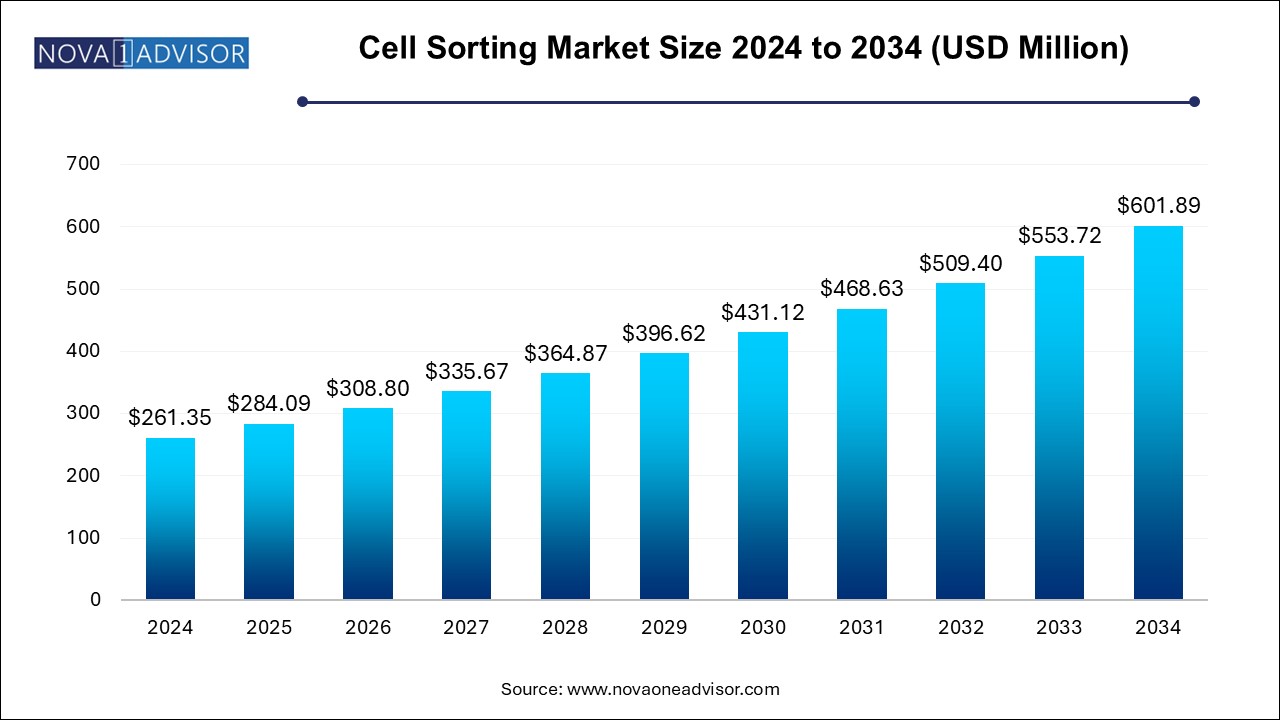

The cell sorting market size was exhibited at USD 261.35 million in 2024 and is projected to hit around USD 601.89 million by 2034, growing at a CAGR of 8.7% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 284.09 Million |

| Market Size by 2034 | USD 601.89 Million |

| Growth Rate From 2025 to 2034 | CAGR of 8.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Technology, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | BD; Bio-Rad Laboratories, Inc.; Danaher Corporation; Sony Group Corporation; Miltenyi Biotec; On-chip Biotechnologies Co., Ltd.; Cytonome/ST, LLC; Union Biometrica, Inc.; Thermo Fisher Scientific Inc.; uFluidix |

The cell sorting industry has witnessed significant advancements, driven by innovations such as high-speed sorting. Four primary techniques, including Fluorescence-Based Droplet Sorting, Magnetic Activated Cell Sorting (MACS), and micro-fluidics, have enhanced the precision and effectiveness of cell sorting, thereby driving market growth.

Technological advancements are a primary driver for industry growth worldwide, with continuous innovations in cell sorting technologies, such as high-speed sorting and advanced detection capabilities, enhancing precision and efficiency. These advancements have made cell sorting tools essential in various fields, including research and clinical applications. Fluorescence-Activated Cell Sorting (FACS), in particular, is a significant contributor to the market’s growth due to its ability to provide quick and quantitative measurements of cell properties, making it an essential tool for sorting heterogeneous cell populations.

The biotechnology and pharmaceutical sectors’ expansion drives demand for advanced cell sorting technologies, essential for drug discovery, diagnostics, and research, with research institutions being the largest consumers. In addition, according to UNAIDS, nearly 40 million people are living with HIV in 2024 and around 1.3 million people are newly infected with HIV in 2024. The rising prevalence of chronic diseases, particularly HIV and cancer, is a major driver of market growth, as cell sorting technologies are essential for quantifying and characterizing infected cells.

Research and development initiatives are also driving the market’s growth, with a notable rise in research activities related to cellular analysis in fields such as immunology, stem cell research, and drug discovery. The increasing investment in cell-based therapies and applications is fueling the demand for cell sorting technologies, making them an essential tool for researchers and clinicians.

Reagents and consumables dominated the market with a revenue share of 61.3% in 2024. The reagents and consumables provide essential products for precise and efficient cell sorting. These products, including fluorescent dyes, antibodies, and specialized reagents, are crucial for labeling and identifying specific cell types. Growing demand for high-quality, application-specific reagents fuels market growth.

Cell sorting services are expected to register the fastest CAGR of 9.3% during the forecast period. The demand for technical support and training services is expected to rise as cell sorting technology advances, as research centers and laboratories require assistance in handling complex cell sorters. Regular maintenance services, including check-ups and calibrations, are essential to ensure optimal performance, prevent instrument breakdown, and increase durability, driving growth in the services segment.

Fluorescence-based droplet cell sorting (FACS) technology accounted for the largest revenue share of 41.4% in 2024 is its highly accurate and efficient method, utilizing fluorescent tags to identify and sort cells. This technique is particularly relevant in research and diagnostic fields, offering a versatile platform for various applications. With its ability to be easily modified, fluorescence-based droplet sorting is suitable for diverse biological fields, including regenerative medicine and vaccine development.

Magnetic-activated cell sorting (MACS) technology is expected to register the fastest CAGR of 9.4% during the forecast period. The MACS technology utilizes magnetic beads coated with antibodies targeting specific cells, enabling high selectivity and minimal contamination of non-target cells. This technology is versatile, applicable to various cell types, including stem cells, immune cells, and tumor cells, making it a valuable tool across diverse fields. The MACS procedure is also straightforward to perform, differing from more complex methods.

Research applications held the largest share of 62.6% in 2024, leading market revenue worldwide. Substantial investments in biomedical research by government and private organizations have yielded significant advancements. The National Institutes of Health (NIH) has reported increased funding, enabling researchers to tackle complex biological questions. Collaborations between academia and industry have also flourished, leveraging cell sorting technologies to drive research goals forward.

Clinical applications are expected to register significant growth with a CAGR of 8.1% over the forecast period. The demand for cell sorting technologies has increased due to the growing prevalence of chronic diseases, such as cancer, diabetes, and autoimmunity. Healthcare professionals require advanced diagnostic methods to identify disease causes and develop effective treatments. Technologies such as FACS and microfluidics have improved the efficiency of cell sorting systems, making them a valuable tool in clinical laboratories and daily diagnostics.

Cell Sorting Market By End Use Insights

Research institutions led the market with a revenue share of 39.0% in 2024. Leading research institutions drive scientific innovation in fields such as cancer biology, immunology, and stem cell biology. The demand for precise and efficient cell sorting technologies fuels advancements in devices and bio-reagents. Skilled researchers, trained in operating advanced equipment, are well-equipped to adopt and innovate using these technologies, making them more likely to pioneer new developments compared to other users.

The medical schools and academic institutions segment is expected to register the fastest CAGR of 9.1% during the forecast period. Medical colleges and academic institutions often secure funding from government, private, and industry-backed grants, enabling them to invest in cutting-edge technologies such as cell sorting systems. These institutions provide intensive training sessions, allowing students to work with advanced equipment such as flow cytometry and cell sorting. This combination of education and access to technology fosters innovation and develops the next generation of scientists.

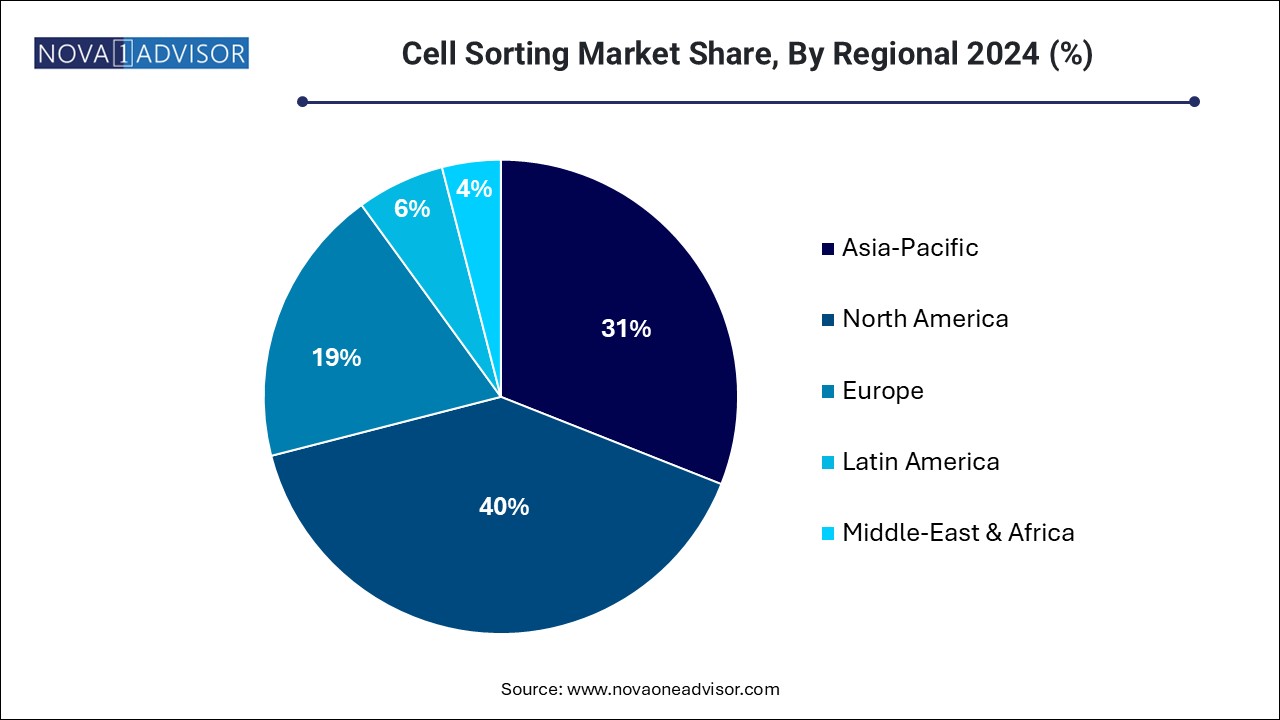

North America cell sorting market is projected to grow significantly over the forecast period. The growth of the cell sorting market can be attributed to various factors, including a well-established healthcare industry, rising incidence of chronic diseases, increased R&D spending, and technological innovation driven by key players. Moreover, North America’s significant R&D expenditure, involving pharmaceutical, biotech, and university research centers, contributes to market growth.

U.S. Cell Sorting Market Trends

The cell sorting market in the U.S. dominated the North America cell sorting market with a revenue share of 85.6% in 2024. The U.S. maintains its position as a leader in cell sorting technologies, with commercially available platforms such as FACS and MACS. The country’s robust research ecosystem, comprising esteemed universities, research centers, and biotechnology organizations, fosters extensive research and innovation in cell sorting applications, including cancer, immunology, and stem cell research.

Asia Pacific Cell Sorting Market Trends

Asia Pacific cell sorting market dominated the global cell sorting market with a revenue share of 31.0% in 2024. The region is witnessing a surge in advancements in cell sorting technologies, including FACS and MACS. The region has seen significant research activities in biotechnology and pharmaceutical industries over the past decade. Developing countries such as China and India are prioritizing research and development, driving growth in the market for cell sorting systems and creating opportunities for investment.

The cell sorting market in China is expected to grow rapidly over the coming years, driven by escalating research and development in biotechnology and pharmaceuticals, as well as expanding healthcare infrastructure and investments in medical research. The prevalence of chronic diseases, such as cancer and HIV, necessitates advanced diagnostic tools, propelling demand for efficient cell sorting methods. As China prioritizes healthcare access and research capabilities, it solidifies its position as a leader in the Asia-Pacific cell sorting market.

Europe Cell Sorting Market Trends

Europe cell sorting market was identified as a lucrative region in the global cell sorting market in 2024. Europe is facing a growing burden of chronic diseases, including cancer and diabetes. To address this, the region has invested heavily in biotechnology and pharmaceutical sectors. This influx of funding has enabled increased research spending and initiatives, including those involving cell sorting technologies, which are crucial in the development of new drugs.

Germany’s cell sorting market maintained a significant market share in 2024. The country’s rigorous regulatory standards guarantee high-quality products in the biotechnology sector. Global players, headquartered in Germany, have established a strong presence, fostering innovation and attracting international collaborations, solidifying Germany’s position as a leading player in the global cell sorting market.

Latin America Cell Sorting Market Trends

Latin America cell sorting market is expected to register the second-fastest CAGR of 8.9% between 2024 and 2030. Governments and private entities in Latin America are investing significantly in healthcare infrastructure and biotechnology research. Brazil and Argentina are leading this initiative, prioritizing scientific research capabilities. Notably, Brazil’s National Health System has augmented funding for biomedical studies, fostering a conducive environment for innovation and growth in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell sorting market

By Product

By Technology

By Application

By End Use

By Regional