The clinical microbiology market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 8.34 billion by 2034, growing at a CAGR of 5.36% during the forecast period 2024 to 2034.

The clinical microbiology market plays a fundamental role in modern healthcare, focused on the detection, diagnosis, and management of infectious diseases caused by bacteria, viruses, fungi, and parasites. Clinical microbiologists work at the intersection of laboratory science and patient care, providing vital information that guides treatment decisions, outbreak management, and infection control protocols.

Over the years, the clinical microbiology landscape has undergone a dramatic transformation. Traditional culture-based techniques, once the mainstay of diagnosis, have been supplemented and, in some cases, replaced by advanced molecular diagnostic tools, mass spectrometry-based methods, and automated culture systems. This evolution has significantly reduced the time to diagnosis, improved sensitivity, and enhanced the ability to detect emerging and drug-resistant pathogens.

The COVID-19 pandemic further underscored the critical importance of robust clinical microbiology infrastructure, accelerating investments into laboratory automation, point-of-care diagnostics, and molecular assays. Moreover, growing antimicrobial resistance (AMR), healthcare-associated infections (HAIs), and zoonotic spillover risks have reinforced the need for faster, more comprehensive microbial detection capabilities.

Hospitals, diagnostic laboratories, research institutions, and pharmaceutical companies are heavily investing in next-generation clinical microbiology tools to enhance infectious disease surveillance and treatment outcomes, driving sustained market growth globally.

Rapid Adoption of Molecular Diagnostics: PCR, NGS, and isothermal amplification methods gaining prominence in clinical microbiology workflows.

Automation and High-throughput Testing: Robotic sample processing and automated culture systems enhancing lab productivity and accuracy.

Expansion of Mass Spectrometry: MALDI-TOF MS becoming a mainstream tool for rapid and cost-effective microbial identification.

Focus on Antimicrobial Stewardship: Microbiology labs playing a pivotal role in guiding targeted antibiotic therapy.

Growing Emphasis on Point-of-Care Testing: Decentralized testing solutions enabling faster diagnosis in outpatient and emergency settings.

Integration of AI and Machine Learning: AI-powered systems assisting in colony recognition, pattern analysis, and data management.

Emergence of Syndromic Testing Panels: Multiplex assays enabling simultaneous detection of multiple pathogens from a single sample.

Increased Investment in Biosafety and Biocontainment: Post-pandemic upgrades to lab safety infrastructure boosting demand for autoclaves and biosafety cabinets.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.22 Billion |

| Market Size by 2034 | USD 8.34 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.36% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Disease, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | bioMérieux SA; BD; Abbott; Danaher Corp. (Cepheid, Inc.); Abbott (Alere, Inc.); Hologic, Inc.; F. Hoffmann-La Roche Ltd; Bruker; Bio-Rad Laboratories, Inc. |

The key driver propelling the clinical microbiology market is the rising global burden of infectious diseases combined with the alarming growth of antimicrobial resistance (AMR). Infectious diseases such as tuberculosis, HIV/AIDS, pneumonia, urinary tract infections, and healthcare-associated infections continue to cause millions of deaths annually, particularly in low- and middle-income countries.

At the same time, the misuse and overuse of antibiotics have led to the emergence of multidrug-resistant pathogens such as MRSA, VRE, carbapenem-resistant Enterobacteriaceae, and drug-resistant Mycobacterium tuberculosis. Accurate and timely microbiological diagnosis is essential for effective patient management, infection control, and public health response. Consequently, healthcare providers are increasingly investing in advanced microbiology systems to support rapid, precise microbial detection and resistance profiling, driving market expansion.

Despite the expanding market, the high costs associated with advanced diagnostic instruments remain a significant restraint. Technologies such as automated culture systems, molecular diagnostic platforms, and mass spectrometry analyzers require substantial upfront investment, maintenance, calibration, and skilled personnel for operation.

Small and mid-sized hospitals, particularly in developing regions, may find it challenging to afford these systems without external funding or public-private partnerships. Moreover, reimbursement limitations for advanced diagnostic tests can restrict widespread adoption, especially when payers prioritize cost containment over diagnostic innovation.

A significant opportunity lies in the expansion of decentralized microbiology testing and point-of-care (POC) diagnostics. Traditional centralized laboratory testing often involves delays due to sample transport and processing times. In contrast, POC technologies provide rapid microbial identification at the bedside, in outpatient clinics, or even in rural healthcare settings.

The development of compact, easy-to-use devices capable of performing molecular assays, antigen detection, or pathogen culture at the point of need can revolutionize infectious disease diagnosis, especially in resource-limited environments. Companies focusing on portable, affordable, and highly accurate POC microbiology solutions are poised to capture significant market share.

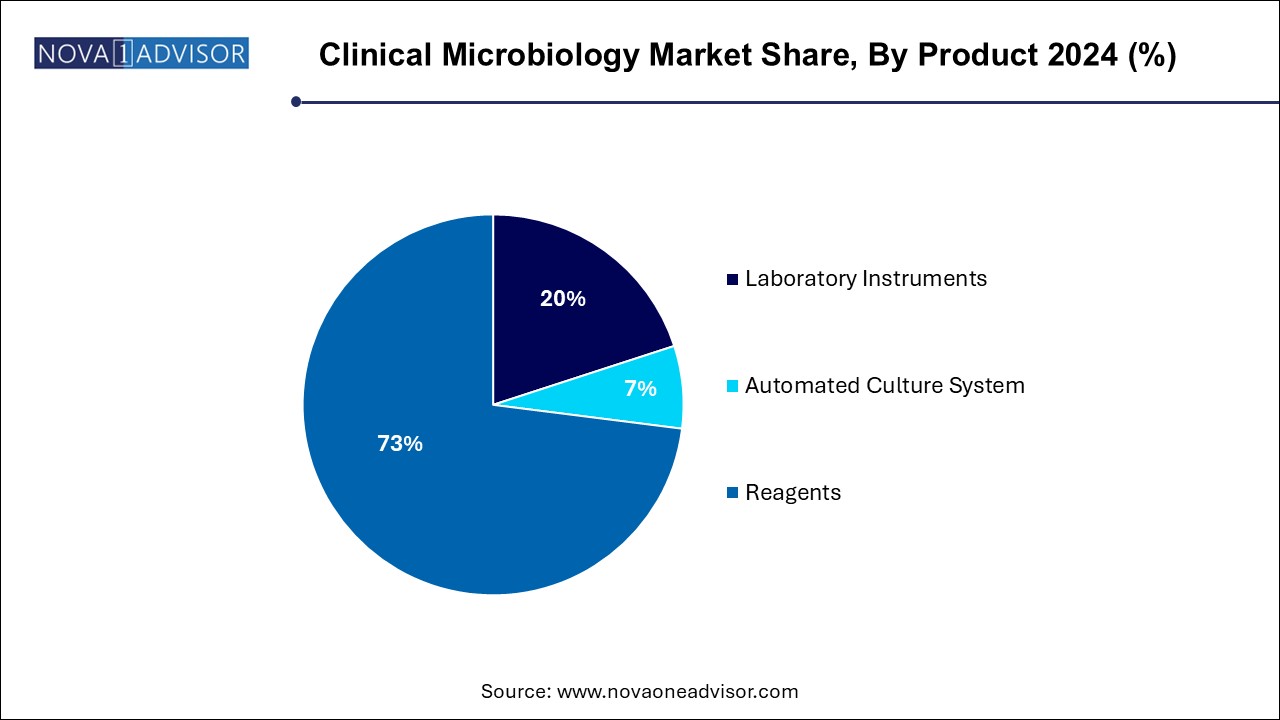

Laboratory instruments dominate the clinical microbiology product segment, owing to their central role in every microbiological workflow. Instruments such as incubators, gram stainers, autoclave sterilizers, colony counters, and petri dish fillers form the backbone of routine microbial culture and analysis. Advanced microscopy tools, MALDI-TOF mass spectrometers, and automated culture systems further enhance diagnostic speed and precision, making laboratory instruments indispensable.

Reagents are the fastest-growing segment, reflecting the recurring nature of their consumption and the increasing diversity of microbial testing panels. Molecular reagents, culture media, stains, and immunoassay kits are essential for diagnostic, surveillance, and research purposes. As laboratories expand their test menus to cover emerging pathogens and antimicrobial resistance profiling, the demand for high-quality reagents is experiencing robust growth.

Respiratory diseases dominate the clinical microbiology market by disease category, given the high prevalence and contagious nature of infections like influenza, COVID-19, tuberculosis, and bacterial pneumonias. Microbiology labs play a critical role in rapidly identifying respiratory pathogens to guide infection control measures and optimize antiviral or antibiotic therapy.

Bloodstream infections (BSIs) are growing fastest, driven by the critical need for early and accurate detection of sepsis-causing pathogens. Bloodstream infections are associated with high morbidity and mortality, necessitating immediate microbiological diagnosis for appropriate antimicrobial intervention. Automated blood culture systems, molecular septicemia panels, and rapid susceptibility testing are key technologies fueling this segment’s growth.

North America dominates the global clinical microbiology market, owing to a combination of advanced healthcare infrastructure, substantial R&D investments, and high awareness levels regarding infectious diseases and antimicrobial resistance. The U.S., in particular, benefits from strong government initiatives (e.g., CDC’s AMR strategies), a robust diagnostics industry, and the presence of leading microbiology technology providers such as Thermo Fisher Scientific, bioMérieux, and Becton Dickinson.

Additionally, favorable reimbursement frameworks for molecular and culture-based testing, stringent regulatory standards for laboratory operations, and aggressive adoption of laboratory automation technologies solidify North America's leadership position.

Asia-Pacific is the fastest-growing region, driven by improving healthcare infrastructure, rising infectious disease burden, and increasing investments in diagnostic capabilities. Countries like China, India, Japan, and South Korea are making significant strides in expanding clinical microbiology services to address growing public health challenges.

Government-backed infectious disease control programs, expanding private healthcare sectors, and rising research collaborations with international diagnostic companies are propelling market expansion. Furthermore, the high prevalence of diseases like tuberculosis, dengue, and hospital-acquired infections in Asia-Pacific reinforces the urgent need for rapid, accurate clinical microbiology diagnostics.

March 2025: bioMérieux launched a next-generation automated culture system integrated with AI-based colony recognition, enhancing lab throughput and diagnostic accuracy.

February 2025: Thermo Fisher Scientific introduced a new MALDI-TOF mass spectrometer optimized for microbial identification, offering faster turnaround times and expanded pathogen databases.

January 2025: BD (Becton, Dickinson and Company) announced the global launch of its BD MAX™ MDR-TB molecular assay for rapid detection of multidrug-resistant tuberculosis.

December 2024: Bruker Corporation expanded its MALDI Biotyper platform by adding an antimicrobial resistance (AMR) profiling module for Gram-negative bacteria.

November 2024: Qiagen announced partnerships with leading hospitals in Asia-Pacific to deploy its QIAstat-Dx syndromic testing panels for respiratory and gastrointestinal infections.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the clinical microbiology market

By Product

By Disease

By Regional