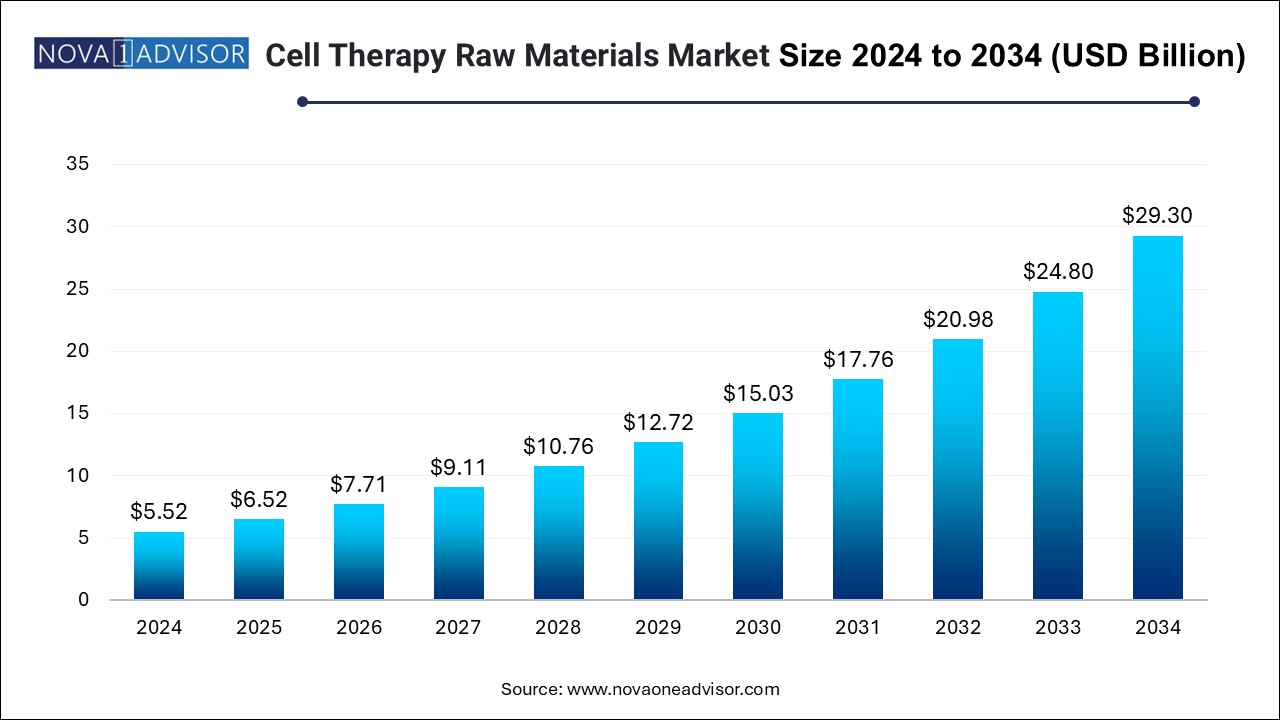

The cell therapy raw materials market size was exhibited at USD 5.52 billion in 2024 and is projected to hit around USD 29.3 billion by 2034, growing at a CAGR of 18.17% during the forecast period 2025 to 2034.

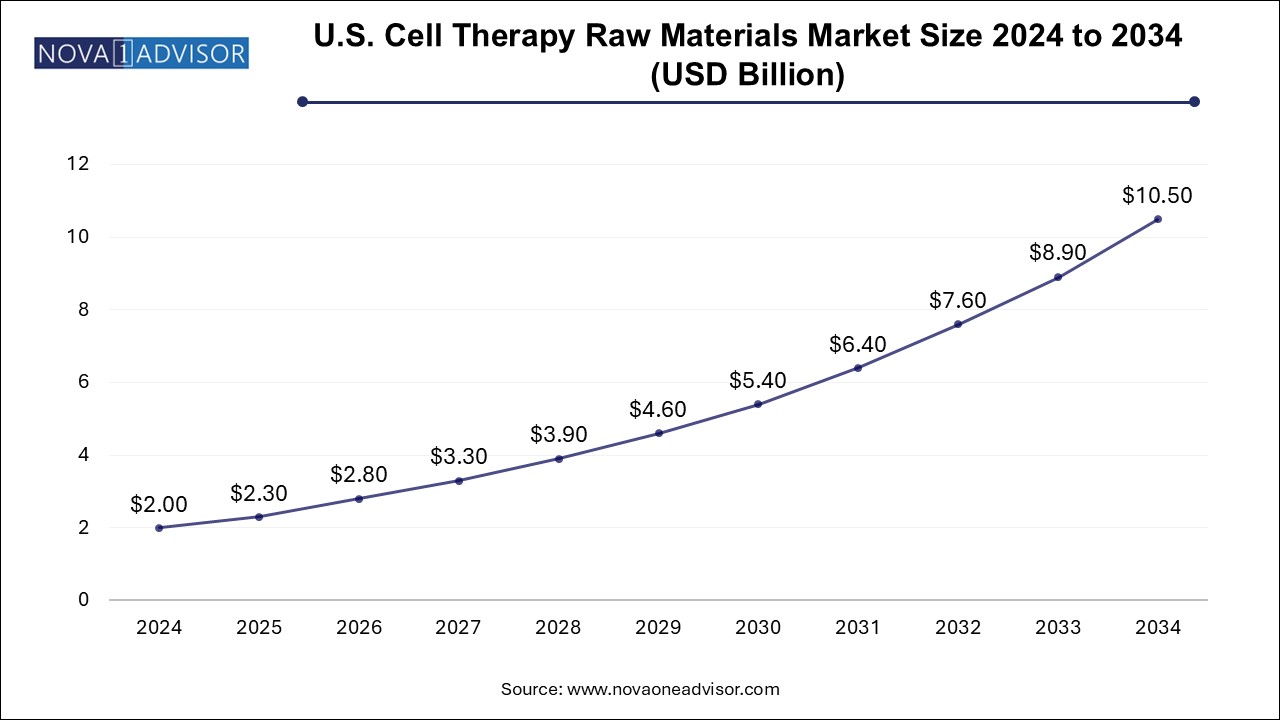

The U.S. cell therapy raw materials market size is evaluated at USD 2.0 billion in 2024 and is projected to be worth around USD 10.5 billion by 2034, growing at a CAGR of 16.27% from 2025 to 2034.

North America remains the dominant region in the global cell therapy raw materials market, driven by its leadership in cell therapy R&D, clinical trials, and commercial approvals. The U.S. is home to several leading CAR-T therapy developers, stem cell research institutions, and a robust CMO/CRO network. Regulatory clarity from the FDA regarding raw material documentation and GMP expectations also supports product standardization and vendor expansion. Furthermore, the U.S. government and private sector investment in cell-based therapies—such as the Regenerative Medicine Advanced Therapy (RMAT) designation—has catalyzed demand for compliant, scalable raw materials. Major raw material providers such as Thermo Fisher Scientific, Lonza, and Bio-Techne maintain their largest production or distribution hubs in this region.

Asia Pacific is the fastest-growing regional market, fueled by a surge in cell therapy research in China, South Korea, Japan, and India. China, in particular, has emerged as a clinical trial hub for CAR-T and MSC therapies, supported by government funding and regulatory reforms that allow for accelerated development. Local biotech companies are investing in GMP facilities and sourcing raw materials domestically and internationally. The region also benefits from cost-effective manufacturing and a growing network of biobanks and stem cell repositories. As the region harmonizes quality standards and expands its raw material production capabilities, it is expected to capture a significant share of the global market.

The cell therapy raw materials market is a critical subset of the broader advanced therapy manufacturing ecosystem, providing the foundational components necessary to enable the development, expansion, and commercialization of cell-based therapies. As cell therapy continues to gain momentum across oncology, regenerative medicine, autoimmune disorders, and rare disease applications, the quality, consistency, and scalability of raw materials are becoming more central to the success of this therapeutic class.

Cell therapies rely heavily on a sophisticated infrastructure of biological inputs and processing reagents—ranging from culture media and sera to antibodies, cytokines, and buffers. These raw materials directly influence the expansion potential, viability, differentiation, and therapeutic functionality of the final cell product. Any variability, contamination, or inconsistency in these materials can compromise efficacy or introduce safety risks, making raw material quality assurance a top priority for developers and regulators alike.

The market is being driven by the growth of approved autologous and allogeneic therapies, such as CAR-T therapies for hematologic malignancies, as well as the clinical expansion of mesenchymal stem cells (MSCs) and induced pluripotent stem cells (iPSCs). Moreover, the increasing number of cell therapy clinical trials—particularly in the U.S., Europe, and parts of Asia—has significantly raised the demand for GMP-compliant, traceable, and scalable raw material solutions.

This market operates at the intersection of biotech innovation, supply chain logistics, and biomanufacturing compliance. Vendors that offer raw materials tailored for cell-specific applications, with documented viral clearance, animal-origin-free formulations, and consistency across lots, are being favored. As cell therapies move from experimental stages to mainstream healthcare, the raw materials segment will be instrumental in supporting industrial scalability and clinical reliability.

Shift Toward Chemically Defined and Serum-Free Media: Developers are minimizing the use of animal-derived components to reduce variability and meet regulatory expectations.

GMP-Grade Raw Materials Standardization: Demand for Good Manufacturing Practice (GMP)-certified materials is increasing, especially for late-stage clinical and commercial manufacturing.

Expansion of Closed-System Processing: Materials compatible with automated, closed-system bioreactors are in higher demand to support aseptic processing and scalability.

Rise of Cell-Type Specific Reagents: Companies are offering tailored raw materials for T cells, NK cells, dendritic cells, and stem cells to improve process efficiency.

Integration of Supply Chain Monitoring Tools: Digital tools for real-time inventory tracking, traceability, and cold-chain assurance are becoming standard.

Strategic Collaborations Between CMOs and Raw Material Suppliers: Partnerships are being formed to co-develop scalable upstream materials aligned with specific manufacturing platforms.

Growth in Customization and On-Demand Supply: Developers are demanding more bespoke raw materials with defined biological attributes, especially in personalized therapy models.

| Report Coverage | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Market Size by 2034 | USD 29.3 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 18.17% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; Sartorius Stedim Biotech Actylis.; ACROBiosystems; STEMCELL Technologies; Grifols, S.A.; Charles River Laboratories; RoosterBio, Inc.; PromoCell GmbH |

A significant driver of the cell therapy raw materials market is the surging number of clinical trials and commercial approvals in the cell and gene therapy space. According to global clinical trial registries, there are currently over 2,000 active cell therapy trials, spanning indications such as leukemia, lymphoma, solid tumors, heart failure, and musculoskeletal repair. Many of these trials are in advanced phases, with a growing proportion supported by venture capital and large pharmaceutical partnerships.

The expansion of these trials, particularly for CAR-T therapies, stem cell-based interventions, and regenerative applications, is increasing the demand for reliable and standardized raw materials. Materials such as cytokines (e.g., IL-2, IL-15), xeno-free sera, and specialized growth media are needed not only in R&D phases but also in GMP conditions for human use. With the FDA and EMA pushing for manufacturing consistency and safety, sponsors are turning to high-quality raw material vendors that can provide batch traceability, documentation, and global compliance. As more cell therapies gain regulatory approval, the raw material supply chain will need to keep pace with both volume and quality expectations.

Despite strong growth, the market faces a notable constraint in the form of supply chain complexity and contamination risks associated with raw materials, especially those derived from animal or human sources. Many cell therapy products still rely on fetal bovine serum (FBS), human platelet lysates, or animal-origin cytokines. These materials carry inherent risks of viral contamination, immunogenicity, and batch-to-batch variability, which can compromise product safety and efficacy.

Moreover, the global supply of high-quality, GMP-grade raw materials is limited, often subject to regional bottlenecks, long lead times, and variable pricing. Events such as pandemics or geopolitical conflicts can disrupt supply chains, resulting in delays in therapy production or trial advancement. Additionally, the regulatory burden for validating raw materials—especially for commercial-grade products—is substantial. Manufacturers must demonstrate source integrity, consistency, and viral clearance through extensive documentation and testing. For small biotech firms or academic labs, navigating these requirements can be costly and time-consuming, restraining wider adoption of certain raw material types.

The rise of allogeneic, off-the-shelf cell therapies offers a compelling opportunity for the raw materials market. Unlike autologous therapies that are patient-specific and low-volume, allogeneic models involve large-scale cell expansion from universal donors, making them significantly more reliant on raw material throughput, scalability, and lot consistency. Companies working on allogeneic CAR-Ts, NK cells, and MSCs require robust upstream materials that can support bulk expansion without compromising cell viability or therapeutic potency.

This shift enables raw material vendors to scale manufacturing processes, invest in larger GMP production facilities, and develop cell-type specific supplements and media that can optimize yield and function. It also opens doors for new formulations—such as serum-free or recombinant cytokine mixes—designed to extend culture viability or promote specific phenotypes. As off-the-shelf therapies gain momentum, the demand for high-volume, GMP-compliant raw materials that can support centralized manufacturing models will present a high-growth, high-margin opportunity for suppliers.

Based on Media emerged as the dominant product segment in the cell therapy raw materials market, owing to its foundational role in cell expansion and viability. Cell culture media are central to every stage of cell therapy manufacturing, from initial isolation and expansion to final formulation. Developers require highly defined media formulations tailored to cell type, function, and clinical application. This includes basal media, custom blends, and xeno-free media designed to minimize variability and contamination risks. Demand is particularly high in T cell and stem cell therapies, where media performance directly impacts cell proliferation, phenotype, and therapeutic efficacy.

In contrast, cell culture supplements are the fastest-growing product category, driven by their role in enhancing specific cell functions such as differentiation, cytokine secretion, or anti-tumor activity. Supplements like human platelet lysates, growth factors (e.g., EGF, FGF), and cytokines (e.g., IL-2, IL-7) are increasingly being optimized for defined clinical workflows. The trend toward modular, additive culture systems that support both autologous and allogeneic expansion is pushing innovation in supplement formulations. As new cell types enter clinical development—such as dendritic cells or gamma delta T cells—the need for cell-specific supplements is rising, further fueling this segment’s growth.

Based on Biopharmaceutical and pharmaceutical companies remained the leading end users, as they represent the majority of entities developing commercial and late-phase clinical cell therapies. These companies demand large quantities of GMP-certified raw materials for consistent batch production, regulatory compliance, and process standardization. They typically maintain long-term supply agreements with raw material vendors and often require custom formulation services to align with proprietary cell therapy protocols. Moreover, pharmaceutical companies are heavily invested in scaling allogeneic and off-the-shelf therapies, which drives their reliance on bulk, consistent, and validated raw materials.

Meanwhile, Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are the fastest-growing end-use segment, owing to increased outsourcing in the biopharma industry. As small and mid-sized biotech firms advance their cell therapy pipelines, they often turn to CROs and CMOs for preclinical, clinical, and GMP manufacturing support. These organizations, in turn, require access to high-quality, readily available raw materials to meet diverse client demands. The ability to quickly source, validate, and integrate raw materials into client-specific processes is critical, making this segment a hotbed for raw material vendor partnerships and growth.

In March 2025, Thermo Fisher Scientific announced the expansion of its GMP media production facilities in the U.S. to meet increasing demand from cell therapy manufacturers, with a focus on serum-free and chemically defined formulations.

Lonza, in February 2025, introduced a new range of xeno-free cytokines and growth factors under its CellBio product line, aimed at supporting allogeneic cell therapy workflows.

Bio-Techne Corporation launched a GMP-grade IL-15 cytokine for NK cell expansion in January 2025, citing increasing demand from CAR-NK developers.

In December 2024, Sartorius AG completed its acquisition of a small U.S.-based reagent manufacturer, enhancing its portfolio of raw materials for T cell and iPSC culture.

Corning Incorporated, in November 2024, introduced a new line of closed-system media and buffer packaging designed to reduce contamination risks in automated cell therapy production.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell therapy raw materials market

By Product Scope

By End Use Scope

By Regional