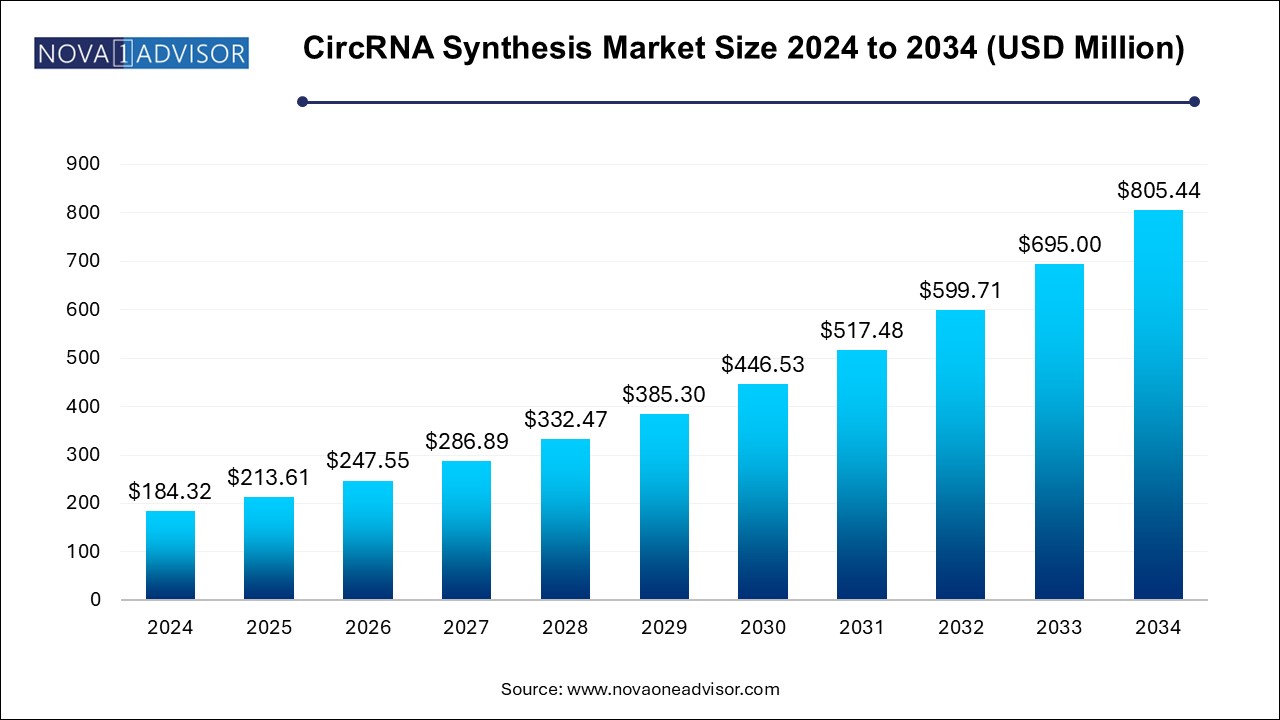

The circRNA synthesis market size was exhibited at USD 184.32 million in 2024 and is projected to hit around USD 805.44 million by 2034, growing at a CAGR of 15.89% during the forecast period 2025 to 2034.

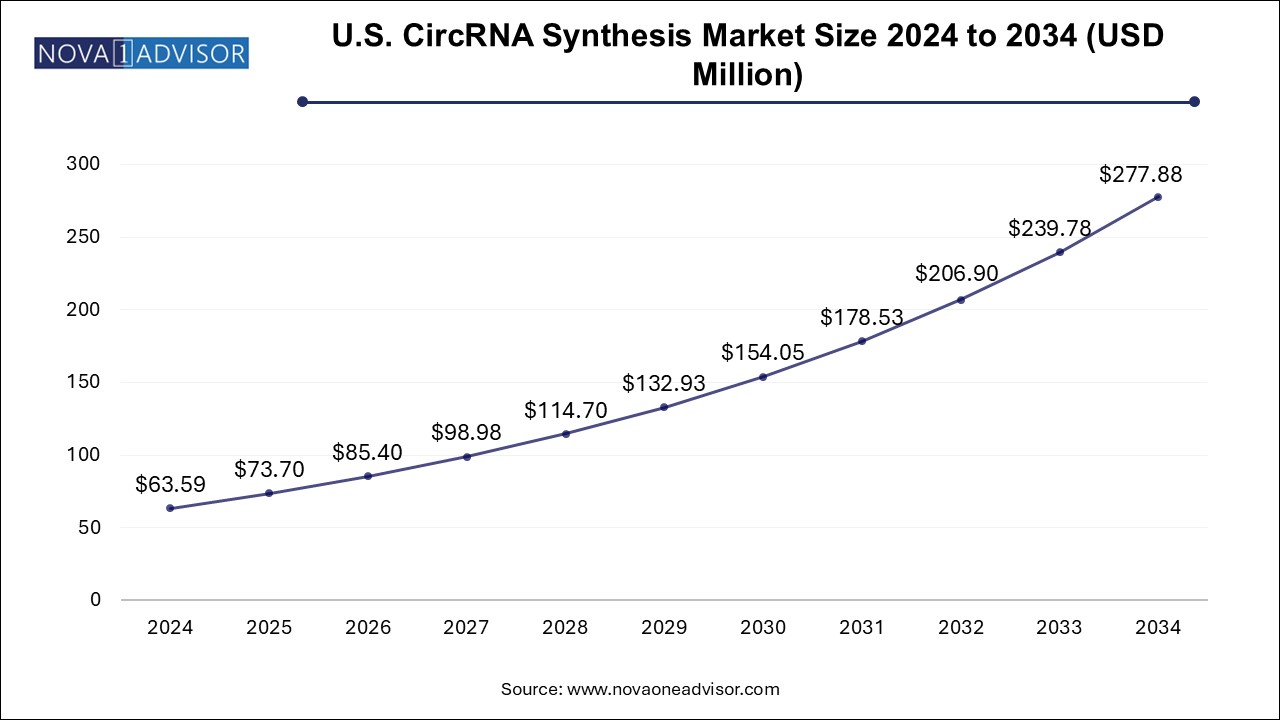

The U.S. circRNA synthesis market size is evaluated at USD 63.59 million in 2024 and is projected to be worth around USD 277.88 million by 2034, growing at a CAGR of 14.34% from 2025 to 2034.

North America dominated the CircRNA Synthesis Market in 2024, attributed to its advanced research infrastructure, strong funding landscape, and presence of major biotechnology players. The U.S. alone accounts for a significant share of circRNA-focused academic publications and patents. Additionally, the presence of established CROs, access to venture capital, and strategic partnerships between biotech startups and pharma giants are accelerating circRNA research in the region. For instance, recent collaborations between U.S.-based RNA therapeutics companies and top-tier academic institutions have boosted synthesis activity and product development.

In contrast, Asia Pacific is projected to be the fastest-growing region, driven by increasing government initiatives, expanding biotech industry, and growing participation in RNA research. China, Japan, and South Korea are witnessing a surge in RNA-focused startups and have invested heavily in genomics and synthetic biology. Chinese biotech companies, for example, are exploring circRNAs for immuno-oncology applications, with multiple clinical trials expected to begin in the next two years. Moreover, favorable regulatory frameworks and cost advantages are attracting international researchers to partner with Asian CROs for synthesis and drug development.

The Circular RNA (circRNA) Synthesis Market has emerged as a highly promising and rapidly evolving segment within the field of RNA therapeutics and molecular biology. CircRNAs are covalently closed loop RNA molecules that have shown significant potential in gene regulation, disease biomarkers, and therapeutic applications, especially in oncology, neurological diseases, and cardiovascular conditions. Their structural stability, resistance to exonucleases, and unique functions such as miRNA sponging and protein translation have made them a focal point for research and development.

The demand for circRNA synthesis tools and services has been growing steadily, driven by increasing investments in RNA-based research, expanding applications of non-coding RNA in drug development, and growing awareness among pharmaceutical companies and academic researchers about the therapeutic potential of circRNAs. Moreover, the advances in next-generation sequencing (NGS) and RNA engineering technologies have significantly facilitated the identification and design of circRNA molecules, thereby boosting the demand for synthesis services.

Rise in therapeutic exploration of circRNAs: Increasing focus on using circRNAs as therapeutic targets or delivery vehicles in cancer and genetic disorders.

Growth of custom synthesis services: A surge in demand for tailored circRNA synthesis for specific research and pre-clinical applications.

Expansion of RNA-based diagnostics: Utilization of circRNAs as reliable biomarkers for early diagnosis of diseases, including various cancers and neurodegenerative disorders.

Collaborative R&D initiatives: Strategic partnerships between pharmaceutical companies and research institutions to accelerate drug discovery using circRNAs.

Advancements in bioinformatics tools: Improved computational platforms to predict and analyze circRNA formation, structure, and function.

Integration with CRISPR technologies: Use of CRISPR-based systems to modulate circRNA expression and understand their biological roles.

Regulatory progress in RNA therapeutics: Regulatory agencies are gradually establishing frameworks for RNA-based therapeutics, including those involving circRNAs.

Adoption of automation in circRNA synthesis workflows: Automation enhances precision, scalability, and reproducibility, especially in high-throughput synthesis environments.

| Report Coverage | Details |

| Market Size in 2025 | USD 213.61 Million |

| Market Size by 2034 | USD 805.44 Million |

| Growth Rate From 2025 to 2034 | CAGR of 15.89% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product & Services, Application, End Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | LGC Biosearch Technologies; Creative Biogene;SBS Genetech; Applied Biological Materials Inc.; GenScript; Amerigo Scientific; BOC Sciences;GeneCopoeia, Inc.; Guangzhou Geneseed Biotech. Co., Ltd.; Creative Biolabs |

One of the primary drivers of the CircRNA Synthesis Market is the increased focus on non-coding RNAs (ncRNAs) in therapeutic development. While messenger RNA (mRNA) has already shown its efficacy in vaccines and gene therapy, researchers are now increasingly exploring ncRNAs such as microRNAs, long non-coding RNAs (lncRNAs), and circRNAs for their regulatory capabilities. CircRNAs, in particular, are gaining momentum due to their unique circular structure, which confers them with enhanced stability and longer half-lives compared to linear RNAs.

This interest has been amplified by recent breakthroughs in understanding the role of circRNAs in various biological processes and diseases. For instance, studies have shown that certain circRNAs act as microRNA sponges or interact with RNA-binding proteins to influence gene expression, offering novel therapeutic avenues. Pharma companies are beginning to invest in this technology, as evidenced by several preclinical circRNA programs initiated over the past two years. This trend is expected to further drive demand for advanced synthesis platforms and customized circRNA solutions.

Despite the promising outlook, the CircRNA Synthesis Market is not without challenges. A key restraint is the technical complexity associated with synthesizing and validating functional circRNAs. The process of back-splicing linear RNA to form a closed circular molecule is intricate, and ensuring the correct circularization without unwanted linear RNA contaminants requires high-precision methods.

Moreover, distinguishing functional circRNAs from other RNA species during downstream applications remains difficult, often requiring extensive purification and validation steps. These challenges not only increase costs but also limit the scalability of synthesis for clinical and commercial use. For many early-stage biotech firms, the cost and effort associated with developing in-house synthesis capabilities may be prohibitive, thus slowing broader adoption.

An exciting opportunity for market expansion lies in the emergence of circRNA-based cancer therapies. As cancer research increasingly focuses on understanding non-coding regions of the genome, circRNAs are being investigated for their role in tumorigenesis, metastasis, and drug resistance. Several studies have identified cancer-specific circRNAs that can serve either as therapeutic targets or as direct treatment modalities.

For instance, circRNAs such as circHIPK3 and circSMARCA5 have been associated with tumor suppression or promotion, depending on the cancer type. The ability to either overexpress or silence these circRNAs offers a highly personalized therapeutic approach. Startups and research institutions are now developing synthetic circRNAs that can be delivered via lipid nanoparticles or viral vectors, opening new frontiers in precision oncology. The growing interest and potential funding from venture capital in this area make it a fertile ground for market growth.

Reagents & kits dominated the CircRNA Synthesis Market in 2024, owing to their indispensable role in facilitating core synthesis processes such as circularization, transcription, purification, and analysis. These kits often include enzymes, buffers, primers, and nucleotides essential for reliable synthesis, making them a routine purchase for research laboratories and biotech companies. The availability of commercial kits with optimized protocols has significantly lowered the entry barrier for researchers delving into circRNA studies. Additionally, increased product launches from companies like New England Biolabs and Thermo Fisher Scientific have strengthened this segment's dominance.

In contrast, the services segment is projected to grow at the fastest CAGR during the forecast period, fueled by the rising demand for custom circRNA design, synthesis, and validation services. Many academic and early-stage biotech companies lack in-house capabilities or expertise required to design functional circRNA constructs. Contract Research Organizations (CROs) and synthesis providers offer end-to-end services tailored to specific research objectives, ranging from preclinical studies to proof-of-concept therapeutics. This growing reliance on external partners to handle the complexities of synthesis is expected to significantly propel this segment.

Therapeutics development emerged as the largest application segment, accounting for the majority of revenue in 2024. CircRNAs are gaining recognition as viable therapeutic agents, either as novel RNA therapeutics themselves or as modulators of gene expression. The increased funding for RNA-based therapies post-COVID-19 has also spilled over into the non-coding RNA space, with companies exploring circRNA constructs for cancer, cardiovascular, and rare diseases. Synthetic circRNAs are being designed to act as RNA decoys, protein scaffolds, or modulators of immune responses, further expanding their utility in this segment.

Meanwhile, the drug discovery segment is poised to witness the highest growth rate, driven by the integration of circRNA profiling in early-stage biomarker identification and target validation workflows. CircRNAs, due to their tissue-specific expression and stability, are becoming attractive biomarkers for pharmaceutical companies aiming for precision medicine approaches. Advanced sequencing platforms and AI-based analytics are being used to identify disease-specific circRNAs, accelerating the pace of drug discovery programs. The growing demand for circRNA profiling and synthesis for in vitro screening is fueling rapid expansion in this segment.

Pharmaceutical & biotechnology companies accounted for the largest market share in 2024 due to their significant investments in RNA-based therapeutics and exploratory circRNA programs. These companies are increasingly partnering with CROs and universities to explore circRNAs as novel drug candidates or targets, driving substantial demand for synthesis services and products. High-throughput synthesis and automation have further enabled biotech firms to scale their circRNA research efficiently.

Academic & research institutes, on the other hand, are expected to register the fastest growth. Universities and research centers are at the forefront of foundational circRNA biology, playing a key role in uncovering novel mechanisms and validating clinical relevance. Several publicly funded projects across the U.S., Europe, and Asia are now focusing on the therapeutic and diagnostic potential of circRNAs. This growing academic involvement is translating into higher procurement of kits, instruments, and outsourced services, boosting market expansion in this segment.

Twist Bioscience Corporation

Synbio Technologies

New England Biolabs

Thermo Fisher Scientific Inc.

CircuRNA Therapeutics

Anima Biotech

RNA Disease Diagnostics, Inc.

GeneUniversal Biotech

Creative Biolabs

Baseclick GmbH

December 2024: Anima Biotech announced a partnership with a leading academic institute to develop synthetic circRNAs for neurological disease therapeutics, with a focus on translation regulation via circRNA.

October 2024: Twist Bioscience expanded its synthetic biology portfolio to include circular RNA design and synthesis solutions, targeting academic and biopharma clients.

August 2024: Synbio Technologies launched a new circRNA synthesis platform offering customizable constructs for therapeutic research, supporting lengths up to 5 kb.

July 2024: RNA Disease Diagnostics, Inc. secured Series A funding to develop circRNA-based diagnostic panels for pancreatic and ovarian cancers.

June 2024: CircuRNA Therapeutics, a biotech startup, announced its preclinical data on a novel circRNA-based therapy showing significant efficacy in a mouse model of glioblastoma.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the circRNA synthesis market

By Product & Services

By Application

By End Use

By Regional