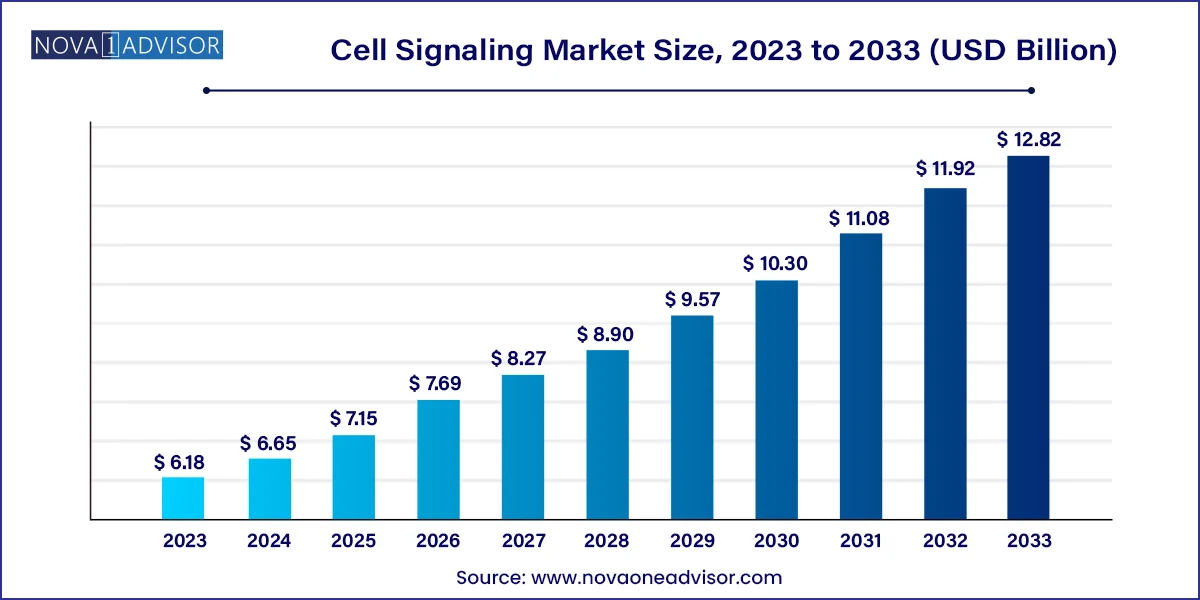

The global cell signaling market size was valued at USD 6.18 billion in 2023 and is anticipated to reach around USD 12.82 billion by 2033, growing at a CAGR of 7.57% from 2024 to 2033.

An increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders globally, as well as growing advancements in cell signaling research, are the prime factors driving market growth. According to the American Cancer Society, in 2022, about 1.9 million new cancer cases were reported in the U.S., along with 609,360 cancer-related deaths.

As cancer involves complex disruptions in cellular signaling pathways, there is an increasing demand for targeted therapies that specifically address the aberrant signaling mechanisms fueling cancer growth. Furthermore, cell signaling studies enable the identification of specific signaling molecules and pathways that contribute to cancer progression, which makes them a reliable approach to treat this disorder.

In addition to it, advancements in cell signaling research further play a pivotal role in boosting overall market growth. For instance, in June 2021, Thermo Fisher Scientific Inc. introduced the Attune CytPix Flow Cytometer, which integrates acoustic focusing flow cytometry technology with a high-speed camera. This system enables the simultaneous acquisition of high-resolution bright-field images and robust fluorescent flow cytometry data from cells, enhancing the comprehensive analysis of cell characteristics. As scientific understanding of intricate signaling pathways within cells deepens with such advancement, researchers can identify specific molecules and mechanisms associated with diseases, particularly in the context of cancer and other complex disorders.

Rising government funding for research serves as a significant driver for the growth of the market for cell signaling. As governments allocate more resources to scientific and biomedical research initiatives, there is a notable boost in funding for studies focused on understanding cell signaling pathways and their implications on health and disease. For instance, in February 2022, the Indian government established cutting-edge stem cell research facilities in 40 prominent health research and educational institutions. In the last three years, the Indian government has allocated USD 80 million through the Indian Council of Medical Research (ICMR) for specific research projects.

Furthermore, partnerships and collaborations play a crucial role in driving the market for cell signaling by fostering innovation, leveraging expertise, and accelerating the development and commercialization of products. For instance, in May 2023, Pfizer and Thermo Fisher Scientific Inc. announced a partnership to help increase local availability of next-generation sequencing (NGS)-based screening for patients with lung & breast cancer in more than 30 countries across Latin America, the Middle East, Africa, and Asia where advanced genomic testing was previously limited or unavailable.

| Report Attribute | Details |

| Market Size in 2024 | USD 6.65 Billion |

| Market Size by 2033 | USD 12.82 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.57% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product & Services, technology, disease type, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Agilent Technologies Inc.; Illumina Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd.; BioMérieux; Abbott; Leica Biosystems; Guardant Health, Inc.; EntroGen, Inc. |

Endocrine signaling accounted for the largest revenue share of 42.19% in 2023 and is anticipated to witness fastest growth through 2033. The system communicates and transfers information from a particular part of the body to another by sending chemical signals referred to as hormones. The presence of this component increases demand for endocrine signaling. An increased prevalence of endocrine-related disorders such as adrenal insufficiency, Cushing's disease, gigantism, hypothyroidism, as well as hyperthyroidism is a primary factor driving expansion.

For instance, undiagnosed endocrine diseases affect approximately 13 million people in the U.S. alone, accounting for 4.78% of the population. Thyroid disease is one of the most common endocrine disorders, accounting for 30-40% of patients in endocrine treatment. It also identifies how pharmaceutical interventions change critical signaling pathways. Thus, an increase in the number of patients suffering from chronic diseases, which leads to an increase in the number of drug discoveries along with therapeutic development, are reasons contributing to the growth of the cell signaling market.

Consumables accounted for the largest revenue share in 2023. This share is due to repurchasing of consumables. Furthermore, the expanding number of advances in genomes and proteomics, as well as the growing emphasis on customized medicine and targeted therapies, are accelerating this segment's growth rate. Growing government and private sector funding of cell-based research is predicted to propel the global cell signaling industry forward. According to data from the National Institutes of Health (NIH) portal, an estimated USD 45 billion was provided for stem cell research in fiscal year 2021. Similar increases in funding grants for research on embryonic stem cells & induced pluripotent stem cells were observed in March 2020.

Instruments segment is estimated to register a substantial CAGR over the forecast period. Factors such as technological advancements, growing demand for automated systems, and expanding PoC diagnostics demand are contributing to segment growth. Furthermore, rising prevalence of chronic diseases, increase of fund grants for cell-based research and others are driving segment expansion. As a result, increased government participation in the development of cell-based research in the form of additional financing is predicted to boost market expansion.

Microscopy segment dominated the market in 2023. Fluorescence microscopy applications in signaling are not restricted to examining localization. Several methodologies enable researchers to study the dynamics of protein interactions in real-time, whether at rest or after stimulation, and thus explore signal transmission, amplification, and integration throughout the cell. Furthermore, microscopy allows for the investigation of single-cell expression kinetics, bringing cell uniqueness and robustness against variability of gene expression to a new level of signaling research. Factors linked to technological breakthroughs in recent years have accelerated the development of light microscopy, which is boosting demand for this segment.

On the other hand, flow cytometry is anticipated to grow at the fastest rate during the forecast period. Flow cytometry is a technique for analyzing single cells in solution efficiently and precisely. It is highly useful for studying the immune system and how it responds to infectious diseases, as well as cancer. Researchers can use this technique to track live movements and thus increase the demand for flow cytometry and advance market growth.

AKT signaling pathway dominated the market in 2023. AKT signaling pathway, commonly known as the survival route, regulates cell development, apoptotic signals, and proliferation. This signaling pathway is the most frequently dysregulated in most common cancer types. The anticipated development of commercial diagnostic tests depending on the down-regulation of the AKT pathway will drive the cell signaling sector to grow over the expected timeframe.

In 2023, the AMPK signaling pathway segment also had a sizable market share. This is primarily owing to an increase in the prevalence of cancer and tumors globally. Depending on the tissue-specific tumor microenvironment, the AMPK pathway exhibits both oncogene and tumor suppressor effects. According to a study published in BioMed Central (BMC) in August 2020, MAPK signaling is present in over 85% of cancers and is caused by genetic changes in its upstream activators or components.

North America dominated the overall market for cell signaling in 2023. Factors such as the local presence of a substantial number of key players such as Thermo Fisher Scientific, Merck KGaA, and Cell Signaling Technology Inc., among others, coupled with an upsurge in research and development spending by key players to develop innovative and advanced products, are attributed for the regional cell signaling industry growth.

U.S. accounted for a dominant share in the North American market for cell signaling in 2023. Majority of the big players have been involved in R&D activities involving cell signaling pathways. A bulk of COVID-19 patients died as a result of a cytokine storm triggered by the virus. Excessive production of these pro-inflammatory cytokines worsens the acute respiratory distress syndrome and causes widespread tissue damage, leading to multi-organ failure and death. Thus, addressing cell signaling pathways such as cytokines during COVID-19 care may result in a lower death rate and better outcomes. This is likely to have a favorable impact on this market.

Considering its dense population, Asia Pacific is expected to witness the fastest market growth through 2033. Furthermore, rising chronic illness prevalence, expanding R&D expenditures, developing key player alliances with local suppliers, a rising elderly population, and advancing life science facilities are all driving growth in the region's cell signaling business. China accounted for a significant share of the cell signaling industry in Asia Pacific in 2023. Increased R&D in cell design and cell physiology is a major regional growth driver. In China, government aid and rising disposable incomes are indirectly boosting the cell signaling sector.

The following are the leading companies in the cell signaling market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these cell signaling companies are analyzed to map the supply network.

In February 2023, Bio-Techne Corporation & Cell Signaling Technology established a partnership, thus adding the Simple Western validation to Cell Signaling Technology antibodies. This agreement would help improve researchers' ability to analyze critical molecular signaling pathways effectively.

In December 2022, Merck KGaA and Mersana Therapeutics announced a research cooperation and commercial license agreement to develop innovative antibody-drug conjugates (ADCs) using Mersana's patented Immunosynthen STING-agonist ADC technology. The cooperation will focus on developing innovative STING-agonist ADCs for up to two targets, with Mersana's platform used to conjugate Merck KGaA proprietary antibodies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cell Signaling market.

By Type

By Product

By Technology

By Pathway

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1.1. Segment Definitions

1.2. Information analysis

1.3. Market formulation & data visualization

1.4. Data validation & publishing

1.5. Information Procurement

1.5.1. Primary Research

1.6. Information or Data Analysis

1.7. Market Formulation & Validation

1.8. Market Model

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Cell Signaling Market: Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Cell Signaling Market Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Dynamics

3.4. Market Drivers Analysis

3.4.1. Rising incidence of chronic diseases

3.4.2. Technological advancement in cell based signaling research

3.5. Market Restraint Analysis

3.5.1. High cost associated with cell signaling research

3.6. Business Environment Analysis

3.6.1. Porter’s Five Forces Analysis

3.6.2. PESTLE Analysis

3.6.3. COVID-19 Analysis

Chapter 4. Cell Signaling Market: Type Estimates & Trend Analysis

4.1. Cell Signaling Market: Type Movement Analysis

4.2. Endocrine Signaling

4.2.1. Endocrine Signaling Market Estimates and Forecasts, 2021 - 2033(USD Million)

4.3. Paracrine Signaling

4.3.1. Paracrine Signaling Market Estimates and Forecasts, 2021 - 2033(USD Million)

4.4. Autocrine Signaling

4.4.1. Autocrine Signaling Market Estimates and Forecasts, 2021 - 2033(USD Million)

4.5. Others

4.5.1. Others Market Estimates and Forecasts, 2021 - 2033(USD Million)

Chapter 5. Cell Signaling Market: Product Estimates & Trend Analysis

5.1. Cell Signaling Market: Product Movement Analysis

5.2. Consumables

5.2.1. Consumables Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

5.3. Instruments

5.3.1. Instruments Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

Chapter 6. Cell Signaling Market: Technology Estimates & Trend Analysis

6.1. Cell Signaling Market: Technology Movement Analysis

6.2. Flow Cytometry

6.2.1. Flow Cytometry Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

6.3. Microscopy

6.3.1. Microscopy Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

6.4. Western Blotting

6.4.1. Western Blotting Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

6.5. ELISA

6.5.1. ELISA Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

6.6. Others

6.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

Chapter 7. Cell Signaling Market: Pathway Estimates & Trend Analysis

7.1. Cell Signaling Market: Pathway Movement Analysis

7.2. AKT Signaling Pathway

7.2.1. AKT Signaling Pathway Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

7.3. AMPK Signaling Pathway

7.3.1. AMPK Signaling Pathway Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

7.4. ErbB/HER Signaling Pathway

7.4.1. ErbB/HER Signaling Pathway Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

7.5. Other Signaling Pathways

7.5.1. Other Signaling Pathways Market Revenue Estimates and Forecasts, 2021 - 2033(USD Million)

Chapter 8. Cell Signaling Market: Regional Business Analysis

8.1. Regional Market Snapshot

8.2. North America

8.2.1. North America Cell Signaling Market 2021 - 2033(USD Million)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Competitive Scenario

8.2.2.3. Regulatory Framework

8.2.2.4. Target Disease Prevalence

8.2.2.5. U.S. Cell Signaling Market, 2021 - 2033(USD Million)

8.2.3. CANADA

8.2.3.1. Key Country Dynamics

8.2.3.2. Competitive Scenario

8.2.3.3. Regulatory Framework

8.2.3.4. Target Disease Prevalence

8.2.3.5. Canada Cell Signaling Market, 2021 - 2033(USD Million)

8.3. Europe

8.3.1. Europe Cell Signaling Market, 2021 - 2033(USD Million)

8.3.2. UK

8.3.2.1. Key Country Dynamics

8.3.2.2. Competitive Scenario

8.3.2.3. Regulatory Framework

8.3.2.4. Target Disease Prevalence

8.3.2.5. UK Cell Signaling Market, 2021 - 2033(USD Million)

8.3.3. GERMANY

8.3.3.1. Key Country Dynamics

8.3.3.2. Competitive Scenario

8.3.3.3. Regulatory Framework

8.3.3.4. Target Disease Prevalence

8.3.3.5. Germany Cell Signaling Market, 2021 - 2033(USD Million)

8.3.4. SPAIN

8.3.4.1. Key Country Dynamics

8.3.4.2. Competitive Scenario

8.3.4.3. Regulatory Framework

8.3.4.4. Target Disease Prevalence

8.3.4.5. Spain Cell Signaling Market, 2021 - 2033(USD Million)

8.3.5. FRANCE

8.3.5.1. Key Country Dynamics

8.3.5.2. Competitive Scenario

8.3.5.3. Regulatory Framework

8.3.5.4. Target Disease Prevalence

8.3.5.5. France Cell Signaling Market, 2021 - 2033(USD Million)

8.3.6. ITALY

8.3.6.1. Key Country Dynamics

8.3.6.2. Competitive Scenario

8.3.6.3. Regulatory Framework

8.3.6.4. Target Disease Prevalence

8.3.6.5. Italy Cell Signaling Market, 2021 - 2033(USD Million)

8.3.7. DENMARK

8.3.7.1. Key Country Dynamics

8.3.7.2. Competitive Scenario

8.3.7.3. Regulatory Framework

8.3.7.4. Target Disease Prevalence

8.3.7.5. Denmark Cell Signaling Market, 2021 - 2033(USD Million)

8.3.8. SWEDEN

8.3.8.1. Key Country Dynamics

8.3.8.2. Competitive Scenario

8.3.8.3. Regulatory Framework

8.3.8.4. Target Disease Prevalence

8.3.8.5. Sweden Cell Signaling Market, 2021 - 2033(USD Million)

8.3.9. NORWAY

8.3.9.1. Key Country Dynamics

8.3.9.2. Competitive Scenario

8.3.9.3. Regulatory Framework

8.3.9.4. Target Disease Prevalence

8.3.9.5. Norway Cell Signaling Market, 2021 - 2033(USD Million)

8.4. Asia Pacific

8.4.1. Asia-Pacific Cell Signaling Market, 2021 - 2033(USD Million)

8.4.2. JAPAN

8.4.2.1. Key Country Dynamics

8.4.2.2. Competitive Scenario

8.4.2.3. Regulatory Framework

8.4.2.4. Target Disease Prevalence

8.4.2.5. Japan Cell Signaling Market, 2021 - 2033(USD Million)

8.4.3. CHINA

8.4.3.1. Key Country Dynamics

8.4.3.2. Competitive Scenario

8.4.3.3. Regulatory Framework

8.4.3.4. Target Disease Prevalence

8.4.3.5. China Cell Signaling Market, 2021 - 2033(USD Million)

8.4.4. INDIA

8.4.4.1. Key Country Dynamics

8.4.4.2. Competitive Scenario

8.4.4.3. Regulatory Framework

8.4.4.4. Target Disease Prevalence

8.4.4.5. India Cell Signaling Market, 2021 - 2033(USD Million)

8.4.5. SOUTH KOREA

8.4.5.1. Key Country Dynamics

8.4.5.2. Competitive Scenario

8.4.5.3. Regulatory Framework

8.4.5.4. Target Disease Prevalence

8.4.5.5. South Korea Cell Signaling Market, 2021 - 2033(USD Million)

8.4.6. THAILAND

8.4.6.1. Key Country Dynamics

8.4.6.2. Competitive Scenario

8.4.6.3. Regulatory Framework

8.4.6.4. Target Disease Prevalence

8.4.6.5. Thailand Cell Signaling Market, 2021 - 2033(USD Million)

8.4.7. AUSTRALIA

8.4.7.1. Key Country Dynamics

8.4.7.2. Competitive Scenario

8.4.7.3. Regulatory Framework

8.4.7.4. Target Disease Prevalence

8.4.7.5. Australia Cell Signaling Market, 2021 - 2033(USD Million)

8.5. Latin America

8.5.1. Latin America Cell Signaling Market, 2021 - 2033(USD Million)

8.5.2. BRAZIL

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Target Disease Prevalence

8.5.2.5. Brazil Cell Signaling Market, 2021 - 2033(USD Million)

8.5.3. MEXICO

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Target Disease Prevalence

8.5.3.5. Mexico Cell Signaling Market, 2021 - 2033(USD Million)

8.5.4. ARGENTINA

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Target Disease Prevalence

8.5.4.5. Argentina Cell Signaling Market, 2021 - 2033(USD Million)

8.6. MEA

8.6.1. MEA Cell Signaling Market, 2021 - 2033(USD Million)

8.6.2. SOUTH AFRICA

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. Target Disease Prevalence

8.6.2.5. South Africa Cell Signaling Market, 2021 - 2033(USD Million)

8.6.3. SAUDI ARABIA

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Target Disease Prevalence

8.6.3.5. Saudi Arabia Cell Signaling Market, 2021 - 2033(USD Million)

8.6.4. UAE

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Target Disease Prevalence

8.6.4.5. UAE Cell Signaling Market, 2021 - 2033(USD Million)

8.6.5. KUWAIT

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Target Disease Prevalence

8.6.5.5. Kuwait Cell Signaling Market, 2021 - 2033(USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Strategy Mapping

9.2.1. Acquisitions

9.2.2. Product/Service Launches

9.2.3. Partnerships/Collaborations

9.2.4. Others

9.3. Market Position Analysis, 2023

9.4. Company Profiles

9.4.1. Thermo Fisher Scientific, Inc.

9.4.1.1. Company Overview

9.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.1.3. Product Benchmarking

9.4.1.4. Strategic Initiatives

9.4.2. QIAGEN

9.4.2.1. Company Overview

9.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.2.3. Product Benchmarking

9.4.2.4. Strategic Initiatives

9.4.3. Becton, Dickinson and Company

9.4.3.1. Company Overview

9.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.3.3. Product Benchmarking

9.4.3.4. Strategic Initiatives

9.4.4. Bio-Rad Laboratories Inc.

9.4.4.1. Company Overview

9.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.4.3. Product Benchmarking

9.4.4.4. Strategic Initiatives

9.4.5. Bio-Techne Corporation

9.4.5.1. Company Overview

9.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.5.3. Product Benchmarking

9.4.5.4. Strategic Initiatives

9.4.6. Cell Signaling Technology Inc.

9.4.6.1. Company Overview

9.4.6.2. Product Benchmarking

9.4.6.3. Strategic Initiatives

9.4.7. Danaher

9.4.7.1. Company Overview

9.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.7.3. Product Benchmarking

9.4.7.4. Strategic Initiatives

9.4.8. Merck KGaA

9.4.8.1. Company Overview

9.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.8.3. Product Benchmarking

9.4.8.4. Strategic Initiatives

9.4.9. PerkinElmer Inc.

9.4.9.1. Company Overview

9.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.9.3. Product Benchmarking

9.4.9.4. Strategic Initiatives

9.4.10. Promega Corporation

9.4.10.1. Company Overview

9.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.10.3. Product Benchmarking

9.4.10.4. Strategic Initiatives