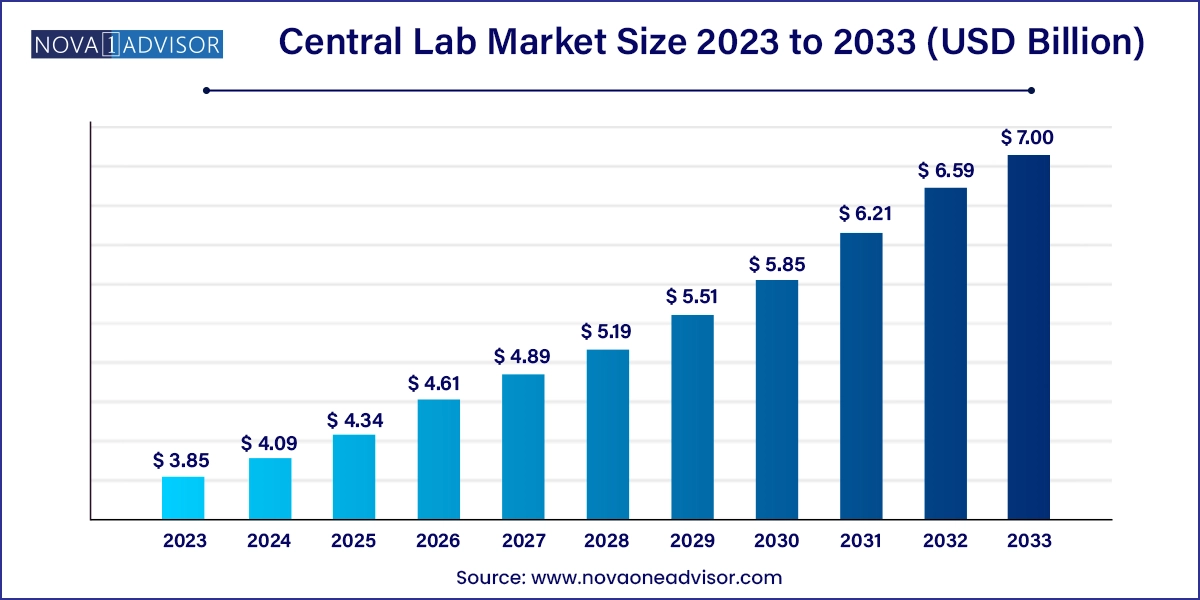

The global central lab market size was valued at USD 3.85 billion in 2023 and is projected to surpass around USD 7.00 billion by 2033, registering a CAGR of 6.16% over the forecast period of 2024 to 2033.

The growth can be attributed to increasing investment in R&D and increased focus of sponsors & investigators on reducing research costs. Moreover, the increasing adoption of outsourcing laboratory services by pharmaceutical & biotechnology companies and other end users to reduce the overall cost of research activities further supports the market growth over the forecast period. A survey conducted in 2022 with biopharmaceutical companies suggests that the outsourcing trend is expected to continue in the coming years as it allows investigators to focus on the trial.

Increased focus on diagnostics owing to COVID-19 led to a rise in funding for novel diagnostics with the potential to improve diagnosis scenarios. For instance, in April 2023, according to LabCentral 2022 Impact Report, companies raised USD 6.05 billion in funding, including 21% of all early-stage funding globally, dosed 4,504 participants in 37 clinical trials, and granted 56 patents. Such strategies are likely to improve the demand for central laboratory services for clinical studies in the country. Furthermore, in March 2021, Bio-Techne Corporation opened a new immunoassay-focused R&D and manufacturing facility in Minneapolis, U.S. This facility is engaged in the production of ELLA immunoassay cartridges for rapid detection of biomarkers for diagnosis of diseases. Thus, opening of such manufacturing facilities in countries strengthens the production of immunoassay test kit development for diagnosis of infectious respiratory diseases during the forecast period.

The preference of consumers toward small- and medium-scale enterprises is rising, owing to the presence of depth & breadth of specialty lab solutions. For instance, in February 2023, Cerba Research signed a Memorandum of Understanding (MoU) with Teddy Clinical Research Laboratory to enter into a joint venture with an aim to combine Teddy's well-established reputation in mainland China, known for providing high-quality central lab solutions backed by more than 12 years of clinical trial experience, with Cerba Research's technical capabilities and scientific expertise. Cerba Research excels in areas such as vaccines, immuno-oncology, cell & gene therapy, and infectious disease research drug development.

The presence of up-to-date and novel instruments in the new laboratory is expected to enhance automation and provide more efficient results with high-quality data. In May 2023, the China Association of Clinical Laboratory Practice Expo stood as the premier exhibition for IVD within China. Drawing a gathering of more than 30,000 experts, including entrepreneurs, scholars, users, and thought leaders in the clinical laboratory sector from across the world, CACLP fosters the exchange of advancements in the industry. It serves as a platform for enhancing partnerships and collectively shaping the future of the IVD industry. However, changes in government regulations can adversely affect central lab market growth.

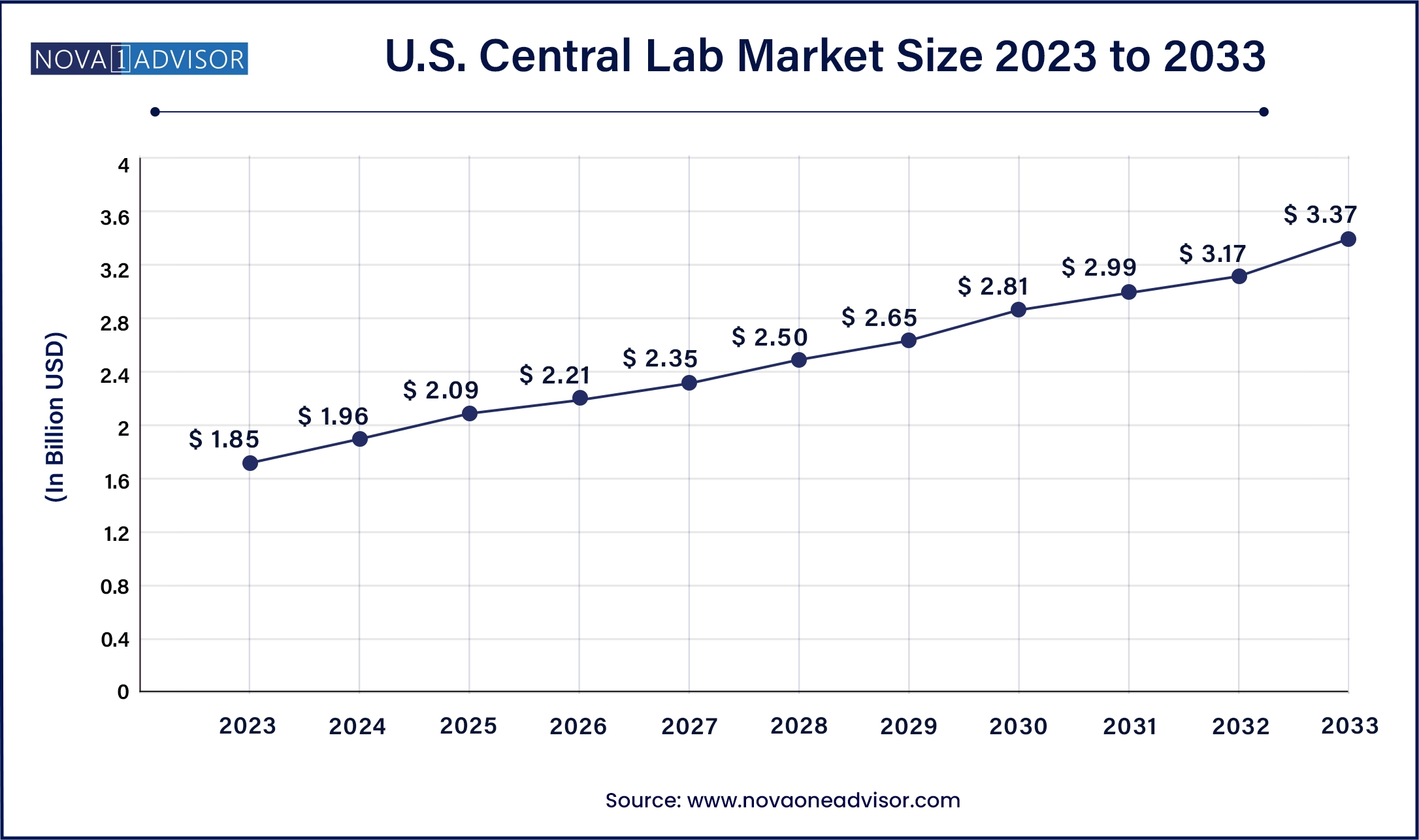

The U.S. central lab market size was valued at USD 1.85 billion in 2023 and is anticipated to reach around USD 3.37billion by 2033, growing at a CAGR of 6.18% from 2024 to 2033.

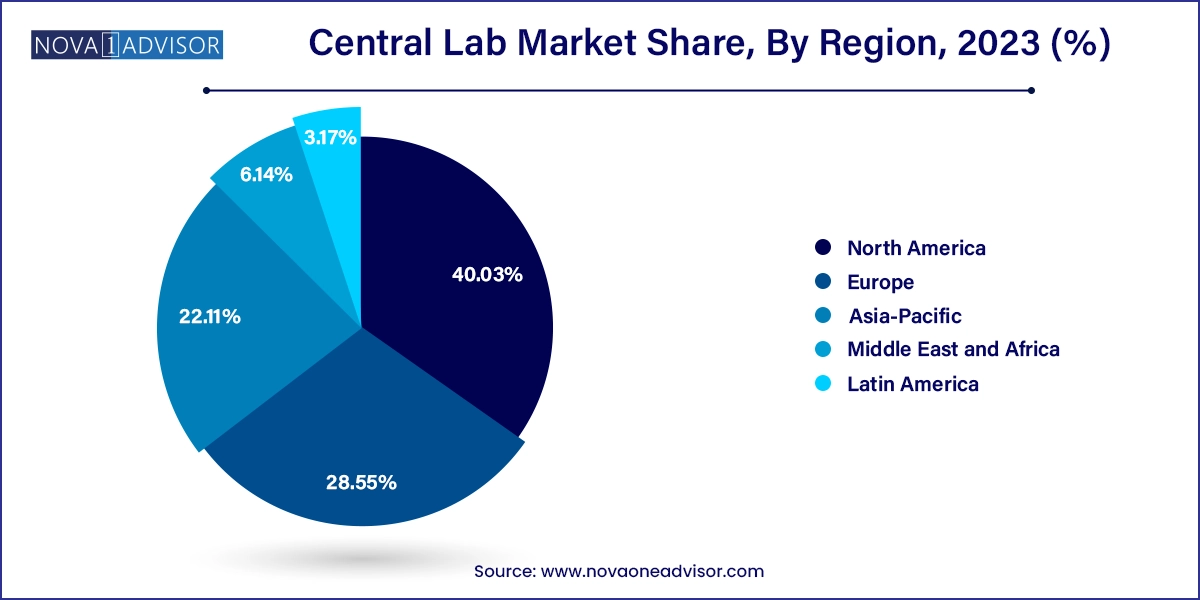

North America dominated the market with a share of 40.03% in 2023. The market is collectively driven by the increasing adoption of molecular testing due to its high accuracy, sensitivity, and specificity. High prevalence of infections such as Sexually Transmitted Infections (STIs) & tuberculosis in the region is also anticipated to propel the demand for clinical research pertaining to the development of diagnostic devices and therapeutics. For instance, according to CDC, in March 2022, in the U.S., over 20 million new cases of STI are expected to occur annually, leading to approximately USD 10–USD 17 billion in costs per year, and the prevalence is expected to grow further. Moreover, key players are constantly focusing on expanding their presence in the field of clinical development. For instance, in July 2022, LabCorp announced the development of its spin-off company focusing on clinical development to enhance CRO capabilities. These factors are anticipated to positively impact the market growth in the region.

Asia Pacific is expected to witness the fastest growth in the market with a CAGR of 7.74% over the forecast period due to increasing adoption of central lab services in the region. China and India are considered prospective business hubs for clinical testing & service providers. Furthermore, with urbanization, increase in disposable income, awareness about the prevention of severe diseases, and education the market is expected to grow in this region. Asia Pacific markets, such as Australia, China, Korea, and Taiwan, already have healthcare reimbursement systems, which provide coverage for diagnostic tests. In addition, increasing government support has increased the opportunities for drug development companies. For instance, in September 2019, the Ministry of Food and Drug Safety announced a 5-year plan for the advancement of clinical trials in South Korea. This plan was launched to enhance clinical trial management by 2023

| Report Attribute | Details |

| Market Size in 2024 | USD 4.09 Billion |

| Market Size by 2033 | USD 7.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.16% |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, and By End User |

| Base Year | 2023 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | ACM Global Laboratories; Labconnect; Cerba Research; Eurofins Scientific; Medicover Integrated Clinical Services (MICS) (Synevo Central Labs); Versiti (Cenetron); A.P. Møller Holding A/S (Unilabs); Ampersand Capital Partners (Pacific Biomarkers); Lambda Therapeutics Research Ltd; Cirion Biopharma Research Inc. |

The demand for novel drugs for diseases is rising, which can be attributed to increasing awareness and personal approaches to treatment. Furthermore, the accelerating pace of innovation cycles is leading products to enter preclinical stages, thereby creating an opportunity for the central labs. The rise in demand can also be attributed to development in technology, which not only allows treatment but also cures diseases. Part of this development can be attributed to the rise in demand for personalized medicine and therapies. The growth in biotechnology-based therapies, such as cell and gene therapy, is expected to further drive the demand for the market owing to the stringent guidelines associated with clinical trials of the biotechnology sector.

A crucial aspect of clinical trials involves gathering, analyzing, and documenting specimens from participants. These responsibilities are typically handled by a central lab, which provides specimen collection kits, logistics services, safety alerts, and an extensive range of testing & reporting services. The clinical trial investigators and sponsors outsource 80% of the central lab work and prefer the labs that provide integrated services. A survey conducted in 2022 with biopharmaceutical companies suggests that the outsourcing trend is expected to continue in the coming years as it allows investigators to focus on the trial.

However, the logistics and sample handling is restraining the growth of the overall market. Supply chain, sample handling, and logistics play a crucial role in the sample sent to clinical labs. These samples require fast logistics and are highly sensitive and with temperature control, thereby getting the most accurate results by maintaining sample stability. The results from samples received outside stability need to be revised and accepted. Thus, Standard Operating Procedures (SOPs) to keep the sample stable are crucial for allowing easier transport and storage. This also requires collaboration with the clinical site to conform to testing and sample handling requirements, hence, making communication significant.

Biomarker services held the largest market share of 39.02% in 2023 of the market. Biomarkers represent a promising option for clinical development programs to ascertain new pathways for diagnostics and discern disease mechanisms for the development of better therapeutics. Biomarker studies provide early detection of life-threatening diseases, evaluation of the risk of side effects associated with investigation therapies, and disease progression in patients during clinical trials. Moreover, market players are expanding their offerings in biomarker services to strengthen their position in the market. For instance, in January 2023, Unilabs partnered with Ambry Genetics to improve its high-quality genetic testing services for biopharmaceutical companies conducting clinical trials in Europe, Latin America, and the Middle East.

Genetic services segment is anticipated to grow at the fastest growth rate over the forecast period with a CAGR of 7.67%. The growth of the market is driven by the increasing significance of genetic analysis in clinical studies. Understanding the underlying genetic factors can aid in the development of targeted therapies for a variety of diseases, such as cancer and inheritable diseases. Furthermore, genetic differences in pathways for drug metabolism may alter a patient’s response to treatment. An increase in research activities for genetic testing is projected to fuel the demand for central lab genetic services over the forecast period. In December 2022, the Cystic Fibrosis Foundation Therapeutics Lab announced to facilitate the development of genetic-based therapies for people with cystic fibrosis.

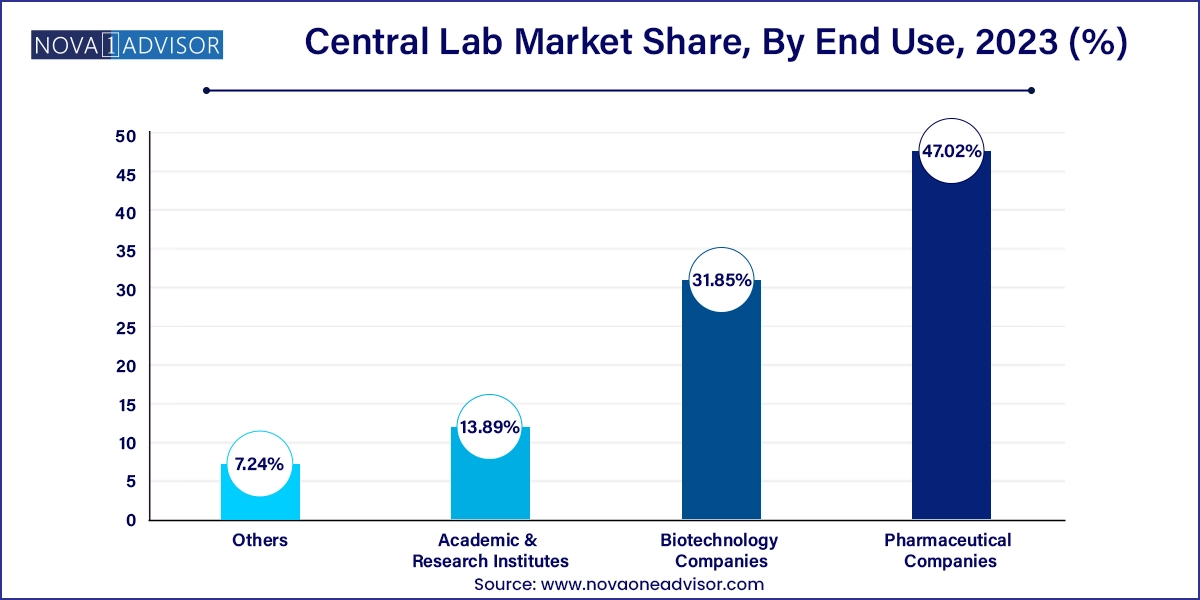

Pharmaceutical companies end-use segment held the largest market share of 47.02% in 2023 of the market. Pharmaceutical companies rely on central laboratory service providers to evaluate the efficacy of new drug products. For the evaluation of investigational drugs, the service providers offer tests such as biochemistry, hematology, histopathology, immunology, endocrinology, microbiology, real-time PCR, and clinical pathology. Central lab services providers like Covance, Celerion, Altasciences, NorthEast BioAnalytical Laboratories LLC, and Shanghai Medicilon offer preclinical & clinical trial services to pharmaceutical companies to complete clinical trials. Furthermore, market players are partnering with pharmaceutical companies to strengthen their service offerings and expand their geographic footprint. For instance, in April 2023, Sygnature Discovery collaborated with Daewoong Pharmaceutical to boost its global innovations in drug development.

Biotechnology companies segment is anticipated to grow at the fastest growth rate in the market with a CAGR of 7.10% over the forecast period. An increase in activities for the development of biological therapies is expected to drive the market in the coming years. By 2025, the U.S. FDA will approve 10 to 20 cell & gene therapy products per year. The market for cell and gene therapy-related services, which includes contract development & manufacturing, analytical testing, and regulatory consulting, has also been growing rapidly in response to the demand for these therapies. Moreover, Pace Analytical expanded its capabilities to support gene therapy projects by investing in analytical equipment, including capillary electrophoresis, Ultrapressure Liquid Chromatography (UPLC), large-molecule time-of-flight mass spectroscopy, and microplate readers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Central Lab market.

By Product Type

By End User

By Region