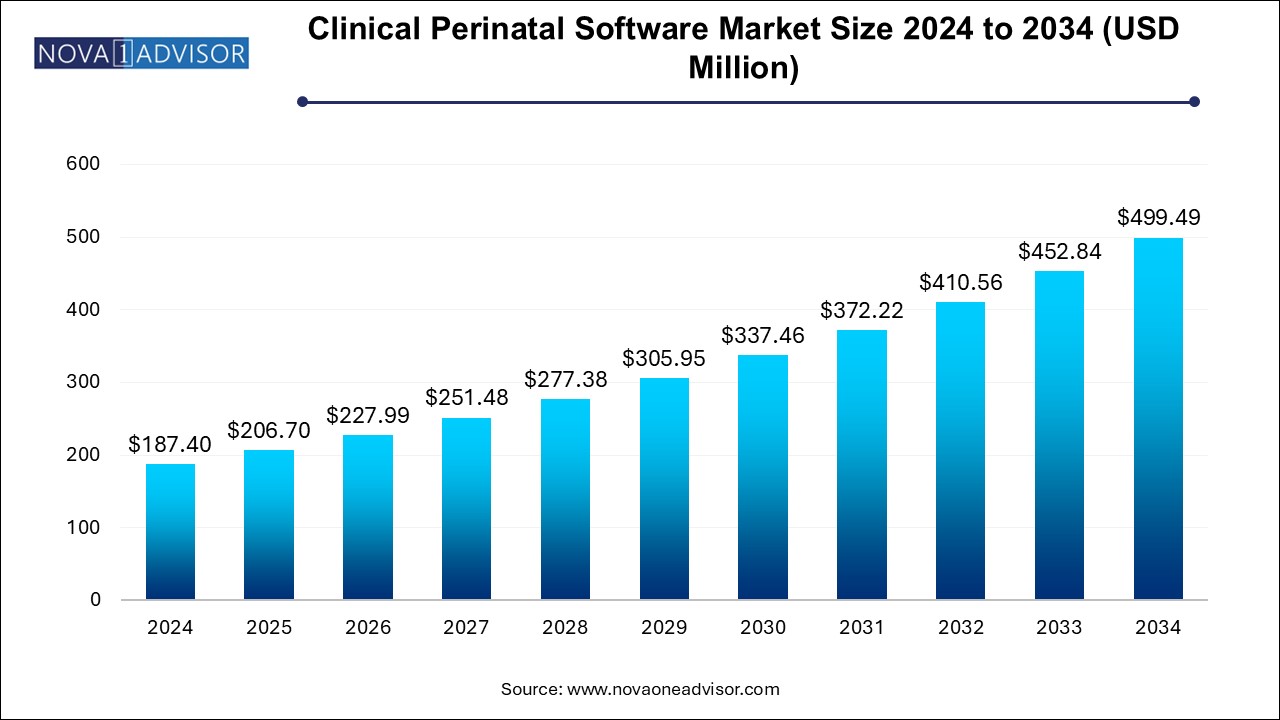

The clinical perinatal software market size was exhibited at USD 187.4 million in 2024 and is projected to hit around USD 499.49 million by 2034, growing at a CAGR of 10.3% during the forecast period 2025 to 2034.

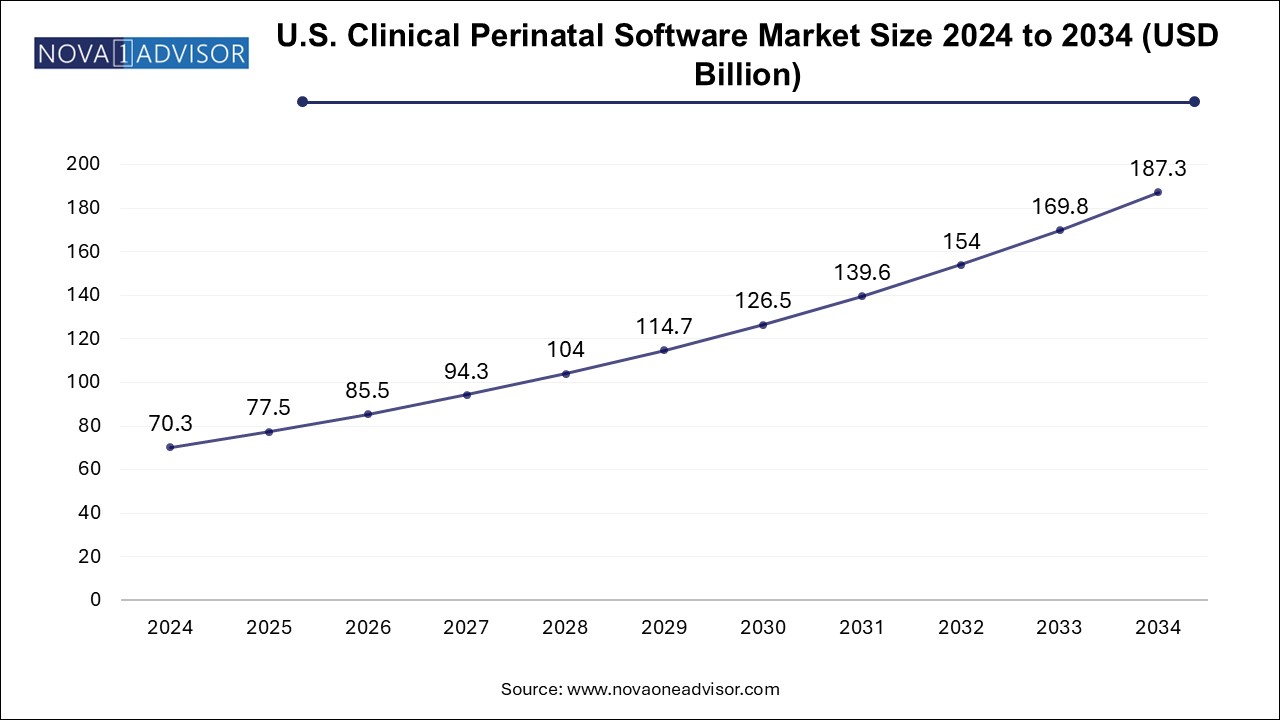

The U.S. clinical perinatal software market size is evaluated at USD 70.3 billion in 2024 and is projected to be worth around USD 187.3 billion by 2034, growing at a CAGR of 9.31% from 2025 to 2034.

North America, led by the United States, dominates the global clinical perinatal software market. The region benefits from advanced healthcare infrastructure, widespread adoption of EHRs, and stringent maternal care quality mandates. U.S. hospitals are investing in perinatal IT solutions to improve outcomes, meet Joint Commission standards, and reduce malpractice exposure.

Government initiatives like the Maternal Health Innovation Program and integration of perinatal metrics into value-based reimbursement further drive market growth. Additionally, leading vendors such as PeriGen and Cerner (Oracle Health) are headquartered in the region, supporting innovation and product availability. North America's growing number of high-risk pregnancies due to comorbidities also underscores the need for advanced monitoring and predictive analytics tools.

Asia Pacific is the fastest-growing region, fueled by rising maternal awareness, healthcare digitization, and increasing investments in maternal and child health infrastructure. Countries like India, China, Indonesia, and the Philippines are experiencing a surge in institutional deliveries, especially in urban areas. This shift is prompting hospitals and maternity clinics to adopt digital tools for labor management and documentation.

National programs such as India’s LaQshya initiative and China’s “Healthy Mother, Healthy Baby” plan are focusing on improving intrapartum care quality, creating opportunities for perinatal software adoption. Moreover, local and global vendors are launching affordable cloud-based solutions tailored to the needs of resource-limited settings, making Asia Pacific a lucrative and dynamic market for the foreseeable future.

The clinical perinatal software market represents a growing and technologically transformative segment of maternal and neonatal healthcare. This software facilitates digital tracking, monitoring, and documentation of maternal and fetal health data throughout the prenatal, intrapartum, and postnatal periods. Deployed in hospitals, clinics, and maternity centers, clinical perinatal software systems aim to enhance patient safety, support clinical decision-making, streamline workflows, and improve outcomes for mothers and infants.

These systems are increasingly being adopted in response to the growing global emphasis on reducing maternal and neonatal morbidity and mortality rates. Clinical perinatal software enables electronic capture of fetal heart rate patterns, maternal vitals, contraction frequency, labor progress, and other crucial parameters. When integrated with electronic health records (EHRs), these solutions provide clinicians with real-time alerts, historical trends, and data analytics for better care coordination.

As the prevalence of high-risk pregnancies and preterm births rises worldwide—particularly due to factors like advanced maternal age, gestational diabetes, hypertension, and obesity—there is increasing pressure on care providers to ensure timely, accurate, and evidence-based interventions. Clinical perinatal software plays a pivotal role in achieving these goals. The market is also driven by healthcare digitization initiatives, regulatory mandates for data documentation, and a focus on patient-centric care models.

Growing Integration of Perinatal Software with Hospital-Wide EHR Systems

Cloud-Based Deployments Offering Remote Accessibility and Scalability

AI and Predictive Analytics Enhancing Risk Detection for Preterm Labor and Fetal Distress

Increased Demand for Interoperability and Standardized Patient Documentation

Adoption of Mobile Apps for Remote Fetal Monitoring in Maternity Clinics

Emergence of Real-Time Decision Support Tools in Labor and Delivery Units

Expansion of Tele-Perinatal Services in Rural and Underserved Regions

Focus on Compliance with Clinical Guidelines and National Quality Metrics

Growing Use of Workflow Automation for Nurse Charting and Documentation

Vendor Collaborations with Public Health Agencies to Improve Maternal Outcomes

| Report Coverage | Details |

| Market Size in 2025 | USD 206.7 Million |

| Market Size by 2034 | USD 499.49 Million |

| Growth Rate From 2025 to 2034 | CAGR of 10.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Deployment, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | PeriGen, Inc.; Koninklijke Philips N.V.; Trium Analysis Online GmbH; EDAN Instruments, Inc.; K2 Medical Systems Ltd.; Huntleigh Healthcare Limited.; Clinical Computer Systems, Inc.; General Electric Company |

A significant driver for the clinical perinatal software market is the increasing demand for real-time maternal and fetal monitoring solutions. Obstetric units are under growing pressure to deliver rapid, data-driven interventions, especially in high-risk pregnancies. Adverse events during labor and delivery, such as fetal hypoxia, uterine rupture, or eclampsia, require immediate clinical response. Delays in documentation or interpretation of physiological data can lead to life-threatening consequences.

Clinical perinatal software solutions bridge this gap by enabling continuous monitoring of fetal heart rates, uterine contractions, and maternal vitals. Real-time dashboards and customizable alert systems notify clinicians of abnormalities, facilitating early detection of fetal distress or labor complications. For example, modern software can automatically generate a partogram—graphing labor progression—and issue alerts if deviations from normal labor patterns are detected. This capability significantly reduces the risk of missed clinical cues and improves patient safety, contributing to the software's growing adoption in both developed and emerging healthcare systems.

One of the key restraints limiting the adoption of clinical perinatal software is the high initial cost of software acquisition, customization, and implementation, particularly for small- and mid-sized healthcare facilities. These costs include licensing fees, infrastructure upgrades, staff training, and ongoing maintenance. In addition, integrating perinatal software with existing hospital information systems (HIS), laboratory systems, and EHR platforms can be technically complex and time-consuming.

Interoperability remains a challenge, especially when hospitals use legacy systems or multiple software vendors across departments. Data silos, inconsistent terminologies, and format incompatibilities can hinder seamless communication between obstetricians, midwives, and pediatricians. Moreover, strict data privacy regulations such as HIPAA and GDPR impose additional burdens in ensuring secure data exchange and access control. Addressing these challenges requires vendor partnerships, IT investment, and a clear roadmap for health IT modernization—factors not always feasible in resource-limited settings.

A compelling opportunity in this market lies in the expansion of cloud-based clinical perinatal software solutions and remote fetal monitoring technologies. Cloud deployment enables secure, real-time access to patient records and monitoring dashboards from any location, supporting remote consultations and collaborative care—especially important for rural and underserved populations.

The rise of telehealth during and after the COVID-19 pandemic has further accelerated the adoption of cloud-native platforms. Healthcare providers can now offer tele-perinatal services such as virtual prenatal visits, remote fetal monitoring, and digital birth plan management. These features enhance patient engagement, reduce hospital overcrowding, and ensure continuity of care. Vendors offering scalable, interoperable, and compliant cloud solutions stand to gain significantly as health systems worldwide shift toward digital transformation and population health management.

Based on the product, the integrated segment held the largest revenue share of 80.0% in 2024. due to their ability to unify multiple functionalities—such as fetal monitoring, documentation, workflow management, and analytics—within a single interface. These systems enable seamless coordination between labor and delivery teams, reduce manual data entry errors, and offer comprehensive dashboards that visualize patient status in real time. Large hospitals and academic medical centers prefer integrated platforms for their scalability and ability to support enterprise-wide care pathways.

The standalone segment is also expected to grow significantly over the forecast period. These solutions may focus solely on fetal monitoring or documentation, providing core functionalities without the overhead of a full hospital IT integration. Their plug-and-play nature and quick implementation timelines make them ideal for settings with limited IT infrastructure or funding.

The While on-premise deployment remains prevalent—particularly in large hospitals that require robust data control and customized configurations—the cloud-based segment is growing rapidly. Cloud-based deployment offers numerous advantages, including remote access, reduced hardware investment, easier updates, and faster scaling. These solutions are particularly attractive for health systems implementing digital transformation initiatives or expanding regional maternity networks.

For instance, a network of maternity clinics using cloud-based perinatal software can centralize data storage, standardize workflows, and provide secure access to specialists across multiple locations. Moreover, cloud-based platforms offer built-in disaster recovery and can integrate with mobile applications, enabling patients to upload home monitoring data and receive feedback from clinicians.

Healthcare systems increasingly value this flexibility, especially in the wake of pandemics or natural disasters that disrupt in-person care delivery. Cloud deployment also supports subscription-based pricing models, making advanced perinatal tools accessible to smaller practices.

Based on end use, the hospital/ clinics segment dominated the market with a revenue share of over 63.0% in 2024. Tertiary and secondary hospitals often deal with complex, high-risk pregnancies that demand advanced perinatal monitoring and decision support. These institutions invest in integrated software platforms to ensure continuity from triage to postnatal discharge, improve patient safety, and meet accreditation and quality benchmarks.

The maternity clinics segment is expected to exhibit the fastest CAGR over the forecast period. These clinics offer prenatal care, low-risk deliveries, and postpartum follow-ups, and they increasingly adopt standalone or cloud-based perinatal software to improve care quality and operational efficiency. The trend toward midwifery-led care and patient-centered birth experiences is also boosting investment in digital documentation and fetal monitoring systems in this segment.

March 2025: PeriGen launched an updated version of its PeriWatch® Vigilance system with enhanced AI-driven early warning for maternal sepsis and uterine rupture.

February 2025: GE HealthCare announced a partnership with a leading U.S. hospital chain to pilot its AI-integrated fetal monitoring system in high-risk obstetric units.

January 2025: Philips introduced a new cloud-based perinatal platform designed for remote maternity care in rural clinics across Southeast Asia.

December 2024: Cerner Corporation (Oracle Health) rolled out an advanced perinatal module within its EHR ecosystem, offering unified access to labor notes, fetal tracings, and neonatal charts.

November 2024: Edan Instruments launched a mobile-connected fetal monitor compatible with third-party perinatal software systems for decentralized monitoring.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the clinical perinatal software market

By Product

By Deployment Model

By Application

By End Use

By Regional