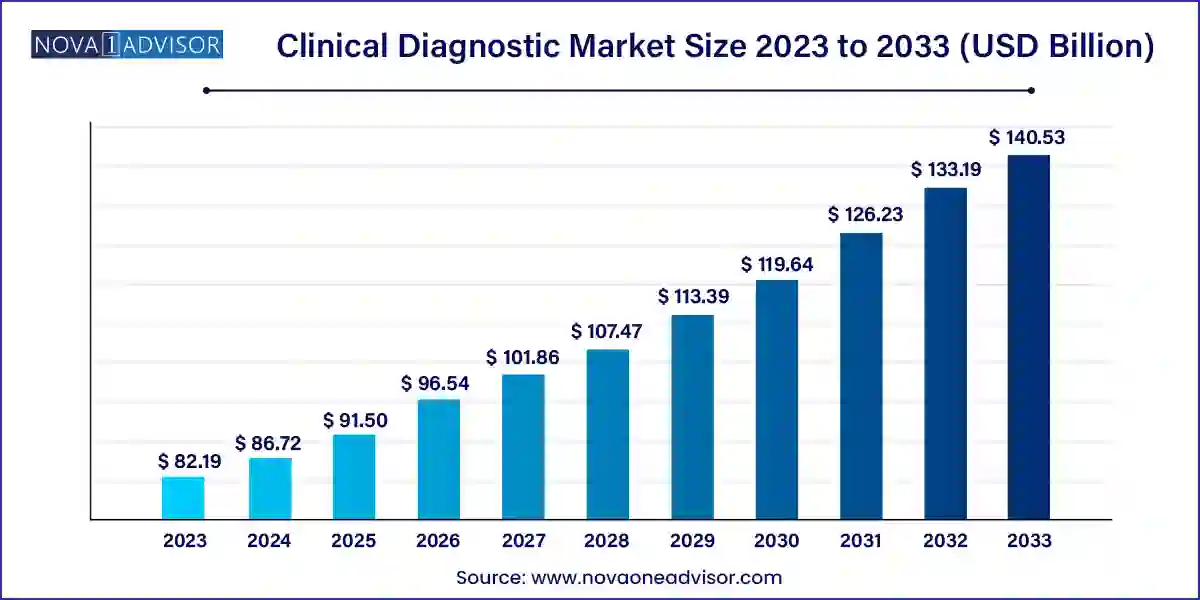

The global clinical diagnostics market size was valued at USD 82.19 billion in 2023 and is anticipated to reach around USD 140.53 billion by 2033, growing at a CAGR of 5.51% from 2024 to 2033.

The clinical diagnostics market plays a critical role in the healthcare ecosystem, acting as the gateway to disease detection, monitoring, and management. Clinical diagnostics refer to tests conducted in laboratories, hospitals, or at the point of care to detect or monitor medical conditions. These tests influence approximately 70% of clinical decision-making, yet account for only a small percentage of overall healthcare spending—a testament to their high value in guiding treatment outcomes efficiently and cost-effectively.

Over the past decade, the market has undergone a significant transformation, driven by innovations in molecular diagnostics, automation of laboratory workflows, miniaturization of devices, and the integration of AI-driven technologies. These advances have helped improve test sensitivity, reduce turnaround times, and facilitate earlier disease detection. From chronic disease panels like lipid and liver profiles to infectious disease screening and genetic diagnostics, clinical diagnostics are indispensable in both preventive and therapeutic healthcare models.

The surge in lifestyle-related illnesses such as diabetes, cardiovascular disease, and cancer, combined with aging global populations, has heightened the demand for timely and accurate diagnostic testing. The COVID-19 pandemic served as a global inflection point, dramatically highlighting the role of diagnostics in disease surveillance, mass screening, and epidemiological management. In its aftermath, the diagnostics industry has witnessed a surge in investment, public-private collaborations, and rapid regulatory approvals for next-generation diagnostic technologies.

Furthermore, healthcare systems across both developed and developing nations are prioritizing diagnostics as a strategic pillar for managing costs and improving patient outcomes. The market is no longer confined to centralized laboratories. Instead, it has expanded to point-of-care (PoC) testing, home-based diagnostics, and mobile health platforms, allowing for real-time data collection and rapid intervention. The growing focus on personalized medicine, where diagnostic data tailors treatment to individual patients, also continues to fuel market expansion.

Boom in Molecular and Genetic Diagnostics: Increased demand for PCR, NGS, and other molecular platforms for cancer, infectious disease, and hereditary conditions.

Integration of Artificial Intelligence (AI): AI-enabled diagnostic systems are enhancing test accuracy, image interpretation, and predictive analytics.

Rise of Point-of-Care and At-home Testing: Consumer-friendly diagnostic kits for glucose monitoring, fertility tracking, and infectious disease screening are on the rise.

Automation and High-throughput Systems in Labs: Laboratories are automating workflows using robotic sample processors and automated analyzers to handle high sample volumes efficiently.

Growing Demand for Companion Diagnostics: These tests are critical in oncology and immunotherapy for identifying appropriate patient cohorts for targeted therapies.

Globalization of Diagnostic Services: Companies are entering emerging markets via partnerships, remote diagnostics platforms, and mobile labs.

Personalized and Preventive Diagnostics: Shift toward proactive testing, biomarker discovery, and early detection tools for lifestyle and age-related diseases.

Regulatory Streamlining Post-COVID: Expedited approval pathways and emergency-use authorizations have sped up time-to-market for novel diagnostic products.

| Report Attribute | Details |

| Market Size in 2024 | USD 86.72 Billion |

| Market Size by 2033 | USD 140.53 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.51% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Test, By Product, By End User, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Abbott Laboratories, Bio-Rad Laboratories Inc., Danaher Corporation, Becton, Dickinson and Company, Qiagen, and Roche Diagnostics. |

One of the key drivers of the global clinical diagnostics market is the escalating burden of chronic and infectious diseases, which continues to expand across age groups and geographies. According to the World Health Organization (WHO), non-communicable diseases (NCDs) like diabetes, cardiovascular diseases, and cancer are responsible for over 70% of all global deaths. Timely diagnosis is crucial for early intervention, reducing disease progression, and minimizing treatment costs.

Simultaneously, the world continues to face persistent threats from infectious diseases like HIV, tuberculosis, influenza, and emerging zoonotic infections. The COVID-19 pandemic underscored the indispensable role of diagnostics in controlling outbreaks and enabling large-scale population testing. As a result, governments and healthcare organizations are now heavily investing in diagnostics infrastructure, scaling up capabilities in both high-end labs and decentralized care settings. This foundational shift is expected to support long-term growth in the clinical diagnostics landscape.

Despite remarkable technological progress, a key barrier to wider adoption of clinical diagnostics lies in the high cost of advanced diagnostic systems, particularly for molecular and imaging-based tests. Instruments such as real-time PCR machines, next-generation sequencing platforms, and mass spectrometers require significant capital investment and maintenance. Moreover, skilled personnel are needed to interpret the results, further raising operational costs.

In low- and middle-income countries (LMICs), the cost remains a significant deterrent to adopting advanced diagnostics on a broad scale. Even in high-income settings, reimbursement delays, restrictive insurance coverage, and fragmented healthcare delivery models can restrict patient access to comprehensive testing. As testing moves toward more personalized and sophisticated platforms, ensuring cost-effectiveness and equitable access remains a major challenge for industry stakeholders.

The most promising opportunity in the clinical diagnostics market lies in the expansion of point-of-care (PoC) and home-based diagnostic solutions. The shift toward decentralized healthcare—fueled by pandemic-induced behaviors and digital health innovation—has created a fertile environment for real-time, non-laboratory-based testing. Devices for rapid glucose testing, COVID-19 antigen detection, pregnancy, cholesterol, and coagulation monitoring are now widely available and affordable.

As healthcare consumerism rises, patients increasingly seek tools that offer convenience, immediacy, and autonomy in monitoring their health. Companies like Abbott (BinaxNOW), Roche (Accutrend), and Everlywell have gained traction with rapid, smartphone-integrated, or mail-in testing platforms. Advances in biosensors, wearable diagnostics, and smartphone-based data visualization offer vast untapped potential. By bringing diagnostics to the doorstep, this segment stands to revolutionize healthcare delivery, especially in remote and underserved communities.

Infectious disease testing dominates the global clinical diagnostics market, buoyed by the long-standing need to diagnose conditions like HIV, hepatitis, tuberculosis, and now, respiratory viruses such as SARS-CoV-2. These tests are vital for screening, surveillance, and managing outbreaks. During the COVID-19 pandemic, the surge in demand for RT-PCR, rapid antigen, and antibody testing flooded labs and supply chains globally. This accelerated not only adoption but also innovations in sample collection (e.g., saliva swabs, home kits), processing automation, and result delivery systems.

While infectious disease diagnostics maintain dominance, complete blood count (CBC) testing remains a standard, high-volume test performed across virtually all healthcare settings. It is indispensable in assessing overall health, detecting blood disorders, and evaluating treatment responses. On the other hand, electrolyte testing is emerging as one of the fastest-growing segments, driven by the rise in chronic kidney disease (CKD), intensive care admissions, and the broader use of electrolyte panels in perioperative and emergency care.

In terms of product segmentation, reagents represent the dominant share in the clinical diagnostics market. Reagents—including buffers, enzymes, antibodies, and assay kits—are the core components enabling test reactions and accurate results across all test platforms. They are required on a recurring basis and often account for the largest portion of lab operating budgets. The widespread usage of PCR, immunoassays, and hematology tests further elevates demand for high-quality reagents, particularly those that ensure high sensitivity and specificity.

Meanwhile, instruments such as analyzers, sample processors, and diagnostic platforms are increasingly being upgraded to meet high-throughput demands. Automation, modularity, and integration with LIS (Laboratory Information Systems) are key focus areas. The other products category, including control materials, software interfaces, and consumables, is rapidly gaining traction due to the increasing sophistication of lab workflows and the growing focus on traceability and compliance.

Hospital laboratories hold the leading position among end users due to the large test volumes handled daily and the need for integrated diagnostic services within inpatient and outpatient care. Hospitals invest heavily in central labs equipped with automated analyzers, high-end molecular platforms, and immunodiagnostic tools. These labs not only serve clinical care but also play a critical role in infection control, monitoring chronic diseases, and managing emergency diagnostics.

However, point-of-care testing (PoCT) is emerging as the fastest-growing end-user segment, owing to its expansion in urgent care clinics, emergency rooms, home settings, and long-term care facilities. The immediacy of results allows clinicians to initiate treatment during the same patient encounter, significantly improving clinical outcomes and patient satisfaction. From handheld blood glucose meters to portable troponin tests for cardiac events, the PoCT space is rich with innovation and continues to attract substantial investment.

Regional Insights

North America, particularly the United States, dominates the global clinical diagnostics market. This dominance is attributed to advanced healthcare infrastructure, high healthcare expenditure, the presence of major diagnostic companies, and favorable reimbursement policies. The U.S. also leads in research and development (R&D), frequently being the first market where new diagnostic technologies are introduced and adopted. Widespread access to lab services, digital health platforms, and public health campaigns ensures a mature and well-penetrated diagnostics landscape.

Asia-Pacific Emerged as the Fastest-Growing Region

On the other hand, Asia-Pacific is the fastest-growing region in the clinical diagnostics market. Rapid urbanization, growing healthcare investments, rising incidence of chronic and infectious diseases, and improving healthcare access are propelling demand across countries like China, India, and Indonesia. Governments in the region are expanding diagnostic networks and laboratory infrastructure as part of universal health coverage efforts. Furthermore, rising awareness and increasing disposable income are encouraging consumers to proactively seek diagnostic testing, especially for lifestyle diseases. Multinational diagnostics companies are forming local partnerships and launching affordable, localized solutions tailored to these fast-growing markets.

Clinical Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Clinical Diagnostics market.

By Test

By Product

By End User

By Region