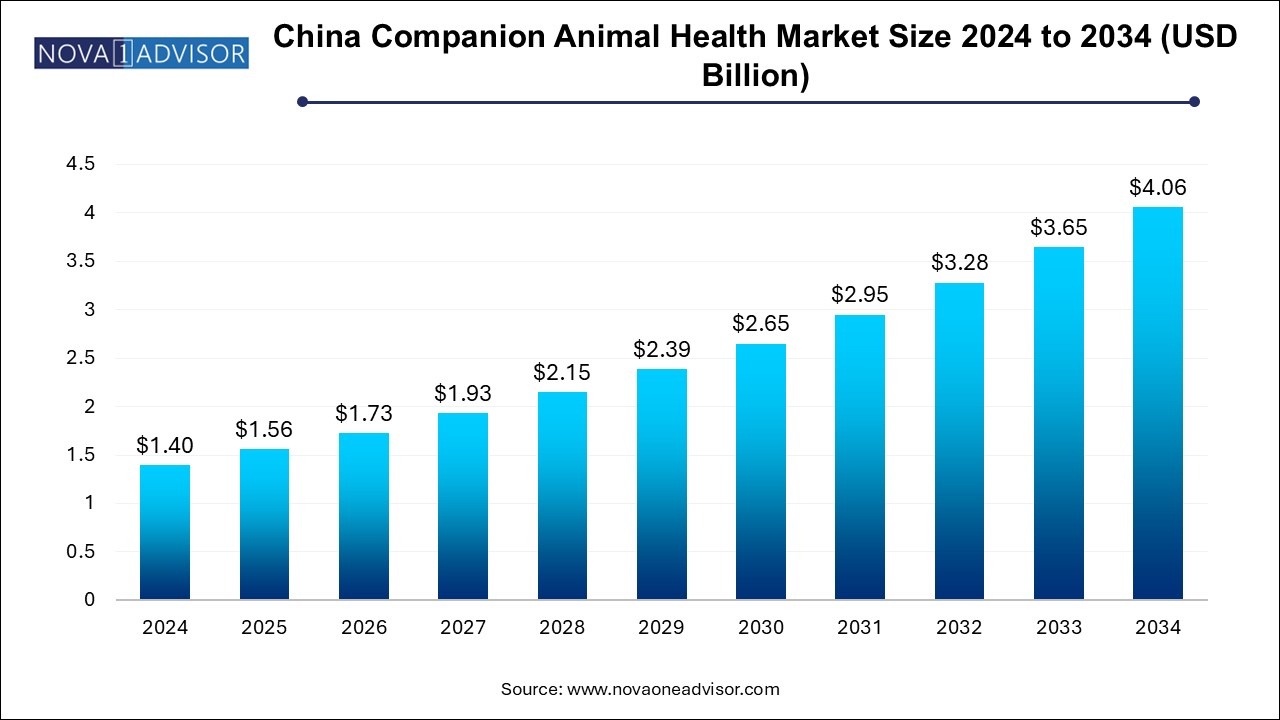

The China companion animal health market size was exhibited at USD 1.4 billion in 2024 and is projected to hit around USD 4.06 billion by 2034, growing at a CAGR of 11.23% during the forecast period 2025 to 2034.

The companion animal health market in China has evolved from a niche veterinary domain into a high-growth industry fueled by rising pet ownership, improving disposable incomes, and changing cultural perceptions toward animals. Historically, pets were less common in Chinese households due to urbanization policies, housing restrictions, and social attitudes. However, over the past decade, China's rapidly expanding middle class has embraced pet companionship as part of modern living. As a result, the market for companion animal health products and services has expanded significantly.

In 2024, China ranks among the top five countries in the world in terms of pet population, with an estimated 200 million pets, including dogs, cats, birds, and other small mammals. Pet owners in Tier 1 cities like Shanghai, Beijing, and Shenzhen are increasingly viewing their pets as family members, leading to demand for quality veterinary care, preventive medicine, dietary supplements, and pet wellness services. Unlike livestock, which are managed with a commercial lens, companion animals require personalized healthcare attention that spans diagnostics, pharmaceuticals, surgery, and chronic care management.

The growing sophistication of China's veterinary infrastructure—including a surge in veterinary clinics, specialized hospitals, and diagnostic laboratories—has enabled access to better care. Domestic and international companies are investing in R&D, new biologics, and digital health technologies tailored for companion animals. E-commerce platforms such as JD.com and Alibaba’s Tmall have also facilitated convenient access to pharmaceuticals and supplements, accelerating market penetration beyond urban hubs.

China's companion animal health market is projected to witness robust growth through 2034, driven by a convergence of factors: urban lifestyle shifts, pet humanization trends, government support for veterinary education, and the growing presence of pet health insurance services.

Rising Pet Ownership Among Millennials and Gen Z: Younger generations in China are opting for pets over traditional family planning, boosting long-term demand for pet healthcare.

Expansion of Veterinary Infrastructure: The number of licensed pet clinics has increased dramatically, especially in urban and semi-urban areas.

Digitalization of Veterinary Services: Tele-veterinary consultations, online diagnostics, and AI-based symptom analysis tools are gaining traction.

Growing Popularity of Pet Supplements: Preventive care and wellness are encouraging pet owners to adopt probiotics, multivitamins, and omega-3 supplements.

Emergence of Pet Health Insurance: Insurance providers are launching policies to cover diagnostics, surgeries, and even chronic disease management in pets.

Increased Investment in Local R&D: Chinese veterinary pharmaceutical companies are scaling production and innovation to reduce reliance on imports.

E-commerce as a Dominant Distribution Channel: Pet medications, vaccines, and supplements are increasingly purchased online, supported by strong logistics networks.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.56 Billion |

| Market Size by 2034 | USD 4.06 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.23% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Animal Type, Product, Distribution Channel, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Boehringer Ingelheim International GmbH; Elanco; Merck & Co., Inc.; Zoetis; Ceva; Virbac; Bimeda, Inc.; IDEXX Laboratories; Thermo Fisher Scientific; Randox Laboratories |

One of the most significant drivers in the Chinese companion animal health market is the phenomenon of pet humanization. As economic stability increases and fertility rates decline, pets are increasingly perceived not merely as animals but as family members. This emotional shift is fueling unprecedented expenditure on pet well-being, extending beyond food to include vaccinations, dental care, anti-parasitic treatments, dermatological care, and behavioral therapy.

Pet parents in China are now seeking premium healthcare services for their animals, including annual wellness exams, genetic screening, and even physical therapy. High-income households are investing in regular diagnostics and are more willing to pay for advanced surgical interventions. For instance, laparoscopic surgeries, orthopedic treatments, and chronic disease therapies that were once rare are now being offered at specialty veterinary centers across major cities. The pet humanization trend has transformed the market from a reactive to a preventive healthcare model.

While demand is surging, the Chinese companion animal health market continues to face a shortage of skilled veterinary professionals. As of 2024, the number of certified veterinarians per capita remains low compared to Western countries, leading to disparities in care quality. Additionally, many veterinary colleges still focus on livestock health, resulting in a talent gap in companion animal medicine.

Regulatory inconsistencies further complicate the landscape. While the Ministry of Agriculture and Rural Affairs governs veterinary licensing, there remains limited oversight over product approvals and distribution standards in the companion animal segment. Counterfeit drugs and unregulated supplements still circulate in rural markets, undermining consumer trust and health outcomes. The lack of standardized clinical protocols across veterinary institutions also contributes to uneven service quality.

The integration of digital health technologies offers significant growth opportunities in the Chinese companion animal health market. With more than 1 billion smartphone users and extensive 5G coverage, China is uniquely positioned to leverage telemedicine platforms tailored for pets. Companies like JD Health and Alibaba Health are experimenting with virtual vet consultations, AI-powered symptom checkers, and mobile apps that offer vaccination reminders, health records, and even behavioral coaching.

Moreover, wearable health monitors for pets—ranging from GPS-enabled collars to devices that track vital signs—are gaining popularity among tech-savvy urban pet owners. These innovations enable continuous health monitoring, allowing early detection of conditions such as heart disease, kidney dysfunction, or abnormal activity levels. The application of big data analytics in veterinary diagnostics can also support personalized care and targeted marketing of healthcare products. As regulatory frameworks evolve to accommodate digital solutions, this tech-driven segment is expected to unlock new revenue streams.

The Dogs dominate the China companion animal health market, both in terms of ownership and healthcare spending. Dogs are commonly kept in urban households, and their care requirements—ranging from vaccinations to joint health supplements—drive a large portion of healthcare demand. Chinese pet owners are particularly concerned with canine infectious diseases such as parvovirus and rabies, leading to widespread adoption of vaccination programs and regular check-ups. Additionally, dog-related health services such as orthopedic care, grooming-related dermatological treatments, and behavioral therapies are growing rapidly in popularity. Many dog owners are also investing in nutritional supplements, reflecting a trend toward long-term well-being.

Cats, however, represent the fastest-growing segment by animal type. Urban apartment dwellers, especially young professionals, increasingly prefer cats due to their low-maintenance nature. As feline ownership grows, so does awareness of cat-specific health needs such as feline leukemia virus (FeLV), dental hygiene, and stress-related disorders. Veterinary clinics are expanding their feline-specific offerings, and e-commerce platforms are featuring cat health products more prominently. The surge in neutering services, parasite control treatments, and specialized cat nutrition products demonstrates a market pivot to accommodate rising feline healthcare demands.

The Pharmaceuticals are the leading product segment, driven by high demand for parasiticides, anti-infectives, and anti-inflammatory drugs. Pet owners in China are especially concerned with tick and flea control, digestive infections, and joint inflammation, particularly for aging pets. Pharmaceutical sales are also boosted by increased vet prescriptions and growing availability through retail and hospital channels. Both domestically produced and imported brands compete in this space, with a notable emphasis on quality and safety.

Diagnostics are the fastest-growing product segment, spurred by increased demand for early disease detection, post-vaccine monitoring, and chronic disease management. Pet clinics are increasingly equipped with in-house blood analyzers, ultrasound systems, and radiography, and are investing in real-time PCR and immunoassay technologies. Additionally, the trend of preventive healthcare is encouraging more pet owners to opt for annual health screenings, driving demand for diagnostic services and kits. As consumer trust in veterinary diagnostics grows, this segment is expected to expand significantly, particularly in Tier 2 and Tier 3 cities.

Hospital/clinic pharmacies dominate the distribution channel, primarily due to the centralized dispensing of prescription-only medications and biologics during veterinary visits. Since many Chinese pet owners still rely on vet recommendations for pet healthcare products, hospitals remain the most trusted channel for pharmaceuticals and advanced therapeutics. Veterinary chains also offer exclusive in-house brands, encouraging loyalty and repeat visits.

E-commerce is the fastest-growing distribution channel, fueled by platforms like JD.com, Tmall, and Pinduoduo, which offer a wide range of veterinary medicines, supplements, and diagnostic kits. Livestreaming and influencer marketing have played a unique role in educating pet owners about product benefits, especially for preventive care. Some startups are even introducing subscription-based health kits, which include monthly supplies of supplements, flea/tick medication, and wellness snacks. The convenience, price competitiveness, and variety available online have accelerated this channel’s growth trajectory.

Hospitals and clinics are the dominant end-use segment in China’s companion animal health landscape. These settings handle everything from vaccinations and diagnostics to surgeries and emergency care. Pet owners trust hospitals for managing serious illnesses or chronic conditions like arthritis, skin disorders, and diabetes. The rise of corporate veterinary chains like New Ruipeng Pet Healthcare Group and Doctorpet has also brought standardization, improved quality, and better infrastructure to hospital-based care. Clinics are further investing in multidisciplinary services, including dermatology, cardiology, and dental care, to meet diverse health needs.

Point-of-care (POC) is the fastest-growing segment, including services offered at pet grooming centers, mobile vet units, and even smart vending machines that dispense OTC pet medications and supplements. These decentralized services cater to pet owners seeking convenience, particularly in fast-paced urban environments. Some POC setups also include diagnostic services such as quick blood tests or skin analysis, conducted by trained technicians under remote veterinary supervision. As more pet health brands partner with lifestyle centers and retail stores, the expansion of point-of-care is expected to redefine traditional veterinary service boundaries.

China’s unique socio-cultural and economic landscape plays a critical role in shaping the trajectory of its companion animal health market. Urbanization has been a key driver, with more than 65% of China’s population now residing in cities, where smaller family sizes and delayed childbirth have encouraged pet ownership as a source of companionship and emotional fulfillment.

Tier 1 cities like Shanghai, Beijing, Shenzhen, and Guangzhou are at the forefront of advanced veterinary service adoption, driven by higher incomes, consumer awareness, and tech-savvy behaviors. Veterinary hospital chains and premium pet health brands often pilot new services in these cities before scaling across Tier 2 and Tier 3 cities.

Government policy is also gradually shifting to support the veterinary profession, with new guidelines for veterinary drug safety, clinical trials, and practice licensing. Local governments in cities like Chengdu and Hangzhou have introduced subsidies for pet sterilization and vaccination, further enhancing the companion animal healthcare infrastructure. Overall, the rapid growth of China’s digital economy, rising consumer expectations, and a burgeoning middle class are setting the stage for continued expansion of the market.

March 2025: New Ruipeng Pet Healthcare Group announced the acquisition of a 60% stake in a Shanghai-based diagnostics lab, enhancing its capabilities in in-clinic testing services.

February 2025: JD Pet Health launched its smart consultation app featuring AI-assisted symptom analysis for cats and dogs, enabling owners to access remote veterinary support.

December 2024: Zoetis opened a new manufacturing facility in Jiangsu Province, aimed at increasing the local production of vaccines and pharmaceuticals for companion animals.

October 2024: Virbac China entered into a strategic distribution partnership with Tmall Pet, aiming to improve e-commerce penetration of its parasiticides and supplements.

August 2024: Boehringer Ingelheim Veterinary hosted its first China-exclusive animal health innovation summit in Beijing, announcing plans for expanded R&D in feline biologics.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the China companion animal health market

By Animal Type

By Product

By Distribution Channel

By End-use