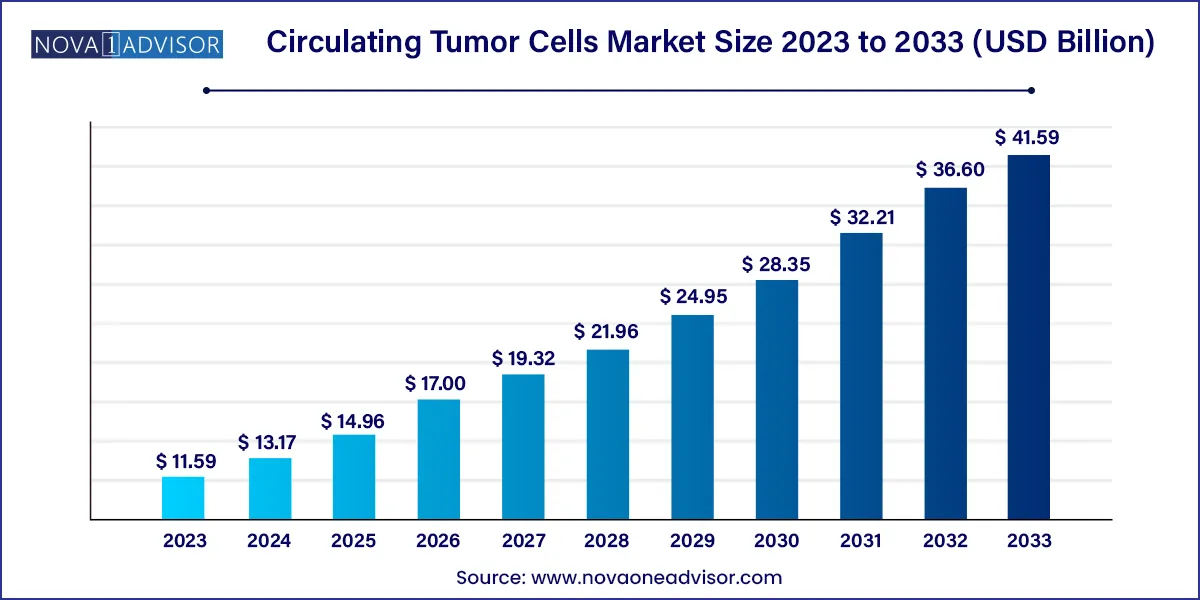

The global circulating tumor cells market size reached USD 11.59 billion in 2023 and is projected to hit around USD 41.59 billion by 2033, expanding at a CAGR of 13.63% during the forecast period from 2024 to 2033.

Key Takeaways:

Circulating Tumor Cells Market Overview

The Circulating Tumor Cells (CTCs) market presents a transformative landscape in the realm of cancer diagnostics and monitoring. CTCs are cancer cells that break away from the primary tumor and circulate in the bloodstream, holding immense potential for revolutionizing how we detect, characterize, and manage cancer. This overview explores the key facets of the Circulating Tumor Cells market, highlighting its significance, drivers, challenges, and the technological innovations shaping its trajectory.

Circulating Tumor Cells Market Growth

The non-invasiveness and advantages offered by circulating tumor cells (CTC), it is considered a promising tool in cancer diagnosis. This is anticipated to contribute to the market’s growth. Technological advancements in chip technology is another key factor driving the growth. the ongoing advancements in chip technology have positively impacted market growth. Cluster chip technology plays a key role in capturing the exceptionally rare group of cells, such as CTCs. Isolation of CTCs is a cumbersome process and requires high accuracy. The chip technology not only helps perform precise CTC isolation but also helps overcome the challenges associated with isolation devices developed by key companies. The challenges include lower sensitivity, the inability to capture CTCs of all sizes & types, high manufacturing costs, and difficulty in retrieving captured CTCs from the devices for further laboratory analysis. Moreover, the white blood cells that contaminate trapped CTCs, which are similar in size, can be mistakenly regarded as CTCs; this is a limitation associated with these devices.

Increasing global prevalence of cancer is one of the major drivers for growth of the CTC market. In 2023, the Pan American Health Organization reported around 20 million newly diagnosed cancer cases and 10 million cancer-related deaths. Projections indicate a probable 60% surge in cancer burden over the next two decades, posing additional challenges to healthcare systems, individuals, and communities. It is anticipated that the global incidence of new cancer cases expected rise to approximately 30 million by the year 2040.

In addition, circulating tumor cells in breast cancer diagnosis are released in the bloodstream by cancerous tumors. As per the Breast Cancer Statistics and Resources, it is anticipated that in 2023, around 297,790 women might be diagnosed of breast cancer in the U.S., solidifying its status as the most prevalent cancer among American women. The rising burden of cancer also attracts increased investment in research and development for new cancer therapies & technologies. CTCs that actively participate in clinical trials and adopt innovative treatment options can attract patients seeking access to cutting-edge care, further boosting their market position.

Circulating Tumor Cells Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 13.17 Billion |

| Market Size by 2033 | USD 41.59 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.63% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, application, product, specimen, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | QIAGEN; Bio-Techne Corp.; Precision for Medicine; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys, Inc.; Miltenyi Biotec; IVDiagnostics; BioFluidica; Canopus Bioscience Ltd.; Biolidics Limited; Creativ MicroTech, Inc.; LungLife AI, Inc.; Epic Sciences; Rarecells Diagnostics; ScreenCell; Menarini Silicon Biosystems; LineaRx, Inc. (Vitatex, Inc.); Sysmex Corporation; STEMCELL Technologies, Inc. |

Key Factors Driving the Circulating Tumor Cells Market:

Segments Insights:

Technology Insights

In 2023, the CTC detection and enrichment methods segment accounted for the largest revenue share of 66.29%. The availability of different methods for the enrichment of circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period. Moreover, positive or negative enrichment of CTCs based on biological properties is expected to hold significant potential for market growth. An effective enrichment process helps in the enhancement of sensitivity, selectivity, and yield, thereby ensuring successful clinical translation of this field. Different techniques for CTC detection include magnetic beads-based centrifugal force, enrichment, filtration, and other physical properties such as density, deformity, size, & electric charges.

The CTC analysis segment is expected to register the fastest CAGR from 2024 to 2033. Understanding subclonal intratumor heterogeneity using CTC detection can help clinicians in determining the underlying reasons for unresponsive patients subjected to targeted therapy, eventually leading to enhanced cancer therapies. Hence, CTC analysis is a minimally invasive method in repetitive analysis and validated technology for tumor study & clinical decision making. Technological advancements such as immunofluorescence, Next-Generation Sequencing (NGS), Fluorescence In Situ Hybridization (FISH), and quantitative PCR (qPCR) are anticipated to improve CTC analyses. Hence, due to the presence of fundamental principle of amplification in qPCR, the detection of CTCs in a large blood sample becomes efficient and accurate.

Application Insights

The research segment dominated the market and captured the largest revenue share in 2023. CTCs are regarded as a substrate of cancer metastasis. Currently, the enumeration of CTCs represents an effective predictive and prognostic biomarker capable of monitoring the efficacy of adjuvant therapies, identifying early development of metastases, and evaluating therapeutic responses better than conventional imaging methods. In addition, CTC enumeration remains largely a research tool.

Recently, the focus has shifted toward CTC characterization and isolation, which can provide significant opportunities in predictive testing research. For instance, in April 2021, Bio-Techne Corporation acquired Asuragen, Inc. for USD 215 million. Asuragen’s expertise in productizing lab-developed tests and commercializing innovative molecular products allowed Bio-Techne to offer advanced solutions to researchers and clinicians.

Clinical/ liquid biopsy is expected to register a significant CAGR from 2024 to 2033. In a liquid biopsy, the analysis CTCs in a cancer patient’s bloodstream has received significant attention for their potential clinical utility. The number of CTCs in a patient’s blood can differ based on cancer type, stage, and treatment. The number of CTCs found in the patient’s bloodstream indicates the state of the disease. Patients in the later stages of cancer show a higher number of CTCs than patients in early stages of cancer.

Product Insights

The kits & reagents segment dominated the market and accounted for the largest revenue share of 2023. This can be attributed to frequent purchases and high usage rates. For instance, CellSearch Circulating Tumour Cell Kit authorized by the U.S. FDA, is one the most popular products produced in the U.S. Additionally, the availability of a robust product portfolio coupled with advancements in microfluidics technology is expected to propel the market growth.

The devices or systems segment is expected to showcase significant CAGR during the forecast period. The introduction of fabricated glass microchips to overcome the challenges and to increase technical completeness for mass production is expected to propel the segment growth. The development of automated instruments that eliminate the use of additional blood collection tubes reduces the cost of blood collection tubes.

The reduction in costs is also observed as the transportation is free of the additional laboratory consumables and transfer tubes when the reagent-equipped tubes are used. On the other hand, kits and reagents have also contributed significantly to the segment’s revenue.

End-use Insights

The research and academic institutes segment accounted for the largest revenue share of 2023. This can be attributed to the increasing focus on research and development activities for cancer diagnosis and treatment. These institutes are investing heavily in advanced technologies and equipment to enhance the accuracy and efficiency of circulating tumor cell detection and analysis.

The diagnostic centers segment is expected to register a significant CAGR from 2024 to 2033. This is due to their advanced technology and expertise in detecting and analyzing CTCs. They have access to advanced equipment and trained professionals who can perform accurate and reliable tests. Additionally, diagnostic centers have partnerships with hospitals and healthcare providers, which gives them a larger customer base and more opportunities to expand their services. These factors have contributed to their success in the CTC market.

Specimen Insights

The blood specimen segment dominated the market and accounted for the largest revenue share in 2023. A large concentration of these cells in blood samples as compared with other biospecimens is responsible for the largest penetration of this specimen type. Approaches for tumor cell identification in blood samples are considered important in current cancer research, as it aids in the prediction of prognosis and determination of the response to systemic chemotherapy. However, the use of whole blood as a specimen poses a challenge when combined with microfluidic technology.

The bone marrow segment is expected to register a significant CAGR during the forecast period. Bone marrow samples, when analyzed for CTCs, play a vital role in cancer research and clinical trials. Researchers use these samples to study the biology of circulating tumor cells, understand the mechanisms of metastasis, and develop novel therapeutic approaches. These factors are expected to support segment growth in the forecast years.

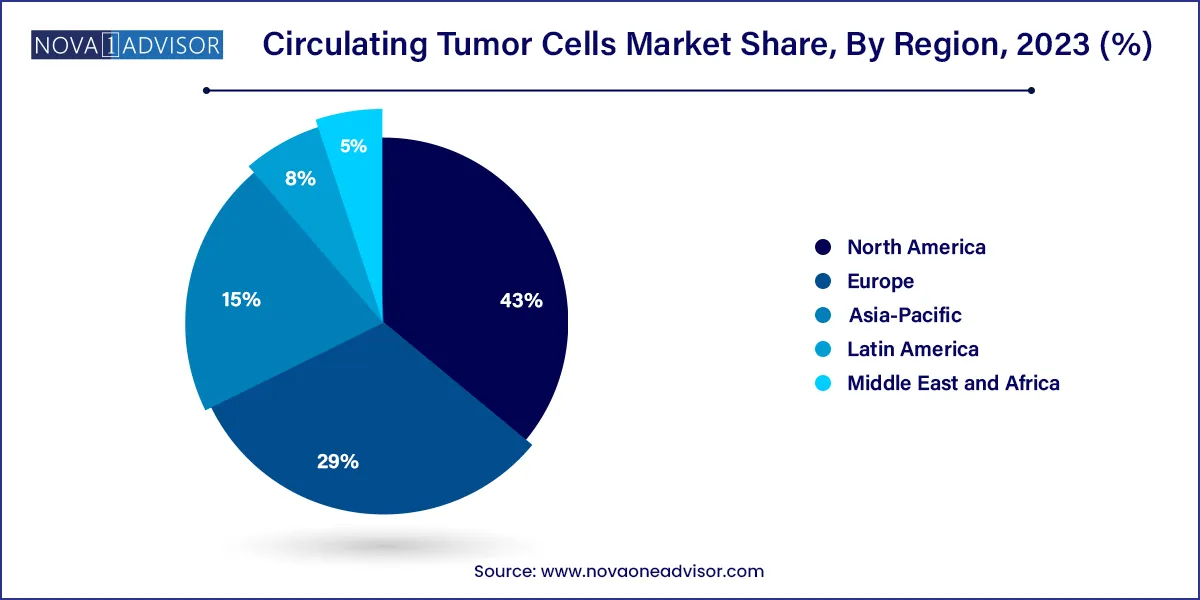

Regional Insights

North America captured the largest revenue share of 43% in 2023. Aviva Biosciences; Apocell, Inc.; Advanced Cell Diagnostics; Biocept, Inc.; Biofluidica, Inc.; and CellTraffix, Inc. are the key players operating in the region. These players are undertaking various strategies to enhance their market hold, which is a key factor responsible for the high share of the U.S. market for circulating tumor cells.

The U.S. is anticipated to significantly contribute to the regional market's growth due to factors including the rising incidence of cancer, product approvals, and increased R&D efforts. For instance, the American Cancer Society projects that there approximately 127,070 lung cancer fatalities nationwide and about 238,340 new instances of lung cancer diagnosis in 2023. Furthermore, the presence of a population with high susceptibility to cancer, an increase in market penetration rates, and technologically advanced cancer care infrastructure are supporting the region’s growth.

Asia Pacific is projected to grow at a lucrative CAGR during the forecast period, due to high unmet diagnostic needs coupled with rapidly growing awareness with regard to early detection of cancer and risk assessment. China is a major country that drives the regional market growth. The economy of China developed its infrastructure with academic and research institutes that provide knowledge and create interest in the emerging fields of diagnostics, biotechnology, & genetics. It also created facilities to support their development by adopting the latest technologies. The competitive nature of the government, leading to high investments in emerging fields of research, is anticipated to boost revenue generation over the forecast period.

Recent Developments

Key Circulating Tumor Cells Companies:

The following are the leading companies in the circulating tumor cells market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these CTC companies are analyzed to map the supply network.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Circulating Tumor Cells market.

By Technology

By Application

By Product

By Specimen

By End-use

By Region