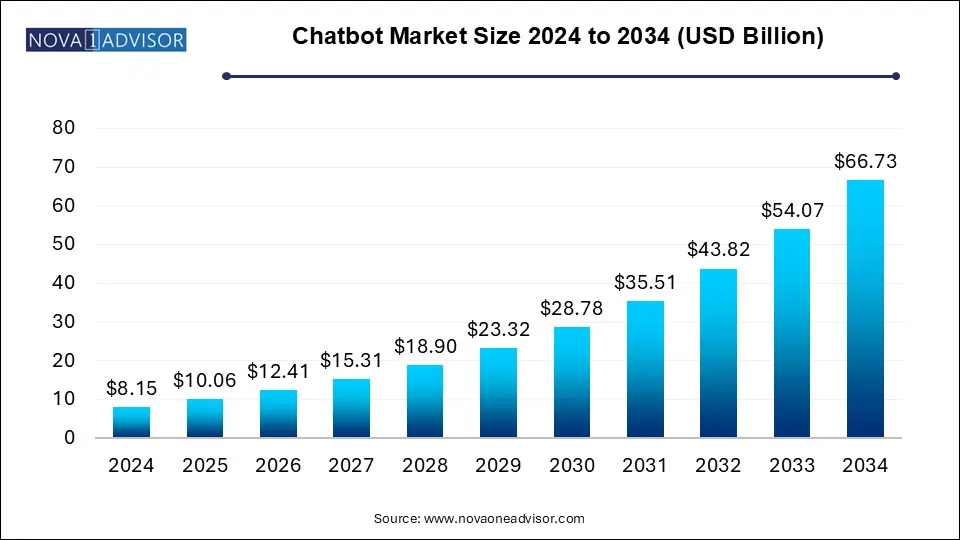

The chatbot market size was exhibited at USD 8.15 billion in 2024 and is projected to hit around USD 66.73 billion by 2034, growing at a CAGR of 23.4% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.06 Billion |

| Market Size by 2034 | USD 66.73 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 23.4% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Offering, Type, Medium, Business Function, Application, Vertical, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | [24]7.ai, Inc.; Acuvate; Aivo; Artificial Solutions; Botsify Inc.; Creative Virtual Ltd.; eGain Corporation; IBM Corporation; Inbenta Technologies Inc.; Next IT Corp.; Nuance Communications, Inc. |

The chatbot industry is experiencing significant growth due to advancements in artificial intelligence (AI) and machine learning. Businesses are increasingly adopting chatbots to enhance customer interactions and streamline operations. These virtual assistants provide 24/7 availability, reducing response times and improving user satisfaction. Industries such as e-commerce, banking, and data privacy & compliance are particularly benefitting from these innovations. The integration of natural language processing has enabled chatbots to handle complex queries with greater accuracy. This has expanded their use beyond customer support to areas like sales and internal operations.

Consumer preferences for instant and personalized interactions are driving the adoption of chatbot solutions. Companies are utilizing chatbots to gather insights and improve engagement through conversational marketing. The rise of messaging platforms and Sales & Marketing-enabled technologies has broadened the reach of these tools. Startups and established firms alike are investing heavily in AI to create advanced chatbot solutions. Moreover, multilingual support has allowed businesses to cater to diverse audiences, fueling global expansion. This adaptability positions chatbots as essential tools for organizations aiming to enhance efficiency and reach.

In Jan 2025, LG Electronics and Microsoft teamed up to take the chatbot market to the next level with the integration of their advanced technologies into AI-driven agents. The companies have joined together in a strategic partnership that will develop next-generation AI solutions for various environments such as homes, vehicles, hotels, and offices. Accordingly, the collaboration between the two aims to create new benchmarks in the chatbot industry for better interactivity, personalization, and seamless integration across smart ecosystems, building on LG's expertise in home appliances with Microsoft's standing in AI and cloud technologies.

The market is also witnessing growth due to cost-saving potential and scalability of chatbot solutions. Small and medium enterprises are implementing these tools to compete with larger players and optimize resources. Integration with analytics tools helps companies assess chatbot performance and refine user experiences. As regulatory compliance becomes more stringent, secure and compliant chatbot solutions are gaining attention. Emerging trends, including Sales & Marketing bots and augmented reality integrations, are expected to propel future innovations. With continuous investment and technological progress, the market shows no signs of slowing down.

The solution segment dominated the chatbot market with a revenue share of 62.0% in 2024. These solutions include AI-powered platforms that deliver personalized, context-aware responses to users. Enterprises are focusing on deploying chatbots for customer service, lead generation, and employee support functions. Market leaders are enhancing their offerings by integrating advanced features such as machine learning and multilingual capabilities. These developments have positioned chatbot solutions as indispensable for improving operational efficiency and user engagement.

The services segment is growing rapidly as organizations prioritize managed and cloud-based solutions. Service providers are increasingly offering support for chatbot deployment, customization, and integration into existing systems. Demand for consulting services is also rising as businesses seek guidance on leveraging chatbot technology effectively. Subscription-based and pay-as-you-go models have made these services more accessible to small and medium enterprises. This trend underscores the importance of services in scaling chatbot adoption and maximizing their benefits across industries.

Standalone chatbots dominate the chatbot industry in 2024. This type of chatbots function independently, offering greater control and customization options. Their ability to operate without integration into other platforms appeals to businesses seeking specific functionalities. These chatbots are often used in industries requiring tailored solutions, such as customer support and retail. Their offline capabilities make them reliable for environments where internet connectivity is limited. This combination of flexibility and reliability has solidified their position as a preferred choice in many sectors.

Web-based chatbots are growing in popularity due to their ease of deployment and cross-device accessibility via browsers. They integrate well with existing web platforms, enabling real-time customer interactions. Cloud technology advancements support their scalability, reducing the need for significant infrastructure investments. Businesses value their ability to enhance user experiences by providing seamless, on-demand service. This trend shows a shift toward more flexible and accessible solutions in the chatbot market.

The mobile applications segment accounted for the highest revenue share in 2024 and is anticipated to continue leading throughout the forecast period. Mobile applications dominate the chatbot industry due to their ability to offer personalized, on-the-go experiences for users. These apps integrate chatbots to provide real-time customer support, product recommendations, and more. Their wide reach through smartphones makes them a critical tool for businesses looking to enhance customer engagement. Chatbots in mobile apps have become essential in industries like retail, banking, and entertainment. The flexibility and direct access to users have solidified mobile applications as a dominant platform in the chatbot space.

Social media chatbots are growing as businesses increasingly utilize platforms such as Facebook, Instagram, and Twitter for customer interaction. These chatbots help companies manage customer inquiries, marketing campaigns, and even sales through social channels. The ability to engage directly with large audiences in real time is driving this growth. Social media chatbots offer businesses the opportunity to enhance brand visibility and customer service. Their integration into social platforms aligns with the growing trend of using digital communication tools for business interactions.

The sales and marketing segment accounted for the highest revenue share in 2024. Sales and marketing functions dominate the use of chatbots due to their effectiveness in automating customer interactions. Chatbots handle lead generation, marketing campaigns, and customer relationship management, significantly improving sales processes. By delivering personalized recommendations and nurturing leads, they help businesses increase conversion rates. These chatbots are instrumental in driving marketing strategies by engaging users instantly. The high demand for automation in sales and marketing has led to this function becoming a dominant force in chatbot use.

Finance-related chatbots are growing as financial institutions look for ways to improve operational efficiency and customer service. These chatbots help with automating tasks like financial planning, account management, and personalized investment advice. With the growing need for customer support in the finance sector, chatbots are becoming a valuable tool. They offer personalized insights and real-time solutions to clients, making financial services more accessible. This growth shows a shift toward more automated and user-friendly solutions in the finance industry.

The customer service segment dominated the chatbot market in 2024. Customer service chatbots are a dominant force in the chatbot industry, as they improve response times and reduce the workload of human agents. These bots provide 24/7 support, handle high volumes of inquiries, and efficiently resolve basic customer issues. Their ability to deliver instant responses makes them critical for businesses aiming to streamline operations and boost customer satisfaction. Industries such as e-commerce, telecom, and hospitality increasingly rely on chatbots to manage frequently asked questions and deliver quick resolutions. The scalability and efficiency of customer service chatbots have solidified their dominance in the chatbot industry.

Chatbots in payment processing are rapidly growing within the chatbot industry due to the rising demand for secure, automated transactions. These bots assist with bill payments, fund transfers, and transaction updates, improving the overall efficiency of financial operations. Their integration into digital wallets and banking apps is expanding, offering users greater convenience and control over their financial activities. The increasing popularity of mobile payments and online banking has accelerated the adoption of payment processing chatbots. This growth highlights the chatbot industry's broader shift toward automating financial services and enhancing the customer experience.

The retail and e-commerce segment dominated the market share of 28.0% in 2024, with chatbots enhancing shopping experiences by providing personalized recommendations and assisting with order tracking. These bots streamline customer interactions, from product searches to post-purchase support, driving customer satisfaction and sales. Chatbots in this sector help retailers manage high traffic during peak shopping seasons and reduce response times. Their integration into e-commerce platforms has become crucial for maintaining competitiveness in the market. Retail and e-commerce businesses increasingly rely on chatbots to improve operational efficiency and enhance the shopping experience.

Chatbots in the BFSI sector are growing as financial institutions embrace digital transformation. Thus, by 2025, the market for chatbot in BFSI will surpass USD 2 Billion. These chatbots provide services such as account management, fraud detection, and claim processing, improving both customer experience and operational efficiency. The growing complexity of financial products and services drives the need for automation in customer support. Chatbots help meet the demand for personalized financial advice and quick resolution of issues. As BFSI companies continue to focus on innovation, chatbots will play an increasingly important role in shaping customer interactions.

North America chatbot market leads the global industry accounting for leading share of 31.1% in 2024. The regional market is marked by significant investment in AI and automation technologies. Companies across various sectors, including retail and banking, are leveraging chatbots to improve customer service and optimize operations. The region is home to some of the largest chatbot development companies, driving innovation and setting trends. As businesses continue to prioritize digital transformation, the market in North America is expected to experience sustained growth.

U.S. Chatbot Market Trends

In the U.S. chatbot market is thriving due to a strong emphasis on customer experience and operational efficiency. Enterprises across industries, from finance to Data Privacy & Compliance, are increasingly integrating chatbots for tasks like lead generation, customer support, and data management. The widespread use of AI and machine learning technologies is propelling the adoption of more advanced chatbot solutions.

Europe Chatbot Market Trends

The Europe chatbot market in is growing steadily as businesses embrace digital solutions to enhance customer engagement. AI-driven chatbots are increasingly being adopted across sectors such as retail, Data Privacy & Compliance, and finance. The region's strong regulatory focus on data privacy and security has made companies cautious yet keen on chatbot solutions.

Asia Pacific Chatbot Market Trends

The Asia Pacific chatbot market is expanding rapidly, driven by the region’s technological growth and digitalization. Countries such as China, India, and Japan are adopting chatbots for customer service, e-commerce, and financial services. With a growing internet user base and mobile-first adoption, chatbots are becoming crucial for businesses looking to engage customers efficiently. The region’s strong focus on innovation and digital transformation continues to fuel the widespread adoption of chatbot solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the chatbot market

By Offering

By Type

By Medium

By Business Function

By Application

By Vertical

By Regional