end-to-end testing solutions. Additionally, academic medical centers like the University of Pennsylvania and MD Anderson Cancer Center are driving innovation in cell therapy analytics.

Asia-Pacific is the fastest-growing region, driven by increased R&D investments in China, South Korea, and Japan. China, in particular, has seen a proliferation of CAR-T and gene therapy trials, supported by national regulatory reforms. Regional CROs are upgrading their testing capabilities to meet global standards and support multinational clinical trials.

The region’s large patient base, emerging biotechnology hubs, and improved regulatory transparency are attracting Western sponsors to outsource early-stage testing and sample analysis. This trend is expected to propel Asia-Pacific’s share in the global CGT bioanalytical testing landscape in the coming years.

March 2025: Charles River Laboratories announced the acquisition of a specialized cell therapy testing CRO to expand its capacity for CAR-T bioanalysis and flow cytometry-based assays.

February 2025: Labcorp Drug Development launched a suite of validated AAV vector quantification assays for gene therapy developers under GMP conditions.

January 2025: ICON plc partnered with a leading gene therapy firm to support global multi-center trials, offering centralized bioanalytical testing and sample logistics.

December 2024: BioAgilytix opened a new bioanalytical facility in Massachusetts dedicated to high-throughput cell and gene therapy assay development and immunogenicity testing.

November 2024: WuXi AppTec announced the expansion of its viral vector characterization lab in Shanghai, aiming to serve both domestic and global clients in CGT.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cell & Gene Therapy Bioanalytical Testing Services market.

By Test Type

By Product Type

By Stage of Development by Product Type

By Indication

By Region