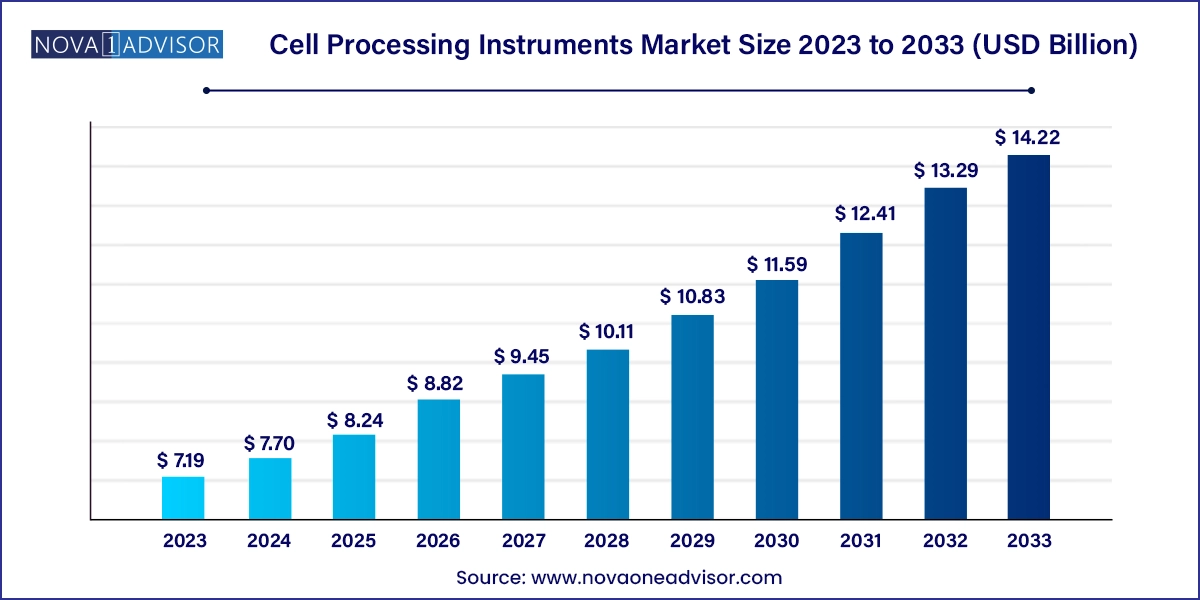

The global cell processing instruments market size was valued at USD 7.19 billion in 2023 and is anticipated to reach around USD 14.22 billion by 2033, growing at a CAGR of 7.06% from 2024 to 2033.

The Cell Processing Instruments Market is at the core of advancements in cell biology, regenerative medicine, immunotherapy, and drug discovery. This market encompasses a wide array of devices used to isolate, quantify, monitor, sort, and prepare cells for clinical or research applications. These instruments ranging from cell counters and flow cytometers to automated cell processors—are crucial for ensuring precision, sterility, and scalability in laboratory workflows.

The rapid expansion of cell-based research, especially in stem cell therapy, CAR-T therapies, tissue engineering, and single-cell genomics, has significantly increased the demand for sophisticated cell processing platforms. High-throughput screening, quality control in biomanufacturing, and precision oncology all rely heavily on these instruments to deliver reproducible results and maintain regulatory compliance.

Cell processing instruments bridge the gap between laboratory experimentation and clinical application. They enable researchers and biopharmaceutical companies to prepare therapeutic cells under standardized, Good Manufacturing Practice (GMP) conditions. Furthermore, the integration of AI, robotics, and real-time analytics into next-gen instruments is streamlining workflows and reducing manual error.

As global healthcare shifts toward personalized and regenerative medicine, the role of cell processing instruments becomes increasingly critical not just in labs but also in clinical settings. The market is poised for sustained growth, supported by technological innovation, increasing government funding in cell-based research, and the booming biopharmaceutical sector.

Automation and Miniaturization: Automated cell processors and benchtop instruments are improving workflow speed, reducing human error, and increasing reproducibility.

Adoption of AI and Machine Learning: Smart instruments with AI-driven analytics are being used for real-time image analysis, predictive maintenance, and anomaly detection.

Integration with GMP Manufacturing: There is a rising demand for closed-system cell processing devices suitable for GMP-compliant cell therapy manufacturing environments.

Shift Toward Single-Cell Analysis: Advanced cytometry and imaging systems capable of single-cell resolution are enabling new breakthroughs in genomics and immunology.

Personalized Medicine and Immunotherapy Boom: Instruments supporting T-cell expansion, dendritic cell maturation, and CAR-T processing are seeing accelerated demand.

Multi-parameter Analysis and Multiplexing: Flow cytometers and imaging cytometers are evolving to simultaneously analyze multiple markers and cellular features in complex populations.

Increased Demand for Point-of-care Systems: Compact and portable instruments for clinical cell processing are being developed for decentralized healthcare settings.

| Report Attribute | Details |

| Market Size in 2024 | USD 7.70 Billion |

| Market Size by 2033 | USD 14.22 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.06% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, application, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Danaher; Merck KGaA; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; BD; Bio-Rad Laboratories, Inc; Sartorius AG; Bio-Techne.; Revvity Inc.; Miltenyi Biotec |

A primary driver propelling the cell processing instruments market is the exponential growth in cell and gene therapy (CGT) development, particularly in immuno-oncology and rare genetic diseases. As of 2025, there are over 1,600 CGT clinical trials underway globally, many of which rely on precise, standardized cell processing for therapeutic cells like CAR-T, TCR-T, NK cells, and stem cells.

These therapies demand highly controlled environments for cell isolation, expansion, modification, and quality assurance—a need met by advanced instruments such as automated bioreactors, flow cytometers, and closed-system separators. For instance, in CAR-T therapy, cell viability and purity during T-cell enrichment and transduction are critical success factors, and robust instrumentation is required at every step.

As CGT pipelines mature and move toward commercialization, pharmaceutical companies and contract manufacturing organizations (CMOs) are investing in scalable, modular cell processing platforms. This trend is especially visible in North America and Europe, where regulatory approvals and commercial launches of cell therapies are rapidly increasing. Thus, the surging CGT landscape is significantly boosting instrument adoption and innovation.

Despite its promising growth, the market faces a notable restraint in the form of high capital investment and operational complexity associated with advanced cell processing instruments. High-end systems, particularly automated cell processors, imaging cytometers, and GMP-grade flow cytometers, can cost upwards of hundreds of thousands of dollars. This pricing creates a substantial barrier for small research labs, startups, and institutions in emerging economies.

In addition to purchase costs, maintenance, software upgrades, operator training, and data integration pose ongoing expenses and technical challenges. Some instruments require specialized infrastructure, including cleanrooms or controlled environments, making them unsuitable for many academic or decentralized setups.

Moreover, standardizing cell processing protocols across various cell types and therapeutic modalities remains complex. Variability in cell quality, donor characteristics, and assay conditions can impact instrument performance and data interpretation. These technical and cost barriers may hinder widespread adoption, particularly in resource-constrained settings.

A transformative opportunity in the cell processing instruments market lies in the convergence of artificial intelligence (AI) with closed-system automation. As cell therapies scale toward commercial viability, the need for high-throughput, contamination-free, and reproducible processing becomes paramount. Next-generation instruments are embedding AI-powered analytics, real-time imaging, and smart sensors into fully automated systems that require minimal human intervention.

Such platforms are ideal for GMP environments, where closed-system automation reduces the risk of contamination and meets stringent regulatory guidelines. AI enables real-time monitoring of cell viability, morphology, and population dynamics, which helps in early error detection, predictive modeling, and batch optimization.

For example, startup companies are developing integrated systems that combine cell counting, washing, concentration, transduction, and expansion in one unit—ideal for CGT production. This automation not only enhances scalability but also democratizes complex cell processing, making it accessible to mid-sized players and hospitals. As these AI-integrated platforms evolve, they promise to significantly enhance efficiency, consistency, and scalability of cell-based therapeutics production.

Flow cytometers dominate the type segment, owing to their indispensable role in analyzing cell populations based on size, granularity, and fluorescence labeling. Widely used in immunology, oncology, and stem cell research, flow cytometers help characterize immune cell subsets, assess transduction efficiency, and monitor cell viability in therapeutic manufacturing. The ability to perform multi-parameter analysis makes flow cytometry a preferred technology for both research and clinical applications.

Automated cell processing systems represent the fastest-growing segment, primarily driven by the expansion of clinical cell therapy programs. These systems perform multiple tasks—cell selection, washing, expansion, and formulation—in a closed-loop format. Products like the CliniMACS Prodigy (Miltenyi Biotec) and LOVO system (Fresenius Kabi) have revolutionized the cell therapy manufacturing space by enabling hands-free processing with minimal operator intervention. Their application in GMP-compliant facilities has made them an essential component in CGT production.

Cell isolation and separation is the dominant application, as this process forms the foundation for most downstream workflows in research and clinical settings. Instruments such as cell separators, magnetic bead-based sorters, and centrifuge systems are commonly used to purify T cells, B cells, stem cells, and cancer cells from blood or tissue samples. Precise isolation is crucial for downstream success in therapies and assays, making this a high-priority application across labs and manufacturing units.

Cell viability and proliferation analysis is the fastest-growing segment, especially in the context of expanding therapeutic cells like CAR-T or MSCs. Instruments equipped with real-time monitoring capabilities for assessing cell health, growth kinetics, and apoptosis are gaining popularity. This demand is especially high in CGT manufacturing, where cell quality metrics directly impact therapeutic outcomes and regulatory compliance.

Pharmaceutical and biotechnology companies lead the end-use segment, fueled by robust investment in drug discovery, regenerative medicine, and clinical manufacturing. These firms heavily utilize flow cytometers, bioreactors, and automated processors to scale up production, ensure QC compliance, and develop standardized protocols. The CGT revolution is a major catalyst driving instrument purchases and upgrades across these companies.

However, Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are the fastest-growing end users. These organizations offer cost-effective, flexible services to biotech firms lacking internal infrastructure. As demand for outsourcing rises, CROs and CMOs are equipping their facilities with state-of-the-art cell processing tools to provide services like toxicity screening, immune profiling, and GMP cell production. This trend is expected to continue as smaller biotech firms enter the cell therapy space.

North America is the dominant region in the global cell processing instruments market, underpinned by its leadership in biotechnology innovation, CGT commercialization, and academic research. The United States is home to major companies like Thermo Fisher Scientific, Becton Dickinson, and Bio-Rad, as well as world-renowned institutions such as the NIH, MD Anderson, and Harvard Medical School. These organizations are at the forefront of translating research into clinically relevant therapies.

Furthermore, the FDA’s accelerated pathways for regenerative medicines and strong funding from government and venture capital sources provide a fertile ground for instrument innovation. High adoption rates of automated platforms and AI-integrated devices in North America reinforce its position as the market leader.

Asia-Pacific is the fastest-growing region, driven by rising healthcare expenditure, increasing clinical trials, and expanding biotech ecosystems in countries like China, India, Japan, and South Korea. China, in particular, is emerging as a hub for cell and gene therapy R&D, with strong government backing, public-private partnerships, and growing GMP infrastructure.

Academic institutions and biotech startups in the region are adopting advanced flow cytometry, cell separation, and imaging technologies to support immunotherapy, regenerative medicine, and cancer research. Moreover, the relatively low manufacturing costs and large patient populations make Asia-Pacific an attractive destination for outsourced CGT manufacturing, boosting demand for next-gen cell processing instruments.

The following are the leading companies in the cell processing instruments market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cell Processing Instruments market.

By Type

By Application

By End-use

By Region