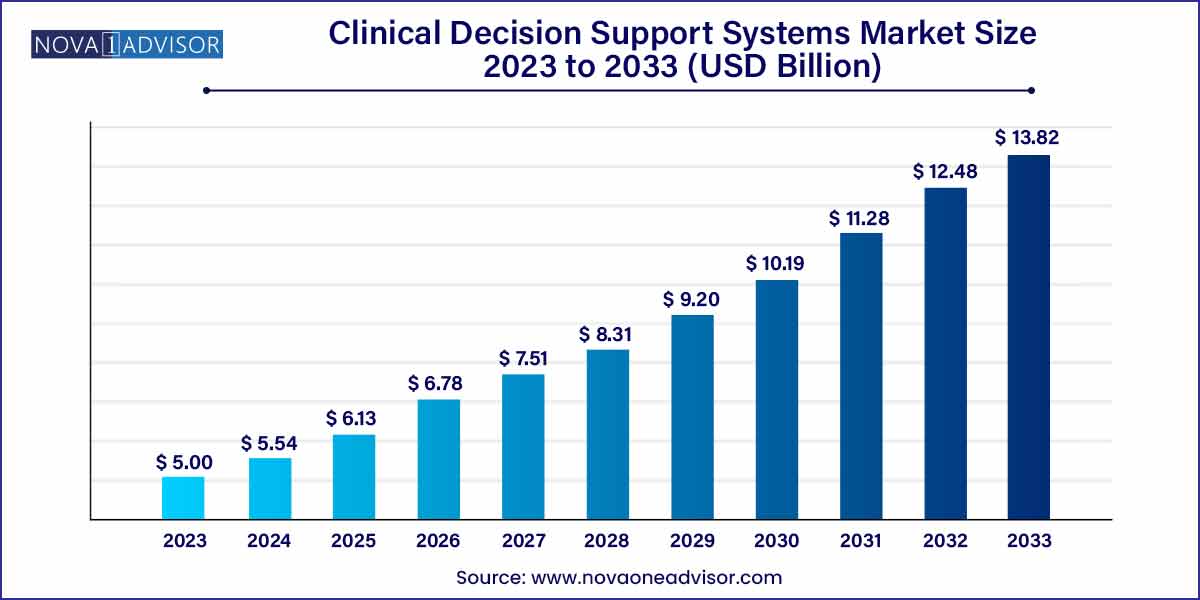

The global clinical decision support systems market size was exhibited at USD 5.0 billion in 2023 and is projected to hit around USD 13.82 billion by 2033, growing at a CAGR of 10.7% during the forecast period of 2024 to 2033.

Key Takeaways:

Clinical Decision Support Systems Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 5.0 Billion |

| Market Size by 2033 | USD 13.82 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Delivery Mode, Component, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | McKesson Corporation; Cerner Corporation; Siemens Healthineers GmbH; Allscripts Healthcare, LLC; athenahealth, Inc.; NextGen Healthcare Inc.; Koninklijke Philips N.V. (Royal Philips); IBM Corporation; Agfa-Gevaert Group; Wolters Kluwer N.V. |

The rising demand for quality care and integrated reliable technical solutions is one of the key trends escalating market growth. Increasing adoption of information systems by hospitals and healthcare institutes and favorable initiatives taken by several governments worldwide are also stimulating the growth of the market.

Clinical decision support systems (CDSS) are strictly regulated by authorities such as the FDA. Therefore, platforms introduced or in developmental phases are expected to fulfill relevant criteria set by FDA & CE Mark. In addition, competitors have to take into account the non-violation of information technology and cyber laws to assure the integrity of products.

CDSS vendors and organizations have undertaken initiatives to help curb the pandemic. CDSS has become a vital tool in the fight against COVID-19, as it showed how healthcare teams can stay on top of the latest COVID information and intelligence, helping advance the quality of the care they provide. The Infectious Diseases Society of America endorsed repeating a COVID-19 test in patients with a moderate-to-high probability of COVID-19. However, there was little direction about what factors cause a patient to have a low or high probability of contracting the infection.

A team of infectious disease specialists at Massachusetts General Hospital worked around the clock. Thus, dedicated efforts led to the development of a CDS tool called COvid Risk cALculator (CORAL). The tool is embedded within the EHR. This is expected to positively impact market growth. Moreover, in October 2020, CORAL, an outpatient version, was introduced. CORAL remained exclusive as the only algorithm that has been combined into routine, prospective clinician workflow through an EHR CDSS.

Rapid advancements in the fields of biotechnology and bioinformatics are encouraging improvements and optimizations in data storage, management, and analytics platforms. The marketplace is anticipated to witness a large number of innovations following R&D projects backed up by large corporate investments. Integration of cloud computing and interoperability platforms in different systems will further promote smooth functioning and seamless data flow, thereby revving up the adoption of CDSS.

In recent years, there has been substantial growth in the number of hospitals and healthcare facilities adopting various types and levels of clinical decision support systems, indicating a significant potential for increased deployment. In industrialized regions, demand for decision assistance based on factual evidence and real-time knowledge has increased at a faster rate. CDSS makes physical order entry easier by allowing physicians to choose from a database of prescriptions. The growing number of patients in clinics and hospitals has made it more difficult to keep track of and manage data for each one.

Over the past few years, the development of collaborations among CDSS providers & hospitals has witnessed a significant surge. Government recognition and initiatives to encourage the adoption of CDSS and EHR systems are estimated to further increase demand. Integration with Electronic Health Records (EHR) improves the efficiency of clinical care by reducing the time to search for a patient’s history and clinical records.

Furthermore, the U.S. Government's Health and Medicare Acts have endorsed CDSS, financially rewarding CDS integration into EHRs (Electronic Health Records). In 2013, around 41% of U.S. hospitals having an EHR also had a CDSS, while 40.2% of U.S. hospitals had cutting-edge CDS capability in 2021. In addition, companies are involved in partnerships to develop and provide software updated with the latest information.

Clinical decision-making is a complicated task that requires a knowledgeable practitioner, a supportive environment, and reliable informational inputs. The difficulty faced in quality clinical decision-making by healthcare entities can be addressed with the implementation of CDSS as a supportive tool. The emergence of CDSS has been recognized as an important solution to overcome issues in delivering high-quality care to patients by improving and streamlining the quality of healthcare delivery.

Segments Insights:

Product Insights

Standalone CDSS held the largest market share of over 31.00% in 2023, as it is widely adopted due to its low cost and simplicity. Ease of use in hospitals and clinical settings has contributed to its highest share. The standalone segment will continue to dominate the market throughout the forecast period. CDSS products are available either standalone, or integration with EHR or CPOE, or both.

Integrated EHR with CDSS segment is poised to show lucrative growth through 2033. Growing awareness and adoption of EHR by multi-specialty health care units is poised to influence the share of CDSS integrated with EHR. These systems provide patient database and history to CDSS, which can provide clinical solutions and suggest medication to the practitioner, thus automating the clinical workflow. CDSS and EHRs are often integrated to streamline workflows and make use of present data sets. There is a rising number of CDSS functions built into EHR systems, which is expected to support segment growth.

Application Insights

Drug allergy alerts accounted for the largest market share of over 26.0% in 2023. Several people have allergies to some specific drugs, and consequently, it is important to have systems that provide allergy alerts. The burden of allergies, i.e., drug allergies, is rising. In the process of prescribing, dispensing, or administering a drug, a medicine error may happen and can have adverse outcomes, e.g., medication may be given to a patient with a documented allergy to that drug.

The clinical guidelines segment is anticipated to show lucrative growth during the projection period. The CDS system offers guidelines for treatment and diagnosis. It retrieves data from the knowledge base and utilizes it for treatment, providing the practitioner with clinical guidelines to be followed during the treatment course, thus improving the quality of care.

Component Insights

CDSS services held the largest market share of over 42.6% in 2023. This is due to timely up-gradation of software as well as the knowledge base available for use. Services in CDSS involve the maintenance of components and their accessories. It includes hardware & software upgrades, as well as providing a knowledge database with the latest innovations & recent medications.

CDSS software segment is anticipated to show lucrative growth during the assessment period. The CDSS software, when used in integration with software for CPOE and EHRs, provides enhanced decision support by making customized and specific results for the particular patient. Novel innovations for technical support and interoperability of the software are anticipated to drive the market during the projection years.

Delivery Mode Insights

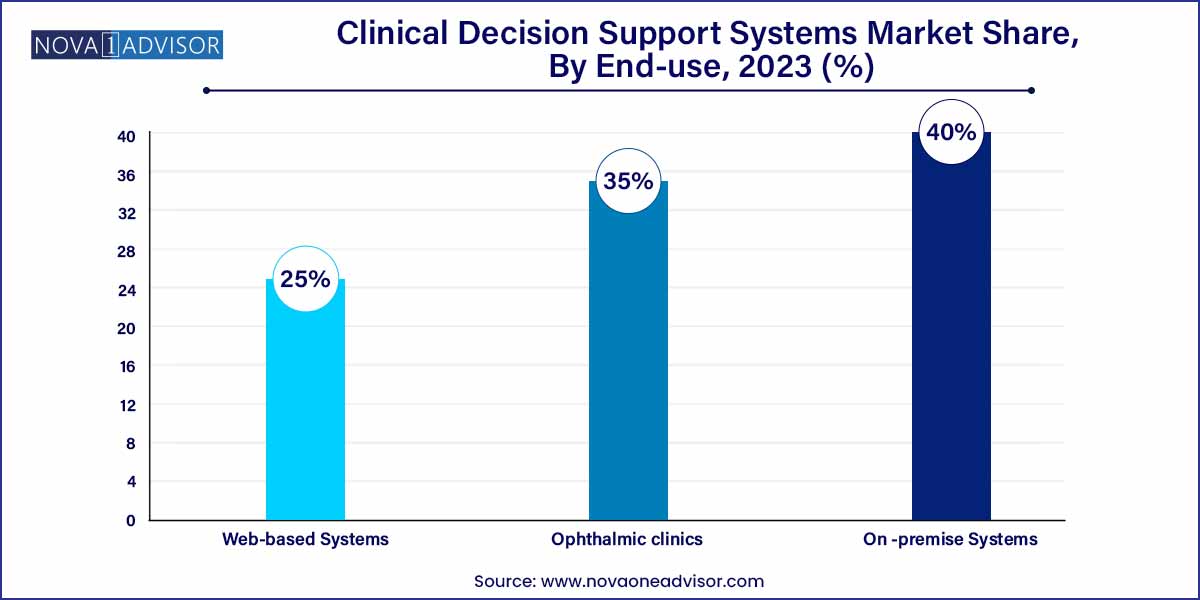

Cloud-based systems held the second largest market share in 2023 of around 35%, owing to significant innovations in information technology, with potential applications in the healthcare sector. Reliability and cost-efficiency are major factors that contribute to the growth of this segment.

The primary services provided under cloud computing are Platform as a Service (PaaS), which creates a platform, i.e., develops an OS to run the software; Infrastructure as a Service (IaaS), which uses virtual technology to create a user interface to provide the services; and Software as a Service (SaaS), which forms the most critical aspect of the cloud provider, as it enables them to operate, install, & manage software to provide services to the end-user.

CDSSs require access to healthcare data and knowledge which is stored in a database. Data stored on the web is easily accessible through mobile and computer devices. Web-based devices use the data stored on the web to provide decision support to medical practitioners. Technological innovation has enabled the designing of web-based systems for the accurate diagnosis of different health conditions. For instance, Net Decision Support System is a web-based system that offers support for depression management.

Regional Insights

The North American region dominated the global CDSS market in 2023 with over 45.0% revenue share; the region comprises the U.S. and Canada. Its market lead can be attributed to the surging demand for healthcare information technology solutions in the medical sector. Rapid technological advancements and the growing importance of providing quality healthcare services are further contributing to market growth in this region.

Asia Pacific is anticipated to be the fastest-growing region in the global CDSS market. This can be attributed to increasing investments in the healthcare sector in countries such as Australia, China, India, and Japan. Asia Pacific’s market is showing high potential due to increasing R&D expenditure by governments of key economies for increasing the penetration of information technology in the medical field. In addition, the increasing geriatric population pool is likely to serve as a key factor fueling the regional market.

Some of the prominent players in the clinical decision support systems market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical decision support systems market.

Product

Application

Delivery Mode

Component

By Region

Chapter 1 Clinical Decision Support Systems Market: Research Methodology & Scope

1.1 Market Segmentation & Scope

1.1.1 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased database

1.3.2 Internal Database

1.3.3 Secondary sources

1.3.4 Primary Research

1.3.5 Details of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis

1.7 List Of Secondary Sources

1.8 Report Objectives

Chapter 2 Clinical Decision Support Systems Market: Executive Summary

2.1 Clinical Decision Support Systems Market Outlook, 2021 - 2033

2.2 Clinical Decision Support Systems Market Summary, 2020

Chapter 3 Clinical Decision Support Systems Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent market outlook

3.1.2 Ancillary market outlook

3.2 Penetration & Growth Prospect Mapping

3.3 Clinical Decision Support Systems Market Dynamics

3.3.1 Market driver analysis

3.3.1.1 Increase in demand for quality care and technical solutions

3.3.1.2 Rise in adoption of CDSS by organizations

3.3.1.3 Levels and impact of CDSS use

3.3.1.4 Government initiatives for adoption and implementation of health IT solutions

3.3.1.5 Rise in technological innovations

3.3.1.6 Increasing number of mergers & acquisitions by market players

3.3.1.7 Growing incidence of medication errors

3.3.2 Market restraint analysis

3.3.2.1 Expensive and time-consuming implementation

3.3.2.2 Lack of trained personnel

3.3.3 Market Opportunity Analysis

3.3.3.1 Government initiatives for better healthcare in developing countries

3.3.4 Market Threat Analysis

3.3.4.1 Data security concerns

3.4 Clinical Decision Support Systems Market Analysis Tools

3.4.1 Industry analysis - Porter’s Five Forces

3.4.1.1 Bargaining Power of Suppliers: LOW

3.4.1.2 Bargaining Power of Buyers: moderate

3.4.1.3 Threat of Substitutes: moderate

3.4.1.4 Threat of New Entrants: moderate

3.4.1.5 Competitive Rivalry: High

3.4.2 Clinical Decision Support Systems- SWOT Analysis, by Factor (Political & Legal, Economic, and Technological)

3.4.2.1 Political & Legal

3.4.2.2 Economic

3.4.2.3 Technological

3.4.2.4 Social

3.5 Clinical Decision Support System - Unmet Need Analysis

Chapter 4 COVID-19 Impact Analysis

4.1 Impact of COVID-19

4.1.1 Disease Prevalence Analysis

4.2 Current and Future Impact Analysis

4.2.1 Current Impact Analysis

4.2.2 Future Impact Analysis

4.3 Impact on Market Players

Chapter 5 Clinical Decision Support Systems Market: Product Estimates & Trend Analysis

5.1 Product Market Share Analysis, 2024 & 2033

5.2 Product Dashboard

5.3 Standalone CDSS

5.3.1 Standalone CDSS market estimates and forecasts, 2021 - 2033

5.4 Integrated CPOE With CDSS

5.4.1 Integrated CPOE with CDSS market estimates and forecasts, 2021 - 2033

5.5 Integrated EHR With CDSS

5.5.1 Integrated EHR with CDSS market estimates and forecasts, 2021 - 2033

5.6 Integrated CDSS With CPOE and EHR

5.6.1 Integrated CDSS with CPOE and EHR market estimates and forecasts, 2021 - 2033

Chapter 6 Clinical Decision Support Systems Market: Application Estimates & Trend Analysis

6.1 Application Market Share Analysis, 2024 & 2033

6.2 Application Dashboard

6.3 Drug-Drug Interactions (DDI)

6.3.1 Drug-Drug Interactions (DDI) market estimates and forecasts, 2021 - 2033

6.4 Drug Allergy Alerts

6.4.1 Drug Allergy Alerts market estimates and forecasts, 2021 - 2033

6.5 Clinical Reminders

6.5.1 Clinical Reminders market estimates and forecasts, 2021 - 2033

6.6 Clinical Guidelines

6.6.1 Clinical Guidelines market estimates and forecasts, 2021 - 2033

6.7 Drug Dosing Support

6.7.1 Drug Dosing Support market estimates and forecasts, 2021 - 2033

6.8 Others

6.8.1 Others market estimates and forecasts, 2021 - 2033

Chapter 7 Clinical Decision Support Systems Market: Delivery Mode Estimates & Trend Analysis

7.1 Delivery Mode Market Share Analysis, 2024 & 2033

7.2 Delivery Mode Dashboard

7.3 Web-Based Systems

7.3.1 Web-based CDSS market estimates and forecasts, 2021 - 2033

7.4 Cloud-Based Systems

7.4.1 Cloud-based systems market estimates and forecasts, 2021 - 2033

7.5 On-Premises Systems

7.5.1 On-premises systems market estimates and forecasts, 2021 - 2033

Chapter 8 Clinical Decision Support Systems Market: Component Estimates & Trend Analysis

8.1 Component Market Share Analysis, 2024 & 2033

8.2 Component Dashboard

8.3 Hardware

8.3.1 Hardware market estimates and forecasts, 2021 - 2033

8.4 Software

8.4.1 Software market estimates and forecasts, 2021 - 2033

8.5 Services

7.2.3.1. Services market estimates and forecasts, 2021 - 2033

Chapter 9. Clinical Decision Support Systems Market : Regional Estimates & Trend Analysis

9.1. Definition & Scope

9.2. Regional Market Share Analysis, 2024 & 2033

9.3. Regional Market Dashboard

9.4. Regional Market Snapshot

9.5. Market Size, & Forecasts, Revenue and Trend Analysis, 2022 to 2030

9.5.1. North America

9.5.1.1. North America Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.1.2. U.S.

9.5.1.2.1. Key Country Dynamics

9.5.1.2.2. Competitive Scenario

9.5.1.2.3. Regulatory Framework

9.5.1.2.4. Reimbursement Scenario

9.5.1.2.5. U.S. Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.1.3. Canada

9.5.1.3.1. Key Country Dynamics

9.5.1.3.2. Competitive Scenario

9.5.1.3.3. Regulatory Framework

9.5.1.3.4. Reimbursement Scenario

9.5.1.3.5. Canada Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2. Europe

9.5.2.1. Europe Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033 (USD Million)

9.5.2.2. UK

9.5.2.2.1. Key Country Dynamics

9.5.2.2.2. Competitive Scenario

9.5.2.2.3. Regulatory Framework

9.5.2.2.4. Reimbursement Scenario

9.5.2.2.5. UK Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.3. Germany

9.5.2.3.1. Key Country Dynamics

9.5.2.3.2. Competitive Scenario

9.5.2.3.3. Regulatory Framework

9.5.2.3.4. Reimbursement Scenario

9.5.2.3.5. Germany Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.4. France

9.5.2.4.1. Key Country Dynamics

9.5.2.4.2. Competitive Scenario

9.5.2.4.3. Regulatory Framework

9.5.2.4.4. Reimbursement Scenario

9.5.2.4.5. France Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.5. Italy

9.5.2.5.1. Key Country Dynamics

9.5.2.5.2. Competitive Scenario

9.5.2.5.3. Regulatory Framework

9.5.2.5.4. Reimbursement Scenario

9.5.2.5.5. Italy Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.6. Spain

9.5.2.6.1. Key Country Dynamics

9.5.2.6.2. Competitive Scenario

9.5.2.6.3. Regulatory Framework

9.5.2.6.4. Reimbursement Scenario

9.5.2.6.5. Spain Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.7. Denmark

9.5.2.7.1. Key Country Dynamics

9.5.2.7.2. Competitive Scenario

9.5.2.7.3. Regulatory Framework

9.5.2.7.4. Reimbursement Scenario

9.5.2.7.5. Denmark Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.8. Sweden

9.5.2.8.1. Key Country Dynamics

9.5.2.8.2. Competitive Scenario

9.5.2.8.3. Regulatory Framework

9.5.2.8.4. Reimbursement Scenario

9.5.2.8.5. Sweden Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.2.9. Norway

9.5.2.9.1. Key Country Dynamics

9.5.2.9.2. Competitive Scenario

9.5.2.9.3. Regulatory Framework

9.5.2.9.4. Reimbursement Scenario

9.5.2.9.5. Norway Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.3. Asia Pacific

9.5.3.1. Asia Pacific Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033 (USD Million)

9.5.3.2. Japan

9.5.3.2.1. Key Country Dynamics

9.5.3.2.2. Competitive Scenario

9.5.3.2.3. Regulatory Framework

9.5.3.2.4. Reimbursement Scenario

9.5.3.2.5. Japan Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.3.3. India

9.5.3.3.1. Key Country Dynamics

9.5.3.3.2. Competitive Scenario

9.5.3.3.3. Regulatory Framework

9.5.3.3.4. Reimbursement Scenario

9.5.3.3.5. India Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.3.4. China

9.5.3.4.1. Key Country Dynamics

9.5.3.4.2. Competitive Scenario

9.5.3.4.3. Regulatory Framework

9.5.3.4.4. Reimbursement Scenario

9.5.3.4.5. China Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.3.5. Australia

9.5.3.5.1. Key Country Dynamics

9.5.3.5.2. 8. 6. 3.5Competitive Scenario

9.5.3.5.3. Regulatory Framework

9.5.3.5.4. Reimbursement Scenario

9.5.3.5.5. Australia Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.5.3.6. Thailand

9.5.3.6.1. Key Country Dynamics

9.5.3.6.2. 8. Competitive Scenario

9.5.3.6.3. Regulatory Framework

9.5.3.6.4. Reimbursement Scenario

9.5.3.6.5. Thailand Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.6. South Korea

9.6.1.1. Key Country Dynamics

9.6.1.2. 8. 6. 3.7Competitive Scenario

9.6.1.3. Regulatory Framework

9.6.1.4. Reimbursement Scenario

9.6.1.5. South Korea Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.7. Latin America

9.7.1.1. Latin America Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033 (USD Million)

9.7.1.2. Brazil

9.7.1.2.1. Key Country Dynamics

9.7.1.2.2. Competitive Scenario

9.7.1.2.3. Regulatory Framework

9.7.1.2.4. Reimbursement Scenario

9.7.1.2.5. Brazil Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.7.1.3. Mexico

9.7.1.3.1. Key Country Dynamics

9.7.1.3.2. Competitive Scenario

9.7.1.3.3. Regulatory Framework

9.7.1.3.4. Reimbursement Scenario

9.7.1.3.5. 6. 4.3.5 Mexico Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.7.1.4. Argentina

9.7.1.4.1. Key Country Dynamics

9.7.1.4.2. Competitive Scenario

9.7.1.4.3. Regulatory Framework

9.7.1.4.4. Reimbursement Scenario

9.7.1.4.5. Argentina Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.8. MEA

9.8.1.1. MEA Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033 (USD Million)

9.8.1.2. South Africa

9.8.1.2.1. Key Country Dynamics

9.8.1.2.2. Competitive Scenario

9.8.1.2.3. Regulatory Framework

9.8.1.2.4. Reimbursement Scenario

9.8.1.2.5. South Africa Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.8.1.3. Saudi Arabia

9.8.1.3.1. Key Country Dynamics

9.8.1.3.2. Competitive Scenario

9.8.1.3.3. Regulatory Framework

9.8.1.3.4. Reimbursement Scenario

9.8.1.3.5. Saudi Arabia Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.8.1.4. UAE

9.8.1.4.1. Key Country Dynamics

9.8.1.4.2. Competitive Scenario

9.8.1.4.3. Regulatory Framework

9.8.1.4.4. Reimbursement Scenario

9.8.1.4.5. UAE Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

9.8.1.5. Kuwait

9.8.1.5.1. Key Country Dynamics

9.8.1.5.2. Competitive Scenario

9.8.1.5.3. Regulatory Framework

9.8.1.5.4. Reimbursement Scenario

9.8.1.5.5. Kuwait Clinical Decision Support Systems Market estimates and forecast, 2021 - 2033

Chapter 10 Company Profiles

10.1 Company Profiles

10.1.1 McKesson Corporation

10.1.1.1 Company overview

10.1.1.2 Financial performance

10.1.1.3 Product benchmarking

10.1.1.4 Strategic initiatives

10.1.2 Cerner Corporation

10.1.2.1 Company overview

10.1.2.2 Financial performance

10.1.2.3 Product benchmarking

10.1.2.4 Strategic initiatives

10.1.3 Siemens Healthcare GmbH

10.1.3.1 Company overview

10.1.3.2 Financial performance

10.1.3.3 Product benchmarking

10.1.3.4 Strategic initiatives

10.1.4 Allscripts Healthcare, LLC

10.1.4.1 Company overview

10.1.4.2 Financial performance

10.1.4.3 Product benchmarking

10.1.4.4 Strategic initiatives

10.1.5 athenahealth, Inc.

10.1.5.1 Company overview

10.1.5.2 Financial performance

10.1.5.3 Product benchmarking

10.1.5.4 Strategic initiatives

10.1.6 NextGen Healthcare, Inc.

10.1.6.1 Company overview

10.1.6.2 Financial performance

10.1.6.3 Product benchmarking

10.1.6.4 Strategic initiatives

10.1.7 Koninklijke Philips N.V.

10.1.7.1 Company overview

10.1.7.1 Financial performance

10.1.7.2 Product benchmarking

10.1.7.3 Strategic initiatives

10.1.8 IBM Corporation

10.1.8.1 Company overview

10.1.8.2 Financial performance

10.1.8.3 Research, development and engineering expenditure

10.1.8.4 Product benchmarking

10.1.8.5 Strategic initiatives

10.1.9 Agfa-Gevaert Group

10.1.9.1 Company overview

10.1.9.2 Financial performance

10.1.9.3 Product benchmarking

10.1.9.4 Strategic initiatives

10.1.10 Wolters Kluwer N.V.

10.1.10.1 Company overview

10.1.10.2 Financial performance

10.1.10.3 Product benchmarking

10.1.10.4 Strategic initiatives

10.2 Market Participation Categorization

10.3 Company Dashboard Analysis

10.4 Public Companies

10.4.1 Company market position analysis

10.4.2 Synergy Analysis: Major Deals & Strategic Alliances

10.5 Detailed List of Market Players

10.6 Key Players Comparison Table - Clinical Decision Support System Market