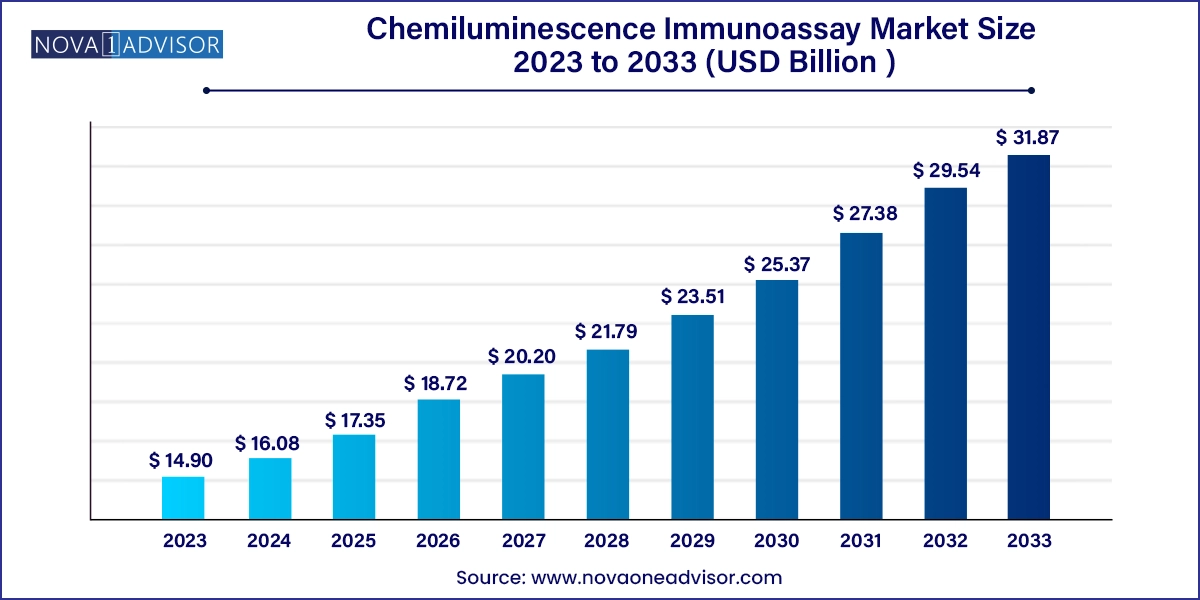

The global chemiluminescence immunoassay market size was valued at USD 14.90 billion in 2023 and is anticipated to reach around USD 31.87 billion by 2033, growing at a CAGR of 7.9% from 2024 to 2033.

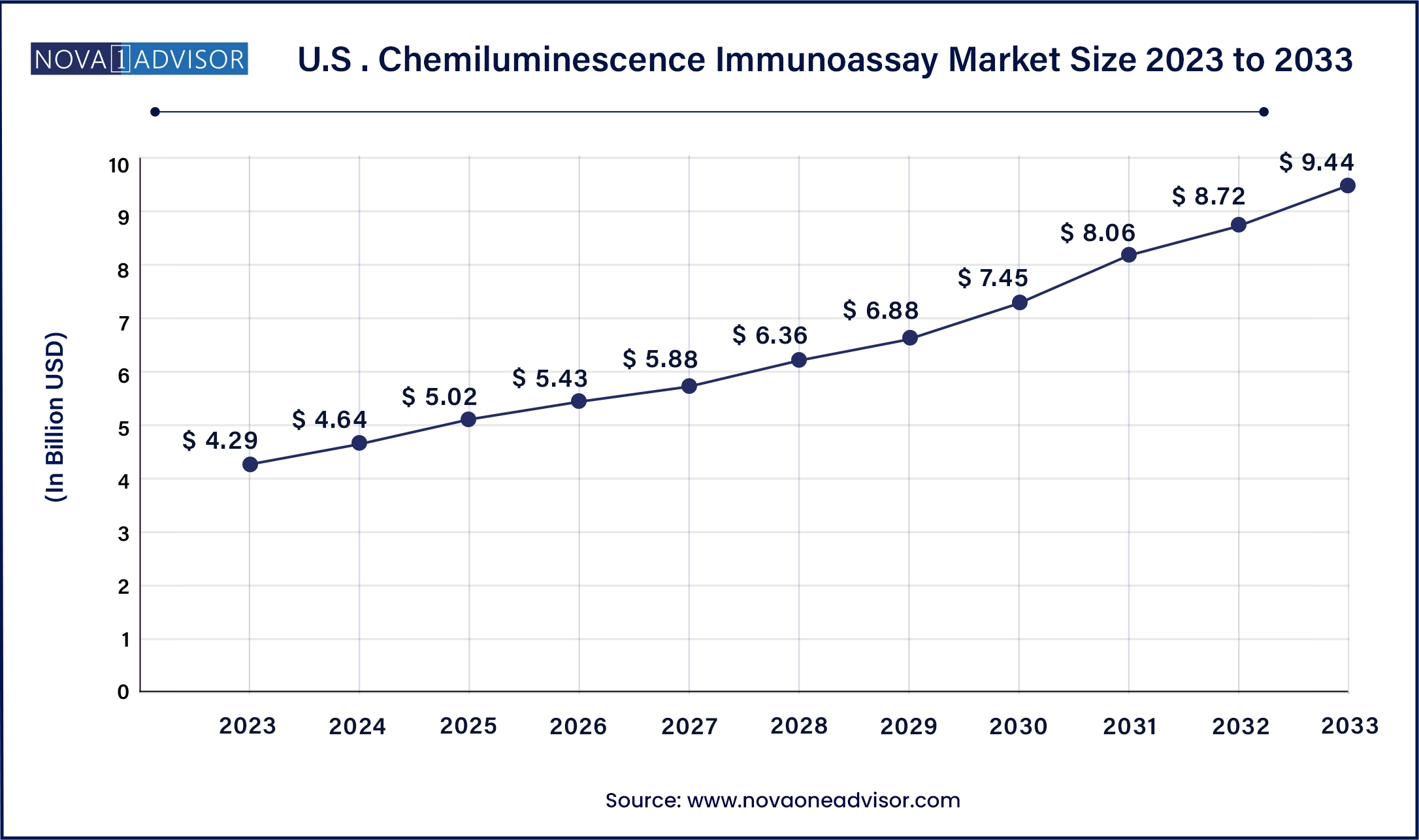

The U.S. chemiluminescence immunoassay market size was estimated at USD 4.29 billion in 2023 and is predicted to be worth around USD 9.44 billion by 2033, at a CAGR of 8.2% from 2024 to 2033.

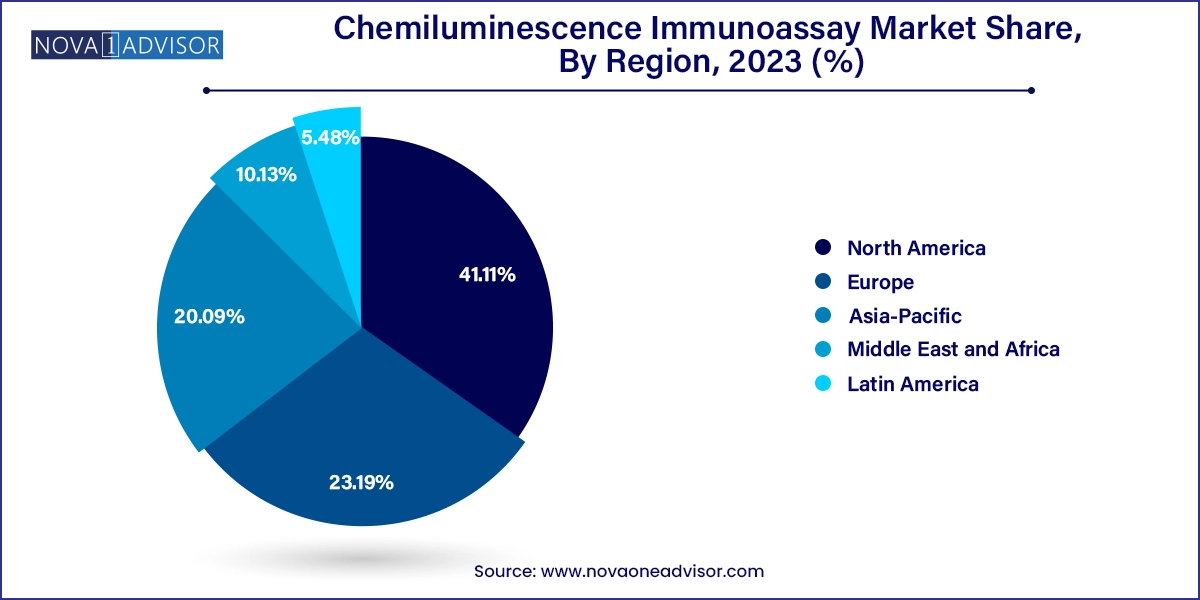

North America, particularly the United States, dominates the chemiluminescence immunoassay market due to its strong healthcare infrastructure, early technology adoption, and presence of major industry players. The region benefits from a high volume of clinical tests, favorable reimbursement policies, and well-established laboratory chains. Companies like Abbott Laboratories, Siemens Healthineers, and Roche Diagnostics have substantial installed bases in U.S. hospitals and labs. The emphasis on preventive care, chronic disease management, and personalized medicine continues to fuel demand for high-throughput, automated CLIA systems in the region.

Asia Pacific Chemiluminescence Immunoassay Market Trends

Asia-Pacific is the fastest-growing regional market, driven by improving healthcare access, rising disease awareness, and growing investment in laboratory infrastructure. Countries such as China and India are witnessing rapid expansion of diagnostic centers, both public and private. Rising middle-class populations and increased health expenditure are boosting demand for reliable diagnostic testing. Moreover, local manufacturers in China and South Korea are emerging with cost-effective CLIA solutions tailored to regional needs. Government initiatives to strengthen disease surveillance and preventive diagnostics are further accelerating market penetration.

The global chemiluminescence immunoassay (CLIA) market has witnessed steady growth over the past decade, evolving into a vital diagnostic technology across a wide range of medical applications. As the demand for rapid, sensitive, and high-throughput diagnostic techniques has intensified, CLIA systems have emerged as a gold standard for accurate biomarker detection in both clinical and research settings. Chemiluminescence immunoassays work by using luminescent markers to detect specific antigens or antibodies, offering greater sensitivity than traditional ELISA or colorimetric immunoassays.

In today’s clinical landscape, where timely diagnosis directly influences patient outcomes and healthcare costs, CLIA-based diagnostic platforms offer a compelling combination of precision, speed, and versatility. They are widely used for detecting infectious diseases, endocrine disorders, cancer markers, cardiac biomarkers, autoimmune diseases, and more. In addition, their role in therapeutic drug monitoring and blood screening has expanded with the growing focus on personalized medicine.

Leading diagnostic manufacturers have focused on improving automation, multiplexing capabilities, and user-friendly software interfaces. From high-volume laboratories in metropolitan hospitals to decentralized diagnostic units in emerging markets, CLIA systems are playing a transformative role. The market is further propelled by the increasing global disease burden, rising geriatric populations, and demand for point-of-care and laboratory-based testing tools that offer both sensitivity and specificity.

Automation of CLIA systems gaining widespread adoption: Fully automated platforms are streamlining laboratory workflows, reducing manual errors, and increasing throughput in hospital and reference labs.

Growing application in chronic disease monitoring: CLIA tests are being increasingly used for monitoring endocrine, oncological, and cardiovascular conditions.

Rise of multiplexing and hybrid technologies: Platforms integrating chemiluminescence with magnetic particles or microfluidics are gaining ground for multi-analyte testing.

Use of AI-enabled software for data analysis: Enhanced diagnostics interpretation through artificial intelligence is improving result accuracy and operational efficiency.

Shift toward reagent rental models: Diagnostic companies are increasingly offering instruments under reagent leasing contracts to reduce upfront costs for smaller labs.

Miniaturization and portability of CLIA analyzers: Emerging innovations are making it feasible to deploy CLIA systems in decentralized and remote care environments.

Increased research use of CLIA for novel biomarkers: The growing demand for biomarker-based assays in drug development is boosting usage in pharmaceutical and biotech R&D.

Adoption in veterinary and environmental testing: New applications are being explored in animal health and environmental toxin monitoring using CLIA-based assays.

| Report Attribute | Details |

| Market Size in 2024 | USD 16.08 Billion |

| Market Size by 2033 | USD 31.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Technology, Sample Type, Application, End-use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott Laboratories; Beckman Coulter Inc.; DiaSorin S.p.A.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; F. Hoffmann-La Roche AG; Siemens Healthineers; Ortho Clinical Diagnostics |

The rising burden of chronic and infectious diseases is one of the most significant drivers fueling the chemiluminescence immunoassay market. Conditions like diabetes, thyroid disorders, cardiovascular diseases, HIV, hepatitis, and cancers demand timely diagnosis and continuous monitoring, both of which are effectively supported by CLIA technologies. The sensitivity and specificity offered by CLIA systems make them ideal for early detection, a crucial factor in controlling disease progression.

For instance, in endocrine disorders such as hypothyroidism or adrenal insufficiency, CLIA assays are routinely employed to measure TSH, FT4, cortisol, and related hormone levels. Similarly, in oncology, tumor markers such as PSA, CA-125, and CEA are accurately quantified through CLIA platforms. The post-pandemic diagnostic awareness has further escalated the usage of CLIA systems in infection panels, especially for respiratory and sexually transmitted infections.

Despite its advantages, the CLIA market is restrained by the relatively high cost of instruments and reagents, particularly for resource-limited settings. Fully automated CLIA platforms often require a significant upfront investment, along with ongoing maintenance and calibration expenses. Smaller laboratories and diagnostic centers in developing regions may find it difficult to adopt such high-throughput systems due to capital constraints.

In addition, the operational complexity associated with multi-parameter systems, particularly those used for research or multiplex assays, necessitates trained personnel and robust quality assurance protocols. Lack of standardized calibration across manufacturers also creates inter-laboratory variability, posing a challenge for reproducibility and compliance with regulatory standards.

A significant opportunity in the CLIA market lies in the development of portable and point-of-care (POC) CLIA analyzers. With the rise in chronic diseases, pandemic preparedness, and telemedicine, there is a growing need for diagnostic systems that can deliver fast and accurate results closer to the patient.

Innovations in microfluidics, LED-based detection, and compact design are paving the way for CLIA systems to be used in outpatient clinics, mobile health units, and even home settings. For example, certain compact CLIA devices have been deployed in COVID-19 testing units and are now transitioning into broader applications, such as cardiovascular risk profiling or fertility monitoring. As healthcare delivery shifts toward decentralized and preventive care, manufacturers who focus on portable, battery-operated, or smartphone-integrated CLIA platforms are likely to unlock new market segments.

Consumables, including reagents and assay kits, dominated the chemiluminescence immunoassay market due to their recurring usage and essential role in the testing process. Reagents such as luminophore markers and enzymatic conjugates are critical to the detection mechanism, and their continuous replenishment drives sustained revenue. With increasing test volumes, especially in hospitals and clinical labs, the demand for high-quality, pre-packaged consumables is accelerating. In addition, reagents are increasingly being tailored to specific disease markers and analyzers, creating a high level of product differentiation and brand loyalty.

Software & services are the fastest-growing product segment, as labs seek integrated solutions that support data management, compliance, and remote analytics. AI-enhanced diagnostic interpretation, LIS integration, and real-time data monitoring are becoming standard features. Furthermore, as CLIA platforms become more automated, the need for predictive maintenance, remote troubleshooting, and analytics dashboards is growing. Vendors now offer cloud-enabled platforms that track instrument performance, reagent usage, and test volumes, enabling laboratories to optimize operations.

Blood remains the dominant sample type in the CLIA market, as serum and plasma provide reliable matrices for a wide range of biomarker analyses. Blood-based assays are standard in endocrinology, oncology, and infectious disease diagnostics. Laboratories continue to prefer blood samples for their high diagnostic yield and compatibility with existing protocols.

Saliva, however, is growing as a non-invasive alternative, especially in areas like hormone monitoring (e.g., cortisol, testosterone), infectious disease screening (HIV, COVID-19), and drug testing. CLIA-based saliva tests are gaining traction in pediatric populations, remote care settings, and behavioral health monitoring due to their ease of collection and minimal biohazard risk.

Endocrinology has long been the dominant application area for CLIA due to the high prevalence of hormone-related disorders and the requirement for quantitative precision. CLIA systems are widely used to measure levels of TSH, insulin, LH, FSH, and cortisol. The increasing prevalence of thyroid dysfunction and metabolic syndromes in developed and emerging countries alike supports demand for continuous hormone testing.

Oncology is the fastest-growing application area, driven by the expanding role of early detection and treatment monitoring in cancer care. Tumor markers such as PSA (prostate), CA-125 (ovarian), and AFP (liver) are being routinely assessed via CLIA. New developments in liquid biopsy and circulating tumor markers are further enhancing the utility of CLIA in oncology diagnostics, helping clinicians make more informed decisions with faster turnaround times.

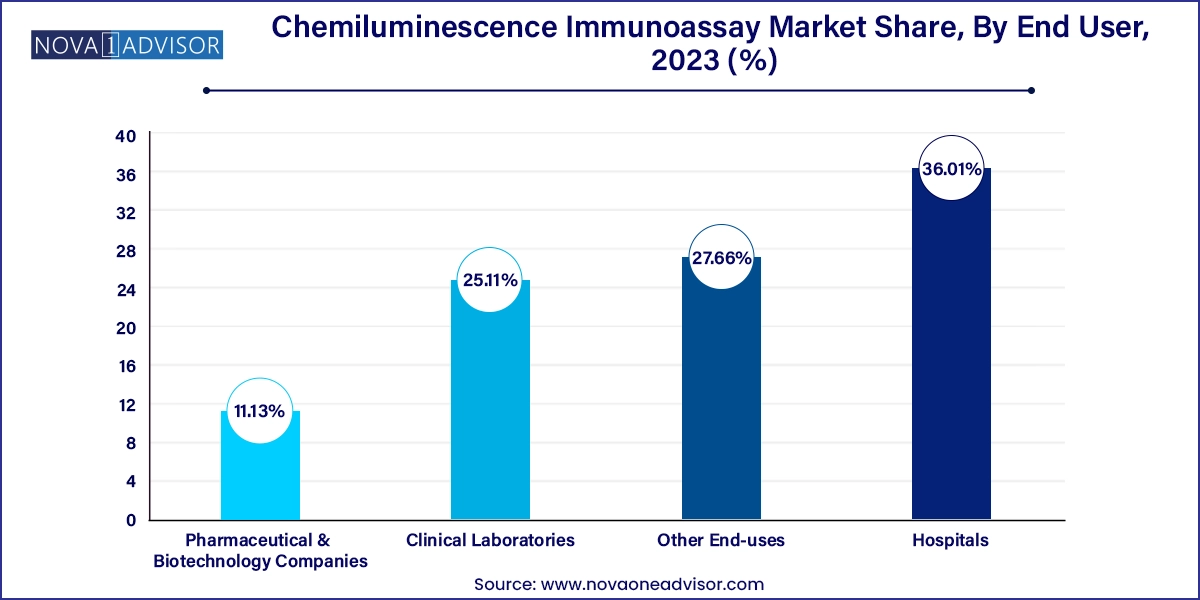

Hospitals are the leading end-user segment in the CLIA market, given their centralized laboratory setups, access to advanced instruments, and high patient volume. Hospitals perform large volumes of CLIA tests daily for triage, treatment planning, and health screening. The ability to process multiple assays in a single run makes CLIA ideal for inpatient and outpatient diagnostics.

Pharmaceutical & biotechnology companies are emerging as a fast-growing segment due to their increasing use of CLIA for clinical trials, pharmacokinetics, and biomarker discovery. Drug developers rely on sensitive immunoassays to monitor therapeutic levels, immune responses, and toxicity profiles. As biologics and immunotherapies expand, CLIA’s precision and scalability make it invaluable in drug development pipelines.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Chemiluminescence Immunoassay market.

By Product

By Technology

By Sample Type

By Application

By End-use

By Region